Asset Holdings, Savings, and Temporary Migration

advertisement

ANNALSOF ECONOMICS AND STATISTICS

NUMBER97/98,JANUARY/JUNE

2010

AssetHoldings,

Savings,

andTemporary

Migration

ChristianDUSTMANNand JosepMESTRES

(CReAM)

University

CollegeLondonand Centre

forResearchandAnalysisofMigration

inrelation

totheirreturn

ofimmigrants

Thispaperanalyzessavingsandassetholdings

plans.We

Further,

byreturn

plansofimmigrants.

maybe affected

arguethatsavingsandassetaccumulation

return

thewaysavingsandassetsareheldinthehomeandhostcountry

mayalso be relatedtofuture

andnativesmayleadtoserious

savingsandassetsbetweenimmigrants

plans.Thus,comparing

with

We showthatimmigrants

whenneglecting

thehomecountry

underestimation

component.

In

in

the

home

of

their

a

return

addition,

country.

savings

proportion

temporary

plansplace higher

inthehomecountry

are

andtheshareofassetsandhousingvalueaccumulated

boththemagnitude

andlowerthevalueofassetsand

theirmigration

as temporary,

whoconsider

largerforimmigrants

we findno

on observable

heldinthehostcountry.

characteristics,

Finally,andconditional

property

with

more

than

withtemporary

save

evidencethatimmigrants

immigrants

plans

migration

plans.*

permanent

migration

I.

Introduction

is important

forassessmentof thewelfareimpliof immigrants

The economicperformance

the

a largenumberof papersinvestigate

Not surprisingly

cationsof immigration.

therefore,

and

for

different

over

the

of

countries,

cycle,

migration

(relative)earnings

position immigrants

butis

data1.An area thathas receivedless attention,

and time-series

usingbothcross-section

in thereceiving

forassessingtheeconomicpositionof immigrants

perhapsequallyimportant

assetsandsavingsarelikelyto

andsavings.Like earnings,

is theirassetaccumulation

country,

inthepastmayhaveaffected

Returnintentions

return.

be affected

past

byplansabouta future

ofcurrent

assetholdingsand

the

and

therefore

as wellas pastexpenditures,

magnitude

earnings

where

return

intentions

Furthermore,

maydetermine

pastandcurrent

savings.2

pastandcurrent

assetsand savingsare held.For instance,whenconsidering

housingand otherinvestments,

rather

as temporary

areintended

inthecountry

oforiginifmigrations

thesemaybe undertaken

thanpermanent.3

1. From the early work of CHISWICK [1978] and BORJAS [1985] to DUSTMANN [1993], FRIEDBERG [1993], BORJAS

[1995], BARTH et al. [2004], BRATSBERG and al [2006] and LUBOTSKY [2007] among others.

2. See DUSTMANN [1995, 1997] for a theoreticalanalysis of the interactionbetween returnmigrationand immigrant

savings.

3. See WOODRUFF and ZENTENO [2007] and YANG [2008] forevidence on the creationof enterprisesof immigrants

in theirhome countrieswhile abroad. DUSTMANN and KIRCHKAMP [2002] and MESNARD [2004] provide evidence of

activitiesafterreturn.

immigrantsundertakingentrepreneurial

* JEL:F22, D31, R21 /KEY WORDS: International

Migration,Wealth Accumulation, Housing Demand.

289

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

CHRISTIAN DUSTMANN AND JOSEP MESTRES

A number

ofpapersanalysethewealthgapbetweenimmigrants

andnatives.Mostofthese

a

even

conditional

on

observable

characteristics4.

However,mostmeasures

report persistent

gap,

ofimmigrant

wealthdo notconsider

in

wealth

the

home

andhostcountry

immigrants'

separately.

wealthaccumulation

without

betweenlocations

Hence,an analysisthatconsiders

differentiating

mostofthese

mayonlygivean incomplete

pictureof assetholdingsand savings.In addition,

studiesdo notallow eitherforheterogeneity

acrossimmigrants

due to differences

in pastand

current

return

plans5.

In thispaper,we providean analysisofimmigrant

to

savingsandassetholdingsin relation

and

current

return

We

also

consider

the

that

and

assets

are

held

past

plans.

possibility savings

notonlyinthehostcountry,

butalso inthecountry

oforigin.Ouranalysisis basedon a unique

datasourcethatprovidesinformation

on assetholdings,

itscomposition

andlocation,as wellas

return

assetaccumulation

and savings,andhowit

immigrants'

plans.We describeimmigrants'

relatestoreturn

as wellas individual

andhouseholdcharacteristics.

Thepapermakes

intentions,

twocontributions.

it

betweenreturn

First, providesanalysisoftherelationship

plans,on theone

ontheother.

theimportance

ofconsiderhand,andsavingsandassetholdings

Second,itillustrates

assetholdings

notonlyinthehostbutalso thehomecountry.

ingmigrants'

Ourresults

showthattheoveralllevelofsavingsandassetaccumulation

ofimmigrants

would

be severely

ifhomecountry

underestimated

wealthis nottakenintoconsideration.

In addition,

return

The totalvalueof

theyshowhowimmigrants'

plansarerelatedto wealthaccumulation.

assetshelddoesnotdiffer

between

with

households

intentions

significantly

immigrant

temporary

andthosewithpermanent

ones.However,

thedistribution

oftheseassetsbetweenhost-andhome

locationdoesdiffer.

whoplantoreturn

do allocatea higher

oftheir

country

Migrants

proportion

intheirhomecountry.

savings,assetsandproperty

The structure

ofthepaperis as follows:inthenextsectionwe discussconceptual

considerin

III

Section

we

ourdataandexplainthedescriptive

ations,

present

evidence,in SectionIV we

showourresults

andfinally

in SectionV we concludeanddiscusspotential

implications.

II. ConceptualConsiderations

and Estimation

II.7 A SimpleModel

We start

witha simplemodelthatfocuseson thewaytemporary

vs permanent

relate

migrations

to savingsbehavior.

A moredetailedanalysisoftheinterplay

betweensavingsandreturn

(both

exogenousandoptimally

chosen)canbe foundinDUSTMANN

[1995].

As inGALORandSTARK[1990],supposethatthelifetime

oftheimmigrant

canbe divided

into2 sub-periods:

1

is

the

time

to

be

in

the

host

and

period

spent

country, period2 is thetime

tobe spentinthehomecountry

aftera possiblereturn.

inperiod2 takesplacewithprobReturn

4. See for example BLAU and GRAHAM [1990], COULSON [1999], BORJAS [2002], AMUEDO-DORANTES and

POZO [2002], PAINTER et al. [2003], OSILI and PAULSON [2004], COBB-CLARK and HILDEBRAND [2006], SINNING

[2007, 2009] or BAUER et al. [2009].

5. An exceptionis BAUER and SINNING[2009], who foundthatthesavings behaviourof migrantsis relatedto theirreturn

measures of migrantsavings,assuming eitherthatno remittancesare saved or that

plans. The analysis considersdifferent

all remittancesare saved, withoutdifferentiating

between remittancepurposes. It does not investigateimmigranthomeownershipor asset holdings.

290

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS, ASSET HOLDINGS, AND TEMPORARY MIGRATION

= 0, themigration

In thecase that/?

is permanent.

Considerthefollowing

inter-temporal

ability/?.

function:

utility

U = u'cl) + p$ü2(cE2)+ (l-p)u2(c12)

1

(1)

2

9

in period1 in thehostcountry

and и and и arethe

In equation(1), и is thesub-utility

whichwe assume

inperiod2 inthehomeandinthehostcountry

samesub-utilities

respectively,

first

and

second

J2

and

(pare

in

concave consumption.

as beingstrictly

c1,

Further,

periodconTheparameter

inimmigration

respectively.

(indexE) countries

(indexI) andemigration

sumption

in the

home

to

the

a

return

attaches

to

the

g

is

the

country

possible

probability migrant

p [0, 1]

secondperiod.

thanconinthesecondperiodinthecase ofa return

mayinducemoreutility

Consumption

etc.Thisis capduetocomplementarities

inthehostcountry,

climate,

friends,

through

sumption

>

and

a

of

level

has

a

If

the

turedbytheparameter

highermarginal

utility

higher

ß. ß 1, migrant

ifhe/she

consumesinthehomecountry.

utility

for

forthefirst

Thebudgetconstraint

periodis givenbyw1= c1 + s. The budgetconstraint

=

andw^2+ rs= cE2inthe

thesecondperiodis w72+s J2 inthecase ofa permanent

migration

inperiod1 aredenotedbyw1,andinperiod2 byw^2andw72inhome

case ofa return.

