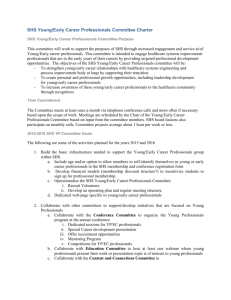

ADMINISTRATIVE SERVICES

advertisement

ADMINISTRATIVE SERVICES 18422 Bear Valley Road Victorville, CA 923955849 (760) 245-4271, x 2465 Fax (760) 243-2371 G.H. Javaheripour, Ed.D. Vice President Administrative Services java@vvc.edu ANNUAL REPORT FOR THE VICTOR VALLEY COMMUNITY COLLEGE DISTRICT FUTURIS TRUST AUGUST 2012 The Victor Valley Community College District has established the Futuris Public Entity Investment Trust. This Trust is an IRS Section 115 Trust that is used for the purposes of investment and disbursement of funds irrevocably designated by the District for the payment of its obligations to eligible employees (and former employees) of the District and their eligible dependents and beneficiaries for life, sick, hospitalization, major medical, accident, disability, dental and other similar benefits (sometimes referred to as “other post-employment benefits,” or “OPEB”), in compliance with governmental Accounting Statement Nos. 43 and 45. The Governmental Accounting Standards Board (GASB) adopted Statements 43 and 45 for public sector employers to identify and report their Other PostEmployment Benefits (OPEB) liabilities. GASB Statements 43 and 45 establish uniform financial reporting standards for OPEB and improve relevance and usefulness of the reporting. In particular, the statements require systematic, accrual-based measurement and recognition of OPEB expenses over the employees’ years of service as well as providing information regarding the progress being made toward funding the plan. GASB 43 establishes uniform financial reporting standards for OPEB Plans, while GASB 45 establishes uniform financial reporting standards for Employers. Both of these standards provide instructions for calculating expenses and liabilities as well as requiring supplementary information schedules to be added to the year–end financial reports. The District has created a Retirement Board of Authority consisting of District personnel to oversee and run the Futuris Trust. Benefit Trust Company is the qualified Discretionary Trustee for asset and fiduciary management and investment policy development. Keenan & Associates is the Program Coordinator for the Futuris Trust providing oversight of the Futuris program and guidance to the District. Attached to this notice is the most recent annual statement for the Trust. This statement shows (as of the date of the statement); the total assets in the Trust, the market value, the book value, all contribution and distribution activity (including all fees and expenses associated with the Trust), income activity, purchase activity, sale activity, and realized gains and losses. Please note that the Trust is not itself an employee benefit plan. Rather, the assets in the Trust are irrevocably designated for the funding of employee benefit plans. You are being provided this information pursuant to California Government Code Section 53216.4. For more information regarding the Futuris Public Entity Investment Trust, please contact G.H. Javaheripour at (760) 245-4271, extension 2464 with the Victor Valley Community College District. Victor Valley Ccd** ROSLYN WASHINGTON KEENAN & ASSOCIATES 2355 CRENSHAW BLVD STE 200 TORRANCE CA 90501 Account Number: 43-E028-01-4 For Period 07/01/11 Through 07/31/11 Asset Allocation Asset Valuation Market Value % of Account 3,202,655.73 4,639,686.71 0.00 40.8% 59.2% $ 7,842,342.44 100.0% Description Common Stocks Fixed Income SE Cash & Equivale COMMON STOCKS Total Assets Accrued Income 10,199.83 FIXED INCOME SECURITIES Total Valuation $ 7,852,542.27 Market Reconcilement Beginning Market Value Period $ 7,845,902.35 YTD $ 7,845,902.35 17,713.01 2.57 1,668.72 -12,744.38 17,713.01 2.57 1,668.72 -12,744.38 $ 7,852,542.27 $ 7,852,542.27 Income Dividend Income................................................................................................ Realized Gains/(Losses)........................................................................................ Accrued Income..................................................................................................... Net Change In Unrealized Apprec(Deprec)........................................................... Ending Market Value Asset Position As of 07/31/11 Asset Description Shares Accruals Cost Market Value 259,961.08 305,984.67 Common Stocks Blackrock Equity Dividend I Madvx 16,840.103 Page 1 of 5 Victor Valley Ccd** Account Number: 43-E028-01-4 For Period 07/01/11 Through 07/31/11 Asset Position As of 07/31/11 Asset Description Cost Market Value 19,579.504 265,458.50 298,000.05 5,884.418 194,600.89 249,322.79 Jhancock Classic Value I Jcvix 17,644.848 263,536.59 299,433.07 Hartford Capital Appreciation Y Hcayx 10,074.305 321,714.25 364,186.13 Hartford Midcap Y Hmdyx 6,061.767 121,445.57 147,604.03 Nuveen Tradewinds Val Opportunites I Nvorx 6,470.065 198,845.35 231,434.23 Nuveen Tradewinds Global All-Cap I Nwgrx 7,975.229 208,176.88 238,140.34 Prudential Global Real Estate Z Purzx 4,039.177 79,896.32 81,227.85 Royce Global Value Invmt Rgvix 25,834.408 387,516.12 380,799.17 Royce Special Equity Instl Rseix 7,079.938 153,776.25 147,616.71 217,360.16 221,960.67 190,057.93 236,946.02 Brandes Instl International Equity Biiex Cohen & Steers Realty Shares Instl Csrix Thornburg Investment Income Builder Tibix Thornburg International Value I Tgvix Shares 11,476.767 Accruals 1,214.37 8,056.648 Fixed Income Securities Delaware Diversified Income Instl Dpffx 83,593.718 651.31 784,572.50 790,796.57 Legg Mason Bw Global Opps Bd Is Gobsx 29,578.066 1,091.23 315,991.85 328,020.75 Metropolitan West Total Return Bond Mwtix 73,930.142 3,197.91 767,149.31 777,005.79 Oppenheimer International Bond Y 62,175.130 1,448.17 385,610.96 422,790.88 765,071.68 791,499.20 Pimco Total Return Fd Instl Prudential Total Return Bond Z Pdbzx 0.19 55,427.115 2,596.65 Page 2 of 5 Victor Valley Ccd** Account Number: 43-E028-01-4 For Period 07/01/11 Through 07/31/11 Asset Position As of 07/31/11 Asset Description Shares Accruals Cost Market Value Templeton Global Bond Adv Tgbax 53,392.532 696,032.24 747,495.45 Western Asset Core Plus Bond Instl Wacpx 70,776.296 747,207.64 782,078.07 $ 7,323,982.07 $ 7,842,342.44 Cash & Equivalents Cash Total Market Value $ 10,199.83 Total Market Value Plus Accruals $ 7,852,542.27 Income Activity Date Description Cash Dividend Income 07/01/11 Legg Mason Bw Global Opps Bd Is Gobsx Div To 06/30/11 1,039.53 07/01/11 Metropolitan West Total Return Bond Mwtix Div To 06/30/11 2,721.04 07/01/11 Oppenheimer International Bond Y Div To 06/30/11 1,384.45 07/01/11 Pimco Total Return Fd Instl Div To 06/30/11 07/01/11 Prudential Total Return Bond Z Pdbzx Div To 06/30/11 2,455.64 07/01/11 Western Asset Core Plus Bond Instl Wacpx Div $ .028 P/S on 70,591.726 2,021.04 07/05/11 Cohen & Steers Realty Shares Instl Csrix Div $ .160 P/S on 5,861.974 937.92 07/19/11 Templeton Global Bond Adv Tgbax Div $ .053 P/S on 53,188.846 0.48 2,819.01 Page 3 of 5 Victor Valley Ccd** Account Number: 43-E028-01-4 For