Foundations of Strategy Chapter 3: Resources and Capabilities Team 5

advertisement

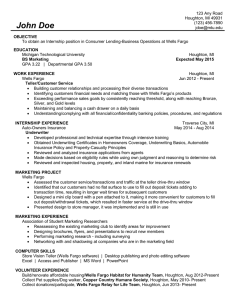

Foundations of Strategy Chapter 3: Resources and Capabilities Team 5 Micah Decuire, Kendra Kimberlin, Dylan Blase, Skylar Bogle and Daniel Uribe SPORTS AUTHORITY FILES FOR BANKRUPTCY • A well know brand and past industry leader has filed for bankruptcy after 10 years of being taken over by the hedge fund Leonard Green & Partners. • This failure is a direct issue that came from the misuse of allocated resources after such an extended period. Showing that they were not capable of retaining their abilities and remain a top competitor. • This bankruptcy will help other companies like Academy, Dick http://money.cnn.com/2016/03/02/news/companies/sports-authority-bankruptcy/ Hyundai Motor Company • Notorious for low quality cars • Redesigned its brand • Redesigned its product • Strategic manufacturing and locations • Was able to overcome the bad stigma by the market The role of resources and capabilities in strategy formulation • Resources and capabilities of a firm demonstrate how strategy interacts with the internal environment. • Resources and capabilities are more secure bases for formulating a strategy • Firms realizing their core competencies • Firms make mistakes when they focus on resources/capabilities that are about to be obsolete. Identifying the organization’s resources • Resources can be identified as tangible, intangible, human resource • Tangible • Are the easiest to identify, physical assets • Intangible • Usually the most valuable, but often invisible. • Human resources • Employees of a firm are important because they provide stability Wells Fargo’s Resources and Linkage Competitive Advantage Strategy Organizational Capabilities Resources Tangible ● Financial (Cost, securities, borrowing capacity) ● Physical Intangible ● Technology (patents, copyrights, trade secrets) ● Reputation ● Culture Human ● Skill/know-how ● Capacity for communication and collaboration Industry Success Factors Hyundai Motor Company Resource Category Illustrative example Strategic relevance Tangible resources Domestic and overseas production Ease into the market Intangible resources Built a reliable brand Consumers highly regarded brands Human resources Valuable talent and low labor/production costs. Strategic locations of manufacturing. Recruit talent and keep low labor costs. Must maintain lower costs and high quality to compete in industry. Identifying and Appraising Resources and Capabilities Core competences • The fundamental capabilities in a firm’s strategies and performance. • Make considerable value for the ultimate customer or contribute to the efficiency of obtaining that value. • Give an organization the basis for competing in a market. Distinct Competence • Distinct competence is what a firm does exceptionally well relative to the its competitors. It gives the firm competitive advantage. Kodak’s Capabilities • After failing in Betamax, developed into video technology and produced camcorders, digital cameras, and Playstation. Classifying and Disaggregating Capabilities Functional Analysis: Analyzes the functions of the organization as a whole. Identifies principal functions and then the capabilities within each function. Support Activities Value Chain Analysis: Separates the activities of the firm into a sequential chain. Consists of primary and support activities. FIRMS INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT Primary Activities INBOUND LOGISTICS OPERATIONS OUTBOUND ACTIVITIES MARKETING AND SALES SERVICE Hyundai Functional Analysis Function Illustrative Capability Corporate functions Offshore manufacturing. Financing market growth Management information Threshold capability Research and development Upgrading projects and process improvements Operations Ability to schedule production activities Product design Adapts products for local design Marketing Spent more than competitors in this area. Hyundai Value Chain Analysis Type of activity Value chain label Primary activities Inbound logistics Operations Outbound logistics Marketing and sales Service Support activities Infrastructure Human resource management Technology development Procurement Process and Routine Capabilities Organizational processes are the sequence of activities through which a specific task is performed. Routinization are regular and predictable patterns comprising repetitive patterns of activity. Example: a software company having a method for fixing a bug. Example: McDonald’s methods for making a hamburger and maintaining the milkshake machine. Appraising Resources and Capabilities A firm’s ability to obtain profit depends on their ability to establish, sustain, and appropriate returns to their competitive advantage Establishing Competitive Advantage Scarcity: capabilities are not widely available within an industry. Relevance: the capabilities directly influence success in the market. Example: Technology or knowledge only one company has. Example: Wal Mart's relationship with suppliers. Sustaining Competitive Advantage Durability: a capability must be able to last a long period of time. Transferability: the ability to buy a resource or capability. Example: Food products Example: If a company were to be acquired by another, how would the company’s value change. Wells Fargo Capabilities • Does not take many risks • Focus on highly involved customers • Cross-selling • Keeps funding low • Keeps interest paid on deposits low Putting Resource and Capability Analysis to Work Putting Resource and Capability Analysis to Work How do we put these analysis into practice in the business world? This can be broken down into 3-step approach 1. Identify the key resources and capabilities 2. Appraising resources and capabilities 3. Developing strategy implications Step 1 : Identify Key Resources and Capabilities • Create a list of the firm’s resources and capabilities • Key success factors • What factors determine why some firms in an industry are more successful than others and on what resources and capabilities are these success factors based? Wells Fargo believes that three factors contribute to their success: the people, process and philosophy. Step 2: Appraising Resources and Capabilities Resources and Capabilities now need to be appraised against two key criteria: • Importance • Ultimate objective is not to attract customers but to establish sustainable competitive advantage • Relative Strength • Internal discussion to share insights and evidence • building consensus regarding organizations resources and capabilities • benchmarking: powerful tool for quantitative assessment of performance relative to that of competitors WF ensures you maintain a great relationship with them by seeing the same person regularly and them being aware of your needs and future plans Appraising Hyundai’s resources and capabilities Importance Hyundai’s relative strength Marketing and Sales 9 7 Product development 8 9 Manufacturing 8 8 Distribution/dealership network 8 7 Plant and Equipment 8 9 Step 3: Developing Strategy Implications • Exploiting Key Strengths • formulate our strategy to ensure