Earnings

in the

The purchasing

and hostcountriesrespectively.

powerof thehostcountrycurrency

is higher

is givenbyr. Ifr > 1,thepurchasing

homecountry

currency

powerofthehostcountry

homecountry6.

inthemigrant's

itfixesconsumption

Thechoicevariableinperiod1 is savingss. Giventhebudgetconstraint,

is givenby:

ordercondition

inthefirst

period(c1) andinthesecondperiod(c^2,c72).The first

u'=p$üir+ ('-p)u¡

(2)

derivative.

wherethesubscript

j denotesthefirst

levelofsavings.Savingswillbe setsuchthatthemarginal

the

determines

optimal

Equation(2)

inperiod2.

return

in

offorgone

costinterms

utility period1 is equalizedtotheexpectedmarginal

=

ofconsumption

is permanent),

utility

savingswillequalizethemarginal

If/? 0 (themigration

in savings

a

to

leads

a

in thetwoperiodsin thehostcountry.

change

in/?

1),

change

If/?e(0,

the

to

relationship:

following

according

ds_

-№u?-uh

dp rìi+pfì^SiiHl-pWl

(3)

is alwaysnegative.Assumefirstthatß = 1 and r = 1:

in thedenominator

The expression

as is thepurchasing

arethesameinbothcountries,

forconsumption

powerofthehost

preferences

<

In thiscase,savingswillbe increasing

in/?as longas w^ v/,duetothestrict

currency.

country

themarginal

is thatan increaseinsavingsincreases

Theintuition

function.

oftheutility

concavity

between

ratesweredifferent

ifinterest

ratesareequalinthetwocountries;

we haveassumedthatinterest

6. Forsimplicity

assetaccumulation.

sourceofdifferential

thenthiswouldbe an additional

homeandhostcountry

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

291

CHRISTIAN DUSTMANN AND JOSEP MESTRES

ofconsumption

duetolowerwages.Thus,an increaseinthe

Utility

bymoreinthehomecountry,

return

leads

to

Now

toconsume

probability

p

higher

savings.

supposethatß > 1: individuals

prefer

at homerather

thanabroad.Thiswillreinforce

theeffect

ofan increaseinthereturn

probability

on savings.Finally,supposethatthepurchasing

is higherat

powerofthehostcountry

currency

homeso thatr > 1. In thiscase,theoveralleffect

on savingsis ambiguous,

as itis nowunclear

whether

an increaseinsavingsincreases

themarginal

of

moreinthehomeor

utility consumption

thehostcountry.

A wagedifferential

between

homeandhostcountry

thanthegainobtained

larger

>

on savingsthrough

thepurchasing

differential

m/-w^

is

sufficient

fortheeffect

power

(r l)s

ofan increasein/?on savingstobe positive.Thus,according

to thissimplemodel,savingsmay

be positively

or(ifpurchasing

arelarge)negatively

affected

powerdifferentials

byan increasein

thereturn

orthetwoeffects

probability,

maycanceleachotherout.

Ourmodelhas nothing

to say howeveraboutwheresavingsareheld.It maywellbe that

who

a

to a return

aremorelikelyto transfer

someof their

immigrants assign highprobability

Ifthisis thecase,an empirical

savingstothehomecountry.

analysisofimmigrants'

savingsmay

leadto an underestimate

whenonlyconsidering

in

the

host

savings

economy.

Now considerassetholdings,

likehousingassetsorlong-term

Iftheseareproinvestments.

to

the

levelofpastsavings,thenoursimplelife-cycle

modelshouldsuggestthat,in

portional

therelationship

to thetemporariness

ofa migration

is ambiguous.

The modeldoes not

general,

where

these

assets

are

held.

it

is

not

that

who assigna

explain

However,

unlikely immigrants

to

a

later

return

have

a

foraccumulation

inthehomecountry.

Thisis

highprobability

preference

thecase forassetsthathavethecharacter

ofdurableconsumption

particularly

goods,andthatcan

notbe movedfromoneplaceto another,

likehousingassets.

II.2 EmpiricalImplementation

In theempiricalanalysiswe regressthevariousoutcomevariableson a vectorof individual

oforigindummies,

anda measurefortheprobability

to return.

specificcharacteristics,

country

Thegenericregression

hastheform

Yi=ai+Xia2+iri+ui

(4)

whereYtis therespective

outcome,Xtis a vectorof background

characteristics,

щ is an error

and7} is a measureforthetemporariness

ofa migration.

As we explainbelow,inourdata

term,

we observeforeachyearan indicator

ornottheindividual

wouldliketoreturn

questionwhether

homeat somepointinthefuture.

Theseintentions

affect

maychangeovertime,andaccordingly

thesavingsandassetholdingdecision.In ouranalysis,

we willusetheaverageintention

toreturn,

from

information

overthelastfiveyears,as a measureoftemporariness

whenanalyzing

computed

assetholdings,

andthecurrent

intention

toreturn

whenanalyzing

current

savings.

We wouldliketo emphasizethatwe do notinterpret

ourestimates

as causal.Whilein our

is exogenously

simplemodel,thereturn

probability

given,immigrants

maywellchoosewhether

wish

to

and

this

choice

not

be

to

or

decireturn,

they

may

exogenous savings assetaccumulation

sions.Further,

ourmeasureforthetemporariness

ofa migration

witherror,

maywellbe measured

whichwouldbiasthecoefficient

estimate

towards

zero.We believehoweverthattheassociations

betweenthetemporariness

ofa migration

on theone hand,and savingsandassetaccumulation

292

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS, ASSET HOLDINGS, AND TEMPORARY MIGRATION

onbackground

as wellas thechoiceofwherethesearetobe held,whichareconditional

behavior,

in

The

overall

are

and

characteristics, interesting important7.

comparison savingsand assetacof

andnativesis ofcoursenotaffected

betweenimmigrants

cumulation

bypossibleendogeneity

return

migrations.

III. Backgroundand Data

III.7 Background

a strong

The WestGermaneconomyexperienced

by a

upwardswingafter1955,accompanied

ratefellfrom

rate.Between1955and 1960,theunemployment

sharpfallin theunemployment

of

FÜRARBEIT[2009]). At thesametime,thepercentage

5.6% to 1.3% (BUNDESAGENTUR

in

West

and

countries

from

Southern

workers

born

Germany

Turkeyemployed

European

foreign

increasedfrom0.6 percentin 1957to 5.3 percentin 1965,to 11.2 percentin 1973 (see BLITZ

were

Suchagreements

recruitment

was regulated

agreements.

bybilateral

[1977]).Immigration

setup withItaly,Spain,Greece,Turkey,Portugaland Yugoslaviain the 1950's and 1960's.

thesecountries

from

labourstopped.

offoreign

After1973,recruitment

Nevertheless,

immigration

The

reunification

dueto family

[1996]formoredetails). immigrant

continued,

(see DUSTMANN

overthis

Labormigration

movement.

from

that

stems

in

this

we

migration

paper

study

population

the

and

countries

the

both

as

considered

was

emigration

immigration

by

temporary

period initially

has beenquiteconsiderable

return

countries.

(see BOHNING[1987]),a

Still,although

migration

settled

bornworkers

offoreign

permanently8.

largefraction

III.2 Data andSample

Panel(GSOEP).The GSOEPis a householdThe datasetwe use is theGermanSocio-Economie

based panelsurvey,similarto theUS Panel Studyof IncomeDynamics(PSID) or theBritish

HouseholdPanel Study(BHPS). Initiatedin 1984,theGSOEPoversamplesthethen-resident

we havedescrimovement

whichstemsfromthemigration

in Germany,

population

immigrant

bed above.In thefirst

wave,about4500 householdswitha Germanbornhouseholdheadwere

head.Thedataareunique

bornhousehold

witha foreign

andabout1500households

interviewed,

over

on a boostsampleof immigrants a longperiodoftime.

in providing

repeatedinformation

as well as

fortheforeignbornfromtheover-sample,

For ouranalysis,we use observations

forthenativebornfromthestandard

observations

sample.