Period 07/01/11 Through 07/31/11 Income Activity Date Description Cash 07/22/11 Blackrock Equity Dividend I Madvx Div $ .096 P/S on 16,754.417 1,620.32 07/25/11 Delaware Diversified Income Instl Dpffx Div To 07/24/11 2,713.58 Total Dividend Income $ 17,713.01 Total Income $ 17,713.01 Purchase Activity Date Description Cash Common Stocks 07/05/11 Cohen & Steers Realty Shares Instl Csrix Pur 22.444 @ $ 41.790 P/S 07/22/11 Blackrock Equity Dividend I Madvx Pur 85.686 @ $ 18.910 P/S -937.92 -1,620.32 Fixed Income 07/01/11 Legg Mason Bw Global Opps Bd Is Gobsx Pur 95.721 @ $ 10.860 P/S -1,039.53 07/01/11 Metropolitan West Total Return Bond Mwtix Pur 260.886 @ $ 10.430 P/S -2,721.04 07/01/11 Oppenheimer International Bond Y Pur 205.408 @ $ 6.740 P/S -1,384.45 07/01/11 Pimco Total Return Fd Instl Pur .044 @ $ 10.990 P/S 07/01/11 Prudential Total Return Bond Z Pdbzx Pur 174.406 @ $ 14.080 P/S -2,455.64 07/01/11 Western Asset Core Plus Bond Instl Wacpx Pur 184.570 @ $ 10.950 P/S -2,021.04 -0.48 Page 4 of 5 Victor Valley Ccd** Account Number: 43-E028-01-4 For Period 07/01/11 Through 07/31/11 Purchase Activity Date 07/15/11 Description Cash Prudential Total Return Bond Z Pdbzx Purchased 12.624 Shs 07/14/11 @ 14.17 -178.88 07/19/11 Templeton Global Bond Adv Tgbax Pur 203.686 @ $ 13.840 P/S -2,819.01 07/25/11 Delaware Diversified Income Instl Dpffx Pur 288.679 @ $ 9.400 P/S -2,713.58 Total Purchase Activity $ -17,891.89 Sale Activity Date Description Realized Gain/Loss Cash 2.57 178.88 $ 2.57 $ 178.88 Fixed Income 07/13/11 Pimco Total Return Fd Instl Sold 16.203 Shs 07/12/11 @ 11.04 Total Sales WE MAY SELECT A MONEY MARKET OR OTHER MUTUAL FUND ON YOUR BEHALF FOR INVESTMENT OF ALL OR A PORTION OF YOUR FUNDS. WE RECEIVE ADMINISTRATIVE FEES FROM CERTAIN FUND MANAGERS FOR ADMINISTRATIVE SERVICES WE PROVIDE IN CONNECTION WITH THE ACCOUNTS WE HOLD WITH INVESTMENTS IN THEIR FUNDS. STATE TRUST STATUTES PROVIDE THAT A BENEFICIARY MAY NOT COMMENCE A PROCEEDING AGAINST A TRUSTEE FOR BREACH OF TRUST MORE THAN ONE YEAR AFTER THE DATE THE BENEFICIARY OR A REPRESENTATIVE OF A BENEFICIARY WAS SENT A REPORT THAT ADEQUATELY DISCLOSED THE EXISTENCE OF A POTENTIAL CLAIM FOR BREACH OF TRUST AND INFORMED THE BENEFICIARY OF THE TIME ALLOWED FOR COMMENCING A PROCEEDING. THIS ACCOUNT STATEMENT REPRESENTS THE TRUSTEE’S REPORT OF ITS ACTS AND EACH BENEFICIARY OR A REPRESENTATIVE OF A BENEFICIARY HAS ONE YEAR FROM THE DATE OF MAILING OF THIS TRUSTEE’S REPORT TO COMMENCE A PROCEEDING AGAINST THE TRUSTEE FOR BREACH OF TRUST FOR ANY ACTS DISCLOSED IN THE TRUSTEE’S REPORT. STATE TRUST STATUTES REQUIRE THAT A TRUSTEE WHO RECEIVES COMPENSATION FROM AN INVESTMENT COMPANY OR INVESTMENT TRUST FOR WHICH THE TRUSTEE, OR ITS AFFILIATE, PROVIDE INVESTMENT ADVISORY OR INVESTMENT MANAGEMENT SERVICES, THE TRUSTEE MUST AT LEAST ANNUALLY NOTIFY THE PERSONS ENTITLED TO RECEIVE A COPY OF THE TRUSTEE’S ANNUAL REPORT, THE RATE, FORMULA, OR METHOD BY WHICH THAT COMPENSATION WAS DETERMINED. FINANCIAL COUNSELORS, INC., AN AFFILIATE OF THE MIDWEST TRUST COMPANY, RECEIVES UP TO 60 BASIS POINTS FOR SERVING AS INVESTMENT ADVISOR TO THE FCI EQUITY FUND AND RECEIVES UP TO 40 BASIS POINTS FOR SERVING AS INVESTMENT ADVISOR TO THE FCI FIXED INCOME FUND. IF YOU HAVE ANY QUESTIONS, PLEASE CALL YOUR TRUST OFFICER. Page 5 of 5 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 BENEFIT TRUST COMPANY 5901 COLLEGE BLVD STE 100 OVERLAND PARK, KS 66211 GAIL BEAL KEENAN & ASSOCIATES 2355 CRENSHAW BLVD STE 200 TORRANCE, CA 90501 ACCOUNT NAME: VICTOR VALLEY COMMUNITY COLLEGE DISTRICT FUTURIS PUBLIC ENTITY INVESTMENT TRUST** ADMINISTRATIVE OFFICER: SCOTT W RANKIN 913-319-0340 SRANKIN@BENEFITTRUST.COM SCOTT W RANKIN 913-319-0340 SRANKIN@BENEFITTRUST.COM INVESTMENT OFFICER: ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PORTFOLIO SUMMARY TAX COST MARKET VALUE PERCENT EQUITIES 3, 312, 322. 81 3, 370, 051. 56 42. 9% FIXED INCOME 4, 379, 920. 36 4, 490, 750. 82 57. 1% 7 , 692 , 243 . 17 7 , 860 , 802 . 38 100 . 0% ACCRUED INCOME EQUITIES OTHER 1 , 383 . 74 12 , 711 . 73 1 , 383 . 74 12 , 711 . 73 TOTAL ACCRUED INCOME 14 , 095 . 47 14 , 095 . 47 7 , 706 , 338 . 64 7 , 874 , 897 . 85 TOTAL ASSETS TOTAL ASSETS & ACCRUALS BEGINNING MARKET VALUE ENDING MARKET VALUE 7 , 858 , 316 . 51 7 , 874 , 897 . 85 ACTIVITY SUMMARY BEGINNING MARKET VALUE PRIOR ACCRUALS DIVIDENDS AND INTEREST REALIZED GAIN/LOSS CHANGE IN MARKET VALUE CURRENT ACCRUAL ENDING MARKET VALUE THIS PERIOD YEAR TO DATE 7 , 858 , 316 . 51 7 , 526 , 418 . 10 15 , 974 . 07 250 , 281 . 24 117 , 979 . 86 349 , 801 . 16 14 , 095 . 47 7 , 874 , 897 . 85 14 , 797 . 57 114 , 481 . 28 526 . 27 234 , 174 . 30 14 , 095 . 47 7 , 874 , 897 . 85 PAGE 2 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PORTFOLIO DETAIL DESCRIPTION PAGE 3 MARKET MARKET EST ANNUAL VALUE/ PRICE/ INCOME/ CURRENT TAX COST COST PRICE ACCRUED INC YIELD TICKER SHARES MADVX 18,513.298 357,862.05 288,549.59 19.33 15.59 7,516.40 2.10 BRANDES INSTL INTERNATIONAL EQUITY I BIIEX 23,071.356 297,851.21 312,840.15 12.91 13.56 15,180.95 5.10 COHEN & STEERS INSTL REALTY SHARES CSRIX 6,240.259 275,757.05 208,022.98 44.19 33.34 5,578.79 2.02 JHANCOCK CLASSIC VALUE I JCVIX 21,356.339 350,030.40 317,588.53 16.39 14.87 4,805.18 1.37 HARTFORD CAPITAL APPRECIATION Y HCAYX 12,524.990 421,966.91 398,241.19 33.69 31.80 8,780.02 2.08 HARTFORD MIDCAP Y HMDYX 8,339.543 181,385.06 167,209.59 21.75 20.05 775.58 0.43 NUVEEN TRADEWINDS VALUE OPPORTUNITIES I NVORX 7,368.218 210,878.40 227,100.50 28.62 30.82 6,211.41 2.95 NUVEEN TRADEWINDS GLOBAL ALL-CAP I NWGRX 8,887.812 197,487.18 231,236.70 22.22 26.02 3,092.96 1.57 PRUDENTIAL GLOBAL REAL ESTATE Z PURZX 4,341.396 87,131.82 85,328.14 20.07 19.65 1,476.07 1.69 ROYCE GLOBAL VALUE INMVT RGVIX 28,440.607 333,323.91 422,277.86 11.72 14.85 3,299.11 0.99 ROYCE SPECIAL EQUITY INSTL RSEIX 8,741.647 181,913.67 185,284.64 20.81 21.20 1,031.51 0.57 TIBIX 13,423.548 245,650.93 252,511.78 18.30 18.81 16,604.93 1,383.74 6.76 TGVIX 9,076.278 228,812.97 216,131.16 25.21 23.81 3,630.51 1.59 77,983.42 1,383.74 2.31 EQUITIES BLACKROCK EQUITY DIVIDEND I THORNBURG INVESTMENT INCOME BUILDER I THORNBURG INTERNATIONAL VALUE I TOTAL EQUITIES DESCRIPTION FIXED INCOME 3,370,051.56 3,312,322.81 RATING PAR VALUE MARKET MARKET EST ANNUAL VALUE/ PRICE/ INCOME/ TAX COST COST PRICE ACCRUED INC YIELD CURRENT/ MATURITY DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX 83,951.486 782,427.85 787,032.69 9.32 9.37 31,985.52 2,665.46 4.09 LEGG MASON BW GLOBAL OPPS BD IS 27,329.325 305,815.15 292,400.31 11.19 10.70 10,521.79 876.82 3.44 METROPOLITAN WEST TOTAL RETURN BOND I 74,156.440 791,249.21 769,851.33 10.67 10.38 34,705.21 2,892.10 4.39 OPPENHEIMER INTERNATIONAL BOND Y 57,923.910 364,920.63 359,676.83 6.30 6.21 20,562.99 1,713.58 5.63 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PORTFOLIO DETAIL ( CONTINUED ) DESCRIPTION FIXED INCOME RATING PAR VALUE MARKET MARKET EST ANNUAL VALUE/ PRICE/ INCOME/ TAX COST COST PRICE ACCRUED INC PAGE 4 YIELD CURRENT/ MATURITY PRUDENTIAL TOTAL RETURN BOND Z