resources are used to the greatest extent • use strengths to differentiate from competitors • Managing Key Weaknesses • convert weaknesses into strengths • outsource Developing Resources and Capabilities • The most difficult problem in developing capabilities is that we know little about the linkage between resources and capabilities. • In business: the firms that demonstrate the most outstanding capabilities are not necessarily those with the greatest resource endowments. • GM has 4 times the output of Honda and 4 times the R&D expenditure, yet over the past three decades, it is Honda, not GM that has been the world leader in powertrain technology. • The most successful animated movies recently have been by newcomers Pixar and Aardman Animations rather than industry giants Walt Disney. • In telecom equipment, it was the upstart Cisco, rather than the established Alcatel-Lucent, Ericsson and Siemens that established leadership in new era of package switching • Managers with requisite knowledge for capability building is a critical resource Path dependency and the role of early experience. • Organisational capability is path dependent- a company’s capabilities today are the result of its history. • Wells Fargo developed a reputation for trust, dependability, safety and security after offering banking and express services in Gold Rush Port in San Francisco. Structure of organisational capability • Capabilities: involve coordination between organisational members with them integrating their skills with each other and a variety of other resources. • Organisational routines emphasizes informal dimensions since it involves ‘repetitive patterns of activity’, that are ‘ordinarily accomplished without conscious awareness’ Two factors that contribute to efficiency and effectiveness • Organisational learning • The more complex the task is, the greater the gains from learning-by-doing. • Culture, an intangible resources that plays a pivotal role. • The capacity for organisational members to work together successful with minimal management involvement depends upon shared common values, behavioral norms and perceptions. • WF employees work together with common values of wanting to provide customers with the best customer service they can give and deepen their relationship with customers and get their trust. Are organisational capabilities rigid or dynamic? People have challenged the notion that core capabilities inhibit firm’s abilities to access and develop new capabilities. • Flexibility in organisational routines: Studies have proven that even in the most basic daily operation show that even in the most basic day to day operations that there are variation and they have the capacity to adapt. • Dynamic Capability: The capacity to change can be regarded as an organisational capability. • Dynamic capabilities: a ‘firm’s ability to integrate, build and reconfigure internal and external competences to address rapidly changing environments.’ • Capabilities that allow an organisation to reconfigure its resources in order to adapt and change. • ‘Higher level process through which the firm modifies its operating routines.’ • It is agreed that dynamic capabilities are not common at all. • Highly developed capabilities in existing products and technologies create barriers for developing capabilities for new products and technologies for companies. Exploiting completely new business opportunities can be either a disadvantage or advantage to a company depending upon if the change or innovation is competence enhancing or destroying. • TV manufactures, most successful were those who were previously producers of radio. they were successful because the technology was compatible with their capabilities. • Typically, the most successful firms in new industries are start up companies rather than established firms. APPROACHES TO CAPABILITY DEVELOPMENT • Acquiring capabilities: mergers, acquisitions and alliances • Internal development: focus and sequencing • Harley-Davidson Case Study ACQUIRING CAPABILITIES Mergers, Acquisitions, Alliances • These methods are typically used for areas that the current company is struggling with or needs in order to meet market demands . • In acquiring capabilities in this manner comes with a few issues such as integration and a premium that must be paid to gain another entity. • Alliances relieve the costly aspect of the first two options, but require trust and similar paths into the future to maintain the relational capability. Wells Fargo • Since Wells Fargo’s origin in 1852 the company has become very familiar with the concept of acquiring and merging with other banking enterprises to continue their own growth. • Mergers (Northwest) • Acquisitions (Wachovia) • Alliances (Museums) • What was the capability that Wells Fargo needed? Was it successful? INTERNAL DEVELOPMENT This concept of internal development requires serious goals and constant management of the progress as they develop a new focus. This requires all hands on deck from every level to achieve making the vision harder to obtain consistently over time. Sequencing then must be taken into account as well with the idea of resource leveraging meaning using the same resources to gain a new perspective for the future expansion. Wells Fargo With the constant growth that Wells Fargo has achieved and continues to go after, the focus of internal development is considerably smaller than its mergers and acquisitions with the focus on control of the growth and culture instead of its banking practices. Hyundai’s Focuses • Assembly & Manufacturing • Global Logistics • In order to achieve these Hyundai used recruitment in new employees that had other car industry experience as well as creating professional groups to help achieve these capabilities. CASE STUDY: HARLEY-DAVIDSON • 1903 founded by William Harley and three Davidson brothers: William, Arthur and Walter with the classic v-twin engine. • A struggle began from 1953-1981 with the main competition coming from overseas for motorbikes they were soon acquired by AMF to expand production, however this came at with degraded quality. • Not satisfied with the quality senior management decided to take back the strength of just in time production. A new beginning for the company came with the strategic buyout of AMF at the cost of debt. • Customers recognized the changes and created surging demand; which in turn developed loyalty and brand strength. Harley-Davidson became know for the American image of freedom and individuality. • With the demand Harley-Davidson became focused on the needs and wants of the consumers and decided to equate that to the products that were being developed. In addition they refocused the stores to full service with parts, repairs and classes to add to the overall brand loyalty. OVERALL TAKEAWAYS • Firms need to hone in on their core competencies before expanding. • Having a balance of tangible, intangible and human resource is crucial. • Analyze the progress of new resources and capabilities to ensure they are really working out for the health of the company. • Use external sources to direct the entity for new and better things in the future.