The householdhead

in a householdandovertheage of 16 is interviewed.

Each individual

the

andbelow interviewing

inthehousehold

aboutall otherindividuals

information

age.

provides

areincludedinthepanel.

andformtheirownhouseholds

wholeavehouseholds

Individuals

decitotemporary

andtheirrelationship

andMESTRES[2010]wherewe analyzeremittances

7. In DUSTMANN

migration

access

we

have

In

that

IV

with

an

estimator

fixed

effects

a

these

we

address

strategy.

paper,

sions,

bycombining

problems

are

estimates

effects

oftimeperiods.We findthattheIV-fixed

fora largenumber

information

forremittances

torepeated

sizetotheupward

error

measurement

biasthrough

duetothedownward

OLSestimates,

closetotheoriginal

beingofsimilar

Assetsandsavings- whichwe analyzeinthispaper- areonlyobserved

unobservable

biasinducedthrough

heterogeneity.

onceortwiceoverthecourseofthepanel.

from

the

in2004was 3.7 millionpeople,ofwhicharound60 percentoriginated

laborinGermany

8. Thestockofforeign

here

considered

countries

(OECD

[2006]).

sending

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

293

CHRISTIANDUSTMANNAND JOSEPMESTRES

TheGSOEPdataprovidesinformation

on assetholdingsinboththehomeandhostcountries

for

1988.

For

that

there

is

detailed

information

onthetypeofassetholdings,

their

only

yearonly,

- whether

theassetis heldin thehostor sourcecountry9.

valuesand- importantly

Assetholdcash,savings,home

ingsreferto thetotalamountofassetholdingsofthehousehold(including

of

financial

in

net

each

location

Home

refers

etc.)

ownership,

obligations

separately.

ownership

or anyotherproperty

in

to all houses,apartments

ofthehouseholdat market

both

home

prices

andhostcountries.

locationsonlyfor1992 and 199410.

Savingsare declaredin bothhomeand hostcountry

in

the

host

to

the

net

Savings

country

correspond

monthly

savingsofthehouseholdtransformed

toa yearlylevel.Savingsinthehomecountry

to

correspond theindividual

yearlyamountsaved

inthehomecountry

andtransformed

tohousehold

level.We construct

thetotalamountofhouseholdsavingsas thesumoftheyearlyamountsthehouseholdsavedin bothlocations.We will

use thosetwoyearswherewe observesavingsin bothlocations(1992 and 1994) to studythe

allocationof savings.All monetary

variablesareat thehouseholdlevelin realamounts,

where

thereference

yearis 2002.

A further

ofourdatais thatimmigrants

ineachwaveofthe

uniquefeature

provideinformation

whether

intend

to

remain

in

or

whether

wish

toreturn

home

panel

they

permanentlyGermany,

they

atsomestageinthefuture.

We usethisinformation

todifferentiate

between

thosewhodo andthose

whodo notplantoreturn

tothehomecountry.

Ifeconomicdecisionsareinvolved,

itis likelythat

thesearebasedon intentions

ofthissort,rather

thanonpossiblerealizations

ata laterstage.

In addition,

we observeindividual

andhouseholdcharacteristics

inthehostcountry,

as well

as information

on family

members

whoarelivinginthecountry

oforigin.

IV. Results

IV.7 Descriptive

Evidence

Individual

Characteristics:

As we mention

on

above,we measuresavingsandassetaccumulation

thelevelofthehousehold.

Whenwe refer

to characteristics

ofindividuals

within

we

households,

refer

totheheadofhousehold.

Entriesin TABLEI showthattheaverageage ofhousetypically

holdheadsinoursampleis 45, andthatmigrants

residedslightly

lessthan22 yearson averagein

Almost90 percent

oftheheadofhouseholds

aremale,and78 percent

areemployed.

The

Germany.

net

household

income

is

around

Euros

2002

Around

93

25,000

yearly

average

(in

prices).

percent

ofhousehold

headsarenotsingle;however,

havenativepartners.

Almost40 percent

only7 percent

ofall headsofhouseholds

thattheygrewup ina ruralarea.The lastvariablemeasures

the

report

return

intention

ofthehousehold

head.On average,

51percent

ofthehousehold

headsinoursample

thattheywouldwishtoreturn

totheirhomecountry

at somepointinthefuture.

report

We

the

amount

of

for

1992

and 1994.Forimmigrants,

Savings: study yearly

savings

savings

refer

tothetotalamount

savedas wellas theamounts

savedinhostandhomecountries.

As a referHeresavingsrefer

tothetotalamount

saved.

ence,wealsoreport

savingsfornativebornindividuals.

9. See theAPPENDIX fora more detaileddescriptionof thedata construction.

10. The amountof savings in Germanyis declared from1992 onwards,while the amount saved in the home countryis

declared only for1984-1990,1992 and 1994. See thedata constructionAPPENDIX forfurther

details.

294

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS,ASSET HOLDINGS,AND TEMPORARYMIGRATION

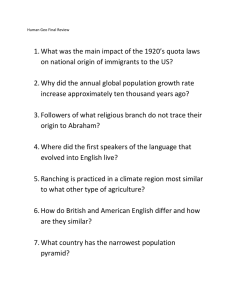

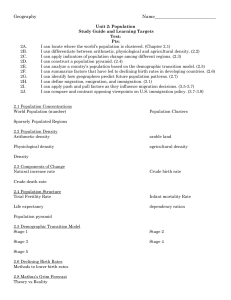

TABLE I. - SummaryStatistics

Mean

Std. Dev.

Age

45.46

11.29

Age AtArrival

23.73

9.16

YearsSinceMigration

2 1.76

5.87

NumberYearsEducation

HouseholdIncome

inHousehold

NumberChildren

9.43

1.92

25,186

0.85

12,157

1.07

NumberAdultsinHousehold

2.66

1.21

inHousehold

NumberEmployedIndividuals

Sex

1.59

0.94

0.88

0.32

Employed

Non Single

0.78

0.41

0.93

0.25

NativePartner

0.07

0.26

SpouseAbroad

Abroad

Children

0.04

0.19

0.07

0.26

RuralChildhood

0.39

0.49

Temporary

NumberofObservations

0.51

0.50

2,456

Note:Calculationsbasedon GSOEPdata,1988,1992,1994.Individualinformation

totheheadofhousehold.HouseholdIncomein 2002 Euros.

corresponds

inthefirst

IntheupperpanelofTABLEII, we describesavingsforall immigrants

pairofcolumns.

andpermanent

with

betweenimmigrants temporary

In nexttwopairsofcolumnswe distinguish

betweenimmigrant

themeandifference

return

pairofcolumnswe report

plans.In thefollowing

of

household11.

the

head

refers

to

return

on

information

The

its

t-statistic.

and

plans

groups

in

thehostcountry.

save

that

households

of

all

48

About percent

report they

immigrant

which

on savinga positiveamount),

The averageamountsavedis 2,046Euros(notconditional

withpermanent

to 7.4 percentof overallhouseholdincome.Immigrants

migration

corresponds

with

those

than

than

in

the

host

to

save

less

are

plans,andthey

temporary

country

likely

plans

to one percent

in

host

in

the

save a loweramount.The difference savings

corresponds

country

The proportion

ofthehouseholdincome.The nextrowshowsthesavingsinthehomecountry.

whosave is morethan4 percentage

intentions

withtemporary

ofimmigrants

pointshigherthan

withtheamountsavedbeinghigheras well.Both

withpermanent

thatofimmigrants

intentions,

different

are significantly

differences

Finally,thelastthreerowsreportthetotal

statistically.

thetotalamountofsavingsofnatives

we report

ofyearlysavings.As a pointofreference,

amount

householdsreportsavings,as compared

in thelasttwocolumns.One in twoof all immigrants

The totalaverageamountofsavingsis equalto 2,199Euros

ornativehouseholds.

to 65 percent

to 10% fornatives),

householdincome,as compared

to 8.1% ofimmigrants'

(whichcorresponds

whichis lowerthantheaveragesavingsfornativesbothin absolutevalueandrelativeto their

householdincomes12.

andreturn

forwhichbothsavingsorassetinformation

11. We useall observations

plansarereported.

datafromtheGermanCentralBank's(Bundesbank)

12. Thehousehold

savingsratioinourdatais inlinewithaggregate

onaverageto 12%ofhousehold

wherehousehold

FinancialAccounts,

disposableincomefor1992and

savingscorrespond

1994 (BUNDESBANK [2008]).

