Proceedings of Annual Shanghai Business, Economics and Finance Conference

advertisement

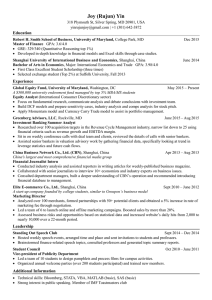

Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 The Effect of Perky Strategies of Working Capital on Companies’ Liquidity Position Hossein Shafiei*, Ali-Akbar Darvishi** and Vahid Haji-Alizadeh*** Investors for increasing their own wealth try to do different kinds of evaluations and they try to evaluate companies’ turnover at different aspects and for different periods of time. For their evaluation they pay attention to different ratios like profitability, liquidity and other financial ratios. Other groups of users of financial statements like creditors and or analysts use similar and recondite methods to analyze and make different decisions for their investment. Between different methods that users of financial statements use for decision making the amount of working capital is one of the most important criteria for financial decision makers. An entity’s continuous operation is highly dependent to companies’ resource management and working capital management has an extraordinary on financial operation. Because operational actions that they are annually, are so much dependent to working capital and managing liquidity structure. Working capital management is related to financial decisions and entity’s current assets and financing for short or long term. Managers use different policies for working capital to manage entity’s resources in best way to achieve the best results. For this purpose managers have tried to know the best method for different situations. Some researchers tried to understand the effect of working capital on different aspects of operation in different companies at different situations. Thus in this research we tried to assess the effect of different policies of working capital on companies liquidity. For this purpose we used a regression model and some statistical methods to estimate the effect of working capital on companies’ liquidity. The results show that there is a significant relationship between working capital and financial leverage, return on assets but its relationship with the size of company is inverse. In other words changing working capital policy management essentially won’t cause a significant decrease in company’s liquidity, and there is no special relationship between working capital and surplus cash fundsat companies. JEL Codes: G10, G11, E44 and E52 1. Introduction Working capital management efficiency is vital especially for manufacturing firms, where a major part of assets is composed of current assets (Horne and Wachowitz, 2000). It directly affects the profitability and liquidity of firms (Raheman and Nasr, 2007). The profitability liquidity tradeoff is important because if working capital management is not given due considerations then the firms are likely to fail and face bankruptcy (Kargar and Bluementhal, 1994). The significance of working capital management efficiency is irrefutable (Filbeck and Krueger, 2005). Working capital is known as life giving force for any economic unit and its management is considered among the most important function of corporate management. Every organization whether, profit oriented or not, irrespective of size and nature of business, requires necessary amount of working capital. Working capital is the most crucial factor for maintaining liquidity, survival, solvency and profitability of business (Mukhopadhyay, 2004). Working capital management is one of the most *Mr. Hossein Shafiei, Department of Accounting, College of Social Science, Sirjan Branch, Islamic Azad University, Sirjan, Iran Corresponding Author: hshafiei@iausirjan.ac.ir **Mr. Ali-Akbar Darvishi, MSc student in accounting, I.A.U Iran. *** Mr. Vahid Haji-Alizadeh, Accountant, SKED Co. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 important areas while making the liquidity and profitability comparisons among firms (Eljelly, 2004), involving the decision of the amount and composition of current assets and the financing of these assets. The greater the relative proportion of liquid assets, the lesser the risk of running out of cash, all other things being equal. All individual components of working capital including cash, marketable securities, account receivables and inventory management play a vital role in the performance of any firm. Shin and Soenen, (1998) argued that efficient working capital management is very important to create value for the shareholders while Smith et. al., (1997) emphasized that profitability and liquidity are the salient goals of working capital management. Considering the importance of working capital management the researchers focused on evaluating the working capital management and profitability relationship such as Uyar, 2009; Samiloglu and Demirgunes, 2008; Vishnani and Shah, 2007; Teruel and Solano, 2007; Lazaridis & Tryfonidis, 2006; Padachi, 2006; Shin and Soenen, 1998; Smith et al., 1997 and Jose et al., 1996 among others. However, there are a few studies with reference to Pakistan like Afza and Nazir 2007 & 2008; Raheman and Nasr 2007 and Shah and Sana 2006. Afza and Nazir (2007, 2008) focused only on the working capital management financing policies. Other two studies focused on the relationship between profitability and working capital management in Pakistan. Shah and Sana (2006) concentrated on the oil and gas sector and estimated the relationship using small sample of 7 firms. Raheman and Nasr (2007) analyzed profitability and working capital management performance of only 94 firms listed on Karachi Stock Exchange for the period 1999-2004 only by using Ordinary Least Square and Generalized Least Square. However this study ignored the fixed effect of each firm as each firm has its unique characteristics and also ignored sector wise analysis of working capital management performance of manufacturing firms. Insufficient evidences on the firm‘s performance and working capital management with reference to Pakistan provide a strong motivation for evaluating the relationship between working capital management and firm performance in detail. The crucial part in managing working capital is required maintaining its liquidity in day-today operation to ensure its smooth running and meets its obligation (Eljelly, 2004). Liquidity plays a significant role in the successful functioning of a business firm. A firm should ensure that it does not suffer from lack-of or excess liquidity to meet its short-term compulsions. A study of liquidity is of major importance to both the internal and the external analysts because of its close relationship with day-to-day operations of a business (Bhunia, 2010). Dilemma in liquidity management is to achieve desired tradeoff between liquidity and profitability (Raheman et all, 2007). Referring to theory of risk and return, investment with more risk will result to more return. Thus, firms with high liquidity of working capital may have low risk then low profitability. Conversely, firm that has low liquidity of working capital, facing high risk results to high profitability. The issue here is in managing working capital, firm must take into consideration all the items in both accounts and try to balance the risk and return (Lee et all, 2008). Firms may have an optimal level of working capital that maximizes their value. Large inventory and generous trade credit policy may lead to high sales. The larger inventory also reduces the risk of a stock-out. Trade credit may stimulate sales because it allows a firm to access product quality before paying (Raheman and Nasr, 2007). Another component of working capital is accounts payables. Raheman and Nasr state that delaying payment of accounts payable to suppliers allows firms to access the quality of bough products and can be inexpensive and flexible source of financing. On the other hand, delaying of such payables can be expensive if a firm is offered a discount for the early payment. By the same token, uncollected accounts receivables can lead to cash inflow problems for the firm. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 A popular measure of working capital management is the cash conversion cycle, that is, the time span between the expenditure for the purchases of raw materials and the collection of sales of finished goods. Deloof (2003), for example, found that the longer the time lag, the larger the investment in working capital. A long cash conversion cycle might increase profitability because it leads to higher sales. However, corporate profitability might decrease with the cash conversion cycle, if the costs of higher investment in working capital rise faster than the benefits of holding more inventories and/or granting more trade credit to customers. A variety of variables related to working capital management that might potentially be associated or ‗responsible‘ for the profitability of manufacturing firms