Can China Smoothly and Successfully Shift to a Sustainable Growth Model Andong Zhu

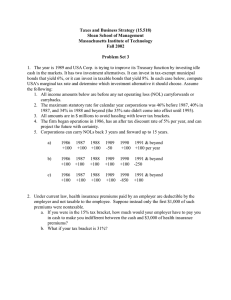

advertisement

Can China Smoothly and Successfully Shift to a Sustainable Growth Model Andong Zhu Tsinghua University Outline Introduction The Growth Models in the past 30 yeas Opportunities and Challenges to New and Sustainable Model Conclusion Introduction: From Old China to New China Semi-Feudal Semi-Colonial Backward Market-Oriented Sustainable Independent GDP Growth Fast (Economic, Economic & Social Income Inequality Social, Environment) Construction Balanced Social Development Development Environment 1949 1978 2002 or 2009? A Family in the “Old China” 1948: Hyper-inflation in China The Achievements of New China before 1978 Preliminarily Industrialized the Economy Established a Independent and Comprehensive Industrial system GDP Growth Rate Averaged at 6.68% per year during 1953-1978 Life Expectancy increased from around 35 to about 67 years. The Growth Models of New China 2.0 Achievements Evolvement of the Growth Models Problems Fast GDP Growth GDP Growth Rate of China:1979-2008 (%) 16 15.2 14 13.5 12 10.9 10 8 6 4 14.213.9 13.1 9.0 11.611.3 9.2 8.9 13.0 11.6 10.9 10.0 9.3 10.4 10.010.1 9.1 7.8 7.6 7.6 7.8 8.4 8.3 9.0 5.3 4.1 3.8 2 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 0 Huge Amount of Foreign Reserves Foreign Reserves of China ($Bn): 1978-2007 2500 1946 2000 1528 1500 1066 1000 819 610 500 1985 1986 1987 1988 1989 1990 2008 1984 2007 1983 2006 1982 2005 1981 2004 1980 2003 1979 2002 6 212 2001 3 2000 3 1999 2 1998 3 1997 8 1996 9 1995 7 1994 3 1993 -1 1992 1 1991 0 155 166 105 140 145 74 11 22 19 21 52 1978 0 403 286 Evolvement of the Growth Models Relatively Balanced/Outward Looking Growth Balanced/Inward Looking Growth Planned Economy With Market Mechanism 1978 1992 Marketization; Privatization Liberalization Imbalanced/outward Looking New growth model? Over-dependent Sustainable On (Economic, International Market Social, Environment) And Development Investment 2001 2009 The Over-dependency on Investment 中国的投资率(%): 1978-2007 44 43.2 42.742.6 42.6 42 41.0 40.540.3 40 42.1 38.8 38.2 38.1 38 37.5 36.1 36 34.8 37.9 37.0 36.3 36.6 32.5 32 36.5 36.236.2 35.3 34.934.8 34.2 34 36.7 36.6 32.8 31.9 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 30 The Consumption Ratio in China 中国的消费率(%): 1978-2007 70 65 62.1 64.4 65.5 67.1 66.5 66.4 65.8 66.0 64.9 63.6 63.9 64.5 最终消费支出 62.5 62.4 62.4 59.3 60 45 62.3 61.4 59.6 56.8 54.3 55 50 58.2 58.1 59.2 59.0 59.6 61.2 居民消费支出 48.8 49.1 50.8 52.5 51.9 52.0 50.8 51.6 50.5 49.9 51.1 50.9 51.8 48.8 49.9 47.5 47.2 44.4 43.5 44.9 45.8 45.2 45.3 46.1 46.4 45.2 49.0 43.7 41.7 39.8 40 37.7 36.3 35.3 19 78 19 79 19 80 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 35 Widening Income Inequality Income Gini Coefficient of China: 1978-2006 0. 46 0. 45 0. 44 0. 44 0. 43 0. 39 0. 40 0. 39 0. 38 0. 37 0. 34 0. 30 0. 31 0. 31 0. 29 0. 32 0. 32 0. 30 0. 37 0. 37 0. 38 0. 39 0. 41 0. 40 0. 35 0. 33 0. 28 0. 26 0. 