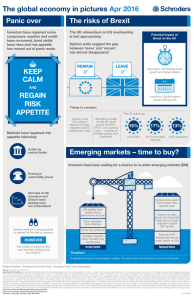

The global economy in pictures Apr 2016 Panic over

advertisement

The global economy in pictures Apr 2016 Panic over The risks of Brexit Investors have regained some composure: equities and credit have recovered, bond yields have risen and risk appetite has moved out of panic mode The UK referendum on EU membership is fast approaching KEEP CALM Potential impact of Brexit on the UK Opinion polls suggest the gap between ‘leave’ and ‘remain’ has almost disappeared REMAIN LEAVE Short-term: We forecast lower growth and higher inflation 2016 AND REGAIN RISK APPETITE Markets have regained risk appetite following: Action by central banks Long-term: Studies expect slower GDP growth Things to consider: The UK makes up: Impact on the UK is likely to depend on trade, migration and EU subscription costs Alternative models for the UK could include the EEA2, EFTA3, or a customs union… however all of these options h ave drawbacks 15% 17% of EU GDP of EU’s domestic demand 13% of EU population Emerging markets – time to buy? Investors have been waiting for a chance to re-enter emerging markets (EM) Firming in commodity prices Tail risks of US recession and China’s hard landing have not materialised Fundamental support for the asset class appears weak EM equities have posted strong performance this year Some valuations look attractive Export and trade growth are structurally weak and no longer outperform global GDP growth Greater evidence of strong activity is needed for the rally to continue Firmer risk sentiment HOWEVER Brazilian President Dilma Rousseff may be removed Expected FED interest rate hike will weigh heavily on EM POSITIVES NEGATIVES This is likely to bring the FED1 back into play, posing a risk for investors Therefore: A significant long-term revival seems unlikely. The time to buy will come soon, but it’s not here yet 1 Federal Reserve. 2European Economic Area. 3European Free Trade Association. Source: Schroders as at April 2016. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 90950416/HKEN