can be found in the literature. In this study, the choice of explanatory variables is based on alternative theories related to working capital management and profitability and additional variables that were studied in reported empirical work. The choice is sometimes limited, however, due to lack of data. As a result, the final set includes eight proxy variables: accounts receivables, accounts payables, inventory, cash conversion cycle, firm size, financial debt ratio, fixed financial assets ratio, and gross operating profit. This study contributes to the effect of perky strategies of working capital on companies‘ liquidity position in at least two ways. First, it focuses on Tehran Stock Exchange Companies where only limited research has been conducted on such firms recently. Second, this study validates some of the finding of previous authors by testing the The effect of perky strategies of working capital on companies‘ liquidity position. Thus, this study adds substance to the existing theory developed by previous authors. 2. Literature Review As earlier stated, the survival of any business depends on its ability of meet, either in the short run or in the long-run, and it obligations as they fall due and also take opportunities either in the form of prompt payment of liabilities in order to enjoying discounts and also to finance business expansion. It is important to state at this point that profitability does not always amount to liquidity as such a critical analysis of company‘s inflow and expected outflow in an accounting period is gamine to effective cash management. Torre (1997) defines treasury (cash) management as a set of techniques that act on the short-term liquidity of a company, and at the same time affect those factors and processes that translate immediately into cash, with the ultimate aim of increasing both the liquidity and profitability of the company. In this sense cash management is the back bone of liquidity management as it affects corporate profitability. Cash in excess of what is required need to be invested in short term securities pending when it is required. The major problem faced by most businesses is the ability to determine the minimum cash level required by the business. Minimum cash level assist management to maintain enough cash to meet its day-to-day operating expenses. To prevent breaks or gaps in the trading cycle due to lack of cash, administrators must calculate the cash amount best suited to their level of activity, plan the timing of the relevant payments and collections and draw up a policy of investment in assets with high liquidity that can be converted to cash at a low transactional cost to serve as support for the treasury funds maintained by the company (Kamath, 1985; Srinivasan & Kim, 1986). It is therefore essential to establish the right level of disposable assets to short-term financial investments at companies. Holding the wrong amount in cash or cash equivalent may interrupt the normal flow of business activities. Moreover, the wrong safety margin may result in financial difficulties, with firms unable to meet needs that may arise at any given time or unable to take advantage of unexpected investment opportunities. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Maintaining a cash surplus thus has a number of advantages. It enables companies to carry on the normal transactions that arise in the course of their activities and avoid any treasury gaps. It also help them cover any unexpected needs for cash by acting as a preventive balance. However, there are also disadvantages in being too conservative, as reflected in the opportunity costs entailed by assets with little or no profitability. Long et al.(2003) developed a model of trade credit in which asymmetric information leads good firms to extend trade credit so that buyers can verify product quality before payment. Their sample contained all industrial (SIC 2000 through 3999) firms with data available from COMPUSTAT for the three-year period ending in 1987 and used regression analysis. They defined trade credit policy as the average time receivables are outstanding and measured this variable by computing each firm's days of sales outstanding (DSO), as accounts receivable per dollar of daily sales. To reduce variability, they averaged DSO and all other measures over a three year period. They found evidence consistent with the model. The findings suggest that producers may increase the implicit