PDBZX 54,853.608 784,955.13 757,962.64 14.31 13.82 29,401.53 2,450.13 3.75 TEMPLETON GLOBAL BOND ADV FUND 52,415.766 671,445.96 682,100.90 12.81 13.01 33,179.18 4.94 WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I 69,110.839 789,936.89 730,895.66 11.43 10.58 25,363.68 2,113.64 3.21 4,490,750.82 4,379,920.36 185,719.90 12,711.73 4.14 7,860,802.38 7,692,243.17 263,703.32 14,095.47 3.35 TOTAL FIXED INCOME GRAND TOTAL ASSETS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 5 TRANSACTION DETAIL DATE DESCRIPTION BEGINNING BALANCE DIVIDENDS 08/11/11 08/11/11 08/11/11 08/11/11 08/12/11 08/16/11 08/17/11 592905509 DIVIDEND ON 73,930.142 SHS METROPOLITAN WEST TOTAL RETURN BOND I AT .042573 PER SHARE PAYABLE 07/31/2011 EFFECTIVE 07/31/2011 UPDATE 37947Q100 DIVIDEND ON 29,578.066 SHS LEGG MASON BW GLOBAL OPPS BD IS AT .036845 PER SHARE PAYABLE 07/31/2011 EFFECTIVE 07/31/2011 UPDATE 68380T509 DIVIDEND ON 62,175.13 SHS OPPENHEIMER INTERNATIONAL BOND Y AT .02309 PER SHARE PAYABLE 07/31/2011 EFFECTIVE 07/31/2011 UPDATE 74440B405 DIVIDEND ON 55,427.115 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX AT .046678 PER SHARE PAYABLE 07/31/2011 EFFECTIVE 07/31/2011 UPDATE 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 07/31/2011 EFFECTIVE 07/31/2011 693390700 DIVIDEND ON PIMCO TOTAL RETURN FUND INSTITUTIONAL PAYABLE 07/31/2011 EFFECTIVE 08/01/2011 TAX EFFECTIVE 07/31/2011 880208400 DIVIDEND ON 53,392.532 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0529 PER SHARE PAYABLE 08/17/2011 EX DATE 08/15/2011 PRINCIPAL CASH INCOME CASH COST 0.00 0.00 7,323,982.07 3,147.45 1,089.79 1,435.64 2,587.24 2,241.12 0.19 2,824.46 08/23/11 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 08/31/2011 2,806.25 09/08/11 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 08/31/2011 EFFECTIVE 08/31/2011 1,071.50 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 6 TRANSACTION DETAIL ( CONTINUED ) DATE DESCRIPTION 09/12/11 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 08/31/2011 EFFECTIVE 08/31/2011 09/12/11 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 08/31/2011 EFFECTIVE 08/31/2011 PRINCIPAL CASH 3,107.43 2,152.84 09/12/11 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 08/31/2011 EFFECTIVE 08/31/2011 1,286.67 09/13/11 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 08/31/2011 EFFECTIVE 08/31/2011 2,485.68 09/19/11 09/19/11 09/26/11 09/28/11 880208400 DIVIDEND ON 49,204.963 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0528 PER SHARE PAYABLE 09/19/2011 EX DATE 09/15/2011 744336504 DIVIDEND ON 4,260.839 SHS PRUDENTIAL GLOBAL REAL ESTATE Z AT .1163 PER SHARE PAYABLE 09/16/2011 EX DATE 09/16/2011 EFFECTIVE 09/16/2011 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 09/21/2011 EFFECTIVE 09/21/2011 885215566 DIVIDEND ON 8,930.884 SHS THORNBURG INTERNATIONAL VALUE I AT .1048299 PER SHARE PAYABLE 09/26/2011 EX DATE 09/23/2011 EFFECTIVE 09/26/2011 2,598.02 495.54 2,714.63 936.22 09/30/11 885215467 DIVIDEND ON THORNBURG INVESTMENT INCOME BUILDER I PAYABLE 09/26/2011 EFFECTIVE 09/26/2011 4,025.07 10/07/11 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 09/30/2011 EFFECTIVE 09/30/2011 1,276.05 INCOME CASH COST GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 7 TRANSACTION DETAIL ( CONTINUED ) DATE 10/07/11 10/07/11 10/07/11 DESCRIPTION 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 09/30/2011 EFFECTIVE 09/30/2011 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 09/30/2011 EFFECTIVE 09/30/2011 19247U106 DIVIDEND ON 6,122.393 SHS COHEN & STEERS INSTL REALTY SHARES AT .207 PER SHARE PAYABLE 09/30/2011 EX DATE 09/30/2011 EFFECTIVE 09/30/2011 PRINCIPAL CASH 2,241.25 884.51 1,267.34 10/07/11 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 09/30/2011 EFFECTIVE 09/30/2011 2,436.26 10/07/11 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 09/30/2011 EFFECTIVE 09/30/2011 2,863.63 10/19/11 10/21/11 880208400 DIVIDEND ON 49,400.744 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0527 PER SHARE PAYABLE 10/19/2011 EX DATE 10/17/2011 09251M504 DIVIDEND ON 18,193.444 SHS BLACKROCK EQUITY DIVIDEND I AT .090085 PER SHARE PAYABLE 10/20/2011 EX DATE 10/20/2011 EFFECTIVE 10/20/2011 2,603.42 1,638.96 10/24/11 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 10/21/2011 EFFECTIVE 10/21/2011 2,575.36 11/04/11 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 10/31/2011 EFFECTIVE 10/31/2011 1,174.60 11/07/11 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 10/31/2011 EFFECTIVE 10/31/2011 11/07/11 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 10/31/2011 EFFECTIVE 10/31/2011 747.03 2,918.99 INCOME CASH COST GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 8 TRANSACTION DETAIL ( CONTINUED ) DATE 11/07/11 11/07/11 11/17/11 11/23/11 11/23/11 DESCRIPTION 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 10/31/2011 EFFECTIVE 10/31/2011 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 10/31/2011 EFFECTIVE 10/31/2011 880208400 DIVIDEND ON 49,601.936 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0527 PER SHARE PAYABLE 11/17/2011 EX DATE 11/15/2011 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 11/21/2011 EFFECTIVE 11/21/2011 416645687 LONG TERM CAPITAL GAINS DIVIDEND ON 7,329.512 SHS HARTFORD MIDCAP Y AT 2.49746 PER SHARE PAYABLE 11/23/2011 EX DATE 11/21/2011 12/05/11 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 11/30/2011 EFFECTIVE 11/30/2011 12/05/11 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 11/30/2011 EFFECTIVE 11/30/2011 12/05/11 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 11/30/2011 EFFECTIVE 11/30/2011 PRINCIPAL CASH GAIN / LOSS 2,286.62 2,614.02 2,591.96 18,305.16 764.33 2,758.90 1,990.65 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 11/30/2011 EFFECTIVE 11/30/2011 1,204.78 12/05/11 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 11/30/2011 EFFECTIVE 11/30/2011 2,341.78 105262703 DIVIDEND ON 21,962.809 SHS BRANDES INSTL INTERNATIONAL EQUITY I AT .6576741 PER SHARE PAYABLE 12/06/2011 EX DATE 12/06/2011 EFFECTIVE 12/06/2011 COST 2,061.29 12/05/11 12/07/11 INCOME CASH 14,444.37 18,305.16 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 9 TRANSACTION DETAIL ( CONTINUED ) DATE 12/09/11 12/09/11 12/09/11 12/09/11 12/09/11 12/12/11 12/12/11 12/13/11 DESCRIPTION 780811824 DIVIDEND ON 28,169.45 SHS ROYCE GLOBAL VALUE INMVT AT .1157999 PER SHARE PAYABLE 12/08/2011 EX DATE 12/08/2011 EFFECTIVE 12/08/2011 780905535 DIVIDEND ON 8,232.908 SHS ROYCE SPECIAL EQUITY INSTL AT .1182 PER SHARE PAYABLE 12/08/2011 EX DATE 12/08/2011 EFFECTIVE 12/08/2011 780905535 LONG TERM CAPITAL GAINS DIVIDEND ON 8,232.908 SHS ROYCE SPECIAL EQUITY INSTL AT 1.0775 PER SHARE PAYABLE 12/08/2011 EX DATE 12/08/2011 EFFECTIVE 12/08/2011 09251M504 DIVIDEND ON 18,287.421 SHS BLACKROCK EQUITY DIVIDEND I AT .116838 PER SHARE PAYABLE 12/09/2011 EX DATE 12/08/2011 09251M504 LONG TERM CAPITAL GAINS DIVIDEND ON 18,287.421 SHS BLACKROCK EQUITY DIVIDEND I AT .007504 PER SHARE PAYABLE 12/09/2011 EX DATE 12/08/2011 37947Q100 SHORT TERM CAPITAL GAINS