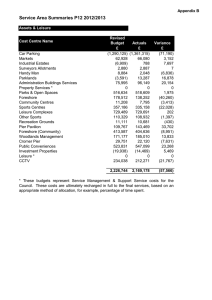

Service Area Summaries P12 2012/2013

advertisement

Appendix B Service Area Summaries P12 2012/2013 Finance Cost Centre Name Local Taxation Benefits Treasury Management Discrectionary Payments Non Distributed Costs Benefits & Revenues Management * Corporate Finance * Internal Audit * Central Costs * Corporate & Democratic Core Revised Budget £ 569,071 1,228,953 55,820 68,000 1,600 0 0 0 0 1,230,013 Actuals £ 594,349 1,233,344 60,198 46,832 95,000 19 0 0 0 1,250,929 Variance £ 25,278 4,391 4,378 (21,168) 93,400 19 0 0 0 20,916 3,153,457 3,280,671 127,214 * These budgets represent Service Management & Support Service costs for the Council. These costs are ultimately recharged in full to the final services, based on an appropriate method of allocation, for example, percentage of time spent. Appendix B General Fund Variances by Service Area - Period 12 - 2012/13 Finance Full Year Budget £ Local Taxation Gross Direct Costs Actuals £ Variance £ Explanation for Major Variances 622,404 538,919 15,000 0 (510,363) (370,718) 442,030 426,148 569,071 594,349 35,642,080 37,208,448 24,319 (35,106,146) 24,319 (36,658,084) 668,700 658,661 1,228,953 1,233,344 55,820 60,198 4,378 Increased recharges from Corporate Finance. 55,820 60,198 4,378 68,000 46,832 (21,168) Less than anticipated discretionary payments. 68,000 46,832 (21,168) Non Distributed Costs Gross Direct Costs 0 95,000 Management Unit Costs 1,600 0 1,600 95,000 Capital Charges Gross Direct Income Management Unit Costs Benefits Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Treasury Management Management Unit Costs Discretionary Payments Gross Direct Costs (83,485) (£35,000) software costs transferred to Capital, this is matched by the transfer of grant. (£5,590) IAS 19 Pension Adjustment. (£35,000) Balance of Council Tax Support grant has been transferred to the grantss earmarked reserve for spend in 2013/14. (£7,336) Postage costs. (15,000) Interest on Business Rate refunds, No payments made in year. 139,645 £35,000 Transferred to capital to match expenditure.£85,072 Court costs awarded less than expected. (15,882) (£5,930) reduced recharge from ICT. The balance is made up of a number of smaller variances. 25,278 1,566,368 £96,485 Increased provision for bad and doubtful debts. £1,336,688 Rent Allowance benefit payments above budgeted level, this is offset by subsidy from the Department for Works and Pensions (DWP). £62,831 Council Tax Benefit payments above budgeted level offset by DWP subsidy. £77,278 Partnership expenditure. £19,935 ICT costs funded from DWP grant. (£35,000) Staff savings - this has been carried forward to fund additional spend in 2013/14. 0 (1,551,938) (£19,935) DWP specific grant for software costs offset by expenditure. (£1,534,166) Subsidy on additional benefit spend. (10,039) (£18,613) Legal services recharge for Fraud work. £30,325 increased charge from ICT reflects current shared services project. The balance is made up of a number of smaller reductions. 4,391 95,000 This budget reflects notional charges in relation to IAS 19 pension costs. The variance consists of £95,000 for Past Service Costs which arise as a result of awarding added years or allowing employees to retire early on unreduced benefits on the grounds of efficiency. The impact of these costs are reversed out of the account to ensure there is no impact on the bottom line. (1,600) No Major Variances 93,400 Appendix B General Fund Variances by Service Area - Period 12 - 2012/13 Finance Full Year Budget £ Benefits & Revenues Management Gross Direct Costs 86,402 Management Unit Costs Corporate Finance Gross Direct Costs Capital Charges Management Unit Costs Internal Audit Gross Direct Costs Management Unit Costs Central Costs Gross Direct Costs Management Unit Costs Corporate & Democratic Core Gross Direct Costs Management Unit Costs Actuals £ Variance £ 93,395 Explanation for Major Variances 6,993 Pay and Grading costs to be funded from the Organisational Development reserve. (6,974) No Major Variances (86,402) (93,376) 0 19 580,936 546,942 8,994 (589,930) 8,994 (555,936) 0 0 105,967 (105,967) 104,433 (104,433) 0 0 45,619 62,430 (45,619) (62,430) 0 0 306,973 923,040 304,753 946,176 1,230,013 1,250,929 20,916 3,153,457 3,280,671 127,214 19 (33,994) (£29,309) Turnover savings. £8,890 Pay and grading costs to be funded from the Organisational Development reserve. (£5,871) IAS19 Pension adjustments. (£4,851) New Appointment advertising 0 33,994 (£11,434) Reduced recharge in from ICT. Decrease in recharges out based on savings in direct costs. 0 (1,534) No Major Variances 1,534 No Major Variances 0 16,811 £18,035 - Pay and grading implementation costs, funded from an earmarked reserve. (16,811) Increased recharges reflecting higher direct costs. 0 (2,220) (£4,492) - External audit costs lower than anticipated. 23,136 £27,004 - Increased recharge from Environmental Services reflecting a more accurate allocation of time. £32,144 Increased recharge from Accountancy reflecting a more accurate allocation of time. (£16,806) - Reduced recharge from Treasury Management. (£5,199) - Lower recharge from Legal Services. The balance consists of minor variances.