cost of extending trade credit by financing their receivables through payables and short-term borrowing. Shin and Soenen (1998), researched the relationship between working capital management and value creation for shareholders. The standard measure for working capital management is the cash conversion cycle (CCC). Cash conversion period reflects the time span between disbursement and collection of cash. It is measured by estimating the inventory conversion period and the receivable conversion period, less the payables conversion period. In their study, Shin and Soenen (1998) used net-trade cycle (NTC) as a measure of working capital management. NTC is basically equal to the cash conversion cycle (CCC) where all three components are expressed as a percentage of sales. NTC may be a proxy for additional working capital needs as a function of the projected sales growth. They examined this relationship by using correlation and regression analysis, by industry, and working capital intensity. Using a COMPUSTAT sample of 58,985 firm years covering the period 1975-1994, they found a strong negative relationship between the length of the firm's net-trade cycle and its profitability. Based on the findings, they suggest that one possible way to create shareholder value is to reduce firm‘s NTC. To test the relationship between working capital management and corporate profitability, Deloof (2003), used a sample of 1,009 large Belgian non-financial firms for a period of 1992-1996. By using correlation and regression tests, he found significant negative relationship between gross operating income and the number of days accounts receivable, inventories, and accounts payable of Belgian firms. Based on the study results, he suggests that managers can increase corporate profitability by reducing the number of day‘s accounts receivable and inventories. 3. Hypothesis In order to investigate the effect of perky strategies of working capital on companies‘ liquidity position, our study specifies the following hypothesis: 3.1. Hypothesis 1 H0: companies that they have perky strategies about current assets in compare to companies that don‘t have perky strategies they have lower surplus cash. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 3.2. Hypothesis 2 H0: companies that they have perky strategies about current liabilities in compare to companies that don‘t have perky strategies they have lower surplus cash. 3.3. Hypothesis 3 H0: The strategy of working capital management have a significant effect on companies surplus cash. 4. The Methodology and Model 4.1 Model The impact of working capital management on corporate performance of manufacturing sector is tested by panel data methodology. The panel data methodology used has certain benefits like using the assumption that firms are heterogeneous, more variability, less colinearity between variables, more informative data, more degree of freedom and more efficiency (Baltagi, 2001). In order to find out the relationship between different variables, first Pearson Correlation Coefficients are calculated. The impact of working capital management on firms’ performance is than investigated using balanced panel data of manufacturing firms listed at Karachi Stock Exchange. For this purpose, we develop an empirical framework first used by Beheshti (2014): 1st model: ECMit = α +β1 C.assetit +β2 C.liabilityit + έ When: ECMit is equal to surplus cash fundsfunds of company i for the period t. C.assetit is equal to current assets of company i for the period t and C.liabilityit is the current liability of company i for the period t. ECM is calculated as the rest of 2nd model: Cit = α0 + α1bmit + α2 sizeit + α3cpxit +α4wcit + α5ltdit +α6rdit + α7cfit + α8σit + ECMit When: Cit equals to natural logarithm of total assets of company except cash of company i at the year t. bmit equals to book value to market value of company i at the year t. sizeit is natural logarithm of total assets of company i at the year t. cpxit is the ratio of net cash flow of investment activities to total assets of company i at the year t. wcit is the ratio of working capital to total assets of company i at the year t. ltdit is the ratio of long term liabilities to total assets of company i at the year t. rdit is the ratio of research and development expenditures to sale of company i at the year t. cfit is the cash flow turnover of company i at the year t. σit is the standard deviation of cash flow of company i at the year t in a special industry. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 4.2 Data and Sampling The data we needed for our hypothesis testing were gathered from financial statements of listed companies at Tehran Stock Exchange (TSE). The data gathered for the period 2008 to 2013. For sampling the systematic elimination method is used. At this systematic method there were some limitations that they are: Banks, investment companies an insurance companies are eliminated from ample. Companies that their financial period end is not at the end of year are eliminated from sample. At the whole period of research they be accepted at TSE, The data required for model analysis be available. After using these limitations only 125 companies from 385 companies were chosen. 5. Findings 5.1. Correlation Analysis Correlation matrix of all variables included in the analysis is presented in Table 3 which is calculated based on data of 125 firms for 6 years. Surplus cash funds Surplus cash funds strategy Size Rate of return Leverage Pearson Correlation strategy size Rate of return leverage 1 Sig. (2-tailed) Pearson Correlation .024 Sig. (2-tailed) .520 1 Pearson Correlation -.027 .029 Sig. (2-tailed) .466 .420 Pearson Correlation .065 -.086(*) -.037 Sig. (2-tailed) .077 .019 .310 Pearson Correlation .024 .537(**) -.069 -.068 Sig. (2-tailed) .507 .000 .060 .064 1 1 1 5.2. Descriptive Statistics Table 1 presents the minimum, maximum, mean, standard deviation, variance, standard deviation for whole variables of this research model. Table 1: The results of descriptive analysis for model variables Current Liabilities Working Capital 1924375.44 1998306.47 -73931.03 .007909 1924375.44 1998306.47 373427.00 375617.50 15872.00 .054868 373427.00 375617.50 5785277.192 7165954.311 2288601.3 .412697 5785277.1 7165954.311 6.135 7.703 -5.855 -.792 6.135 7.703 46.032 69.349 66.177 1.730 46.032 69.349 Current Assets Mean Median Std. Deviation Skewness Kurtosis Surplus Cash Assets Liabilities Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 5.3. Findings Table 2 presents the different strategies mean of working capital and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Table 2: Working capital mean and std. deviation of different strategies Strategy Mean of Working Capital Std. Deviation Conservative 459267.55 1352933.813 Perky -778377.11 2988189.153 t t=6.915 P=.0001 Regarding the t value in table 2 there is a significant difference in working capital for companies that they use a Conservative strategy and companies that they use a perky strategy. Table 3 presents the different strategies mean of current assets and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Table 3: current assets mean and std. deviation of different strategies Strategy Mean of Current assets Std. Deviation 1635091.71 2319724.98 t=-1.600 3941987.904 7568342.395 P=.110 Conservative Perky t Regarding the t value in table 3 there is no significant difference in current assets for companies that they use a Conservative strategy and companies that they use a perky strategy. Table 4 presents the different strategies mean of assets and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Table 4: assets mean and std. deviation of different strategies Strategy Mean of Assets Std. Deviation Conservative 1635091.71 3941987.904 Perky 2319724.98 7568342.395 t t=-1.478 P=.140 Regarding the t value in table 4 there is no significant difference in assets for companies that they use a Conservative strategy and companies that they use a perky strategy. Table 5 presents the different strategies mean of liabilities and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Table 5: liabilities mean and std. deviation of different strategies Strategy Mean of Liabilities Std. Deviation Conservative 3185851.17 2318052.131 Perky 7097359.09 17501046.821 t t=-3.196 P=.0001 Regarding the t value in table 5 there is a significant difference in assets for companies that they use a Conservative strategy and companies that they use a perky strategy. Table 6 presents the different strategies mean of current liabilities and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Table 6: current liabilities mean and std. deviation of different strategies Strategy Mean of Current Liabilities Std. Deviation Conservative 1175824.16 2960065.369 Perky 3098102.08 10301053.972 t t=-3.249 P=.001 Regarding the t value in table 6 there is a significant difference in assets for companies that they