DIVIDEND ON 26,521.623 SHS LEGG MASON BW GLOBAL OPPS BD IS AT .05329 PER SHARE PAYABLE 12/09/2011 EX DATE 12/09/2011 EFFECTIVE 12/09/2011 37947Q100 LONG TERM CAPITAL GAINS DIVIDEND ON 26,521.623 SHS LEGG MASON BW GLOBAL OPPS BD IS AT .07351 PER SHARE PAYABLE 12/09/2011 EX DATE 12/09/2011 EFFECTIVE 12/09/2011 592905509 SHORT TERM CAPITAL GAINS DIVIDEND ON 72,001.411 SHS METROPOLITAN WEST TOTAL RETURN BOND I AT .0474 PER SHARE PAYABLE 12/12/2011 EX DATE 12/12/2011 EFFECTIVE 12/12/2011 PRINCIPAL CASH INCOME CASH COST GAIN / LOSS 3,262.02 973.13 8,870.96 8,870.96 2,136.67 137.23 137.23 1,413.34 1,413.34 1,949.60 1,949.60 3,412.87 3,412.87 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 10 TRANSACTION DETAIL ( CONTINUED ) DATE 12/13/11 12/19/11 12/19/11 12/19/11 12/19/11 12/19/11 12/19/11 12/19/11 DESCRIPTION 592905509 LONG TERM CAPITAL GAINS DIVIDEND ON 72,001.411 SHS METROPOLITAN WEST TOTAL RETURN BOND I AT .0359 PER SHARE PAYABLE 12/12/2011 EX DATE 12/12/2011 EFFECTIVE 12/12/2011 19247U106 DIVIDEND ON 6,158.832 SHS COHEN & STEERS INSTL REALTY SHARES AT .296 PER SHARE PAYABLE 12/15/2011 EX DATE 12/15/2011 EFFECTIVE 12/15/2011 409902756 DIVIDEND ON 21,038.478 SHS JHANCOCK CLASSIC VALUE I AT .22542 PER SHARE PAYABLE 12/16/2011 EX DATE 12/15/2011 EFFECTIVE 12/16/2011 67064Y636 LONG TERM CAPITAL GAINS DIVIDEND ON 6,727.187 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I AT 1.4577 PER SHARE PAYABLE 12/16/2011 EX DATE 12/15/2011 EFFECTIVE 12/16/2011 67064Y636 SHORT TERM CAPITAL GAINS DIVIDEND ON 6,727.187 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I AT .5583 PER SHARE PAYABLE 12/16/2011 EX DATE 12/15/2011 EFFECTIVE 12/16/2011 67065W761 LONG TERM CAPITAL GAINS DIVIDEND ON 8,204.72 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I AT .5902 PER SHARE PAYABLE 12/16/2011 EX DATE 12/15/2011 EFFECTIVE 12/16/2011 67065W761 SHORT TERM CAPITAL GAINS DIVIDEND ON 8,204.72 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I AT 1.0777 PER SHARE PAYABLE 12/16/2011 EX DATE 12/15/2011 EFFECTIVE 12/16/2011 744336504 DIVIDEND ON 4,288.323 SHS PRUDENTIAL GLOBAL REAL ESTATE Z AT .11236 PER SHARE PAYABLE 12/16/2011 EX DATE 12/16/2011 EFFECTIVE 12/16/2011 PRINCIPAL CASH 2,584.85 INCOME CASH COST GAIN / LOSS 2,584.85 1,823.01 4,742.49 9,806.22 9,806.22 3,755.79 3,755.79 4,842.43 4,842.43 8,842.23 8,842.23 481.84 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 11 TRANSACTION DETAIL ( CONTINUED ) DATE 12/19/11 12/20/11 12/27/11 12/27/11 12/27/11 12/27/11 12/27/11 12/27/11 DESCRIPTION 880208400 LONG TERM CAPITAL GAINS DIVIDEND ON 49,805.997 SHS TEMPLETON GLOBAL BOND ADV FUND AT .079 PER SHARE PAYABLE 12/19/2011 EX DATE 12/15/2011 880208400 DIVIDEND ON 49,805.997 SHS TEMPLETON GLOBAL BOND ADV FUND AT .249899 PER SHARE PAYABLE 12/19/2011 EX DATE 12/15/2011 EFFECTIVE 12/19/2011 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 12/21/2011 EFFECTIVE 12/21/2011 246248587 LONG TERM CAPITAL GAINS DIVIDEND ON 79,961.426 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX AT .132 PER SHARE PAYABLE 12/23/2011 EX DATE 12/22/2011 EFFECTIVE 12/23/2011 246248587 SHORT TERM CAPITAL GAINS DIVIDEND ON 79,961.426 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX AT .102 PER SHARE PAYABLE 12/23/2011 EX DATE 12/22/2011 EFFECTIVE 12/23/2011 416645604 DIVIDEND ON 12,251.765 SHS HARTFORD CAPITAL APPRECIATION Y AT .701138 PER SHARE PAYABLE 12/27/2011 EX DATE 12/22/2011 416645687 DIVIDEND ON 8,300.093 SHS HARTFORD MIDCAP Y AT .093111 PER SHARE PAYABLE 12/27/2011 EX DATE 12/22/2011 74440B405 LONG TERM CAPITAL GAINS DIVIDEND ON 52,610.939 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX AT .14242 PER SHARE PAYABLE 12/23/2011 EX DATE 12/23/2011 EFFECTIVE 12/23/2011 PRINCIPAL CASH 3,934.67 INCOME CASH COST GAIN / LOSS 3,934.67 12,446.47 2,480.51 10,554.91 10,554.91 8,156.07 8,156.07 8,590.18 772.83 7,492.85 7,492.85 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 12 TRANSACTION DETAIL ( CONTINUED ) DATE 12/27/11 12/29/11 12/29/11 01/06/12 01/09/12 01/09/12 DESCRIPTION 74440B405 SHORT TERM CAPITAL GAINS DIVIDEND ON 52,610.939 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX AT .18182 PER SHARE PAYABLE 12/23/2011 EX DATE 12/23/2011 EFFECTIVE 12/23/2011 885215467 DIVIDEND ON THORNBURG INVESTMENT INCOME BUILDER I PAYABLE 12/25/2011 EFFECTIVE 12/25/2011 885215566 DIVIDEND ON 8,970.538 SHS THORNBURG INTERNATIONAL VALUE I AT .0428 PER SHARE PAYABLE 12/23/2011 EX DATE 12/23/2011 EFFECTIVE 12/23/2011 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 12/31/2011 EFFECTIVE 12/31/2011 67064Y636 DIVIDEND ON 7,169.09 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I AT .843 PER SHARE PAYABLE 12/30/2011 EX DATE 12/29/2011 EFFECTIVE 12/30/2011 67065W761 DIVIDEND ON 8,762.367 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I AT .3476 PER SHARE PAYABLE 12/30/2011 EX DATE 12/29/2011 EFFECTIVE 12/30/2011 PRINCIPAL CASH 9,565.72 5,015.03 383.94 2,273.37 6,043.54 3,045.80 01/09/12 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 12/31/2011 EFFECTIVE 12/31/2011 01/09/12 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 12/31/2011 EFFECTIVE 12/31/2011 2,370.38 01/11/12 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 12/31/2011 EFFECTIVE 12/31/2011 6,133.00 01/13/12 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 12/31/2011 EFFECTIVE 12/31/2011 2,758.13 826.44 INCOME CASH COST GAIN / LOSS 9,565.72 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 13 TRANSACTION DETAIL ( CONTINUED ) DATE 01/19/12 DESCRIPTION 880208400 DIVIDEND ON 51,142.143 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0526 PER SHARE PAYABLE 01/19/2012 EX DATE 01/17/2012 01/23/12 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 01/21/2012 EFFECTIVE 01/21/2012 02/01/12 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 01/31/2012 EFFECTIVE 01/31/2012 02/01/12 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 01/31/2012 EFFECTIVE 01/31/2012 PRINCIPAL CASH 2,690.08 2,589.71 743.20 1,894.30 02/08/12 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 01/31/2012 EFFECTIVE 01/31/2012 2,821.70 02/08/12 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 01/31/2012 EFFECTIVE 01/31/2012 2,408.39 02/08/12 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 01/31/2012 EFFECTIVE 01/31/2012 1,295.76 02/21/12 880208400 DIVIDEND ON 51,355.641 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0526 PER SHARE PAYABLE 02/17/2012 EX DATE 02/15/2012 EFFECTIVE 02/17/2012 02/23/12 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 02/21/2012 EFFECTIVE 02/21/2012 03/01/12 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 02/29/2012 EFFECTIVE 02/29/2012 03/01/12 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 02/29/2012 EFFECTIVE 02/29/2012 2,701.31 2,634.48 841.74 1,947.93 INCOME CASH COST GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 14 TRANSACTION DETAIL ( CONTINUED ) PRINCIPAL CASH DATE DESCRIPTION 03/01/12 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 02/29/2012 EFFECTIVE 02/29/2012 1,241.84 03/01/12 