14-Dec-15 PRELIMINARY RESULTS Lowest Quintile Second Quintile

advertisement

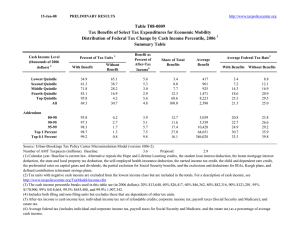

14-Dec-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org T15-0230 1 Benefits from Mortgage Interest Deduction and 15 Percent Non-refundable Credit, 2016 Expanded Cash Income Percentile 2,3 Lowest Quintile Second Quintile Third Quintile Fourth Quintile Top Quintile All Tax Units (thousands) Tax Units with Mortgage Interest Current Mortgage Interest Deduction Average Benefit (dollars) Tax Units with Benefit 4 Current Law Limits 5 $500,000 Limit 6 Percent Tax Units Tax Units Number All Tax All Tax Within With With (thousands) Units Units Class Benefit Benefit 15 Percent Non-refundable Credit Average Benefit (dollars) Tax Units with Benefit Current Law Limits $500,000 Limit Percent Tax Units Tax Units Number All Tax All Tax Within With With (thousands) Units Units Class Benefit Benefit 4 Number (thousands) Percent Within Class 47,691 37,422 33,984 28,418 23,750 172,532 2,793 6,937 12,983 17,294 17,813 57,872 5.9 18.5 38.2 60.9 75.0 33.5 216 1,546 5,356 10,391 16,186 33,694 0.5 4.1 15.8 36.6 68.2 19.5 1 18 129 474 2,134 401 206 441 819 1,296 3,131 2,056 1 18 129 463 1,915 369 206 439 815 1,267 2,810 1,892 471 3,297 10,385 16,614 17,601 48,368 1.0 8.8 30.6 58.5 74.1 28.0 3 38 186 542 1,252 307 258 430 609 928 1,689 1,096 3 38 186 534 1,144 291 258 430 608 913 1,544 1,038 12,233 5,942 4,447 1,129 115 8,887 4,583 3,574 769 63 72.7 77.1 80.4 68.2 54.1 7,643 4,322 3,490 731 59 62.5 72.7 78.5 64.8 51.0 1,228 2,115 3,834 5,359 4,588 1,965 2,907 4,885 8,274 9,004 1,189 1,982 3,315 3,918 2,991 1,903 2,725 4,224 6,057 5,878 8,799 4,522 3,528 753 61 71.9 76.1 79.3 66.8 52.7 955 1,264 1,793 2,272 2,126 1,328 1,662 2,260 3,403 4,031 925 1,186 1,556 1,675 1,417 1,287 1,559 1,962 2,509 2,687 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-3). (1) Calendar year. (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2015 dollars): 20% $22,823; 40% $44,550; 60% $79,661; 80% $141,303; 90% $207,758; 95% $294,348; 99% $720,886; 99.9% $3,672,221. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. Estimates are static and do not assume that taxpayers would adjust their investment portfolio and pay down their mortgage balance if their tax benefit from mortgage interest was reduced. (5) Interest would be eligible subject to current law limits ($1,000,000 of debt on a primary residence or second home, and $100,000 in home equity loans). (6) Interest would be eligible up to a maximum of $500,000 of debt on a primary residence, second home, and/or a home equity loan.