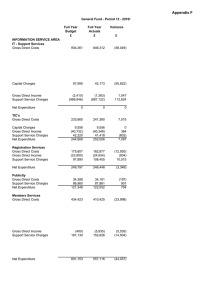

Service Area Summaries P12 2012/2013

advertisement

Appendix B Service Area Summaries P12 2012/2013 Assets & Leisure Cost Centre Name Car Parking Markets Industrial Estates Surveyors Allotments Handy Man Parklands Administration Buildings Services Property Services * Parks & Open Spaces Foreshore Community Centres Sports Centres Leisure Complexes Other Sports Recreation Grounds Pier Pavilion Foreshore (Community) Woodlands Management Cromer Pier Public Conveniences Investment Properties Leisure * CCTV Revised Budget Actuals £ £ (1,290,125) (1,361,315) 62,928 66,080 (6,909) 788 2,880 2,887 8,884 2,048 (3,591) 13,287 75,995 96,149 0 0 516,634 518,609 178,512 138,252 11,208 7,795 357,186 335,158 729,489 729,691 110,329 108,932 11,111 10,681 109,767 143,469 413,587 404,636 171,177 185,010 29,751 22,120 523,831 547,099 (19,938) (14,469) 0 0 234,038 212,271 2,226,744 2,169,178 Variance £ (71,190) 3,152 7,697 7 (6,836) 16,878 20,154 0 1,975 (40,260) (3,413) (22,028) 202 (1,397) (430) 33,702 (8,951) 13,833 (7,631) 23,268 5,469 0 (21,767) (57,566) * These budgets represent Service Management & Support Service costs for the Council. These costs are ultimately recharged in full to the final services, based on an appropriate method of allocation, for example, percentage of time spent. Appendix B General Fund Variances by Servcie Area - Period 12 - 2012/13 Assets & Leisure Full Year Budget £ Car Parking Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Markets Gross Direct Costs Gross Direct Income Management Unit Costs Industrial Estates Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Surveyors Allotments Gross Direct Income Management Unit Costs Handy Man Gross Direct Costs Gross Direct Income Management Unit Costs Parklands Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Actuals £ Variance £ Explanation for Major Variances 695,219 708,353 13,134 £2,821 - Expenditure on repairs and maintenance. £1,822 NNDR costs. £2,203 - Additional ticket purchases. (£1,985) Reduced expenditure on advertising. (£14,464) - Reduction in contract management costs 2012/13. £12,745 - Additional 11/12 contract management costs not accrued for. £8,181 Increase in penalty charge notice administration fee. 0 (80,807) (£58,794) - Increased car park fee income. (£21,194) Additional penalty charge notice income. (£2,618) - Increased rental income on car parks. (3,517) (£5,652) - Reduced Legal Services recharges and disbursements. £2,997- Increased Creditors Section recharge. 14,205 (2,096,431) 14,205 (2,177,238) 96,882 93,365 (1,290,125) (1,361,315) 93,543 (77,285) 46,670 93,931 (77,071) 49,220 62,928 66,080 3,152 17,642 18,337 29,052 (104,923) 29,052 (99,181) 51,320 52,580 695 £1,098 - National Non-Domestic Rates (NNDR) costs following liability for vacant premises falling on NNDC. 0 5,742 £4,670 - Reduction in rental income as a result of vacant properties in year, or lease negotiations being delayed. 1,260 No major variances (6,909) 788 (50) 2,930 (50) 2,937 0 7 No major variances 2,880 2,887 7 80,498 82,152 (117,654) 46,040 (117,766) 37,662 8,884 2,048 27,960 38,721 585 (54,966) 22,830 585 (50,307) 24,288 (3,591) 13,287 (71,190) 388 No major variances 214 No major variances 2,550 £2,273 - Increased Computer Section recharges 7,697 1,654 (£1,051) - Superannuation International Accounting Standard (IAS 19) adjustment. £1,765 - Increase in vehicle repair costs. (112) No major variances (8,378) (£6,220) - Reduced Computer Services recharges. (6,836) 10,761 £11,873 - Additional repairs and maintenance works relating to major water leak. (£1,078) - Reduced expenditure on electricity offset by reduced recoverable charges. 0 No variances 4,659 £4,660 - Reduction in recoverable charges. 