use a Conservative strategy and companies that they use a perky strategy. Table 7 presents the different strategies mean of surplus cash funds and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Table 7: surplus cash funds mean and std. deviation of different strategies Strategy Mean of Surplus Cash funds Std. Deviation Conservative .000378429 .40113 Perky .016148953 .42900 t t=-.516 P=.606 Regarding the t value in table 7, there is no significant difference in surplus cash funds for companies used a conservative strategy and companies applied a perky one. Table 8 presents the different strategies mean of leverage, size and rate of return and standard deviation and t student for companies used a conservative strategy and companies applied a perky one. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Table 8: compared mean of leverage, size and rate of return for companies with different strategies leverage size Rate of Return Std. deviation t p .70726 .196 -15.760 .000 1.6687 1.08133 conservative 5.985980E0 .6038188 -.727 .467 perky 6.021495E0 .7013616 conservative 3.415674 20.2349 2.690 .007 perky .7061089 3.7693 strategy Mean conservative perky Regarding the t value for leverage in table 8, there is a significant difference in leverage for companies used a conservative strategy and companies applied a perky one. And regarding the t value for size in table 8, there is no significant difference in size for companies used a conservative strategy and companies applied a perky one. And regarding the t value in table 8, there is a significant difference in rate of return for companies used a conservative strategy and companies applied a perky one. 6. Conclusion In the current challenging economic environment and increasing external resources, assets and current liabilities i.e. working capital of the company is important and working capital management firms can be considered as a competitive advantage for them. The main goal of this paper tried to show the effect of perky strategies of working capital on companies‘ liquidity position focused on the policies and strategies of listed companies on the TSE companies‘ liquidity. This study results shows a direct relationship between the variables strategy, working capital, financial leverage and return on assets are; But the company has excess cash variable is inversely related to firm size, i.e. the change in working capital strategy firm, does not necessarily reduce the amount of excess cash, In other words, a significant association between working capital policy with no excess cash. References Afza, T. and M. S. Nazir, (2007). Working Capital Management Policies of Firms: Empirical Evidence from Pakistan. Conference Proceedings of 9th South Asian Management Forum (SAMF) on February 24-25, North South University, Dhaka, Bangladesh. Afza, T. and M. S. Nazir, (2008). Working Capital Approaches and Firm‘s Returns. Pakistan. Journal of Commerce and Social Sciences. 1(1), 25-36. Agarwal, J.D. (1988). A goal programming model for working capital management, Finance India, Vol. 2, Issue 2. Almeida, H., M. Campello, and M.S. Weisbach, 2004, The Cash Flow Sensitivity of Cash, Journal of Finance 59, 1777-1804. Anderson, C.W. and L. Garcia-Feij´oo, 2006, Empirical Evidence on Capital Investment, Growth Options, and Security Returns, Journal of Finance 61, 171-194. Baltagi, B. H. (2001). Econometric Analysis of Panel Data. 2nd Edition, John Wiley & Sons. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Bates, T.W., K.T. Kahle, and R. Stulz, 2009, Why Do U.S. Firms Hold So Much More Cash Than They Used To?, Journal of Finance 65, 1985-2021. Berk, J., R.C. Green, and V. Naik, 1999, Optimal Investment, Growth Options, and Security Returns, Journal of Finance 54, 1553-1607. Bernardo, A.E., B. Chowdhry, and A. Goyal, 2007, Growth Options, Beta, and the Cost of Capital, Financial Management 36, 1-13. Bhunia, a (2010). A trend analysis of liquidity management efficiency in selected private sector Indian steel industry, International Journal of Research in Commerce and Management, Volume-1 Issue-5 . Blinder, A. S. and L. Macinni, (1991). Taking Stock: A critical Assessment of Recent Research on Inventories. Journal of Economic Perspectives. 