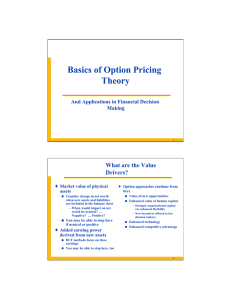

Basics of Option Pricing Theory What are the Value Drivers?

advertisement

Basics of Option Pricing Theory And Applications in Financial Decision Making -1- What are the Value Drivers? F Market value of physical assets l l Consider change in net worth when new assets and liabilities are included in the balance sheet —When would impact on net worth be neutral? … Negative? … Positive? You may be able to stop here if neutral or positive F Added earning power derived from new assets l l F Option approaches continue from here l l Value of new opportunities Enhanced value of human capital — Stronger organizational capital via enhanced flexibility — New incentives offered to key decision makers l l Enhanced technology Enhanced competitive advantage DCF methods focus on these earnings You may be able to stop here, too -2- What are financial options? F Options are financial contracts whose value is contingent upon the value of some underlying asset F Such arrangements are also known as contingent claims l because equilibrium market value of an option moves in direct association with the market value of its underlying asset. F OPT measures this linkage -3- The basics of options Calls and puts defined F Call: privilege of buying the underlying asset at a specified price and time F Put: privilege of selling the underlying asset at a specified price and time -4- The basics of options Regional differences defined F American options can be exercised anytime before expiration date F European options can be exercised only on the expiration date F Asian options are settled based on average price of underlying asset -5- The basics of options F Options may be allowed to expire without exercising them F Options game has a long history l at least as old as the “premium game” of 17th century Amsterdam l developed from an even older “time game” —which evolved into modern futures markets —and spawned modern central banks -6- How are Real Options Different? FFinancial Options assets are financial assets FReal Options l Underlying l Underlying l Rules l Rules governing exercise are stated in contract assets are physical items governing exercise reflect realities in the physical realm -7- Option Applications F Growth options l See F Options to abandon l See F Black/Scholes (1973), Myers (1977) Kensinger (1980), Myers & Majd (1984) Options to shut down temporarily l See McDonald and Siegel (1985) l See Brennan & Schwartz (1985) l See Siegle, Smith, & Paddock (1988) -8- Option Applications F Options to choose the most profitable of several activities l See F Chen, Conover, and Kensinger (1998) Strategic Options l See Grinblatt & Titman (1998) l See Luerhman (1998) l Amram & Kulatilaka (2000) -9- Score Card FDCF significantly underestimates value by ignoring real options FRO also underestimates value FRO doesn’t cover important parts of the value chain - 10 - The physical value chain from a global perspective:How much of it have we covered so far? Support Activities: •Technology Development •Human Resources Development Service Distribution& Marketing Fabrication Refining Basic Extraction Physical Realm Value Added at Each Step - 11 - Score Card FVirtual option analysis helps fill the gap even further - 12 - How are Virtual Options Different? F Real Options F Virtual Options l Underlying assets are physical items l Rules governing exercise reflect realities in the physical realm l Underlying assets are information items l Rules governing exercise reflect realities in the information realm - 13 - Transition-Phase Virtual Options FDerive from information products FUnderlying assets are real options - 14 - Virtual Value Chain & Information Operations GATHER AND APPLY IN THE PHYSICAL REALM STORE AND TRANSFORM IN THE INFORMATION REALM APPLY PRESENT DISTRIBUTE SYNTHESIZE Infosphere SELECT ORGANIZE GATHER - 15 - Forging Links Between Finance and Strategy More Exploration of the Real Options Frontier - 16 - Is there a conflict? Competitive Advantage vs. Shareholder Value F Why do people think there is conflict here? F Why are managers frustrated with the market? F Short Term vs. Long Term? l Is the market myopic? F How long can value-creation