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 02/29/2012 EFFECTIVE 02/29/2012 2,203.61 03/05/12 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 02/29/2012 EFFECTIVE 02/29/2012 2,580.52 03/19/12 03/23/12 03/26/12 03/29/12 03/30/12 04/03/12 04/03/12 880208400 DIVIDEND ON 51,561.534 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0528 PER SHARE PAYABLE 03/19/2012 EX DATE 03/15/2012 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 03/21/2012 EFFECTIVE 03/21/2012 744336504 DIVIDEND ON 4,316.501 SHS PRUDENTIAL GLOBAL REAL ESTATE Z AT .02563 PER SHARE PAYABLE 03/23/2012 EX DATE 03/23/2012 EFFECTIVE 03/23/2012 885215566 DIVIDEND ON 8,986.203 SHS THORNBURG INTERNATIONAL VALUE I AT .07653 PER SHARE PAYABLE 03/26/2012 EX DATE 03/23/2012 EFFECTIVE 03/26/2012 885215467 DIVIDEND ON THORNBURG INVESTMENT INCOME BUILDER I PAYABLE 03/25/2012 EFFECTIVE 03/25/2012 19247U106 DIVIDEND ON 6,207.175 SHS COHEN & STEERS INSTL REALTY SHARES AT .231 PER SHARE PAYABLE 03/30/2012 EX DATE 03/29/2012 EFFECTIVE 03/30/2012 37947Q100 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 03/31/2012 EFFECTIVE 03/31/2012 2,722.45 2,531.55 110.63 687.71 3,018.68 1,433.86 978.22 INCOME CASH COST GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 15 TRANSACTION DETAIL ( CONTINUED ) DATE DESCRIPTION 04/03/12 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 03/31/2012 EFFECTIVE 03/31/2012 04/03/12 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 03/31/2012 EFFECTIVE 03/31/2012 PRINCIPAL CASH 2,963.05 2,263.45 04/03/12 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 03/31/2012 EFFECTIVE 03/31/2012 2,514.23 04/04/12 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 03/31/2012 EFFECTIVE 03/31/2012 1,412.63 04/18/12 04/19/12 880208400 DIVIDEND ON 51,768.25 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0527 PER SHARE PAYABLE 04/18/2012 EX DATE 04/16/2012 09251M504 DIVIDEND ON 18,415.962 SHS BLACKROCK EQUITY DIVIDEND I AT .102378 PER SHARE PAYABLE 04/18/2012 EX DATE 04/17/2012 EFFECTIVE 04/18/2012 2,728.19 1,885.39 04/23/12 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 04/21/2012 EFFECTIVE 04/21/2012 2,515.94 05/01/12 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 04/30/2012 EFFECTIVE 04/30/2012 2,847.82 05/02/12 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 04/30/2012 EFFECTIVE 04/30/2012 1,988.38 05/03/12 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 04/30/2012 EFFECTIVE 04/30/2012 2,318.81 05/03/12 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 04/30/2012 EFFECTIVE 04/30/2012 1,186.50 INCOME CASH COST GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 16 TRANSACTION DETAIL ( CONTINUED ) DATE 05/07/12 05/17/12 05/23/12 06/01/12 DESCRIPTION 524686318 DIVIDEND ON 27,136.536 SHS LEGG MASON BW GLOBAL OPPS BD IS AT .02907701 PER SHARE PAYABLE 05/02/2012 EX DATE 05/02/2012 EFFECTIVE 05/02/2012 880208400 DIVIDEND ON 51,979.247 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0528 PER SHARE PAYABLE 05/17/2012 EX DATE 05/15/2012 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 05/21/2012 EFFECTIVE 05/21/2012 957663503 DIVIDEND ON WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I PAYABLE 05/31/2012 EFFECTIVE 05/31/2012 PRINCIPAL CASH 2,516.64 2,118.43 06/04/12 524686318 DIVIDEND ON LEGG MASON BW GLOBAL OPPS BD IS PAYABLE 06/01/2012 EFFECTIVE 06/01/2012 06/05/12 592905509 DIVIDEND ON METROPOLITAN WEST TOTAL RETURN BOND I PAYABLE 05/31/2012 EFFECTIVE 05/31/2012 2,617.89 06/05/12 68380T509 DIVIDEND ON OPPENHEIMER INTERNATIONAL BOND Y PAYABLE 05/31/2012 EFFECTIVE 05/31/2012 1,301.58 06/20/12 524686318 LONG TERM CAPITAL GAINS DIVIDEND ON 27,282.083 SHS LEGG MASON BW GLOBAL OPPS BD IS AT .00384 PER SHARE PAYABLE 06/19/2012 EX DATE 06/19/2012 EFFECTIVE 06/19/2012 GAIN / LOSS 2,744.50 74440B405 DIVIDEND ON PRUDENTIAL TOTAL RETURN BOND Z PDBZX PAYABLE 05/31/2012 EFFECTIVE 05/31/2012 880208400 DIVIDEND ON 52,197.237 SHS TEMPLETON GLOBAL BOND ADV FUND AT .0525 PER SHARE PAYABLE 06/19/2012 EX DATE 06/15/2012 COST 788.63 06/01/12 06/19/12 INCOME CASH 2,497.53 820.26 2,740.35 104.76 104.76 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 17 TRANSACTION DETAIL ( CONTINUED ) DATE 06/20/12 06/25/12 06/25/12 06/27/12 06/27/12 DESCRIPTION 524686318 SHORT TERM CAPITAL GAINS DIVIDEND ON 27,282.083 SHS LEGG MASON BW GLOBAL OPPS BD IS AT .01545 PER SHARE PAYABLE 06/19/2012 EX DATE 06/19/2012 EFFECTIVE 06/19/2012 744336504 DIVIDEND ON 4,322.131 SHS PRUDENTIAL GLOBAL REAL ESTATE Z AT .08598 PER SHARE PAYABLE 06/22/2012 EX DATE 06/22/2012 EFFECTIVE 06/22/2012 246248587 DIVIDEND ON DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX PAYABLE 06/21/2012 EFFECTIVE 06/21/2012 885215566 DIVIDEND ON 9,011.165 SHS THORNBURG INTERNATIONAL VALUE I AT .17631 PER SHARE PAYABLE 06/25/2012 EX DATE 06/25/2012 EFFECTIVE 06/25/2012 885215467 DIVIDEND ON THORNBURG INVESTMENT INCOME BUILDER I PAYABLE 06/25/2012 EFFECTIVE 06/25/2012 TOTAL DIVIDENDS PURCHASES 08/11/11 08/11/11 08/11/11 08/11/11 592905509 PURCHASED 299.472 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 07/31/2011 AT 10.51 FOR REINVESTMENT 37947Q100 PURCHASED 98.268 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 07/31/2011 AT 11.09 FOR REINVESTMENT 68380T509 PURCHASED 211.124 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 07/31/2011 AT 6.80 FOR REINVESTMENT 74440B405 PURCHASED 181.179 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 07/31/2011 AT 14.28 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 421.51 GAIN / LOSS 421.51 371.62 2,586.90 1,588.76 3,635.47 354,432.41 0.00 0.00 3,147.45- 3,147.45 1,089.79- 1,089.79 1,435.64- 1,435.64 2,587.24- 2,587.24 104,151.17 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 18 TRANSACTION DETAIL ( CONTINUED ) DATE 08/12/11 08/17/11 08/23/11 DESCRIPTION 957663503 PURCHASED 202.816 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 07/31/2011 AT 11.05 FOR REINVESTMENT 880208400 PURCHASED 206.316 SHS TEMPLETON GLOBAL BOND ADV FUND ON 08/17/2011 AT 13.69 FOR REINVESTMENT 246248587 PURCHASED 296.331 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 08/23/2011 AT 9.47 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 2,241.12- 2,241.12 2,824.46- 2,824.46 2,806.25- 2,806.25 08/24/11 09251M504 PURCHASED 1,353.341 SHS BLACKROCK EQUITY DIVIDEND I ON 08/23/2011 AT 16.84 22,790.26- 22,790.26 08/24/11 105262703 PURCHASED 2,383.305 SHS BRANDES INSTL INTERNATIONAL EQUITY I ON 08/23/2011 AT 13.82 32,937.28- 32,937.28 08/24/11 19247U106 PURCHASED 237.975 SHS COHEN & STEERS INSTL REALTY SHARES ON 08/23/2011 AT 37.39 8,897.88- 8,897.88 08/24/11 409902756 PURCHASED 3,393.63 SHS JHANCOCK CLASSIC VALUE I ON 08/23/2011 AT 14.53 49,309.45- 49,309.45 08/24/11 416645604 PURCHASED 2,177.46 SHS HARTFORD CAPITAL APPRECIATION Y ON 08/23/2011 AT 31.20 67,936.76- 67,936.76 08/24/11 416645687 PURCHASED 1,267.745 SHS HARTFORD MIDCAP Y ON 08/23/2011 AT 21.05 26,686.03- 26,686.03 08/24/11 67064Y636 PURCHASED 257.122 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I ON 08/23/2011 AT 33.64 8,649.60- 