KARVY CURRENCY INSIGHT MARKET OVERVIEW GLOBAL TRACKER

advertisement

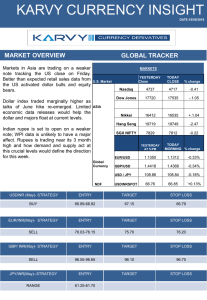

KARVY CURRENCY INSIGHT DATE:17/05/2016 MARKET OVERVIEW GLOBAL TRACKER Global markets are trading on a positive note with Asia taking lead from the uptick in US markets last night. Dollar remained grounded against all the majors except against the Pound which rallied in yesterday’s session. Focus would continue to remain on Pound with inflation data scheduled to be released today. MARKETS YESTERDAY Close TODAY CLOSE Nasdaq 4717 4775 +1.21 Dow Jones 17535 17710 +.1.01 Nikkei 16466 16615 +0.90 Hang Seng 19883 19897 +0.07 SGX NIFTY 7884 7907 +0.35 U.S. Market % change ASIA Indian rupee is set to open on a flat note after the WPI data has seen an uptick yesterday. Long term outlook remains negative for rupee but intraday movement could be muted. YESTERDAY AT 5.PM Global Currency NDF TODAY MORNING % change EUR/USD 1.1320 1.1319 -0.01% GBP/USD 1.4367 1.4486 +0.81% USD / JPY 108.91 108.97 +0.05% 66.80 66.79 `+0.13% USDINRSPOT USDINR (May)- STRATEGY ENTRY TARGET STOP LOSS BUY 66.86-66.88 67.08 66.76 EUR/INR(May)- STRATEGY ENTRY TARGET STOP LOSS SELL 75.99-76.09 75.70 76.15 GBP/ INR(May)- STRATEGY ENTRY TARGET STOP LOSS BUY 96.65-96.75 97.20 96.60 JPY/INR(May)--STRATEGY ENTRY TARGET STOP LOSS RANGE 61.30-61.70 USDINR OUTLOOK CURRENCY TECHNICAL OUTLOOK USDINR TECHNICAL OUTLOOK Above is the Daily Chart of USDINR, the pair opened at 67.02, and made a high of 67.07 and came down from higher levels but upward sloping trend line and higher low formation helped the pair to bounce from the lower levels, the pair is expected to consolidate until close above 67.05 levels with strong volume ,where 50dma lies as RSI stand at 54.16 levels . STRATEGY(May)- ENTRY BUY TARGET 66.86-66.88 STOP LOSS 67.08 66.76 RES PIVOT SUP TREND 67.05/67.15/67.20 66.90 66.94/66.84/66.76 NEUTRAL Fundamental Overview US dollar index is trading at 94.48, on a marginally lower note today. Weaker than expected manufacturing data triggered a selloff in the US dollar but prices quickly moved back. Dollar remained unchanged against the EURO and Yen but depreciated against the Pound, which shot up in yesterday's session. Building permits, housing starts and inflation data from the US in the evening would be the key data to be watched out for. Economic Data & News TIME COUNTRY DATA 01:30:00 USD TIC Net Long-Term Transactions (Mar) 18:00:00 USD 18:00:00 ACTUAL SURV PREVIOUS 36.5B 72.0B Building Permits (Apr) 1.130M 1.086M USD Building Permits (MoM) (Apr) 4.30% -7.70% 18:00:00 USD Core CPI (MoM) (Apr) 0.20% 0.10% 18:00:00 USD CPI (MoM) (Apr) 0.30% 0.10% 18:00:00 USD Housing Starts (Apr) 1.129M 1.089M 18:00:00 USD Housing Starts (MoM) (Apr) 2.90% -8.80% EUR/USD EURINR CURRENCY TECHNICAL OUTLOOK EUR/USD TECHNICAL OUTLOOK EUR/USD. Pair after opening at 1.1310 made a high of 1.1330 , and was trading in the narrow range for the day with some positive bias, the pair is making lower top and lower bottom on hourly chart with prices trading below its 200HMA that stand at 1.1380 until its trade above its recent swing high of 1.1457 any exhaustive opportunity in the pair STRATEGY SELL ENTRY 1.13401.1350 TARGET 1.12801.1250 STOP