5(1), 73-96. Carhart, M.M., 1997, On Persistence in Mutual Fund Performance, Journal of Finance 52, 57-82. Carlson, M., A. Fisher, and R. Giammarino, 2004, Corporate Investment and Asset Price Dynamics: Implications for the Cross-Section of Returns, Journal of Finance 59, 2577-2603. Carlson, M., A. Fisher, and R. Giammarino, 2006, Corporate Investment and Asset Price Dynamics: Implications for SEO Event Studies and Long-Run Performance, Journal of Finance 61, 1009-1034. Chakraborty, K. (2008). Working Capital and Profitability: An Empirical Analysis of Their Relationship with Reference to Selected Companies in the Indian Pharmaceutical Industry, The Icfai Journal of Management Research, Vol. 34. Chen, S., L. Ho, andY. Shih, 2007, Intra-Industry Effects of Corporate Capital Investment Announcements, Financial Management 36, 1-21. Cooper, M.J., H. Gulen, and M.J. Schill, 2008, Asset Growth and the Cross-Section of Stock Returns, Journal of Finance 63, 1609-1651. Czyzewski, A.B., and D.W. Hicks, (1992). Hold Onto Your Cash. Management Accounting. 27-30. Daniel, K. and S. Titman, 2006, Market Reactions to Tangible and Intangible Information, Journal of Finance 61, 1605-1643. Davis, J.L., E.F. Fama, and K.R. French, 2000, Characteristics, Covariances, and Average Returns: 1929 to 1997, Journal of Finance 55, 389-406. Deloof, M. (2003). Does Working Capital Management Affects profitability of Belgian Firms? Journal of Business Finance & Accounting. 30(3) & (4), 0306-686X. Dimson, E., 1979, Risk Measurement When Shares Are Subject to Infrequent Trading, Journal of Financial Economics 7, 197-226. Dittmar, A. and J. Mahrt-Smith, 2007, Corporate Governance and the Value of Cash Holdings, Journal of Financial Economics 83, 599-634. Eljelly, M.A. (2004). Liquidity – Profitability Tradeoff: An empirical investigation in an emerging market. International Journal of Commerce & Management. 14(2). Fama, E.F. and K.R. French, 1992, The Cross-Section of Expected Stock Returns, Journal of Finance 47, 427-465. Fama, E.F. and K.R. French, 1993, Common Risk Factors in the Returns on Stocks and Bonds, Journal of Financial Economics 33, 3-56. Fama, E.F. and J.D. MacBeth, 1973, Risk, Return, and Equilibrium: Empirical Tests, Journal of Political Economy 81, 607-636. Faulkender, M. and R.Wang, 2006, Corporate Financial Policy and the Value of Cash, Journal of Finance 61, 1957-1990. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Foley, C.F., J.C. Hartzell, S. Titman, and G. Twite, 2007, Why Do Firms Hold So Much Cash? A Tax-Based Explanation, Journal of Financial Economics 86, 579-607. Gamba, A. and A. Triantis, 2008, The Value of Financial Flexibility, Journal of Finance 63, 2263-2296. Gomes, J., L. Kogan, and L. Zhang, 2003, Equilibrium Cross-Section of Returns, Journal of Political Economy 111, 693-732. Gopalan, R.,O. Kadan, and M. Pevzner, 2010, Asset Liquidity and Stock Liquidity, Washington University in St. Louis Working Paper. Filbeck, G. and T. M. Krueger, (2005). An Analysis of Working Capital Management results across Industries. American Journal of Business. 20(2), 11-18. Garcia-Teruel, P.J. and Martinez-Solano, P. (2007). Effects of Working Capital Management on SME Profitability. International Journal of Managerial Finance. 3(2), 164-177. Harford, J., W. Mikkelson, and M.M. Partch, 2003, The Effect of Cash Reserves on Corporate Investment and Performance in Industry Downturns, University of Washington Working Paper. Haugen, R.A. and N.L. Baker, 1996, Commonality in the Determinants of Expected Stock Returns, Journal of Financial Economics 41, 401-439. Hausman, J.A. (1978), Specification Tests in Econometrics. Econometrica. 46, 1251-71. Hovakimian, G., 2009, Determinants of Investment Cash Flow Sensitivity, Financial Management 38, 161-183. Jegadeesh, N. and S. Titman, 1993, Returns to Buying Winners and Selling Losers: Implications for Stock-Market Efficiency, Journal of Finance 48, 65-91. John, T.A., 1993, Accounting Measures of Corporate Liquidity, Leverage, and Costs of Financial Distress, Financial Management 22, 91-100. Jose, M. L., C. Lancaster, and J. L. Stevens, (1996). Corporate Returns and Cash Conversion Cycles. Journal of Economics and Finance. 20(1), 33-46. Kargar, J. and R. A. Blumenthal, (1994). Leverage Impact of Working Capital in Small Businesses. TMA Journal. 14(6), 46-53. Kim, C., D.C. Mauer, and A.E. Sherman, 1998, The Determinants of Corporate Liquidity: Theory and Evidence, Journal of Financial and Quantitative Analysis 33, 335-359. Lazaridis, I. and D. Tryfonidis, (2006). Relationship between Working Capital Management and Profitability of Listed Companies in the Athens Stock Exchange. Journal of Financial Management and Analysis. 