8-Apr-16 PRELIMINARY RESULTS Current Law Lowest Quintile

advertisement

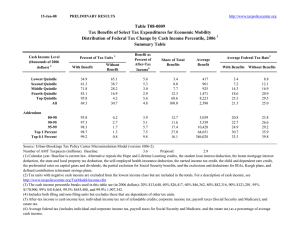

8-Apr-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0070 Number of Tax Units Who Itemize Under Current Law and Without Selected Itemized Deductions, 2016 1 Tax Units with Itemized Deductions Expanded Cash Income Percentile 2,3 Tax Units (thousands) Number (thousands) Lowest Quintile Second Quintile Third Quintile Fourth Quintile Top Quintile All Without the State and Local Tax Deduction 4 Current Law Percent Within Class Number (thousands) Percent Within Class Without the Mortgage Interest Deduction Number (thousands) Percent Within Class Without the Charitable Deduction Number (thousands) Percent Within Class 47,692 37,451 33,994 28,393 23,735 172,532 384 2,729 8,007 13,528 19,499 44,147 0.8 7.3 23.6 47.6 82.2 25.6 247 1,862 4,966 7,614 11,483 26,172 0.5 5.0 14.6 26.8 48.4 15.2 208 1,567 4,659 8,258 14,699 29,391 0.4 4.2 13.7 29.1 61.9 17.0 336 2,294 6,759 11,170 17,597 38,156 0.7 6.1 19.9 39.3 74.1 22.1 12,235 5,933 4,439 1,128 115 9,163 5,132 4,160 1,044 108 74.9 86.5 93.7 92.6 93.8 4,802 3,028 2,985 668 81 39.2 51.0 67.3 59.3 69.8 5,876 4,068 3,756 999 107 48.0 68.6 84.6 88.6 92.5 7,988 4,706 3,926 976 103 65.3 79.3 88.5 86.6 89.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). (1) Calendar year. (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/resources/income-measure-used-distributional-analyses-tax-policy-center (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2015 dollars): 20% $23,099; 40% $45,153; 60% $80,760; 80% $142,601; 90% $209,113; 95% $295,756; 99% $732,323; 99.9% $3,769,396. (4) The state and local tax deduction includes state and local income, sales, and real estate taxes.