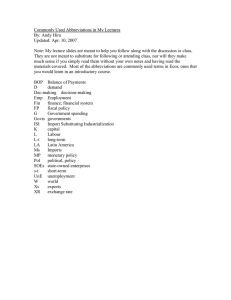

TWO ECONOMICS, DIFFERENT REMEDIES Professor: Cheng-Nan Chen

advertisement

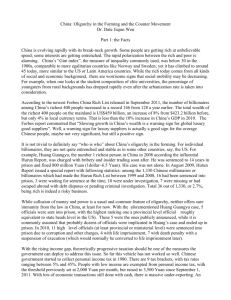

TWO ECONOMICS, DIFFERENT REMEDIES Professor: Cheng-Nan Chen GROUP’S MEMBERS . Mamunur Rahsid Betty Nguyen Tan Nhat Duy Do Nguyen Yen Nhi Huynh Tan Tai ViVi CONTENT The America Deflation in US Today World financial crisis Solution Introduction – China Brief history of SOEs China’s Stimulate Plan THE UNITED STATE The AMERICA is the third or fourth largest country by total area, . It is one of the world's most ethnically diverse and multicultural nations, the product of large-scale immigration from many countries.The U.S. economy is the world's largest national economy, with an estimated 2009 GDP of $14.3 trillion (a quarter of nominal global GDP and a fifth of global GDP at purchasing power parity.The United States is the largest importer of goods and third largest exporter, in the world. . DEFLATION IN THE US TODAY Productivity has surged, thereby contributing to the lack of hiring since 2001 Unemployment dropped slightly to 6.1 percent in September 2003, and 57,000 jobs were created for the first gain in eight months. However, more than one million jobs have disappeared since November 2001 . DEFLATION IN THE US TODAY Some assets (particularly housing) appear overpriced. The U.S. trade deficit continues to grow, hitting $41.8 billion in May 2003. World production may be outpacing demand, particularly in some sectors such as capital goods and consumer durable goods. FINANCIAL CRISIS OF 2007- 2009 The financial crisis of 2007 to the present is a crisis triggered by a liquidity shortfall in the United States banking system. It has resulted in the collapse of large financial institutions, the bailout of banks by national governments, and downturns in stock markets around the world. THE GROWTH OF THE HOUSING BUBBLE Between 1997 and 2006, the price of the typical American house increased by 124%. By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak When prices declined, Banks couldn’t refinancing and customers couldn’t pay loans. During 2007, Banks began foreclosure proceedings on nearly 1.3 million properties.This increased to 2.3 million in 2008. SUB-PRIME LENDING These United States banks believed that the risks of subprime loans could be managed, a belief that was fed by constantly rising home prices. However, the gradual decline of home prices in 2006 led to the possibility of real losses. As home values declined, many borrowers realized that the value of their home was exceeded by the amount they owed on their mortgage. These borrowers began to default on their loans, which drove home prices down further and ruined the value of mortgage-backed securities This downward cycle created a mortgage market meltdown FINANCIAL MARKET IMPACT Initially the companies affected were those directly involved in home construction and mortgage lending such as Northern Rock and Countrywide Financial, as they could no longer obtain financing through the credit markets. Over 100 mortgage lenders went bankrupt during 2007 and 2008 FINANCIAL MARKET IMPACT The financial institution crisis hit its peak in September and October 2008. Several major institutions either failed, were acquired under duress, or were subject to government takeover. These included Lehman Brothers, Merrill Lynch, Fannie Mae, Freddie Mac, Washington Mutual, Wachovia, and AIG FINANCIAL MARKET IMPACT Japan’s years of pain were made worse by deflation, an affliction that assailed the United States during the Great Depression. While falling prices can be good news for people in need of cars, housing and other wares, a sustained, broad drop discourages businesses from investing and hiring. FINANCIAL MARKET IMPACT Germany has done relatively well in the current downturn without large stimulus spending, and that experience is now cited by adherents of austerity. Germans had two advantages over Americans: A more extensive social safety net to give consumers more money, and a vibrant manufacturing base to churn out more goods for export FED’S SOLUTION The Primary way to attack deflation is to inject credit into the economy, giving reluctant consumers the ability to spend Fed traditionally adjusts a benchmark overnight rate for banks that influences rates on car loans, mortgages and other forms of credit FED’S SOLUTION Governments have increased spending or cut taxes to offset declines in consumer spending and business investment. The Fed also relieved American banks of troubled investments, many linked to mortgages, to give the banks room to make new loans. New or reinstated rules designed help stabilize the financial system over the long-run to mitigate or prevent future crises FED’S SOLUTION The Fed pulled this lever long ago, and has kept its target rate from 6.5% to 1.0% to combat the perceived risk of deflation. The Fed then raised the Fed funds rate significantly between July 2004 and July 2006. This contributed to an increase in 1-year and 5year adjustable-rate mortgage (ARM) rates, making ARM interest rate resets more expensive for homeowners. INTRODUCTION-CHINA INTRODUCTION Since 1979, China has reformed and opened its economy. The Chinese leadership has adopted a more pragmatic perspective on many political and socioeconomic problems, and has reduced the role of ideology in economic policy. China's has been the largest reduction of poverty and one of the fastest increases in income levels ever seen. China today is the fourth-largest economy in the world. It has sustained average economic growth of over 9.5% for the past 26 years. INTRODUCTION Chinese legislators unveiled several proposed amendments to the state constitution. Proposal to provide protection for private property rights. Rebalance income distribution between urban and rural regions, and to maintain economic growth while protecting the environment and improving social equity. INDUSTRY Industry and construction account for about 46% of China's GDP. Major industries are mining and ore processing, iron, steel, and so on. Consumer products including footwear, toys, and automobiles. Other transportation equipment including rail cars and ships, aircraft, and telecommunications. CHINA’S ECONOMY Figure: Chinese Exports of Goods and Services as a Percent of GDP: 1985-2008 THE DEVELOPMENT STAGES OF ECONOMY First stage (1952~1976): Planning economy Second stages: First period(1977-1980): 1978- implemented reformed and opened policy Second period(1981-1990): Third period(1991-1993): 1993-GDP grew highest in the history Fourth period(1994-2001): 1998- Asia Financial Crisis The development stages of economy Fifth period(2001-now): 2007-China overtook the United States to become the world’s second largest merchandise exporter after the European Union (EU). 