24 19 78 19 80 19 82 19 84 19 86 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 0.50 0.45 0.40 0.35 0.30 0.25 0.20 0.15 0.10 Sweden 25, India 32.5, United States 40.8, China 44.7, Brazil 59.1 Household Final Consumption Ratio and the the Ratio of top 20% population's income against the Bottom 20%, 2003 80 60 Household Final Consumption ratio (%) 100 40 0 2 4 6 8 10 Q1/Q5 12 14 16 18 20 What are the Major Reasons of Inequality in China? Monopoly? Corruption? Privatization? Income distribution Ownership Labor Relation Income distribution Ownership Share of Chinese Industrial Output by Ownership(%):1990-2004 100 Foreign 90 80 Domestic Private 70 60 Clollectively Owned 50 40 30 20 State_owned 10 0 1 9 90 1 9 91 1 9 92 1 9 93 1 9 94 1 9 95 1 9 96 1 9 97 1 9 98 1 9 99 2 0 00 2 0 01 2 0 02 2 0 03 2 0 04 The Laid-off/privatization Movement(Mn) Urban employment State-owned Units Collectiveowned Units highest level 27331(2005) 11261(1995) 3628(1991) lowest level 19040(1995) 6488(2005) 810(2005) 8291 -4773 -2818 change Informalizing Labor Market 30000 25000 EMP-CITY-SOE EMP-STF&WRK EMP-CITY 20000 15000 10000 5000 0 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 What New Growth model Needed in the Chinese Economy? Balanced/sustainable Economic development Less depend on international Market Less depend on Investment Increasing Private Consumption increasing income of the poor & improving the Social Security Net (re-)nationalization of enterprises; more strictly regulate the market Opportunities and Challenges to New Model Opportunities The Drain Up of the Rural Labor Reserves The Current Crisis (International Market; US Model; Theory, etc) Challenges Low External Debt Risk Risk Indicators on External Debts of China (%): 1985-2007 18 120 16 100 14 12 80 10 60 8 6 40 4 20 2 Debt Service Ratio Liability Ratio Foreign Debt Ratio (RHS) 0 0 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Enough Room for Fiscal and Monetary Policies China Still Has Room to Loose the Money Market: 2005.01~2008.11 8.0% 19% Interest rate of one year loans Required Reserve Ratio (RHS) Required Reserve Ratio of Small and Middle sized FI (RHS) At the end of 2007,total public debt was RMB3.4 Tr.,as 13.8% of GDP and 67.0% of government revenue 2008.11 2008.09 2008.07 2008.05 2008.03 2008.01 2007.11 2007.09 2007.07 2007.05 2007.03 2007.01 2006.11 7% 2006.09 5.0% 2006.07 9% 2006.05 5.5% 2006.03 11% 2006.01 6.0% 2005.11 13% 2005.09 6.5% 2005.07 15% 2005.05 7.0% 2005.03 17% 2005.01 7.5% The Composition of the 4 Tr. RMB Stimulus Plan The Composition of the 4 Trillion RMB Stimulus Plan Re-construction after Dissaster, 1000, 25% Housing for the Poor, 400, 10% Rural Construction, 370, 9% Saving Energy and Decreasing Emmission, 210, 5% Industrial Restructuring, 370, 9% Socail Affairs, 150, 4% Infrastructure Investment, 1500, 38% 20081124 20080611 20071224 20070711 20070118 20060731 20060213 20050816 20050301 20040831 20040312 20030911 20030320 20020927 20020408 20011010 20010418 20001024 20000509 19991104 19990519 19981118 19980608 19971210 19970625 19961226 19960715 19960119 19950808 19950224 19940906 19940328 19931008 19930429 19921116 19920604 19911219 19910709 19901228 7000 Shanghai Stock Market Comprehensive Index:1990.12.28~2009.3.12 6000 5000 4000 3000 2000 1000 0 Conclusion The growth pattern of China has to be changed even without this current Crisis It will not be Easy to transform China to a really Sustainable Development Model Smoothly and Successfully Comments and Questions Welcome! Thank You!