– nation has gradually realized that ...

advertisement

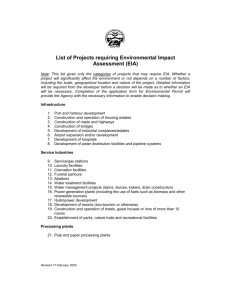

The Effect of Innovation Environment on the Equipment Manufacturing Industry in China Xu-sheng Chen, Hong-qi Wang, Yu Gu School of Management, Harbin University of Science and Technology, Harbin, China (zhshkslw@163.com) Abstract – With the increasing impact of innovation policy, external factors affecting the industry become important in enhancing the innovation ability of firms. This paper analyzes the influence of innovation environment in the development of new products, promotion of technology innovation, and in the increase in market share. First, the paper establishes a corresponding evaluation index system according to the external factors affecting industrial innovation. Second, the paper demonstrates the performance of innovation environment through scores obtained from super- efficient data envelopment analysis (DEA), and distinguishes the degree of effects of the different factors through composite DEA. The results show that innovation support for science and technology is the most significant factor in innovation environment, and that the impact of government support on industrial innovation is the least significant. Finally, the study suggests countermeasures to improve industrial innovation. Keywords - Effect, equipment manufacturing industry, innovation environment, super efficiency DEA I. INTRODUCTION Technological innovation of competitors, labor turnover among enterprises, and the increasing market demand have all enabled innovative behaviors to diffuse, and various factors such as capitals, personnel and equipments etc. to recombine within the industry, promoted changes of production and profit distribution, and resulted in the emergence of new industries [1]. However, industrial innovation marks the result of mutual influence among enterprises, and the disordering trend exists in product selection, market development and technological industrialization in the innovative process. Innovative risks not only come from internal enterprises, but also serve as result of mutual influence among innovative activities of enterprises [2]. External environmental factors, for instance, governmental policies, financial environment, organizational innovation and market variations, can pose material influence on innovative performance of the industry. The role of government in industrial innovation process is attracting increasing attentions, the reason of which lies in that on one hand, government of every ____________________ Sponsored by National Nature Science Fund Project (70773032), Humanities and Social Science Research Youth Fund Project of Ministry of Education in China(10YJC790027),Chinese Postdoctoral Science Foundation(20110491099),Heilongjiang Province Postdoctoral Fund Project(LBH-Z10112) nation has gradually realized that strategic industry has significant influence on long-term development of countries during international competition; on the other hand, it is difficult on average for enterprises to bear innovative risks, which calls for governmental support in capitals and policies. Aiming at innovation conditions, development trend and existing problems in the field of precision engineering, Watanabe emphasizes that innovation efficiency can be improved through formulating, researching and developing technology roadmap [3]. Despite that compared with larger enterprises, small companies prefer innovation, greater innovation risks are in existence due to limitations of scales and technological conditions. Wallsten establishes an equation with several unknowns to test and verify relationship between innovation activities of small enterprises and funding [4]. In addition, as maker of macro control policies in the market, government can coordinate differences between industrial development and social demands according to innovation orientation and requirements on environmental protection of the country or region it locates. It is the main purpose of enterprises to adapt to market changes, improve product diversity and reduce production cost in innovation process, and technological industrialization time enjoys direct influence on occupying market in early phases, which enables enterprises to attach importance to short-term benefits to improve profits, and ignore technology accumulation as well as systematic training of R&D personnel, thus results in the difficulty in realization of technology innovation by leaps and bounds [5]. R&D of scientific institutions as well as teaching