1,458 No major variances 16,878 Appendix B General Fund Variances by Servcie Area - Period 12 - 2012/13 Assets & Leisure Full Year Budget £ Actuals £ Administration Buildings Services Gross Direct Costs 482,875 Capital Charges Gross Direct Income Variance £ 484,183 78,476 (95,622) 78,476 (101,710) (389,734) (364,800) 75,995 96,149 350,316 352,617 (350,316) (352,617) 0 0 438,063 47,386 (50,015) 428,413 47,386 (37,325) 81,200 80,135 516,634 518,609 130,376 95,304 Capital Charges Gross Direct Income 7,213 (6,197) 7,213 (7,409) Management Unit Costs 47,120 43,144 178,512 138,252 Community Centres Gross Direct Costs 6,189 3,867 Capital Charges Gross Direct Income Management Unit Costs 19 0 5,000 19 (516) 4,425 11,208 7,795 Management Unit Costs Property Services Gross Direct Costs Management Unit Costs Parks & Open Spaces Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Foreshore Gross Direct Costs Explanation for Major Variances 1,308 £20,351 - Additional repairs and maintenance expenditure including Disaster Recovery Room installation at Fakenham Connect. (£2,670) - Reduced NNDR costs for Cromer Offices and Annexe, (£8,315) - Reduced Utilities expenditure. (£1,234) - Reduction in Consumable Materials. (£10,681) - Reduced expenditure on equipment. £3,909 - Additional stores issues for Windmill Restaurant. 0 (6,088) (£3,609) - Recovery of costs following insurance claim for Cromer Offices. (£3,923) - Additional recoverable recharges for Fakenham Connect. £1,784 - Reduced Windmill Restaurant sales. 24,934 £15,413 - Reduced Management Unit recharges following lower than anticipated direct expenditure and increased direct income. £8,651 - Additional Computer Services management unit recharges for Windmill Restaurant and North Walsham Offices. 20,154 2,301 £1,450 - Additional overtime expenditure for office opening. (£1,275) - Reduced Continuous Professional Development training costs. (2,301) No major variances 0 (9,650) (£8,989) - Grounds maintenance contract variations 0 12,690 £5,270 - Interest on commuted sums is lower as a result of reduced rates of return on investments. £8,040 - No recharge of metred water or grounds maintenance works. (1,065) No Major Variances. 1,975 (35,072) £2,197 - Bad debts provision. (£32,555) - Underspend on repairs and maintenance (planned Pier painting) due to adverse weather. £28,900 has been carried forward to 2013/14. 0 (1,212) (£1,086) - Insurance claim receipt following damage to lighting column on Cromer Prom (3,976) (£2,780) - Reduced Computer Services management unit recharges. (40,260) (2,322) (£2,322) - Reduced expenditure on repairs and maintenance. 0 (516) No major variances (575) No major variances (3,413) Appendix B General Fund Variances by Servcie Area - Period 12 - 2012/13 Assets & Leisure Full Year Budget £ Sports Centres Gross Direct Costs Actuals £ Variance £ Explanation for Major Variances 374,970 364,019 11,188 11,188 (140,122) (129,813) 111,150 89,764 357,186 335,158 399,445 305,404 24,640 398,832 305,404 25,455 729,489 729,691 109,289 (57,500) 58,540 115,973 (61,019) 53,978 6,684 No Major Variances. (3,519) No Major Variances. (4,562) (£4,210) - Reduced recharges from IT for PC and network support. 110,329 108,932 (1,397) 9,086 285 (1,000) 2,740 9,076 285 (1,288) 2,608 (10) No Major Variances. 0 (288) No Major Variances. (132) No Major Variances. 11,111 10,681 (430) Pier Pavilion Gross Direct Costs Capital Charges 96,897 0 106,229 24,505 Management Unit Costs 12,870 12,735 109,767 143,469 387,037 374,235 (4,750) 31,300 (2,035) 32,436 413,587 404,636 Capital Charges Gross Direct Income Management Unit Costs Leisure Complexes Gross Direct Costs Capital Charges Management Unit Costs Other Sports Gross Direct Costs Gross Direct Income Management Unit Costs Recreation Grounds Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Foreshore (Community) Gross Direct Costs Gross Direct Income Management Unit Costs (10,951) (£3,332) - Salaries and oncosts lower than expected, mainly overtime not required. (£3,797) - Reduced expenditure on purchases for the bar area as a result of reduced demand, offset by reduced income. The balance consists of minor variances. 0 10,309 Sale of food and drink in bar areas is lower than anticipated, this is partly offset by lower expenditure. Hall and pitch hire are also below anticipated levels (21,386) (£13,980) - Reduced recharges from IT for PC and network support. The balance consists of minor variances. (22,028) (613) No Major Variances. 