last? l Are managers unrealistically optimistic about value growth duration? - 17 - Common Link F Productivity is foundation for competitive advantage l l l Value of output per unit of labor or capital Superior value or lower cost for customers A company creates competitive advantage when the long-term value of output is greater than total costs (including cost of capital) F Foundation of share price is long-term forecast of productivity - 18 - Reminder F It isn’t enough to win l You have to do better than expected F Losing may not be bad l If you don’t do as badly as expected F Consistent performance l Makes flat stock price - 19 - Management Myths F Market does not actually value long-term productivity of my company, but judges it only on short-term performance F We here at this company must depart from the shareholder-value model in order to improve our competitive advantage - 20 - Market sees long-term F Evidence concerning stock price reaction to capital expenditure announcements l l Positive for increases in spending, negative for decreases Reverse response for oil exploration in the U.S. (data from 1980s) F Evidence concerning expenditures for R&D l l Positive for high-tech Zero or negative for low-tech F Strategic announcements l l Stategic Alliance study Woolridge (1988) F Value decomposition studies l l Woolridge (1995) Alcar Group - 21 - PVGO - 22 - Appropriate Considerations F Proper application of shareholder value analysis requires careful consideration of l Decision to invest new resources l Decision not to invest F The hazard of incorrect choice in the first case is clear F The hazard of incorrect choice in the second case is that good opportunities might be lost to competitors - 23 - Lesson from History F A company that provides more "value" than investors or customers want to pay for is not competitive, and may not even be viable l Lesson of Italian weavers in 17th century l Lesson of Wallace Company, Houston —Won Malcolm Baldrige National Quality Award in 1990 —Customers unwilling to pay increased prices —Company soon began losing money, laying off employees, and finally sought bankruptcy protection - 24 - Comment F Shareholder value principals are common-sense tools to make a business more competitive (This is closing line of Rappaport article) l l F Goal of strategy is clear to make investment decisions that lead to greater shareholder value (This is opening line of Amram & Kulatilaka article) l - 25 - Components of discipline F Decision is structured, or framed, in terms of the options it creates F All the relevant information on value and risk available in the financial markets is taken into account F Financial market transactions are used to acquire options or otherwise mitigate risk l Sometimes cheaper to buy a financial option than a real option - 26 - Fossil Inc. Seiko price Opportunity Space Casio Timex quality - 27 - Complexity of the decision Real Options Frontier Place to look for positive NPV Distance from financial markets - 28 - Flaw in Traditional Approaches Cone of uncertainty Terminal value third investment value second investment Initial investment time - 29 - Limits of Discipline F Model risk F Imperfect proxies F Lack of observable prices F Lack of liquidity F Private risk - 30 - Impediments to adopting RO approach F Perception of difficulty F Myth that RO tends to find value where none exists F Shortage of value growth opportunities in several large industries F Short value growth duration in emerging industries - 31 - Often options are limited by the environment F Economic limitations F Technological limitations F Political limitations - 32 - Porter’s Generic Product/Market Strategies Broad Market Focused Market Lower Cost Differentiation Cost Leadership Differentiation Cost Focus Differentiation Focus - 33 - Porter’s method for analyzing competitive environment New Entrants Suppliers Industry Rivals Customers Substitutes - 34 - The physical value chain from a global perspective:How much of it have we covered so far? Support Activities: •Technology Development •Human Resources Development Service Distribution& Marketing Fabrication Refining Basic Extraction Physical Realm Value Added at Each