mode of colleges and universities that is catered to innovation can supplement enterprises from realizing technological breakthrough and forming innovation teams of high qualities [6]. By applying triplehelix theory in an earlier phase, some Scholar propose that a synergetic mechanism among administrative departments, R&D establishments and enterprises in the nation can be formed in biology, information and communication technology etc [7][8]. In accordance with analysis on formulation process of lead-free solder standard in developed countries of America, Europe and Japan etc, Masaru designs a cooperative network involving universities, industries and public departments, and determines characteristics of structures of cooperative network in promoting implementation of new technology standards and improving innovation efficiency [9]. Venture capital has become main source of enterprise innovation fund in developed countries. Especially that in knowledge-intensive industries, venture capital enjoys a close relationship with patent growth, technology efficiency and expansion of enterprise scales. Venture capital has become part of innovation strategies in enterprises [10]. It is indicated in empirical study on effects that support venture capital policies of America since 1979 that increasing of venture capital can promote patent growth materially [11]. Based on the research of corporate relationship regarding German technical innovation and Investment Company, Weber structures conception of “relational fit”, and puts forward that cooperation of both parties marks the key to promote knowledge transformation and innovation and improve organizational efficiency [12]. According to analysis on innovation models in recent 50 years, Engel proposes a new commerce innovation model formed through integration of entrepreneurial spirit, technology variation and venture capital, whose fundamental innovation, in general, surpasses technology scope and changes management method of supplying chain [13]. FDI can not only provide capitals to development of host countries, but also promote economic development through increasing industrial employment capacity and foreign trade volume. The aforesaid influence subjects to factors of technical compatibility, market gap, and technology absorption capacity of enterprises in host country. C demonstrates that negative influence of technical overflow occupies a dominant status when there is excessively big gap in technology, and motivation of technology innovation is in proportion to network externality [14]. Moreover, Wang Zong-Ci constructs twostage Cournot model, and analyzes conditions and features of reverse overflow effect in FDI technology diffusion [15]. There are technological differences between foreign enterprises and those of host nations; as a result, externality and knowledge distribution of technology results in that FDI exerts direct influence on overflow of industrial innovation technology in host nations [16]. II. METHODOLOGY 1) Performance Evaluation Based on SE-DEA: DEA often be used to describe the behavior of innovation, and analyzes the various production input and output of between the innovation process. In practice, each enterprise prior do not know their own revenue function, and just having the observation of input-output data. So the production possibility set can be defined as followed. T j ( x j , y j ) y j j y j, j 1, j 0, k 1,, s xj j xj, k 1 k 1 k 1 s k k s k k s k n max j y j j 1 s.t f j ( xi ) n xj j 1 x j 0, j 1,, n (1) Following linear programming problem can be used to instead of problem (P ) . n max j y j j 1 s s.t. x kj kj x j k 1 s y kj kj y j , j 1, , n k 1 ( P) s sj 1 k 1 s xj j 1 k j 0, k 1, , s x 0, y 0, j 1, , n j j (2) Dual problem of the problem (P ) refers to (3). n min u 0j j 1 k k 0 x j j y j j 0, k 1,, s ( D) u j j , j 1,, n 0 j 0, u 0, 0, j 0, j 1,, n (3) We call (P ) and (D ) are non-parameter DEA model. Thus, SE-DEA model can overall distinguish efficient DMU which value of is 1 by CCR. The SEDEA model can be expressed in Figure 1. DUMS of efficient DEA are A, B, C, and D, DUM E is inefficient point. Among compared in efficient point, super efficient value can be obtained based on new best frontier, which the point of super efficient value be excluded from set of decision-making, for example super efficient value of point C can be calculated based on changed best frontier of ABD, its efficiency is OC′/OC > 1. Since the best frontier to invalid point is still ABCD, Efficiency of efficiency value is unchanged. input2 