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

295

CHRISTIANDUSTMANNAND JOSEPMESTRES

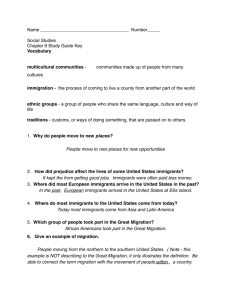

TABLE II. - Savings,HomeOwnershipandAssets

JtlT

All Immigrants

Temporary

Permanent

Immigrants

Immigrants

жг .

Natives

Mean

Mean

N

Mean

N

Mean

N

Difference

TemporaryPermanent

t

Mean

N

Migrants

Savings

In HostCountry

thatsaves

Proportion

AverageAmount

48.3%

1871

50.4%

1,871

2,218

782

782

46.7%

2,046

1,089

1,922 1,089

3.6%

297

1.55

1.74

7.4%

1809

8.0%

754

7.0%

1,055

1.0%

1.89

4.8%

155

1,902

1,902

7.3%

230

797

797

3.0%

101

1,105

1,105

4.3%**

129*

4.35

2.31

HH

0.7%

AverageValueas Percentage

Income

TotalSumHomeandHostCountry

49.8%

Proportion

2,199

AverageAmount

1,838

0.9%

769

0.5%

1,069

0.3%

1.26

1871

1871

52.8%

782

782

47.6%

2,448

2,021

1,089

1,089

5.2%*

427*

2.24

2.32

8.1%

1,809

8.8%

754

7.5%

1,055

1.3%*

2.17

8.4%

860

857

5.5%

577

575

14.1%

27,049

283

282

-8.6%**

7,324

-19,726**

-4.31

-4.91

283

275

20,408**

5.37

4.69

283

283

11.8%**

188

3.26

0.03

229

229

1.5%

-29,786**

0.041

-3.76

172

172

18,706**

155

155

-2,595

(1655)

(Std.Dev.)

HH

AverageValueas Percentage

Income

(3,585)

(3,700)

In HomeCountry

Proportion

AverageAmount

0,207)

(Std.Dev.)

(1921)

(Std.Dev.)

HH

AverageValueas Percentage

Income

HomeOwnership

In HostCountry

thatHoldsProperty

Proportion

AverageValue

(Std.Dev.)

In HomeCountry

thatHoldsProperty

Proportion

AverageValue

13,814

(55,896)

44.2%

(1,127)

(3,835)

(38,995)

30,043

859

835

36,764

TotalSumHomeandHostCountry

thatHoldsProperty

49.9%

Proportion

44,381

AverageValue

859

832

44,443

629

629

20,805

(Std.Dev.)

(59,823)

50.5%

(66,816)

53.8%

(Std.Dev.)

(81,167)

In HostCountry

thatHoldsAssets

Proportion

AverageValue

31,649

In HomeCountry

thatHoldsAssets

Proportion

AverageValue

48,723

595

595

54,130

TotalSumHomeandHostCountry

thatHoldsAssets

83.7%

Proportion

66,777

AverageValue

486

486

65,949

AssetHoldings

(Std.Dev.)

(StdDev.)

(Std.Dev.)

73.4%

(96,379)

71.6%

(75,382)

(103.651)

(78,167)

74.0%

(126,877)

75.7%

(81,975)

84.3%

(96,608)

576

560

(1,259)

(3,974)

(78,417)

31.4%

16,356

(38,792)

576

558

44,255

42.0%

400

400

50,591

(87,108)

72.5%

(128,105)

423

423

35,424

61.6%

331

331

68,544

(53,899)

82.6%

(117,606)

19.1%**

14.0%**

1.7%

65.4% 6,901

2,888 6,901

(5,101)

9.9%

6,688

43.6% 3,329

60,973 3,194

(111,939)

3.46

2.76

0.48

0.25

79.8% 2,959

104,966 2,959

(162,877)

*

meandifference

at 5%; ** significant

meandifference

at 1%

significant

Note:Calculations

basedonGSOEPdataonhouseholdlevel.Averageamount(in 2002 Euros)notconditional

on reporting

anypositive

amount.Property

includeshouse,apartment

oranyotherproperty.

Assetholdingsrefertothetotalamountofassetholdings

Ownership

netoffinancialobligations,

etc.Savingsinthehostcountry

tothenetmonthly

cash,savings,property,

including

corresponds

savings

ofthehouseholdtransformed

to annualamount.Savingsin thehomecountry

to theyearlyamountremitted

to thehome

corresponds

and

is

that

saved.

Both

and

Asset

country

Property

Ownership

holdingsrefertotheyear1988.SavingsFlowsreferto years1992and

1994.We use all observations

forwhichrespective

information

is available.

296

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS, ASSET HOLDINGS, AND TEMPORARY MIGRATION

Whenwe distinguish

withpermanent

betweenimmigrants

andtemporary

there

intentions,

is a cleardifference

betweenthetwogroups,withthosewithtemporary

intentions

savingmore,

inabsoluteas wellas inpercentage

oftheirhouseholdincome.

terms,

HomeOwnership

andAssets:A setof questionsaskingaboutassetholdingswas included

in thesurveyin 1988.Forimmigrants,

and assetholdings,

bothin

questionsrelateto property

andinthehomecountry.

Fornatives,

relatetototalproperty

andassetholdings.

Germany

questions

inthesecond(homeownership)

andthird

We report

(assets)panelsofTABLEII. As

descriptives

whilethenextcolumnsdistinguish

thefirst

twocolumns

before,

report

averagesforallimmigrants,

We includethe

andtemporary

betweenimmigrants

withpermanent

migration

plansrespectively.

inthelasttwocolumns.

natives'averageas reference

in

householdsreportowninghousingproperty

of

about

8.4

percent all immigrant

Only

intentions

reveals

with

and

between

immigrants temporary permanent

Germany.

Distinguishing

witha permanent

however.While14 percentof immigrants

remarkable

differences,

migration

do so.

in Germany,

intention

ownhousingproperty

only5 percentofthosewhowishto return

latter

is

much

lower

for

the

stock

the

value

of

the

Likewise,

category.

housing

in thehomecountry.

About44 percentof all

In thenextrowwe reporthomeownership

thelastrowcombines

inthehomecountry.

households

Finally,

report

owningproperty

immigrant

in Germany

whoholdproperty

ofimmigrants

withtheproportion

thisnumber

(firstrow).Half

44 percent

of

with

This

contrasts

in

home

or

host

holdproperty either

oftheimmigrants

country.

is about

The averagevalueof immigrants'

thatholdproperty.

nativebornhouseholds

property

lowerproperty

lowerthanthatofnatives.However,thismaypartlyreflect

30 percent

pricesin

thecountries

oforigin.

andpermanent

withtemporary

Inthenextcolumnswe distinguish

againbetweenimmigrants

with

return

households

in

two

One

return

housingstock

owning

plans

reports

immigrant

plans.

In addition,

intentions.

with

1

of

those

to

3

inthehomecountry,

permanent

compared just percent

who

wish

toreturn.

for

those

twice

as

is morethan

inthehomecountry

thevalueofproperty

high

aremorelikelyto ownproperty.

However,thetotalvalueofhome

Overall,temporary

migrants

andthosewhodo not.

wish

toreturn

who

households

is

similar

between

immigrant

ownership

refer

tothetotalamount

Asset

on

asset

information

Thenextpanelreports

holdings

holdings.

the

Forimmigrants

ofassets(including

cash,savings,property,

etc.)netoffinancial

obligations.

in

the

home

assets

held

in

and

held

between

assets

a

distinction

draw

country.