8,649.60 08/24/11 744336504 PURCHASED 221.662 SHS PRUDENTIAL GLOBAL REAL ESTATE Z ON 08/23/2011 AT 17.92 3,972.19- 3,972.19 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 19 TRANSACTION DETAIL ( CONTINUED ) PRINCIPAL CASH INCOME CASH DATE DESCRIPTION 08/24/11 780811824 PURCHASED 2,335.042 SHS ROYCE GLOBAL VALUE INMVT ON 08/23/2011 AT 13.49 31,499.72- 31,499.72 08/24/11 780905535 PURCHASED 1,152.97 SHS ROYCE SPECIAL EQUITY INSTL ON 08/23/2011 AT 18.79 21,664.30- 21,664.30 08/24/11 885215467 PURCHASED 1,073.214 SHS THORNBURG INVESTMENT INCOME BUILDER I ON 08/23/2011 AT 18.13 19,457.37- 19,457.37 08/24/11 885215566 PURCHASED 874.236 SHS THORNBURG INTERNATIONAL VALUE I ON 08/23/2011 AT 25.71 22,476.60- 22,476.60 08/24/11 67065W761 PURCHASED 229.491 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I ON 08/23/2011 AT 27.58 6,329.36- 6,329.36 1,071.50- 1,071.50 3,107.43- 3,107.43 2,152.84- 2,152.84 1,286.67- 1,286.67 2,485.68- 2,485.68 2,598.02- 2,598.02 09/08/11 09/12/11 09/12/11 09/12/11 09/13/11 09/19/11 37947Q100 PURCHASED 94.991 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 08/31/2011 AT 11.28 FOR REINVESTMENT 592905509 PURCHASED 295.664 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 08/31/2011 AT 10.51 FOR REINVESTMENT 957663503 PURCHASED 194.651 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 08/31/2011 AT 11.06 FOR REINVESTMENT 68380T509 PURCHASED 190.055 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 08/31/2011 AT 6.77 FOR REINVESTMENT 74440B405 PURCHASED 173.46 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 08/31/2011 AT 14.33 FOR REINVESTMENT 880208400 PURCHASED 195.781 SHS TEMPLETON GLOBAL BOND ADV FUND ON 09/19/2011 AT 13.27 FOR REINVESTMENT COST GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 20 TRANSACTION DETAIL ( CONTINUED ) DATE 09/19/11 09/26/11 09/28/11 09/30/11 10/07/11 10/07/11 10/07/11 10/07/11 10/07/11 10/07/11 DESCRIPTION 744336504 PURCHASED 27.484 SHS PRUDENTIAL GLOBAL REAL ESTATE Z ON 09/16/2011 AT 18.03 FOR REINVESTMENT 246248587 PURCHASED 288.484 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 09/21/2011 AT 9.41 FOR REINVESTMENT 885215566 PURCHASED 39.654 SHS THORNBURG INTERNATIONAL VALUE I ON 09/26/2011 AT 23.61 FOR REINVESTMENT 885215467 PURCHASED 232.126 SHS THORNBURG INVESTMENT INCOME BUILDER I ON 09/26/2011 AT 17.34 FOR REINVESTMENT 68380T509 PURCHASED 202.87 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 09/30/2011 AT 6.29 FOR REINVESTMENT 957663503 PURCHASED 203.196 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 09/30/2011 AT 11.03 FOR REINVESTMENT 37947Q100 PURCHASED 80.556 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 09/30/2011 AT 10.98 FOR REINVESTMENT 19247U106 PURCHASED 36.439 SHS COHEN & STEERS INSTL REALTY SHARES ON 09/30/2011 AT 34.78 FOR REINVESTMENT 74440B405 PURCHASED 171.81 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 09/30/2011 AT 14.18 FOR REINVESTMENT 592905509 PURCHASED 273.508 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 09/30/2011 AT 10.47 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 495.54- 495.54 2,714.63- 2,714.63 936.22- 936.22 4,025.07- 4,025.07 1,276.05- 1,276.05 2,241.25- 2,241.25 884.51- 884.51 1,267.34- 1,267.34 2,436.26- 2,436.26 2,863.63- 2,863.63 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 21 TRANSACTION DETAIL ( CONTINUED ) DATE 10/19/11 10/21/11 10/24/11 11/04/11 11/07/11 11/07/11 11/07/11 11/07/11 11/17/11 11/23/11 DESCRIPTION 880208400 PURCHASED 201.192 SHS TEMPLETON GLOBAL BOND ADV FUND ON 10/19/2011 AT 12.94 FOR REINVESTMENT 09251M504 PURCHASED 93.977 SHS BLACKROCK EQUITY DIVIDEND I ON 10/20/2011 AT 17.44 FOR REINVESTMENT 246248587 PURCHASED 278.117 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 10/21/2011 AT 9.26 FOR REINVESTMENT 68380T509 PURCHASED 182.109 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 10/31/2011 AT 6.45 FOR REINVESTMENT 37947Q100 PURCHASED 66.818 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 10/31/2011 AT 11.18 FOR REINVESTMENT 592905509 PURCHASED 279.062 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 10/31/2011 AT 10.46 FOR REINVESTMENT 957663503 PURCHASED 185.535 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 10/31/2011 AT 11.11 FOR REINVESTMENT 74440B405 PURCHASED 159.125 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 10/31/2011 AT 14.37 FOR REINVESTMENT 880208400 PURCHASED 204.061 SHS TEMPLETON GLOBAL BOND ADV FUND ON 11/17/2011 AT 12.81 FOR REINVESTMENT 246248587 PURCHASED 277.512 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 11/21/2011 AT 9.34 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 2,603.42- 2,603.42 1,638.96- 1,638.96 2,575.36- 2,575.36 1,174.60- 1,174.60 747.03- 747.03 2,918.99- 2,918.99 2,061.29- 2,061.29 2,286.62- 2,286.62 2,614.02- 2,614.02 2,591.96- 2,591.96 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 22 TRANSACTION DETAIL ( CONTINUED ) DATE DESCRIPTION 11/23/11 416645687 PURCHASED 970.581 SHS HARTFORD MIDCAP Y ON 11/23/2011 AT 18.86 FOR REINVESTMENT 12/05/11 12/05/11 12/05/11 12/05/11 12/05/11 12/07/11 12/09/11 12/09/11 12/09/11 37947Q100 PURCHASED 69.675 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 11/30/2011 AT 10.97 FOR REINVESTMENT 592905509 PURCHASED 265.79 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 11/30/2011 AT 10.38 FOR REINVESTMENT 957663503 PURCHASED 180.968 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 11/30/2011 AT 11.00 FOR REINVESTMENT 68380T509 PURCHASED 191.539 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 11/30/2011 AT 6.29 FOR REINVESTMENT 74440B405 PURCHASED 165.38 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 11/30/2011 AT 14.16 FOR REINVESTMENT 105262703 PURCHASED 1,108.547 SHS BRANDES INSTL INTERNATIONAL EQUITY I ON 12/06/2011 AT 13.03 FOR REINVESTMENT 780811824 PURCHASED 271.157 SHS ROYCE GLOBAL VALUE INMVT ON 12/08/2011 AT 12.03 FOR REINVESTMENT 780905535 PURCHASED 50.291 SHS ROYCE SPECIAL EQUITY INSTL ON 12/08/2011 AT 19.35 FOR REINVESTMENT 780905535 PURCHASED 458.448 SHS ROYCE SPECIAL EQUITY INSTL ON 12/08/2011 AT 19.35 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 18,305.16- 18,305.16 764.33- 764.33 2,758.90- 2,758.90 1,990.65- 1,990.65 1,204.78- 1,204.78 2,341.78- 2,341.78 14,444.37- 14,444.37 3,262.02- 3,262.02 973.13- 973.13 8,870.96- 8,870.96 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 23 TRANSACTION DETAIL ( CONTINUED ) DATE DESCRIPTION 12/09/11 09251M504 PURCHASED 120.784 SHS BLACKROCK EQUITY DIVIDEND I ON 12/09/2011 AT 17.69 FOR REINVESTMENT 12/09/11 09251M504 PURCHASED 7.757 SHS BLACKROCK EQUITY DIVIDEND I ON 12/09/2011 AT 17.69 FOR REINVESTMENT 12/12/11 12/12/11 12/13/11 12/13/11 12/19/11 12/19/11 12/19/11 12/19/11 37947Q100 PURCHASED 130.022 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 12/09/2011 AT 10.87 FOR REINVESTMENT 37947Q100 PURCHASED 179.356 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 12/09/2011 AT 10.87 FOR REINVESTMENT 592905509 PURCHASED 330.384 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 12/12/2011 AT 10.33 