A k Effective production frontier is the corresponding surface of the production function y f (x) . The programming problem (P) equivalent refers to (1). E B C′ C D input1 Fig. 1. SE-DEA model 2) Index Comparison Based on Composite DEA: DMU can be a factor in the effectiveness of the unit vector for the component ( D ) (1 ( Di ),..., n ( Di )) T , which is obtained using the above model. Remove the first species with di said output indicator set. Refers to the use of in di DEA method, find the effectiveness of various policy unit of coefficient vector obtained ( Di ) , and can prove capacity of science and technology, so it is removed from the samples. TABLE I DUM OF MANUFACTURING INDUSTRY DUM Industry 1 Processing of Food from Agricultural Products 2 Manufacture of Foods 3 Manufacture of Beverage 4 Manufacture of Tobacco and are adapted to analyze the information of variation regularity. For the invalid DMU, the input index which affects its performances value can be studied, firstly, Invalid vectors ( D j 0 ) should be calculated, thus, new 5 vectors that S i ( j 0 ( D) j 0 ( Di )) / j 0 ( Di ) is defined, For total influence on invalidation of DUM is computed according to (4), the index which has bigger influence score regard as main factor. 8 Manufacture of Textile Manufacture of Textile Wearing Apparel, Foot ware and Caps Manufacture of Leather, Fur, Feather and Its Products Processing of Timbers, Manufacture of Wood, Bamboo, Rattan, Palm, Straw Manufacture of Furniture that ( D) ( Di ) . Obviously, indicators are related to the efficiency value of DMU, the main influence index can be identified through efficiency change, the scores of ( Di ) Si ( j 0 ( D) j 0 ( Di )) *100 / j 0 ( Di ) 6 7 9 10 Manufacture of Paper and Paper Products 11 14 Printing, Reproduction of Recording Media Processing of Petroleum, Coking, Processing of Nucleus Fuel Manufacture of Chemical Raw Material and Chemical Products Manufacture of Medicines 15 Manufacture of Chemical Fiber 16 Manufacture of Rubber 17 Manufacture of Plastic 18 Manufacture of Non-metallic Mineral Products 12 3) Setting up evaluation indexes: According to the DEA model, the paper establishes the index system of inputs and outputs, there is four input indexes, which are government support degree(X1), financial environment (X2), service capacity of science and technology (X3), and degree of market opening (X4). There are three output indexes, which are the ability to development product (Y1), level of profit of new product (Y2), and level of technology innovation (Y3). The formulas are expressed as followed. X1= government funds for S&T activities (unit: 10000yuan); X2= loans from finance institutions for S&T activities (unit: 10000yuan); X3= Intramural expenditures on S&T activities in R&D institutions by industry (unit: 10000yuan); X4= gross industrial output value of joint ventures/ gross industrial output value; Y1= projects of new product development / projects of scientific and technological; Y2= sales revenue of new products enterprises/ sales revenue of products in enterprises; Y3= the number of invention patents in enterprises. 3) Data source: The data of empirical research are taken from China Statistical Yearbook and China Statistical Yearbook on Science and Technology (2009); according to sample requirement of DEA model, 28 industry of manufacturing industry have been selected, and data of sample is listed in Table Ⅰ. Moreover, Other Countries have not proposed the concept of equipment manufacturing industries except China. This paper defined former industries which include DUM21 to DUM27 in Table Ⅰ . Industry of culture, educational and sports goods has not data of service 13 19 Manufacture and Processing of Ferrous Metals 20 Manufacture and Processing of Non-ferrous Metals 21 Manufacture of Metal Products 22 Manufacture of General Purpose Machinery 23 Manufacture of Special Purpose Machinery 24 Manufacture of Transport Equipment 25 Manufacture of Electrical Machinery and Equipment Manufacture of Communication, Computer, Other Electronic Equipment Manufacture of Measuring Instrument, Machinery for Cultural and Office Work Manufacture of Artwork, Other Manufacture 26 27 28 III. RESULTS A. Result of Efficiency by CCR DEA Scores and rank of efficiency by CCR DEA is listed in Table II. TABLE II RESULT OF EFFICIENCY BY CCR DEA DUM scores rank DUM scores rank DUM1 0.1019 28 DUM15 0.8000 13 DUM2 0.2631 24 DUM16 1.0000 1 DUM3 0.8259 12 DUM17 0.6264 17 DUM13 0.3411 0.5454 0.5454 0.2766 DUM4 1.0000 1 DUM18 0.2339 25 DUM14 0.3356 