Germany,

questions

in thehostcountry,

The numbers

suggestthatifwe consideronlyassetholdingsof immigrants

thisdifference

lowerthanthoseofnatives.However,

is considerably

theamount

ofassetholdings

holdassetsalso in thehome

reducedwhentakingintoaccountthatimmigrants

is significantly

betweenimmigrants

inthedistribution

ofassetholdings

Thereis againa starkdifference

country.

oftheirassetsin

hold

most

Whilepermanent

intentions.

andpermanent

withtemporary

migrants

The totalamount

holdassetsmostlyin thehomecountry.

thehostcountry,

migrants

temporary

ofassetholdingsis slightly

migrants.

higherforpermanent

andnative

betweenimmigrant

showthat- foranycomparison

thesefigures

To summarize,

in

oforigin.

the

and

assets

consider

it

to

is

households

country

savings

immigrants'

important

andassetholdingsbetween

in savings,totalproperty

also showdifferences

thefigures

Further,

There

are also starkdifferences

and

with

plans.

migration

permanent

immigrants temporary

withtemporary

thesetwogroupsas towheretheseassetsareheld.Immigrants

between

migration

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

297

CHRISTIAN DUSTMANN AND JOSEP MESTRES

andassetsthanimmigrants

withpermanent

plansholdless property

plansin thehostcountry,

butmoreinthehomecountry.

Thispointsat different

wealthallocationprofiles

betweenthose

who

want

to

return

and

those

who

do

It

not.

also

that

the

migrants

suggests

way immigrants

maypossiblyaffectthehousingmarketin thehostand thehomecountrydependson their

re-migration

plans.

IV.2 Conditional

Results

We nowfocuson thedifferences

betweenimmigrants

withtemporary

andpermanent

migration

inTABLEII do notaccountfordifferences

we report

inhouseholdandindiplans.Thenumbers

vidualcharacteristics.

inassetholdings

todifferences

incontemporaTheyalsorelatedifferences

neousintentions

abouta possiblereturn.

We nowprovidesomefurther

wherewe condition

results,

on differences

in householdcharacteristics,

anduse information

aboutcontemporaneous

return

plans(inthecase ofsavings),andaveragepastreturn

plans(inthecase ofassetholdings).

Forbothsavings,

homeownership

andassetholdings,

we estimate

linearprobability

models

for

the

outcome

and

OLS

and

Tobit

models

for

the

amount

of

variable,

(LPM)

binary

savings.

IN.2.1 Savings

As we discussin SectionII, it is generallyambiguouswhetherimmigrants

withtemporary

withpermanent

migration

planssavemorethanimmigrants

plans.Thisis inlinewiththefigures

in TABLEII, whichshowthattemporary

aremorelikelyto save bothin thehostand

migrants

thehomecountry.

Someofthesedifferences

be

in composition

between

may dueto differences

thetwogroups.To investigate

thisfurther,

we nowpresent

someconditional

wherewe

estimates,

use datafortwoyearsofourpanel(1992 and 1994)thatprovideinformation

on theamountof

in

each

location.

We

construct

a

measure

for

total

and

the

ratio

ofsavingsinthe

savings

savings,

homevs thehostcountry.

If immigrants

withtemporary

intentions

havea higherpropensity

to

intentions

overall.If(in

save,we shouldobservethattheysavemorethanthosewithpermanent

havea preference

forshifting

then

addition)

temporary

immigrants

savingstothehomecountry,

theratioofhometohostcountry

should

be

related

to

return

savings

positively

plans.

Resultsarereported

inTABLEIII. In thefirst

column,we use thetotalamountofsavingsas

thedependent

variable.Columns2 and3 distinguish

betweensavingsinthehomeandhostcounColumn

4

the

ratio

of

in

the

home

andtotalsavings.We report

LPM

try.

reports

savings

country

inthefirst

results

OLS

in

results

the

second

and

Tobit

in

results

the

third

The

panel,

panel

panel13.

onthetemporary

variableincolumns1 suggest

thatoverall,immigrants

pointestimates

migration

withtemporary

withpermanent

migration

planssave morethanimmigrants

migration

plans.

Estimates

arehowevernotstatistically

When

into

significant.

splitting

up savings savingsinthe

homeandhostcountry,

are

and

associatedwith

temporary

migration

plans positively significantly

for

theratioofsavingsinhomevs

savings thehomecountry

only.In thelastcolumn,we report

hostcountry,

whichis positively

andsignificantly

relatedtoreturn

are

plans.Thus,theestimates

13. Total amountof savings correspondsto the amountreported.See the APPENDIX (TABLE I) forfullregressionresults

withall the additionalcontrolvariables forTotal Savings. These resultssuggestthatboth household income and employmentof thehead of thehouseholdaffectsavingspositively.Age, yearssince migration,and educationof thehead of household do not seem to be significantly

associated withhousehold savings conditionalon household income and employment

of thehead of thehousehold.

298

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS, ASSET HOLDINGS, AND TEMPORARY MIGRATION

withthehypothesis

withtemporary

consistent

thatimmigrants

migration

planshavea preference

rather

thaninthehostcountry.

forholdingtheirsavingsintheorigincountry

Theydo notpoint

withtemporary

return

withpermanent

at immigrants

planssavingmorethanimmigrants

plans,

conditional

on otherobservable

characteristics.

TABLE III. -

Savings - Home and Host Country

LinearProbabilityModel

Total

Temporary

(Std.E.)

Savings(=1 Yes,=0 No)

HostCountry HomeCountry

0.024

(0.028)

0.044

(0.028)

0.034***

(0.013)

OLS

Temporary

(Std.E.)

Total

Amount

Savings

HostCountry

14.09

(233.296)

-89.944

(221.917)

Total

Amount

Savings

HostCountry

179.181

(166.524)

U>59

51.145

(151.934)

U>59

RatioHomevs Total

HomeCountry

99.476

(60.442)

0.029***

(0.009)

Tobit

Temporary

(Std.E.)

Observations

RatioHomevs Total

HomeCountry

116.343***

(41.013)

1^685

0.020***

(0.006)

1,680

at 1%

at 5%; *** significant

at 10%; ** significant

significant

includetimeand country

Note: GSOEPdata (1992 and 1994). Householdlevel. All specifications

dummiesand conditionon age, yearssince migration

(and its square),education,gender,marital

statusof thehead of householdas well as householdincomeand numberof

statusand employment

household.Standarderrorsare clusteredby household.Tobit

adultsand childrenin thehostcountry

on the

tothecoefficient

resultsshowunconditional

correspond

Reportedcoefficents

marginaleffects.

intention

variable.

temporary

contemporary

*

andAssetsHoldings

IV.2.2 Property

betweenassetholdings

Distinction

ofimmigrants.

andassetholdings

We nowturntotheproperty

is onlyavailableforoneyear(1988).Assetsmeasurethestock

inthehomeandinthehostcountry

overprevious

ofassetsaccumulated

years,

upto 1988.As thestockofassetshasbeenaccumulated

for1984-1988as a regressor14.

intention

we use theaveragereturn

in TABLEIV and foroverallassetholdings

We showtheresultsforproperty

ownership

forthe

estimates

to above.We reportthecoefficient

in TABLEV, usingsimilarspecifications

the

inthefirst

column total

We report

intentions

overtheperiod1984-198815.

averageofreturn

location

betweentheproperty

whilecolumns2 and3 differentiate

ofproperty

amount

ownership,

in

home

the

theratioofproperty

Column4 reports

in homeandhostcountry.

country

holdings

onthe

LPM

estimation

the

results

of

a

shows

Thefirst

tototalproperty.

withrespect

simple

panel

haveanyproperty

holdings.

migrants

binaryoutcomewhether

on returnplans since the startof thepanel in 1984.

14. We onlyhave information

15. See theAPPENDIX (TABLE II) forthe fullset of regressionresults.Household income and household size are, respecconditionalon household income and

tively,positivelyand negativelyassociated with asset accumulation.Furthermore,

household size, households witholder and bettereducated heads hold more wealth.

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

299

CHRISTIAN DUSTMANN AND JOSEP MESTRES

TABLE IV. -

PropertyOwnership - Home and Host Country

LinearProbabilityModel

Temporary

(Std.E.)

(=1 Yes,=0 No)

Property

Ownership

Total

HostCountry

HomeCountry

0.122*

-0.079**

0.190**

(0.055)

(0.03)

(0.054)

OLS

Total

Temporary

(Std.E.)