2009- a huge expansion of the government role in the corporate sector. Economic expansion from iron, steel, motor vehicle, and tourism. BRIEF HISTORY OF SOEs Before the economic reforms in the 1980s, businesses in China were operated and strictly controlled by governmental agencies.The government and its agencies retained all investment and operating decisions. The managers of these SOEs had little incentive and managerial authority to enhance its efficiency. SOE was not regarded as a mere commercial organization. It was also considered as a quasigovernment agent that was required to pursue the broad social, political and economic objectives of the government BRIEF OF SOEs It has been generally agreed that the government's direct control and management of SOEs, together with other factors such as an over-centralized national economy, result in poor performance of SOEs In the early 1980s, the government began reforming the SOEs. The objective of the SOE's reform was to rejuvenate the SOEs by giving more and more autonomy in making economic decisions and providing financial incentives to managers and employees of SOEs. BRIEF OF SOEs Two major reforms have been adopted for SOEs. They are the contract responsibility system (CRS) and corporatization. CRS The government retains the ownership The SOE is subcontracted to selected individuals (managers) to independently run the firm The managers are rewarded if the operating targets set in the contract are achieved. The financial incentives for managers include sharing of the profits in excess of the targeted amount. CORPORATIZATION Unfortunately, the CRS has not been successful in improving the economic efficiency of SOEs. Consequently, the government intends to replace CRS by corporatization. Corporatization refers to converting SOEs into companies with limited liabilities. FEATURES OF SOEs AFTER RESTRUCTURING There is increasing degree of separation of management and ownership... The decision power now is in the hands of the SOE's managers or the board of directors. Except for large and key SOEs, operations of most SOEs are no longer subject to state plans. 3. SOEs are now operating in freer market and are subject to market forces. The government no longer guarantees a market for an SOE's products and has stopped subsidizing losses incurred in SOEs. FEATURES OF SOEs AFTER RESTRUCTURING The reward of the manager is often directly linked to the performance of the SOE. Accounting information is widely used to measure performance. There is no market for stocks issued by most SOEs.. the value of the firm cannot be determined in a free market. Merger and acquisition of SOEs is not a common practice as there are political restrictions as well as technical problems NEW PROBLEMS HAVE EMERGED Although the abovementioned reforms have improved efficiency of SOEs, new problems have emerged. One of the problem is the self-serving management. China's large SOEs, either corporatized or still under the CRS, now significantly resemble modern corporations in the West in that the SOEs are characterized by a high degree of managerial authority and a separation of ownership from control. As a consequence, potential agency problems have emerged. NEW PROBLEMS HAVE EMERGED The agency problem is more serious among the SOEs' managers as the incentive system is shortterm oriented. Their primary financial reward system is linked the profit performance. As these managers are not allowed to own shares in the SOEs they managed, there is no long-term incentive. NEW PROBLEMS HAVE EMERGED The manager may inflate the profits to their benefit or provide false financial statements to conceal embezzlement and other irregular behavior. The financial statements provided do not represent the true and fair state of SOEs. NEW PROBLEMS HAVE EMERGED As a result, relying on these misleading or false financial information may lead to serious consequences, such as the loss of state funds, the wrong assessment of managers, and the formulation of incorrect economic decisions and policies. CHINESE ECONOMIC STIMULUS PLAN Environment Rural infrastructure Disaster rebuilding Tax cuts Industry Stimulus Package 588 billion USD Housing Health and education Finance Transportation Distribution of The Stimulate Fund 1600 1500 1400 1200 1000 1000 Yuan 800 600 400 370 370 210 200 150 0 Public Reconstruction Rural Infrastructure Work Development Development Technology Promoting Advancement Energy saving Program Education, Culture RESULT OF THE STIMULATE PACKAGE The stimulus provided funds for infrastructure projects and housing developments. Some were used to assist local governments to lend money to state-owned companies to develop housing estates, roads and bridges. This will drive employment in areas of manufacturing, steel, cement and other sectors of the economy. RESULT OF THE STIMULATE PACKAGE Some expert says the vast bulk of stimulate package went to state-owned companies And they used the money to strengthen their dominance in their markets or to enter new ones RESULT OF THE STIMULATE PACKAGE China's economic growth was sustained by the economic stimulus and in addition, assisted neighboring countries with the economic recovery in 2010 Chinese economic growth was around 10 percent even as its European and north American economies were slowing. THE END Thanks for your listening!