Talking Point Schroders India: Sentiment sours

advertisement

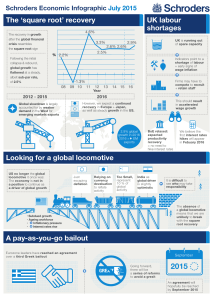

June 2015 Schroders Talking Point India: Sentiment sours Keith Wade, Chief Economist We find ourselves one year on from Narendra Modi’s electoral victory; a stunning result which delivered a powerful mandate. However, while important steps have been taken which reduce macroeconomic vulnerabilities and improve the business environment, “big bang” reforms have been lacking. The modest pace has been largely in line with our expectations but has disappointed the more euphoric reactions to Modi’s triumph. Consequently, we do not yet revise our growth forecasts, though failure to deliver some reform in the next session of parliament would present downside risks. On the positive side, India has come a long way since the “taper tantrum” days saw it earn a place amongst the Fragile Five (Chart 1). The current account deficit has fallen from a high of 5% of GDP in the second quarter of 2013 to just 1.4% at the end of 2014, reducing reliance on short-term foreign capital flows. Inflation has nearly halved, to 4.8%, in one year. The currency has remained far stronger than at the taper tantrum peak, although US dollar strength is exerting pressure, as it is throughout all emerging markets. Further, businesses are reporting a marked qualitative change; a more engaged and proactive bureaucracy and greater ease of doing business. While the headline-grabbing reforms have been absent so far, we have still seen liberalisation of foreign direct investment rules, approvals accelerated for stalled projects and a reduction in fuel subsidies – even if this latter move was facilitated by the serendipitous fall in the oil price. Chart 1: Indian fundamentals improving Source: Thomson Datastream, Schroders. 26 May 2015 However, land and labour reforms have been slow to gain traction, and the failure to pass the Goods and Services Tax in the recent session of parliament seems a missed opportunity. One reason for market disappointment has been the underestimation of the challenges Modi faces in the upper house, where his SchrodersTalking Point Page 2 party does not hold a majority. Seemingly loath to utilise his overall majority to call a joint session (in part because it could hurt his party’s chances in upcoming state elections), Modi has instead had to rely on use of ordinances, allowing state governments to reform their labour laws, and negotiation in the upper house. Yet ordinance is not a long-term solution, and government ordinance on simplifying land acquisition has now been referred to a parliamentary committee following opposition pressure. Meanwhile, encouraging state governments to reform labour laws initially looked promising, but now seems to have lost momentum, and Modi’s modus operandi as a chief executive style politician seems not to help him when trying to persuade rivals to support his policies. So, a steady grind upwards for growth seems more likely than a sudden jump. We expect reforms to eventually be passed, but market patience will likely be tested in the interim. Growth for now will make marginal gains thanks to improved business confidence, easier monetary policy, and the greater ease of doing business discussed above. On inflation, we have revised down our forecast for this year thanks to better than expected outturns, driven in large part by lower food price inflation. We do not expect this, however, to persist into next year, and the risk of an El Nino event means inflation could surprise to the upside, though the government has proved adept at keeping prices under control through efficient distribution so far. We expect two more interest rate cuts this year given the low inflation, taking the policy rate to 7%, but no more than that given the desire to hit an inflation target of 4% in the medium term. Important Information Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The views and opinions contained herein are those of the author(s), and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material, including the website, has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095