FOR REINVESTMENT 592905509 PURCHASED 250.227 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 12/12/2011 AT 10.33 FOR REINVESTMENT 19247U106 PURCHASED 48.343 SHS COHEN & STEERS INSTL REALTY SHARES ON 12/15/2011 AT 37.71 FOR REINVESTMENT 409902756 PURCHASED 317.861 SHS JHANCOCK CLASSIC VALUE I ON 12/16/2011 AT 14.92 FOR REINVESTMENT 67064Y636 PURCHASED 319.525 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I ON 12/16/2011 AT 30.69 FOR REINVESTMENT 67064Y636 PURCHASED 122.378 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I ON 12/16/2011 AT 30.69 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 2,136.67- 2,136.67 137.23- 137.23 1,413.34- 1,413.34 1,949.60- 1,949.60 3,412.87- 3,412.87 2,584.85- 2,584.85 1,823.01- 1,823.01 4,742.49- 4,742.49 9,806.22- 9,806.22 3,755.79- 3,755.79 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 24 TRANSACTION DETAIL ( CONTINUED ) DATE 12/19/11 12/19/11 12/19/11 12/19/11 12/20/11 12/27/11 12/27/11 12/27/11 12/27/11 12/27/11 DESCRIPTION 67065W761 PURCHASED 197.328 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I ON 12/16/2011 AT 24.54 FOR REINVESTMENT 67065W761 PURCHASED 360.319 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I ON 12/16/2011 AT 24.54 FOR REINVESTMENT 744336504 PURCHASED 28.178 SHS PRUDENTIAL GLOBAL REAL ESTATE Z ON 12/16/2011 AT 17.10 FOR REINVESTMENT 880208400 PURCHASED 320.936 SHS TEMPLETON GLOBAL BOND ADV FUND ON 12/19/2011 AT 12.26 FOR REINVESTMENT 880208400 PURCHASED 1,015.21 SHS TEMPLETON GLOBAL BOND ADV FUND ON 12/19/2011 AT 12.26 FOR REINVESTMENT 246248587 PURCHASED 271.986 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 12/21/2011 AT 9.12 FOR REINVESTMENT 246248587 PURCHASED 1,157.337 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 12/23/2011 AT 9.12 FOR REINVESTMENT 246248587 PURCHASED 894.306 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 12/23/2011 AT 9.12 FOR REINVESTMENT 416645604 PURCHASED 273.225 SHS HARTFORD CAPITAL APPRECIATION Y ON 12/27/2011 AT 31.44 FOR REINVESTMENT 416645687 PURCHASED 39.45 SHS HARTFORD MIDCAP Y ON 12/27/2011 AT 19.59 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 4,842.43- 4,842.43 8,842.23- 8,842.23 481.84- 481.84 3,934.67- 3,934.67 12,446.47- 12,446.47 2,480.51- 2,480.51 10,554.91- 10,554.91 8,156.07- 8,156.07 8,590.18- 8,590.18 772.83- 772.83 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 25 TRANSACTION DETAIL ( CONTINUED ) DATE 12/27/11 12/27/11 12/29/11 12/29/11 01/06/12 01/09/12 01/09/12 01/09/12 01/09/12 01/11/12 DESCRIPTION 74440B405 PURCHASED 541.391 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 12/23/2011 AT 13.84 FOR REINVESTMENT 74440B405 PURCHASED 691.165 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 12/23/2011 AT 13.84 FOR REINVESTMENT 885215467 PURCHASED 277.995 SHS THORNBURG INVESTMENT INCOME BUILDER I ON 12/25/2011 AT 18.04 FOR REINVESTMENT 885215566 PURCHASED 15.665 SHS THORNBURG INTERNATIONAL VALUE I ON 12/23/2011 AT 24.51 FOR REINVESTMENT 957663503 PURCHASED 204.624 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 12/31/2011 AT 11.11 FOR REINVESTMENT 67064Y636 PURCHASED 199.128 SHS NUVEEN TRADEWINDS VALUE OPPORTUNITIES I ON 12/30/2011 AT 30.35 FOR REINVESTMENT 67065W761 PURCHASED 125.445 SHS NUVEEN TRADEWINDS GLOBAL ALL-CAP I ON 12/30/2011 AT 24.28 FOR REINVESTMENT 37947Q100 PURCHASED 76.17 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 12/31/2011 AT 10.85 FOR REINVESTMENT 74440B405 PURCHASED 169.92 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 12/31/2011 AT 13.95 FOR REINVESTMENT 68380T509 PURCHASED 990.792 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 12/31/2011 AT 6.19 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 7,492.85- 7,492.85 9,565.72- 9,565.72 5,015.03- 5,015.03 383.94- 383.94 2,273.37- 2,273.37 6,043.54- 6,043.54 3,045.80- 3,045.80 826.44- 826.44 2,370.38- 2,370.38 6,133.00- 6,133.00 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 26 TRANSACTION DETAIL ( CONTINUED ) DATE 01/13/12 01/19/12 01/23/12 02/01/12 02/01/12 02/08/12 02/08/12 02/08/12 02/21/12 02/23/12 DESCRIPTION 592905509 PURCHASED 265.972 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 12/31/2011 AT 10.37 FOR REINVESTMENT 880208400 PURCHASED 213.498 SHS TEMPLETON GLOBAL BOND ADV FUND ON 01/19/2012 AT 12.60 FOR REINVESTMENT 246248587 PURCHASED 283.028 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 01/21/2012 AT 9.15 FOR REINVESTMENT 37947Q100 PURCHASED 66.416 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 01/31/2012 AT 11.19 FOR REINVESTMENT 957663503 PURCHASED 168.233 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 01/31/2012 AT 11.26 FOR REINVESTMENT 592905509 PURCHASED 268.733 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 01/31/2012 AT 10.50 FOR REINVESTMENT 74440B405 PURCHASED 169.724 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 01/31/2012 AT 14.19 FOR REINVESTMENT 68380T509 PURCHASED 203.416 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 01/31/2012 AT 6.37 FOR REINVESTMENT 880208400 PURCHASED 205.893 SHS TEMPLETON GLOBAL BOND ADV FUND ON 02/17/2012 AT 13.12 FOR REINVESTMENT 246248587 PURCHASED 284.809 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 02/21/2012 AT 9.25 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 2,758.13- 2,758.13 2,690.08- 2,690.08 2,589.71- 2,589.71 743.20- 743.20 1,894.30- 1,894.30 2,821.70- 2,821.70 2,408.39- 2,408.39 1,295.76- 1,295.76 2,701.31- 2,701.31 2,634.48- 2,634.48 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 27 TRANSACTION DETAIL ( CONTINUED ) DATE 03/01/12 03/01/12 03/01/12 03/01/12 03/05/12 03/19/12 03/23/12 03/26/12 03/29/12 03/30/12 DESCRIPTION 37947Q100 PURCHASED 74.821 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 02/29/2012 AT 11.25 FOR REINVESTMENT 957663503 PURCHASED 172.231 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 02/29/2012 AT 11.31 FOR REINVESTMENT 68380T509 PURCHASED 194.341 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 02/29/2012 AT 6.39 FOR REINVESTMENT 74440B405 PURCHASED 154.423 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 02/29/2012 AT 14.27 FOR REINVESTMENT 592905509 PURCHASED 244.599 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 02/29/2012 AT 10.55 FOR REINVESTMENT 880208400 PURCHASED 206.716 SHS TEMPLETON GLOBAL BOND ADV FUND ON 03/19/2012 AT 13.17 FOR REINVESTMENT 246248587 PURCHASED 276.069 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 03/21/2012 AT 9.17 FOR REINVESTMENT 744336504 PURCHASED 5.63 SHS PRUDENTIAL GLOBAL REAL ESTATE Z ON 03/23/2012 AT 19.65 FOR REINVESTMENT 885215566 PURCHASED 24.962 SHS THORNBURG INTERNATIONAL VALUE I ON 03/26/2012 AT 27.55 FOR REINVESTMENT 885215467 PURCHASED 159.55 SHS THORNBURG INVESTMENT INCOME BUILDER I ON 03/25/2012 AT 18.92 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 841.74- 841.74 1,947.93- 1,947.93 1,241.84- 1,241.84 2,203.61- 2,203.61 2,580.52- 2,580.52 2,722.45- 2,722.45 2,531.55- 2,531.55 110.63- 110.63 687.71- 687.71 3,018.68- 3,018.68 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 28 