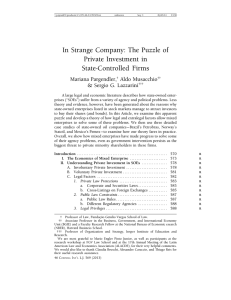

Talking Point Schroders China: Facing collapse or slow decline?

advertisement

November 2015 Schroders Talking Point China: Facing collapse or slow decline? Craig Botham, Emerging Market Economist Our recent visit to China reassured us that things are not so much worse than the data is telling us. Corporates, analysts and officials were candid about many of the challenges faced, but there is little evidence of a crisis at present. While current activity seems to be holding up, we remain concerned about the years ahead given some of what we heard. Prospects of reform Sentiment has soured on the prospect of China becoming more market-oriented. Market reforms will be tolerated only where they serve the purposes of the state and the goal of enhancing social stability. In addition to this, reform is meeting strong resistance from senior management at state owned enterprises (SOEs), who have obvious vested interests in not being merged with one another. Optimism is muted at best that the Fifth Plenum will make substantial changes in this regard. One-child policy scrapped Perhaps the banner policy so far has been the ending of the one child policy, but this is likely to have limited impact. Boosting the fertility rate would definitely help, but it is not certain that ending the one-child policy will be effective. Previous relaxations, such as in 2014 when 11 million couples were eligible for a second child, only 1 million applied to do so. It may be that after so long, the one child norm will take time to reverse. In addition, anecdotally many young Chinese cite the cost of children, particularly education, as a major barrier to considering large families. Reform of state-owned enterprises (SOEs) SOE reform, including mergers, would be a key part of reducing spare capacity in China. Some large SOEs have been employing almost twice as many people as they actually needed. Of course, this is the problem for the government; how to reduce spare capacity without causing massive unemployment, which would call into question the Party’s legitimacy and threaten social stability. The realpolitik of the situation provides further grounds for gloom. SOEs in overcapacity sectors have begun expanding into “emerging industry” areas, but it is questionable how quickly existing staff can be retrained for these new industries. Property divergence Overcapacity in the property market remains a problem but the divergence between Tier 1 cities and the rest is widening. Though it is unsurprising that central Shanghai property should be more resilient than property in a small city in the Western provinces, it creates problems for smaller developers concentrated in the less SchrodersTalking Point Page 2 salubrious regions. All the same, sector consolidation is proceeding at what could best be described as a stately pace. More failures are likely among the market minnows. Financial liberalisation One area of reform that has proceeded reasonably smoothly and rapidly is financial liberalisation, with deposit rates now fully liberalised and the local government debt swap doing much to reduce debt costs, even if it is squeezing bank margins. Local government bonds are seeing buyers other than banks strong armed into it by the state. However, this has much to do with the bond market bubble which has seen a remarkable compression of spreads across the credit space. Local government bonds themselves are still trading at very tight spreads to the sovereign – in no small part due to the assumption of central government support. Currency devaluation Of course, not all financial reforms have been without problems. The devaluation of the renminbi (RMB) in August caught everyone by surprise, including well connected SOEs. In the wake of the policy shock, somewhat panicky firms showed a marked increase in their desire to hedge currency exposure and also began paying off dollar debt. At the same time, wealthy clients of asset managers have also reportedly become keen to diversify their portfolios away from RMB-denominated assets. While the hedging and debt repayment activity has seen a peak and will now wind down, reducing pressure on the currency, the desire for diversification will mean that any relaxation of currency controls will likely see further depreciation. Prospect of hard landing? Our expectation remains that Chinese growth will avoid a calamitous collapse and instead slowly drift lower. But without successful reform, the risk of a hard landing rises. Vested interests will have to be challenged if the misallocation of resources is to be addressed, itself key to transitioning to service led growth. If inefficient SOEs are allowed to continue to dominate, productivity will be hurt and growth will slow much sooner – the next five years will be vital. Important Information Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The views and opinions contained herein are those of the author(s), and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material, including the website, has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095