19 (1), 26 – 35. Lee, A.H.I. and Kang, H.-Y. (2008). A mixed 0-1 integer programming for inventory model: A case study of TFT-LCD manufacturing company in Taiwan, Kybernetes, Vol. 37, Issue 1. McLean, R.D., 2010, ―Share Issuance and Cash Savings, Journal of Financial Economics, forthcoming. Mikkelson, W.H. and M.M. Partch, 2003, Do Persistent Large Cash Reserves Hinder Performance?‖ Journal of Financial and Quantitative Analysis 38, 275-294. Opler, T., L. Pinkowitz, R. Stulz, and R. Williamson, 1999, The Determinants and Implications of Cash Holdings, Journal of Financial Economics 52, 3-46. Mukhopadhyay, D. (2004). Working Capital Management in Heavy Engineering Firms—A Case Study. Accessed from myicwai.com/knowledgebank/fm48. Padachi, K. (2006). Trends in Working Capital Management and its Impact on Firms‘ Performance: An Analysis of Mauritian Small Manufacturing Firms. International Review of Business Research Papers. 2(2), 45 - 58. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Palazzo, D., 2009, Firm‘s Cash Holdings and the Cross-Section of Equity Returns, Boston University Working Paper. Pinkowitz, L., R. Stulz, and R. Williamson, 2006, Does the Contribution of Corporate Cash Holdings and Dividends to Firm Value Depend on Governance? A Cross-Country Analysis, Journal of Finance 61, 2725-2751. Pinkowitz, L. and R. Williamson, 2004, What Is a Dollar Worth? The Market Value of Cash Holdings, Georgetown University Working Paper. Rafuse, M.E. (1996). Working capital management: an urgent need to refocus, Management Decision, Vol. 34, Issue 2. Raheman, A. & Nasr, M. (2007). Working capital management and profitability – case of Pakistani firms. International Review of Business Research Papers, 3 (1). 279-300. Raheman, A. and M. Nasr, (2007). Working Capital Management and Profitability – Case of Pakistani Firms. International Review of Business Research Papers. 3 (2), 275 296. Riddick, L.A. and T.M. Whited, 2009, The Corporate Propensity to Save, Journal of Finance 64, 1729- 1766. Samiloglu, F. and K. Demirgunes, (2008). The Effects of Working Capital Management on Firm Profitability: Evidence from Turkey. The International Journal of Applied Economics and Finance. 2(1), 44-50. Shah, A. and A. Sana, (2006). Impact of Working Capital Management on the Profitability of Oil and Gas Sector of Pakistan. European Journal of Scientific Research. 15(3), 301 - 307. Shin, H., and L. Soenen, (1998). Efficiency of Working Capital and Corporate Profitability. Simutin, M., 2009, ―Excess Cash and Mutual Fund Performance,‖ University of British Columbia Working Paper. Singh, P. (2008). Inventory and Working Capital Management: An Empirical Analysis, The Icfai University Journal of Accounting Research, Vol. 35. Singh, J.P. and Pandey, S. (2008). Impact of Working Capital Management in the Profitability of Hindalco Industries Limited, The Icfai University Journal of Financial Economics, Vol. 36. Sloan, R.G., 1996, Do Stock Prices Fully Reflect Information in Accruals and Cash Flows about Future Earnings?, Accounting Review 71, 289-315. Smith, M. Beaumont, E. Begemann, (1997). Measuring Association between Working Capital and return on Investment. South African Journal of Business Management. 28(1). Soenen, L.A. (1993). Cash Conversion Cycle and Corporate Profitability. Journal of Cash Management. 13, 53-57 Sur, D. (2006). Efficiency of Working Capital Management in Indian Public Enterprises during the Post-liberalization Era: A Case Study of NTPC, The Icfai Journal of Management Research, Vol. 34. Titman, S., K.C.J. Wei, and F. Xie, 2004, Capital Investments and Stock Returns, Journal of Financial and Quantitative Analysis 39, 677-700. Uyar, A. (2009). The Relationship of Cash Conversion Cycle with Firm Size and Profitability: An Empirical Investigation in Turkey. International Research Journal of Finance and Economics. 24. Vishnani, S. and K.S. Bhupesh, (2007). Impact of Working Capital Management Policies on Corporate Performance- An Empirical Study. Global Business Review. 8. 267. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Wang, Y.J. (2002). Liquidity Management, Operating Performance, and Corporate Value: Evidence from Japan and Taiwan. Journal of Multinational Financial Management. 12, 159-169. Yan, X.M., 2006, The Determinants and Implications of Mutual Fund Cash Holdings: Theory and Evidence, Financial Management 35, 67-91. Zhang, L., 2005, The Value Premium, Journal of Finance 60, 67-103.