TRANSACTION DETAIL ( CONTINUED ) DATE 04/03/12 04/03/12 04/03/12 04/03/12 04/03/12 04/04/12 04/18/12 04/19/12 04/23/12 05/01/12 DESCRIPTION 19247U106 PURCHASED 33.084 SHS COHEN & STEERS INSTL REALTY SHARES ON 03/30/2012 AT 43.34 FOR REINVESTMENT 37947Q100 PURCHASED 88.128 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 03/31/2012 AT 11.10 FOR REINVESTMENT 592905509 PURCHASED 281.124 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 03/31/2012 AT 10.54 FOR REINVESTMENT 957663503 PURCHASED 201.017 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 03/31/2012 AT 11.26 FOR REINVESTMENT 74440B405 PURCHASED 177.81 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 03/31/2012 AT 14.14 FOR REINVESTMENT 68380T509 PURCHASED 223.164 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 03/31/2012 AT 6.33 FOR REINVESTMENT 880208400 PURCHASED 210.997 SHS TEMPLETON GLOBAL BOND ADV FUND ON 04/18/2012 AT 12.93 FOR REINVESTMENT 09251M504 PURCHASED 97.336 SHS BLACKROCK EQUITY DIVIDEND I ON 04/18/2012 AT 19.37 FOR REINVESTMENT 246248587 PURCHASED 271.7 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 04/21/2012 AT 9.26 FOR REINVESTMENT 592905509 PURCHASED 268.409 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 04/30/2012 AT 10.61 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 1,433.86- 1,433.86 978.22- 978.22 2,963.05- 2,963.05 2,263.45- 2,263.45 2,514.23- 2,514.23 1,412.63- 1,412.63 2,728.19- 2,728.19 1,885.39- 1,885.39 2,515.94- 2,515.94 2,847.82- 2,847.82 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 29 TRANSACTION DETAIL ( CONTINUED ) DATE 05/02/12 05/03/12 05/03/12 05/07/12 05/17/12 05/23/12 06/01/12 06/01/12 06/04/12 06/05/12 DESCRIPTION 957663503 PURCHASED 175.342 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 04/30/2012 AT 11.34 FOR REINVESTMENT 74440B405 PURCHASED 162.724 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 04/30/2012 AT 14.25 FOR REINVESTMENT 68380T509 PURCHASED 185.972 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 04/30/2012 AT 6.38 FOR REINVESTMENT 524686318 PURCHASED 70.225 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 05/02/2012 AT 11.23 FOR REINVESTMENT 880208400 PURCHASED 217.99 SHS TEMPLETON GLOBAL BOND ADV FUND ON 05/17/2012 AT 12.59 FOR REINVESTMENT 246248587 PURCHASED 272.364 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 05/21/2012 AT 9.24 FOR REINVESTMENT 957663503 PURCHASED 185.99 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 05/31/2012 AT 11.39 FOR REINVESTMENT 74440B405 PURCHASED 175.512 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 05/31/2012 AT 14.23 FOR REINVESTMENT 524686318 PURCHASED 75.322 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 06/01/2012 AT 10.89 FOR REINVESTMENT 592905509 PURCHASED 245.581 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 05/31/2012 AT 10.66 FOR REINVESTMENT PRINCIPAL CASH INCOME CASH COST 1,988.38- 1,988.38 2,318.81- 2,318.81 1,186.50- 1,186.50 788.63- 788.63 2,744.50- 2,744.50 2,516.64- 2,516.64 2,118.43- 2,118.43 2,497.53- 2,497.53 820.26- 820.26 2,617.89- 2,617.89 GAIN / LOSS ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 30 TRANSACTION DETAIL ( CONTINUED ) DATE 06/05/12 06/19/12 06/20/12 06/20/12 06/25/12 06/25/12 06/27/12 06/27/12 DESCRIPTION 68380T509 PURCHASED 210.271 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 05/31/2012 AT 6.19 FOR REINVESTMENT 880208400 PURCHASED 218.529 SHS TEMPLETON GLOBAL BOND ADV FUND ON 06/19/2012 AT 12.54 FOR REINVESTMENT 524686318 PURCHASED 9.404 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 06/19/2012 AT 11.14 FOR REINVESTMENT 524686318 PURCHASED 37.838 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 06/19/2012 AT 11.14 FOR REINVESTMENT 744336504 PURCHASED 19.265 SHS PRUDENTIAL GLOBAL REAL ESTATE Z ON 06/22/2012 AT 19.29 FOR REINVESTMENT 246248587 PURCHASED 278.461 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 06/21/2012 AT 9.29 FOR REINVESTMENT 885215566 PURCHASED 65.113 SHS THORNBURG INTERNATIONAL VALUE I ON 06/25/2012 AT 24.40 FOR REINVESTMENT 885215467 PURCHASED 203.896 SHS THORNBURG INVESTMENT INCOME BUILDER I ON 06/25/2012 AT 17.83 FOR REINVESTMENT TOTAL PURCHASES SALES AND MATURITIES 08/24/11 246248587 SOLD 4,772.736 SHS DELAWARE DIVERSIFIED INCOME FUND INSTL DPFFX ON 08/23/2011 AT 9.44 PRINCIPAL CASH INCOME CASH COST 1,301.58- 1,301.58 2,740.35- 2,740.35 104.76- 104.76 421.51- 421.51 371.62- 371.62 2,586.90- 2,586.90 1,588.76- 1,588.76 3,635.47- 3,635.47 677,039.02- 45,054.63 0.00 677,039.02 44,794.72- GAIN / LOSS 0.00 259.91 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 PAGE 31 TRANSACTION DETAIL ( CONTINUED ) COST GAIN / LOSS 39,382.29 37,036.40- 2,345.89 592905509 SOLD 3,342.227 SHS METROPOLITAN WEST TOTAL RETURN BOND I ON 08/23/2011 AT 10.49 35,059.96 34,681.21- 378.75 08/24/11 68380T509 SOLD 7,236.873 SHS OPPENHEIMER INTERNATIONAL BOND Y ON 08/23/2011 AT 6.78 49,066.00 44,883.18- 4,182.82 08/24/11 74440B405 SOLD 3,667.13 SHS PRUDENTIAL TOTAL RETURN BOND Z PDBZX ON 08/23/2011 AT 14.32 52,513.30 50,618.14- 1,895.16 08/24/11 880208400 SOLD 4,393.885 SHS TEMPLETON GLOBAL BOND ADV FUND ON 08/23/2011 AT 13.71 60,240.17 57,279.28- 2,960.89 08/24/11 957663503 SOLD 3,740.06 SHS WESTERN ASSET FUNDS NON-US OPP I CORE PLUS BOND I ON 08/23/2011 AT 11.04 41,290.26 39,484.99- 1,805.27 308,777.92- 13,828.69 DATE DESCRIPTION 08/24/11 37947Q100 SOLD 3,466.751 SHS LEGG MASON BW GLOBAL OPPS BD IS ON 08/23/2011 AT 11.36 08/24/11 TOTAL SALES AND MATURITIES NON CASH ACTIVITY 05/01/12 05/01/12 PRINCIPAL CASH 322,606.61 INCOME CASH 0.00 37947Q100 EXCHANGE 27,136.536 SHS LEGG MASON BW GLOBAL OPPS BD IS AT THE RATE OF 100% FOR 27,136.536 SHS LEGG MASON BW GLOBAL OPPS BD IS 290,265.15- 524686318 EXCHANGE 27,136.536 SHS LEGG MASON BW GLOBAL OPPS BD IS AT THE RATE OF 100% FOR 27,136.536 SHS LEGG MASON BW GLOBAL OPPS BD IS TOTAL NON CASH ACTIVITY ENDING BALANCE 290,265.15 0.00 0.00 0.00 0.00 0.00 0.00 7,692,243.17 117,979.86 ACCOUNT NUMBER: 11515000312 STATEMENT PERIOD: AUGUST 01, 2011 THROUGH JUNE 30, 2012 We may select a Money Market or other Mutual Fund on your behalf for investment of all or a portion of your funds. We received administrative fees from certain fund managers for administrative services we provide in connection with accounts we hold with investments in their funds. State Trust statutes provide that a beneficiary may not commence a proceeding against a trustee for breach of trust more than one year after the date the beneficiary or a representative of a beneficiary was sent a report that adequately disclosed the existence of a potential claim for breach of trust and informed the beneficiary of the time allowed for commencing a proceeding. This account statement represents the Trustees report of its acts and each Beneficiary or a representative of a Beneficiary has one year from the date of mailing of this Trustees report to commence a proceeding against the Trustee for breach of trust for any acts disclosed in the Trustees report. If you have any questions, pleasecontact your Trust Officer. PAGE 32