0 815 No Major Variances. 202 9,332 £8,021 - Repair and maintenance at the Pavilion Theatre. 24,505 £24,505 - Revenue Funded from Capital under Statute (Refcus), loan repayment. (135) No Major Variances. 33,702 (12,802) (£10,580) - Management fee payable to the RNLI for the Lifeguard Service has been renegotiated. (£3,371) - Rental for emergency telephones. 2,715 £3,015 - Fewer contributions towards Lifeguard Services 1,136 No Major Variances. (8,951) Appendix B General Fund Variances by Servcie Area - Period 12 - 2012/13 Assets & Leisure Full Year Budget £ Actuals £ Variance £ Explanation for Major Variances Woodlands Management Gross Direct Costs 161,473 178,466 16,993 £3,547 - Emergency tree works. £4,393 - Expenditure relating to the delivery of events. £4,243 - Salaries and oncosts are higher than expected. (£7,194) - Expenditure on Access to Nature change and impact project not incurred because grant not claimed until 2013/14. £6,697 - Grounds maintenance at Holt Country Park. £5,692 - Vehicle lease and fuel costs. Capital Charges Gross Direct Income 1,386 (71,062) 1,386 (70,717) 0 345 (£5,061) - Additional woodland grant from the Forestry Commission. (£5,216) - Income earned from events. (£3,317) - Income from the sale of firewood. £10,000 - Access to Nature change and Impact funding not claimed until 2013/14. £2,969 Grant from Woodland Trust not received because of a delay in receiving a signed agreement. 79,380 75,875 171,177 185,010 13,833 34,317 5,232 (16,488) 6,690 27,129 5,232 (16,488) 6,247 (7,188) (£7,188) - Maintenance costs lower than expected. 0 0 No Major Variances. (443) No Major Variances. 29,751 22,120 Public Conveniences Gross Direct Costs 426,854 439,080 Capital Charges Gross Direct Income Management Unit Costs 68,262 (13,752) 42,467 68,262 (14,130) 53,887 12,226 £9,098 - Additional expenditure on repairs and maintenance. £3,614 - Increased utility costs, mainly water and sewerage. 0 (378) No major variances 11,420 £12,888 - Increased Creditors Section recharges. 523,831 547,099 23,268 100,486 103,710 12,869 (217,093) 12,869 (219,535) 83,800 88,487 3,224 £5,768 - Additional repairs and maintenance expenditure on the Rocket House, specifically lift works. (£6,970) - Reduced repairs and maintenance on Chalets, from a delay in the planned works due to weather restrictions. This has been carried forward to 2013/14. £3,511 - Additional utilities costs at the Rocket House offset in part by the recovery of costs from tenants. £1,482 - Additional overtime expenditure incurred relating to lettings of chalets and beach huts. 0 (2,442) (£2,125) - Additional income from filming rights and associated charges, transfered to the Asset Management Reserve to cover additional valuations required to be undertaken in 2013/14. (£1,026) - Additional income following the recovery of utilities costs at the Rocket House. 4,687 £3,448 - Increased Computer Section recharges. £1,471 Increased Creditors Section recharges. (19,938) (14,469) 144,346 (700) (143,646) 140,397 0 (140,397) 0 0 Management Unit Costs Cromer Pier Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Investment Properties Gross Direct Costs Capital Charges Gross Direct Income Management Unit Costs Leisure Gross Direct Costs Gross Direct Income Management Unit Costs (3,505) (£4,030) - Reduced recharges from IT for PC and network support. (7,631) 5,469 (3,949) No Major Variances. 700 No Major Variances. 3,249 Reduced recharges reflecting lower direct costs. 0 Appendix B General Fund Variances by Servcie Area - Period 12 - 2012/13 Assets & Leisure Full Year Budget £ Actuals £ Variance £ CCTV Gross Direct Costs 198,645 183,828 Capital Charges Gross Direct Income Management Unit Costs 9,807 (18,794) 44,380 9,807 (19,060) 37,696 234,038 212,271 (21,767) 2,226,744 2,169,178 (57,566) Explanation for Major Variances (14,817) (£13,766) - No replacement CCTV cameras purchased in the year. 0 (266) No Major Variances. (6,684) (£6,520) - Reduced recharges from IT for PC and network support.