Step - 35 - Virtual Value Chain & Information Operations GATHER AND APPLY IN THE PHYSICAL REALM STORE AND TRANSFORM IN THE INFORMATION REALM APPLY PRESENT DISTRIBUTE SYNTHESIZE Infosphere SELECT ORGANIZE GATHER - 36 - Recognizing the Value of Management Flexibility Real Options Frontier - 37 - Why the sudden interest in real options? F We have had real option applications since 1978 (maybe even 1973) l Calculate value of real options using pricing methods developed for financial options F “Real Options Approach” is more recent: l This is a way of thinking that helps managers formulate their strategic options Source: Amram & Kulatilaka (2000) - 38 - Why the sudden interest in real options? Answer in two words: Demand and Supply F The environment of uncertainty creates demand l l l l Analysts cannot see very far into future Sequential decisions: 1st round investment with clear expectation of later expansion, modification, or abandonment Management must consistently communicate progress (or disappointments) to public markets, even before projects generate cash flows Need to evaluate profitless companies (like Internet startups) F Supply has expanded l l l Advances in academic research Growth of specialized consulting services Improved information technology - 39 - Stewart Myers’ challenge (1984) F Strategic planning needs finance l Present value calculations are needed as a check on strategic analysis and vice versa l Standard discounted cash flow techniques tend to understate the option value of growing profitable lines of business l Corporate finance theory requires extension to deal with real options - 40 - Luehrman Strategy as a Portfolio of Real Options F A business strategy is more like a series of options than it is like a series of static cash flows F Options as Tomatoes l l l Some are ripe and perfect: pick immediately Some are rotten: don’t bother to pick In between: —Edible but would benefit from more time: Pick now or risk loss to birds? —Not yet edible: No decision needed - 41 - - 42 - DCF only Augmented - 43 - - 44 - Illustration using BlackScholes Value of 1st year’s option = $1135.40 Value of 2nd year’s option = $1287.59 NPV = –2000 + 1135.40 + 1287.59 = $422.99 - 45 - Lessons F Rule 1: The more volatile the relation between the prices of the input and output commodities, the greater the difference between the true NPV and the DCF-NPV l Question: What real world factors influence this correlation? F Rule 2: The difference between the true NPV and the DCF-NPV is greater the more innovative the project, and the stronger the barriers to entry - 46 - Rule 3: A company that has the same uses for a system as another company, plus additional operating options, will gain a higher NPV by purchasing the system. That is, the more flexible the system being considered, the greater the difference between true NPV and DCF NPV - 47 - Luehrman Tour of Option Space lower higher Direction of increasing value volatility 0.0 lower value-to-cost 1.0 higher - 48 - Luehrman Tour of Option Space volatility 0.0 lower lower value-to-cost 1.0 higher 6: Rotten tomatoes Never invest Region 1: Region ripe tomatoes Invest now Region 5: Poor prospects Maybe never 4: Green tomatoes higher Maybe later Region 3: Not yet edible Probably later Region 2: Edible but early Maybe now Region - 49 - Buying Flexibility (Trigeorgis & Mason) F Expanded NPV = Static NPV + Option Premia F Sources of Flexibility: l Option to defer —Licensing agreement —Oil lease l l l Option to expand Option to contract Option to switch states —Shut down temporarily —Relocate production Option to abandon F Project Interdependence l - 50 - Evaluating Flexibility (Amran & Kulatilaka, 2000) F Publicly-traded contingent claims F Surrogate portfolios F “Hybrid” Frameworks l Tailored mix l Discounted Cash Flow Analysis (DCF) l Decision Tree Analysis (DTA) l Simulation l Dynamic Programming l Contingent Claims Analysis (CCA) F Summary: l Market tracking l Risk framing (may involve much art mixed with the science) - 51 - Clarification (Amran & Kulatilaka, 2000) F Strategic Options: Future opportunities created by today’s investments F Real options that can be tracked in the market: l Subset of strategic