7,456.369

(8,832.433)

Amount

Property

HostCountry

HomeCountry RatioHomevs Total

0.214**

-2,2919.058**

30,939.940**

(5,565.475)

(6,773.723)

(0.054)

Tobit

Total

Temporary

(Std.E.)

Observations

11,678.86

(7,608.978)

739

Amount

Property

HostCountry

HomeCountry RatioHomevs Total

0.243**

-4,573.934**

28,297.509**

(1,520.867)

(5,849.031)

(0.061)

738

719

739

*

at 5%; ** significant

at 1%

significant

Note:GSOEPdata(1988). Householdlevel.All specifications

includetimeandcountry

dummiesand

condition

on age,yearssincemigration

maritalstatus,householdincome,

(and itssquare),education,

statusandnumberofadultsandchildreninthehostcountry

household.Property

employment

includesthepurchaseofhouse,apartment

oranyotherproperty,

inthehostand inthe

ownership

homecountry.

Tobitresultsshowunconditional

to

marginaleffects.

Reportedcoefficents

correspond

theaverageintention

to return

up to 1988(1984-1988).

Theresultsshowthaton averagetemporary

migration

plansareassociatedwitha 12.2pertoholdproperty.

return

associated

centagepointshigherlikelihood

Further,

plansarenegatively

withowninghousing

in

the

host

but

with

associated

property

country, positively

owningproperty

at home.The intention

to return

to thehomecountry

is associatedwithan 8 percentage

points

lowerlikelihood

to owna housein thehostcountry,

butan almost20 percentage

pointshigher

likelihood

to owna houseinthehomecountry.

In thesecondand thirdpanelof theTable,we reportOLS and Tobitresultsforthevalue

oftheproperty

held(in 2002 Euros).Theseresultsindicatethatthetotalvalueofproperty

that

with

hold

is

not

different

from

that

of

those

immigrants temporary

migration

plans

significantly

withpermanent

difference

intheproperty

wealth

plans.However,thereis a starkandsignificant

allocation

between

hostandhomecountries.

Thoseimmigrants

withtemporary

return

plansholda

loweramount

ofproperty

inthehostcountry

anda higher

amount

ofproperty

inthehomecountry,

inbothOLS andTobitspecifications.

In thelastcolumn,we againreporttheimpactof temporary

migration

planson theratio

between

heldinthehomecountry,

andtotalproperty

As forsavings,thisratio

property

holdings.

is strongly

skewedtowards

forimmigrants

withtemporary

holdingsinthehomecountry

migrationintentions,

inbothspecifications.

We showtheresultsforassetholdingsin TABLEV. Again,we report

thecoefficient

estimatesfortheaverageofreturn

intentions

overtheperiod1984-1988.The structure

ofthetableis

identical

totheprevious

one.Theresults

thatthetotalvalueofassetshelddoesnotdiffer

suggests

between

and

location

significantly

temporary permanent

However,thegeographical

immigrants.

as towhereassetsareheldis different:

households

withtemporary

intentions

holdmoreassetsin

300

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS,ASSET HOLDINGS,AND TEMPORARYMIGRATION

thehomecountry,

andless inthehostcountry,

aftercontrolling

forhouseholdincomeandother

heldassetsto

characteristics.

As theresultsin thelastcolumnshow,theratioofhomecountry

to

return

totalassetsis positively

related

plans.

TABLE V. - AssetHoldings- HomeandHostCountry

LinearProbabilityModel

AssetHoldings(=1 Yes,=0 No)

HomeCountry

HostCountry

Total

Temporary

(Std.E.)

-0.036

(0053)

0.002

(0.057)

0.096

(0.059)

OLS

Total

Temporary

(Std.E.)

6,718.334

(15,522.831)

AssetHoldings

Amount

HomeCountry RatioHomevs Total

HostCountry

-29,173.987**

(10,146.918)

28,606.677**

(10,310.560)

0.133*

(0.060)

Tobit

AssetHolding

Amount

HomeCountry RatioHomevs Total

HostCountry

0.140*

25,472.782**

-17,238.395*

3,510.74

(0.068)

(8,603.728)

(6,714.548)

(12,167.750)

432

531

546

432

Total

Temporary

(Std.E.)

Observations

*

at 1%

at 5%; ** significant

significant

includetimeand countrydummies

Note: GSOEPdata (1988). Householdlevel,All specifications

and conditionon age, yearssince migration

(and its square),education,maritalstatus,household

household.Asset

statusand numberof adultsand childrenin thehostcountry

income,employment

tothetotalamountofassetholdingsnetoffinancial

cash,savings,

including

obligations,

holdingsrefer

Tobitresultsshowunconditional

marginaleffects.

etc.,inthehostand inthehomecountry.

property,

to return

totheaverageintention

up to 1988(1984-1988).

correspond

Reportedcoefficents

V. Conclusions

inrelation

totheirreturn

ofimmigrants

Inthispaper,we analyzesavingsandassetholdings

plans.

in

thehomeandinthe

held

and

assets

stock

between

Ouranalysisdistinguishes

savings,housing

of

distribution

We findevidencethatreturn

hostcountry.

plansare associatedwitha different

locations.

home

host

and

between

and

assets

country

savings,property

and

intotalsavings,property

difference

thatthereis no significant

Ourresultsshowfurther

on

conditional

andtemporary

withpermanent

betweenimmigrants

assetholdings

migration

plans,

toreturn

withintentions

characteristics.

household

observable

However,immigrants

background

in thehome

andmorelikelyto ownproperty

inthehostcountry

areless likelyto ownproperty

is quitesubstantial.

andthisdifference

Thus,ourstudypointsat immigration

policies

country,

than

a

different

thatfavorpermanent

impacton thedomestichousingmarket

having

migrations

policies.

policiesthatfavortemporary

of savings

arealso associatedwithholdinga higherproportion

plans

migration

Temporary

in

thehome

held

assets

of

for

both

andassetsinthehomecountries.

groups immigrants

Finally,

of

is

that

an

assessment

of

our

another

Thus

arequitesubstantial.

paper

finding

important

country

inthe

needstotakeaccountofwealthandassetsaccumulated

wealthaccumulation

immigrants'

nature.

areofa temporary

themoremigrations

Thisis moreimportant,

homecountries.

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SOI

CHRISTIANDUSTMANNAND JOSEPMESTRES

We shouldemphasize

between

thetemporariness

ofmigrations

and

againthattherelationship

in

and

asset

accumulation

behavior

that

we

show

this

should

not

be

as

causal.

savings

paper

interpreted

ourstudy

substantial

inthelocation

differences

ofsavingsandasset

Nevertheless,

pointsatpossibly

between

withdifferent

intentions

aboutthepermanency

oftheir

Further,

holdings

immigrants

migration.

we findnoevidence

thattotalsavingsandassetsheldaredifferent

between

thesetwogroups.

ACKNOWLEDGEMENTS

Thisresearch

was financially

German,

Korean,andNorwegian

supported

bytheAustrian,

the

Multi-donor

Trust

Fund

on

Labor

JobCreation,

and

Markets,

governments

through

EconomicGrowth

administered

andLaborunit.Dustmann

bytheWorldBank'sSocial Protection

fromtheNORFACE

Wewouldliketothankthe

acknowledges

support

Migration

Programme.

HillelRapoport,

andtwoanonymous

referees

forconstructive

comments.

editor,

Correspondence:

Department

ofEconomics,University

CollegeLondon,GowerStreet,

LondonWC1E6BT,U.K.Email: c.dustmannt&ucLac.uk

Appendix

Data Construction

We usedatafrom

theGermanSocio-Economic

Panel.Assetholdings

arereported

for1988,based

on a specialsurveymodule.Savingsare reported

for1992 and 1994. Our sampleconsistsof

households

whoseheadwas borninTurkey,

immigrant

Greece,Yugoslavia,Italyor Spain.

Information

on return

are

in

each

wave

ofthepanel.Individuals

wereasked

plans provided

whether

toremainpermanently

inGermany,

orwhether

homeat

theyintend

theywishto return

somestageinthefuture.

We construct

a binary

variablethatdefinesas temporary

thosewhoplan

inthefuture.

toreturn

As return

is relatedto pastreturn

we

plansmaychange,andassetaccumulation

intentions,

construct

an averagereturn

intention

variableforthelastfiveyearsbeforeassetsaremeasured

(thatis, 1984-1988).