0.3802 0.3802 0.2017 DUM5 0.5377 19 DUM19 0.8401 11 DUM15 0.8000 0.7334 0.3724 0.8000 DUM6 0.7700 15 DUM20 0.4300 20 DUM16 1.6162 1.7809 0.4546 1.7758 DUM7 1.0000 1 DUM21 1.0000 1 DUM17 0.6264 0.6105 0.2844 0.5779 DUM8 0.2169 26 DUM22 0.3583 22 DUM18 0.2339 0.2339 0.2082 0.1963 DUM9 1.0000 1 DUM23 0.3506 23 DUM19 0.7201 0.8401 0.7557 0.8328 DUM10 0.8732 10 DUM24 1.0000 1 DUM20 0.4300 0.4300 0.2708 0.3644 DUM11 0.7144 16 DUM25 1.0000 1 DUM21 1.3531 1.1333 0.2097 1.3531 DUM12 1.0000 1 DUM26 1.0000 1 DUM22 0.3095 0.3583 0.3583 0.2661 DUM13 0.5454 18 DUM27 0.1613 27 DUM23 0.3036 0.3506 0.3506 0.2554 DUM14 0.3802 21 DUM28 0.7916 14 DUM24 1.3062 1.0249 0.3715 1.3062 DUM25 1.0402 1.0709 0.7419 1.0106 DUM26 6.7431 2.2468 7.1645 7.1645 DUM27 0.1613 0.1521 0.1163 0.1613 DUM28 0.7916 0.7259 0.1165 0.6059 B. Result of Efficiency by SE-DEA Scores and rank of efficiency by SE-DEA are listed in Table III. TABLE III TABLE V RESULT OF EFFICIENCY BY SE-DEA SUM OF CHANGED RATIO DUM scores new rank DUM scores new rank DUM4 100.7284 1 DUM21 1.3531 7 DUM7 3.5720 3 DUM24 1.3062 8 DUM9 1.5419 6 DUM25 1.0709 9 DUM12 1.5956 5 DUM26 7.1645 2 DUM16 1.7809 4 C. Result of Index Comparison Based on Composite DEA The efficiency scores of DUM by composite DEA are listed in Table IV; ( Di ) represent the efficiency scores of remove i index. Sum of changed ratio ( S )is listed in i Table V according to formula (4), which comparison to equipment manufacturing industry (DUME). TABLE IV CHANGED EFFICIENCY SCORES BY COMPOSITE DEA j 0 ( Di ) X1 X2 X3 X4 DUM1 0.0479 0.1019 0.1019 0.0947 DUM2 0.2631 0.2499 0.1274 0.2456 DUM3 0.8259 0.5740 0.2048 0.8259 DUM4 100.7284 100.7284 100.7284 5.8697 DUM5 0.5140 0.5377 0.2564 0.3822 DUM6 0.7683 0.7700 0.4176 0.5246 DUM7 1.8064 3.5720 2.8751 3.5720 DUM8 0.2139 0.2169 0.1845 0.1966 DUM9 1.5419 1.5419 0.3189 1.5419 DUM10 0.8732 0.8498 0.2037 0.8251 DUM11 0.7140 0.7142 0.2190 0.5415 DUM12 1.5956 1.5956 0.1812 1.5956 S X1 X2 X3 X4 DUME 40.4491 271.7694 879.8325 77.8929 IV. DISCUSSION Through the calculation of the equipment manufacturing industry efficiency value, the results indicate that the efficiency value of DUM21, DUM24, DUM25and DUM26are reach 1.The efficiency value of DUM22 and DUM23 are located near 0.35, ranking in the entire manufacturing sector are 22nd and 23rd. The efficiency value of DUM21 is 0.1613, the position of its innovation efficiency in the entire manufacturing by comparison, ranking the 27th. The Data envelopment analysis can not give fine distinction while the efficiency values is 1, so the saving situation of input elements are adjusted by SE-DEA method, and the samples which efficiency value not to reach 1 remains. After adjustment, innovation efficiency value of DUM26 is the highest, about 7.1645. Through the analysis of the influence of innovation environment of the equipment manufacturing by composite DEA, we concluded the supporting ability of science and technology most significant impact on industrial innovation, followed by financial environment, Government support and the degree of market opening on the industrial innovation effect is weak. V. CONCLUSION This paper analyzes the external influences of industrial innovation on the equipment manufacturing industry in China using an index system. The index system includes government support, financial environment, support for science and technology, and the degree of market opening. In the manufacture of communication, computer, and other electronic equipment with higher technology support capabilities and greater market-opening degree, the corresponding output indicators relating to new product development and the number of patents in the manufacturing industry are the highest. Hence, the efficiency score in the equipment manufacturing industry is the highest, which reflects the high-input and highoutput feature of innovative influence. The efficiency values of manufacturing measuring instruments and machinery for cultural and office work are lowest because new sales income are lower in proportion compared with the main business. The percentage of industries with an efficiency value of 1 belongs to the equipment manufacturing industries at 57.14%, and the proportion of efficiency value of other manufacturing industries is 23.81%. The efficiency value is significantly lower in the other manufacturing industries compared with that in the equipment manufacturing industry. Based on empirical research, the impact of innovation support for science and technology is the most significant. Thus, enterprises should promote