Taxes and Business Strategy (15.518) Sloan School of Management Fall 2002

advertisement

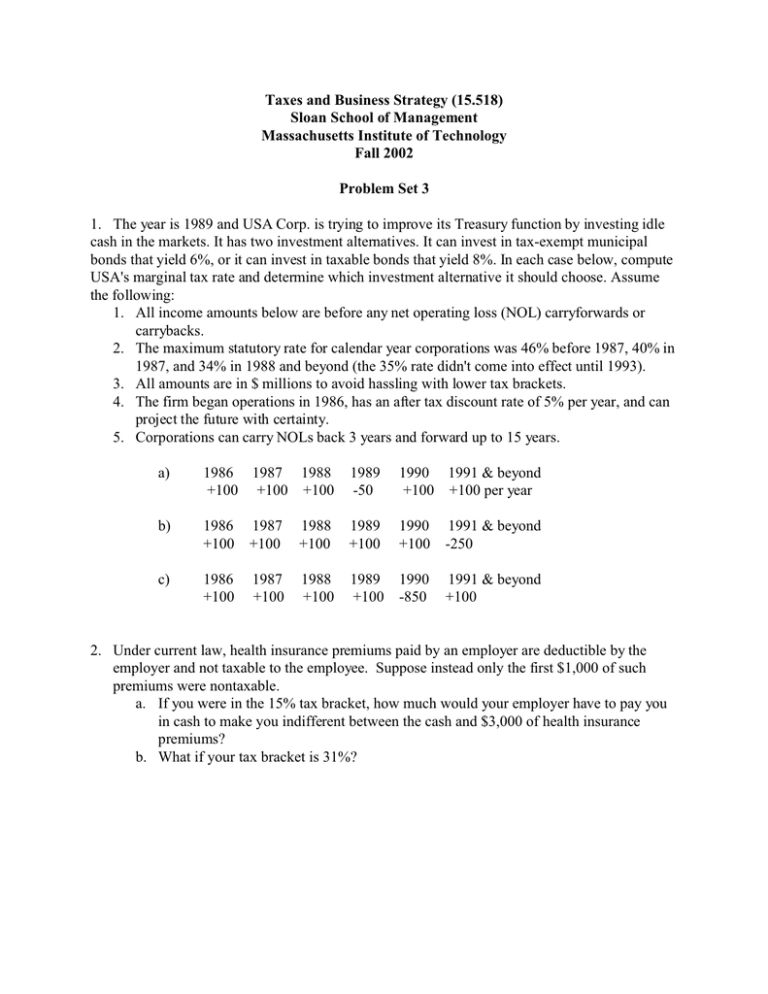

Taxes and Business Strategy (15.518) Sloan School of Management Massachusetts Institute of Technology Fall 2002 Problem Set 3 1. The year is 1989 and USA Corp. is trying to improve its Treasury function by investing idle cash in the markets. It has two investment alternatives. It can invest in tax-exempt municipal bonds that yield 6%, or it can invest in taxable bonds that yield 8%. In each case below, compute USA's marginal tax rate and determine which investment alternative it should choose. Assume the following: 1. All income amounts below are before any net operating loss (NOL) carryforwards or carrybacks. 2. The maximum statutory rate for calendar year corporations was 46% before 1987, 40% in 1987, and 34% in 1988 and beyond (the 35% rate didn't come into effect until 1993). 3. All amounts are in $ millions to avoid hassling with lower tax brackets. 4. The firm began operations in 1986, has an after tax discount rate of 5% per year, and can project the future with certainty. 5. Corporations can carry NOLs back 3 years and forward up to 15 years. a) 1986 1987 1988 +100 +100 +100 1989 -50 1990 1991 & beyond +100 +100 per year b) 1986 +100 1987 +100 1988 +100 1989 +100 1990 +100 1991 & beyond -250 c) 1986 +100 1987 +100 1988 +100 1989 1990 +100 -850 1991 & beyond +100 2. Under current law, health insurance premiums paid by an employer are deductible by the employer and not taxable to the employee. Suppose instead only the first $1,000 of such premiums were nontaxable. a. If you were in the 15% tax bracket, how much would your employer have to pay you in cash to make you indifferent between the cash and $3,000 of health insurance premiums? b. What if your tax bracket is 31%? 3. Suppose you are an employee of Global Enterprises, Inc. (GE). You face a personal marginal tax rate on ordinary income of 50%, and on capital gains the tax rate is 20%. Your after-tax cost of capital is 7% per year. You hold 100 employee stock options that have an exercise price of $20 per option, and the current stock price is $35. A. Assume the options you hold are Incentive Stock Options. What is the present value of any tax due given you intend to hold the stock for 10 years after exercise? What is the present value of any tax deduction that GE might get, assuming GE's marginal tax rate is 10%? B. Repeat (A) but now assume the options are Non-qualified Stock Options. Compare and summarize your results. Now change the facts as follows. Suppose the tax law changed such that GE's marginal tax rate is 34% and your tax rate is 28% on both ordinary income and capital gains. C. Repeat (A) assuming the 100 options are Incentive Stock Options. D. Repeat (C) assuming the 100 options are Non-qualified Stock Options. Summarize and compare the results of (C) and (D). Do you notice any tax-planning opportunities available to you and GE? 4. B2B, Inc., is a high-tech Internet company. It is trying to decide whether to issue Non-qualified Stock Options or Incentive Stock Options to its employees. Each employee will get 10 options. For purposes of this problem, assume that the options are exercised in 3 years and that the underlying stock is sold in 5 years. Assume the following: • Corporate tax rate = 35%, Personal ordinary income rate = 40%, Personal capital gains rate = 28% • After-tax discount rate = 5% • Exercise price of the options = $5 • Market price at grant = $4, Market price at exercise = $30, Market price at sale = $40 Support your answers with "numbers". A. Considering these facts, which type of option plan does B2B, Inc. prefer? B. Which type of option do B2B, Inc. employees prefer? C. Which type of plan should be used? Why? D. Assuming that you knew that the personal capital gains tax rate was going to be cut to 20% in 4 years from the current 28%, which type of plan should be used? Why?