All ourincomevariablesarereported

inrealterms(inEuros,deflated

tothebaseyear2002),

andathousehold

level.Householdincomecorresponds

tothenetmonthly

incomeofthehousehold

transformed

toannuallevel.Theexactwording

ofthequestionis "Ifeverything

is takentogether:

howhighis thetotalmonthly

incomeofall thehouseholdmembers

at present?

Pleasegivethe

netamount,

theamountafterthededuction

oftaxandnationalinsurance

contributions.

monthly

suchas rentsubsidy,

childbenefit,

subsistence

Regularpayments

allowances,

government

grants,

Ifnotknownexactly,

estimate

the

amount".

etc.,shouldbe included.

please

monthly

Information

on household

is availablefor1984-1990,1992and

savingsinthehomecountry

to theyearlyamountsavedin thehomecountry

1994,andcorresponds

bythehousehold.The

todeclaretheamountsentortakentothehomecountry

forthepurpose

questionasksindividuals

of"savingsforlater".We transform

thisvariabletothehousehold

level.Information

onhousehold

in

the

host

is

available

for

1992

onwards

and

to

the

netmonthly

savings

country

corresponds

of

the

household

transformed

to

level.

The

the

asked

is "Do you

savings

yearly

question survey

have

an

amount

of

left

formajorpurchases,

orsavusually

money overeachmonth

emergencies,

on savingsinboththehomeandthehost

ings?Ifyes,howmuch?".Thisimpliesthatinformation

302

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS, ASSET HOLDINGS, AND TEMPORARY MIGRATION

thetotal

is availableonlyfortwoyears(1992 and 1994).Forthoseyears,we construct

country

amountofsavingsas thesumofsavingsinbothlocations.

ina specialsurvey

in 1988whereimmigrants

drawnfromquestions

We useassetinformation

bothinthehomeandinthehostcountry

wereaskedfortheirassetholdings

separately.

refer

tothetotalamountofassetholdings(including

Assetholdings

cash,savings,property,

ofthequesThewording

bothinthehomeandhostcountries.

etc.)butnetoffinancial

obligations,

tionis "Ifyoucouldaddup all thewealthofthishousehold(including

cash,goodsandproperty

total

value?

Please makesureto

its

what

will

be

without

own

but

furniture),

approximate

you

includesthe

thatyoucouldhaveon them".Property

loansandcredits

all themortgages,

subtract

at market

or anyotherproperty

houses,apartments

prices,bothin thehomeandhostcountries.

ofthequestionis "Areyoutheownerof(specifictypeof

thewording

Foreachtypeofproperty,

valueis,thatis,howmuchmoney

itscommercial

Ifyes,howmuchdo youestimate

property)?

householdamounts

to

the

All

entriescorrespond

willyougetifyou sold itnow?"

aggregated

tothebase year2002.

declaredin 1988,inEuros,deflated

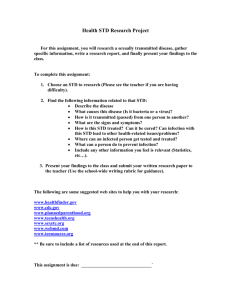

TABLE I. - Total Savings

TotalSavings

(=1 Yes, =0 No)

LPM

Age/10

(Std.E.)

10

YearsSinceMigration/

(Std.E.)

YSM-Squared/100

(Std.E.)

Log HH Income

(Std.E.)

NumberAdultsHH Host

(StdE.)

HH Host

NumberChildren

(Std.E.)

Head HH

Employment

(Std.E.)

I NumberEmployedHH

(Std.E.)

NumberYearsEducation

(Std.E.)

Male Head HH

(Std.E.)

NonSingle

(StdE.)

NativePartner

(Std.E.)

SpouseAbroad

(StdE.)

Abroad

Children

(Std.E.)

RuralChildhood

(Std.E.)

Temporary

{Std.E.)

NumberofObservations

Amount

TOBIT

OLS

15.043

(10.888)

-44.678

(579.814)

-92.917

(133.413)

20.828

(20-377>

-72.385

(954.475)

-131.676

(197.844)

-0.001

(°°°2)

0.063

(0100)

-0.019

(°024)

0.286***

(°089)

-0.047**

(0021)

-0.073***

(°014)

0.152***

(°038)

0.002

(°029)

0.003

(О-007)

0.019

(O-040)

-0.107**

(0049)

0.072

(°053)

0.084

(°083)

-0.067

2,691.025***

(935.280)

-280.394

(219.850)

-352.268***

(118.826)

62.768

(292.701)

236.447

(282.581)

-57.785

(51.418)

167.13

(469.024)

-829.918**

(357.352)

397.2

(403.186)

947.252

(623.977)

529.332

4,072.837***

(255.809)

-469.503***

(107.843)

-433.709***

(79.531)

642.021***

(233.220)

-212.843

(129.628)

-57.937

(38.930)

97.344

(234.473)

-889.294***

(288.561)

369.201

(269.934)

0.047*

(0°28)

0.044

(°028)

238.197

(230.128)

14.09

(233.296)

354.596**

(154.448)

179.181

(166.524)

(O-064)

(665.530)

1,127.213***

(432.572)

213.764

(343.230)

1,659

1,659

1,659

0.024

0.151

0.142

R-squared

*

at 1%

at 5%; ♦♦♦significant

at 10%; ** significant

significant

areclustered

errors

dummies.Standard

includetimeandcountry

Note:GSOEPdata(1992 and 1994).Householdlevel.All specifications

byhousehold.

2010

JANUARY/JUNE

© ANNALSOF ECONOMICSAND STATISTICS- NUMBER97/98,

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

3Q3

CHRISTIANDUSTMANNAND JOSEPMESTRES

TABLE IL - TOTALPROPERTYANDASSETHOLDINGS

TotalProperty

1

(= Yes,= ONo)

LPM

Age/10

0.065*

6,992.39

0.439*

(0026)

(Std.E.)

YearsSinceMigration/

10

(31,944.141)

(0.228)

-40,474.467

-1,594.633

-9,021.404

-0.035

12,131.839

57,212.046**

58,354.315**

-0.028

-6,545.521*

-6,026.319**

-0.03

-0.027

-932.913

-1,940.823

-0.007

(0.017)

(4,933.143)

1,709.037

0.028

14,874.005

13,933.759

-15,353.334*

-13,211.824*

(Std.E.)

(0.061)

(0.016)

(Std.E.)

Head HH

Employment

19,354.011**

0.084

0.344**

(Std.E)

20,423.945**

42,990.847

(0.055)

HH Host

NumberChildren

0.066**

13,363.174

(Std.E)

NumberAdultsHH Host

8,167.744*

(0.025)

-0.104

Log HH Income

(4,123.640)

TotalAssetHoldings

Amount

(= 1 Yes,= ONo)

LPM

OLS

TOBIT

(3,567.110)

(0-223)

(Std.E.)

YSM-Squared/100

Amount

OLS

TOBIT

(0.018)

(35,502.003)

(8,818.495)

(9,691.445)

(2,666.964)

(2,948.062)

(7,884.666)

(8,676.121)

(2,269.345)

(2,504.003)

(0.057)

0.342**

(0.062)

(0.016)

(7,165.884)

(66,282.065)

(16,414.831)

(5,616.612)

-21,355

(52,034.042)

5,675.163

(12,929.400)

108,771.151** 100,564.981**

(18,119.010)

(14,485.252)

-5,194.61

-5,626.295

-79.446

-266.035

(4,546.187)

(3,557.839)

(3,833.999)

0.021

-1,801.02

(7,806.949)

(0.056)

NumberEmployed

HH

-0.013

-2,358.308

-3,104.786

-0.032

NumberYearsEducation

-0.014

2,321.072

(1,568.693)

366.429

(1,330.714)

-0.012

0.172

18,773.464

25,832.981

-0.007

29,624.491

19,496.307

0.015

25,354.86

17,984.492

-0.025

66,389.392*

51,424.168*

-0.068

-9,697.935

-8,631.509

-0.084

13,884.182

15,725.938*

5,437.249

(0.058)

(Std.E.)