options in which the exercise decision is largely triggered by market-priced risk F Something that is private risk today may be securitized in the future l l l Bandwidth trading Weather derivatives Profitless IPOs - 52 - Market Tracking (Amran & Kulatilaka, 2000) Continuum of applicability: F Copper mine l Liquid & well-function markets in spot, futures, and other derivatives F Gas-fueled Electric Power Generation Plant l l Futures, options, and derivatives available for input and output May be large difference between local pricing and market benchmarks F Semiconductor Memory Fab l Data provided by spot & forward trading of chips may be sporadic - 53 - Example of Complex Options Phases of Oil Exploration (Amran & Kulatilaka, 2000) Early Exploration Late Exploration Development Exploitation Option on Option on Option on Underlying Asset ‹—Option on ‹—Option on ‹—Underlying Option on Underlying Asset Underlying Asset Asset Presence of oil Quantity of oil unknown unknown Cost of development unknown - 54 - Pharmaceutical Development: Not Market-Trackable RO (Amran & Kulatilaka, 2000) Phase I Years: 1 Cost: $15 mm Prob: 75% Is compound safe? What is target condition? Phase II Years: 1.5 Cost: $30 mm Prob: 50% Phase III Years: 3 Cost: $200mm Prob: 65% Is compound effective for target condition? Is it safe? Right dose? Safe and effective for large groups with target condition? New Drug Application Years: 1 Cost: $7 mm Prob: 65% Do regulators agree it’s safe? What goes on label? - 55 - Basics of Simple Financial Options Purpose: Provide background on the basics of Option Pricing Theory (OPT) - 56 - Put-Call Parity Consider two portfolios • Portfolio A contains a call and a bond: VA C(S,X,t) + B(X,t) • Portfolio B contains stock plus put: VB S*<X 0 +X =X X-S +S =X S*>X S-X +X =S 0 +S =S S + P(S,X,t) - 57 - Put-Call Parity F If S* < X, Payoff for either portfolio is X dollars F If S* > X, Payoff for either portfolio is S* F Therefore C(S,X,t) + B(X,t) = S + P(S,X,t) - 58 - Keys for using OPT as an analytical tool C(S,X,t) = S - B(X,t) + P(S,X,t) C Call S B(X,t) Stock - 72 - C X C R C l S Call Keys for using OPT as an analytical tool C(S,X,t) = S - B(X,t) + P(S,X,t) B(X,t) Stock - 74 - S C P X C P R C P t C P s C P Call Keys for using OPT as an analytical tool C(S,X,t) + B(X,t) = S + P(S,X,t) B(X,t) Stock - 77 - Basic Option Strategies F Long Call F Long Put F Short Call F Short Put F Long Straddle F Short Straddle - 78 - Long Call $ 0 -C X S X+C - 79 - Long Call Short Call $ C $ 0 -C X S X+C 0 X+C X S - 80 - $ 0 -C S X $ X+C Short Call Long Call Long Put $ C 0 X+C S X X-P 0 X -P S - 81 - $ 0 -C Long Put $ 0 -P S X X+C $ C 0 X+C S X $ P X-P X Short Call Long Call Short Put S 0 X S X-P - 82 - 0 -C S X X+C Long Put $ X-P 0 X -P $ S $ C Short Call $ 0 X+C S X $ P Short Put Long Call Long Straddle 0 X S X-P X-P-C 0 S X -(P+C) X+P+C - 83 - 0 -C S X X+C X-P 0 X -P Long Straddle Long Put $ $ 0 -(P+C) S $ C 0 X+C S X $ P 0 X S X+P+C S X-P $ P+C X-P-C X Short Call $ Short Put Long Call Short Straddle X+P+C 0 X X-P-C S - 84 - Impact of Limited Liability C(V,D,t) = V - B(D,t) + P(V,D,t) Equity F Equity = C(V,D,t) F Debt = V - C(V,D,t) B(D,t) V - 85 - Lessons we can learn even with simple models F F The discounted cash flow NPV, using expected prices of the input and output commodities at future dates, represents only the lower bound of the project’s true NPV. The true NPV may be significantly higher than the DCF estimate. - 86 - Lessons F The more volatile the relationship between the prices of input and output commodities, the greater the difference between the true project NPV and the discounted cash flow NPV. - 87 - Lessons F The difference between the true project NPV and the discounted cash flow NPV is greater: l the more innovative the project, and l the stronger the barriers to entry for potential competitors. - 88 - Lessons F A company with the same potential uses for a system as another company, plus one or more additional uses, will gain a higher NPV by purchasing the system. l Thus, the NPV of a project may differ from one company to another, l And companies with more flexibility have an advantage in generating positive net present value. - 89 -