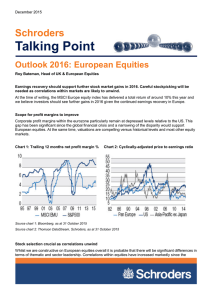

Talking Point Schroders European equities could provide the better opportunity amid global uncertainty

advertisement

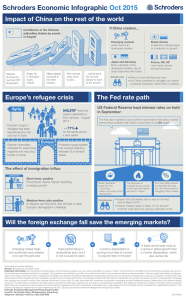

September 2015 Schroders Talking Point European equities could provide the better opportunity amid global uncertainty Rory Bateman, Head of UK & European Equities Given recent equity market volatility, now is an opportune moment to re-assess our view of European equities for the remainder of this year and into 2016. We continue to believe European equities could offer the better investment opportunity in a world of increasing economic uncertainty. Three key risks for European equity markets The three key risks for equities as being Greece and eurozone turmoil, US interest rates, and a possible China ‘hard-landing’. We have some respite from the Greek crisis given the recent bailout agreement and whilst there remain many unresolved issues, there is a clear determination from the authorities on both sides to reach agreement. With regard to the turn in the US rate cycle, never has there been so much coverage and anticipation of the Federal Reserve’s move and we believe therefore the change is probably priced-in. In any case, over the last 25 years the US equity market has initially reacted negatively as interest rates increase, but the reaction is temporary and has reversed within six months as the underlying health of the economy and corporate profits become the key drivers. The slowdown in China has been inevitable, but the degree of slowdown is an area of considerable debate and the trigger for recent market volatility. We recognise that China has been through a government-led, credit-fuelled expansion focused on investment and infrastructure. The economy needs to transition more towards consumption and the government needs to ensure this rebalancing occurs without the economy collapsing. Recent market volatility has been caused by fears that the Chinese authorities will be unable to manage this transition and as a result the 7% GDP growth target will be missed. There have been a series of policy actions, such as trying to artificially inflate the stockmarket, which have impacted international investor confidence in China. In addition, poor manufacturing data has shown the economy is slowing more rapidly than expected. China slowdown likely to impact some export industries Around 10% of goods exported from the EU go to China, nearly 70% of which are within the machinery, transport and chemicals sectors. Whilst the growth of exports to China has been 9.8% p.a. from 2010-2014, the absolute amounts involved are small at €165 billion when compared to intra-EU traded goods which is approximately €2.8 trillion. Our belief is that the long awaited recovery in Europe is happening and whilst specific industries will be impacted by a Chinese slowdown, the momentum around Europe will continue given expanding credit, structural reforms, improved business confidence and increasing consumer expenditure. SchrodersTalking Point Page 2 As a reference point, it has taken seven years for the size of the eurozone economy to exceed the level achieved in 2008. Exports to China helped prevent an even worse European recession during the eurozone crisis, but now the much more important domestic engine of growth will ensure the European economy can grow. Preference for domestic-oriented firms We particularly favour companies whose operations are focused on the domestic economy. Domestically oriented stocks are seeing stronger positive earnings per share revisions than exporters but on average trade at a substantial discount. Whilst we believe the European recovery is on track and the impact from China will be limited, we acknowledge that deflationary pressure from commodities and imports is likely to feed into inflation expectations. In addition, continued currency devaluations in the emerging markets will reduce the relative competitiveness of the euro. These issues may demand a policy response from the European Central Bank at some point but our belief for the coming 12 months is that European equities offer a relatively better investment choice when compared to other markets around the world, and investors could use the weakness in markets to increase their exposure to the recovery story. Important Information Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The views and opinions contained herein are those of the author(s), and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material, including the website, has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095