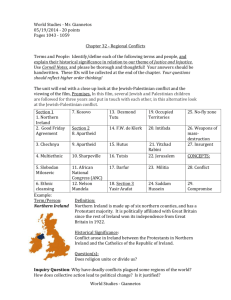

10. Corporate tax setting Summary •

advertisement