(0.029)

(Std.E.)

(0010)

(Std.E.)

Male Head HH

(0.094)

(Std.E.)

NativePartner

(0.081)

(Std.E.)

SpouseAbroad

(0.087)

(Std.E.)

Children

Abroad

0.128*

(0.057)

(Std.E.)

RuralChildhood

-0.01

(0.037)

(Std.E.)

0.122*

Temporary

R-squared

(4,635.975)

(15,077.112)

(13,105.281)

(13,894.105)

(9,335.730)

(5,901.585)

(3,859.390)

(15,119.807)

(11,312.488)

(11,827.956)

(0.027)

(0.009)

(0.127)

(0.101)

(0.081)

(16,136.560)

(7,779.869)

7,329.063**

(2,737.697)

(36,803.571)

(29,301.068)

-19,941.21

(23,635.383)

(12,670.834)

(6,112.197)

4,813.823*

(2,151.789)

(28,689.586)

(22,861.355)

-19,590.228

(18,863.518)

(7,599.675)

0.006

(0.052)

25,068.459

19,478.381

3,562.898

-0.006

6,965.387

4,994.18

6,718.334

3,510.74

(4,932.460)

(0.034)

(15,167.549)

(9,993.592)

(11,837.909)

(7,791.598)

7,456.369

11,678.86

-0.036

(0.053)

(15,522.831)

738

718

718

432

432

432

0.138

0.117

0.011

0.131

0Л8

Q.Q1

(0.055)

(Std.E.)

NumberofObservations

(9,181.844)

(8,832.433)

(7,608.978)

(12,167.750)

*

at 10%; ♦* significant

at 5%; *** significant

at 1%

significant

Note:GSOEPdata(1992 and 1994).Householdlevel.All specifications

includetimeandcountry

dummies.Standard

errors

areclustered

byhousehold.

References

AMUEDO-DORANTES

C. and S. POZO(2002): "Precautionary

andYoung

SavingsbyYoungImmigrants

EconomicJournal,

Vol. 69,No. 1,pp.48-71.[290]

Natives,"Southern

BARTHE., В. BRATSBERG

and О. RAAUM(2004): "Identifying

of Immigrants

EarningsAssimilation

underChanging

Macroeconomic

Scandinavian

Journal

Vol.

Conditions,"

106,No. 1,

ofEconomics,

pp. 1-22.[289]

BAUERТ.К. andM. SINNING(2009): "The SavingsBehaviorofTemporary

and Permanent

in

Migrants

Vol. 24,pp.421-449.[290]

,"Journaloj Population

Economics,

Germany

BAUERТ.К.,D.A. COBB-CLARK,

V. HILDEBRAND

andM. SINNING

(2009): "A Comparative

Analysisof

theNativity

WealthGap,"EconomicInquiry,

[290]

forthcoming.

BLAU F.D. and J.W. GRAHAM(1990): "Black-White

Differences

in Wealthand AssetComposition,"

TheQuarterly

JournalofEconomics,

Vol. 105,No. 2, pp.321-39.[290]

BLITZR.C. (1977): "A Benefit-Cost

in West-Germany,

AnalysisofForeignWorkers

1957-1973,"Kyklos,

Vol. 30,No. 3,pp.479 - 502. [293]

304

© ANNALSOF ECONOMICS AND STATISTICS - NUMBER97/98,JANUARY/JUNE

2010

This content downloaded from 140.247.212.176 on Tue, 02 Jun 2015 00:54:54 UTC

All use subject to JSTOR Terms and Conditions

SAVINGS,ASSET HOLDINGS,AND TEMPORARYMIGRATION

BOHNING

W. (1987): StudiesinInternational

St.Martin'sPress,New York.[293]

Migration,

andtheEarnings

ofImmigrants,"

Journal

BORJAS

G.J.(1985):"Assimilation,

ChangesinCohortQuality,

of

LaborEconomics,

Vol. 3,No. 4, pp.463-489.[289]

- WhatHappenedtoImmigrant

andChangesinCohortQualityRevisited

BORJAS

G.J.(1995):"Assimilation

Vol.

No.

in

the

Journal

Labor

Economics,

13,

2,201-245.[289]

1980s,"

of

Earnings

Journalof UrbanEconomics,

BORJASG. J. (2002): "Horneo

Population,"

wnershipin the Immigrant

Vol. 52,No. 3,pp.448-476.[290]

and theRelativeWages of

BRATSBERG

В., E. ERLINGand O. RAAUM(2006): "Local Unemployment

The

Review

Evidence

from

the

Current

of Economicsand

PopulationSurveys,"

Immigrants:

Vol. 88,No. 2, pp.243-263.[289]

Statistics,

imZeitverlauf,"

FÜRARBEIT(2009): "Arbeitslosigkeit

BUNDESAGENTUR

http://www.pub.arbeitsamt.de/

hsťservices/statistik/detail/z.html.

[293]

bank.de/down1991to2007,"http://www.bundesAccounts

forGermany

BUNDESBANK

(2008):"Financial

1991_2007.en.xls.[295]

load/statistik/fìnanzierungsrechnung/anlageverhalten_

ofForeign-born

ontheEarnings

B.R. (1978):"TheEffect

ofAmericanization

CHISWICK

Men,"TheJournal

Vol. 86,No. 5, pp. 897-921.[289]

ofPoliticalEconomy,

COBB-CLARKD.A. and V. HILDEBRAND(2006): "The WealthAnd AssetHoldingsOf U.S.-BornAnd

Households:EvidenceFromSipp Data," ReviewofIncomeand Wealth,Blackwell

Foreign-Born

52,

Publishing, Vol. No. 1,pp. 17-42.[290]

RatesSo Low?ImmigraCOULSONN. E. (1999):"WhyAreHispanicandAsian-American

Homeownership

Vol. 45,No. 2, pp.209-227.[290]

JournalofUrbanEconomics,

tionandOtherFactors,"

JournalofPopulationEconomics,

ofTemporary

C. (1993): "Earnings

DUSTMANN

Migrants,"

Adjustment

Vol. 6, pp. 153-168.[289]

- A LifeCycleAnalysis,"

Workers

DUSTMANN

С (1995): "SavingsBehaviorofMigrant

Zeitschrift

fuer

51

1

533.

Vol.

und

4,

[289,290]

pp.

Socialwissenschaften,

WirtschaftsDUSTMANNС (1996): "ReturnMigration:The EuropeanExperience,"EconomicPolicy,Vol. 22,

pp.215-250.[293]

Journal

andPrecautionary

С (1997):"Return

DUSTMANN

ofDevelopment

Savings,"

Uncertainty

Migration,

Vol. 52,pp.295-316.[289]

Economics,

Choiceafter

DurationandActivity

DUSTMANN

C. andO. KIRCHKAMP

(2002): "The OptimalMigration

Vol. 67,pp.351-72.[289]

JournalofDevelopment

Economics,

Remigration,"

JournalofDevelopment

andTemporary

DUSTMANN

C. andJ.MESTRES(2010): "Remittances

Migration,"

No.

62-70.

92,

1,pp.

Economics,

[293]

intheUnitedStates:TheRoleof

ofImmigrants

FRIEDBERG

R.M. (1993): "TheLaborMarketAssimilation

BrownUniversity

[289]

manuscript.

Age atArrival,"

andMigrants'

ofReturnMigration

GALORO. andO. STARK(1990): "Migrants'Savings,theProbability

International

EconomicReview,Vol. 31,No. 2, pp.463-67.[290]

Performance,"

Journalof

LUBOTSKYD. (2007): "Chutesor Ladders?A Longitudinal

Earnings,"

Analysisof Immigrant

Vol. 115,No. 5,pp. 820-867.[289]

PoliticalEconomy,

EconomicPapers,

andCapitalMarketImperfections,"

MESNARDA. (2004): "Temporary

Oxford

Migration

Vol. 56,pp.242-262.[289]

Outlook:SOPEMI 2006Edition.[293]

OECD (2006):International

Migration

WealthAssimilation:EviOSILI U.O. and A. PAULSON(2004): "ProspectsforImmigrant-Native

Federal ReserveBank of Chicago Working

dence fromFinancialMarketParticipation,"

Paper

No. 04-18. [290]

2010