mechanisms of cooperation with research institutes and universities, and use their respective advantages to develop new technologies and new products. The equipment manufacturing industry has always been the focus of government support, but the influence of government support on the innovation of the equipment manufacturing industry is the weakest. This weak influence shows that government investment efficiency should be raised. Establishing a mechanism for financial classification, developing a number of promising projects, implementing tilt funds for key projects, and improving the dissemination of knowledge infrastructure are the main measures to improve support efficiency. The financial environment has a lower influence on the innovation of the equipment manufacturing industry. The low influence shows that the financial system supporting industrial innovation is undeveloped in China. Enterprises should attract social capital using multichannels such as credit, equity and bonds, circulation loan amount, small business joint guaranteed loans, corporate account overdraft, chattel mortgage, and so on. REFERENCES [1] Singh, Davinder, Nanda, Tarun, “Strategic alignment of technological innovation initiatives in cutting tool industry in the region” , International Journal of Technology, Policy and Management, vol. 9, no. 4, pp. 358–86, March 2009. [2] Leiponen, Aija, Drejer Ina, “What exactly are technological regimes? Intra-industry heterogeneity in the organization of innovation activities” , Research Policy, vol. 36, no. 8, pp. 1221–38, 2007. [3] Watanabe, M. “expectation for the Japan Society for the Precision Engineering-enhancement of communication among industry, academia and government for establishment of national innovation system through the technology road mapping activities” , Journal of the Japan Society of Precision Engineering, vol. 72, no. 10, pp.1207– 10, 2006. [4] S.J.Wallsten, “The effects of government-industry R&D programs on private R&D: the case of the small business innovation research program” , Rand Journal of Economics, vol. 31, no. 1, pp.82–100, 2000. [5] A. Kaldor, “Recent experiments in university-industrygovernment collaborations; the good, the bad, and the indifferent” , American Chemical Society, Division of Petroleum Chemistry, Preprints, vol. 37, no. 4, pp.245–68, 1992. [6] Hong H J, Luo W, Zhang Z Y , Zhang L C, Fan D P, “Exploration into the Innovative Mode of Combining Learning with Researching and Production” , Key Engineering Materials, vol. 455, pp.535–38, 2011. [7] Etzkowitz, Henry, Leydesdorff, Loet “The dynamics of innovation: From National Systems and mode 2 to a Triple Helix of university-industry-government relations” , Research Policy, vol. 29, no. 2, pp. 109–23, 2000. [8] Leydesdorff, L., Meyer, M. “The Triple Helix of universityindustry-government relations” , Scientometrics, vol. 58, no. 2, pp.191–203, 2003. [9] Masaru, Yarime “University-industry collaboration networks for the creation of innovation: A comparative analysis of the development of lead-free solders in Japan, Europe and the United States” , Portland International Conference on Management of Engineering and Technology, vol. 1, pp. 368–86, 2006. [10] Peneder, M. “The contribution of venture capital to modern systems of innovation: a critical review” , International Journal of Public Sector Performance Management, vol. 1, no. 3, pp.245–59, 2009. [11] Kortum, S Lerner, J. “Assessing the contribution of venture capital to innovation” , Rand Journal of Economics, vol. 31, no. 4, pp.674–92, 2000. [12] Weber, Barbara, Christiana “Corporate venture capital as a means of radical innovation: Relational fit, social capital, and knowledge transfer” , Journal of Engineering and Technology Management, vol. 24, no. 2, pp. 11–35, 2007. [13] Engel, Jerome S. “Accelerating corporate innovation: Lessons from the venture capital model” , Research Technology Management, vol. 54, no. 3, pp. 36–43, 2011. [14] Wang Zong-Ci; Han, Bo-Tang; Zhong, Zhi-Yang “The game analysis of technology-sourcing FDI based on reverse spillover effects motivation” , Journal of Beijing Institute of Technology, vol. 31, no. 6, pp. 745–48, 2011. [15] Tao Chang-qi, Qi Ya-wei, “ FDI, technology spillover and R&D competition game” , Journal of Information and Computational Science, vol. 6, no. 1, pp. 367–74, 2009. [16] Schneider, P.H. “International trade, economic growth and intellectual property rights: A panel data study of developed and developing countries” , Journal of Development Economics, vol. 78, no. 2, pp.529–47, 2005.