LOSS STRATEGY 1.1370 RES PIVOT SUP 1.1440/1.1490 1.1400 1.1280/1250 SELL ENTRY TARGET STOP LOSS 75.9976.09 75.70 76.15 RES PIVOT SUP 76.05/76.35 76.00 75.81/75.68 Fundamental Overview Euro is trading at 1.1320, remaining largely unchanged in yesterday's session as most of the European markets remained closed. Euro gained marginally in the US session, only to retreat as markets shrugged off the weak manufacturing data from the US. There is no major economic data scheduled to be reported from the EU but focus would be on the minutes of the last ECB meeting as investors would be looking for clues of further stimulus from the ECB. Economic Data & News TIME 14:30:00 COUNTRY EUR EVENT Trade Balance (Mar) ACTUAL SURV PREVIOUS 22.5B GBP/USD GBP/INR CURRENCY TECHNICAL OUTLOOK GBP/USD TECHNICAL OUTLOOK ABOVE is the Daily chart of GBPUSD pair after opening at 1.4355, made a high of 1.4383 and was trading with negative bias overall trend remains weak yesterday, but the pair took support of 100SMA around 1.4330 and reversed from the levels if the pair can trade above 1.4540 levels we may see short covering in the pair with supports coming in at 1.4400 STRATEGY BUY ENTRY ABV 1.4530 TARGET 1.4570 STOP LOSS 1.4500 RES PIVOT SUP 1.4560/1.4495 1.4450 1.4440/1/4380 STRATEGY ENTRY TARGET STOP LOSS BUY 96.6596.75 97.20 96.60 RES 97.59/97.45/97.15 PIVOT 96.85 SUP 96.75/96.49/96.30 Fundamental Overview Pound is trading close to the 1.45 mark, taking a bounce from the recent lows of 1.4330. There was no specific reason for such a strong rally as no major data was reported in yesterday's session. Inflation data is scheduled to be reported in the afternoon, which is expected to improve. Going by the inflation expectations report published last week, an uptick in the inflation data can be expected and could lead to further appreciation in the pound. Overall, Pound remains weak but with heavy built up of short positions, interim bouts of volatility can be expected in the opposite direction. Economic Data & News TIME 14:00:00 14:00:00 14:00:00 COUNTRY GBP GBP GBP DATA CPI (MoM) (Apr) CPI (YoY) (Apr) PPI Input (MoM) (Apr) ACTUAL SURV 0.30% 0.50% 1.10% PREVIOUS 0.40% 0.50% 2.00% USD/JPY JPYINR CURRENCY TECHNICAL OUTLOOK USD/JPY TECHNICAL OUTLOOK USD/JPY pair after opening at 108.64 and made a low of 108.43 and was consolidating in the narrow range ,the pair is finding supports at the lower levels with divergence in price and indicators which confirm demand at lower levels with prices near its 8 and 21DMA at is 108.51 and 108.81 so short term any dip is a buy opportunity until prices close below 108 STRATEGY ENTRY RANE 108.20109.50 TARGET STOP LOSS STRATEGY ENTRY TARGET RANGE 61.30-61.70 STOP LOSS RES PIVOT SUP RES PIVOT SUP 109.10/109.50 108.70 107.85/106.45 62.01/61.78/61.55 61.45 61.20/61.00/60.75 Fundamental Overview Japanese Yen is trading at 108.97, trading near 109.0 with no change from yesterday’s level. Markets would be looking forward to the GDP report that is due to be published this week. Yen is likely to remain in the range for the time being and before the G7 finance ministers meeting scheduled in this month. Economic Data & News TIME COUNTRY 10:00:00 JPY DATA Industrial Production (MoM) (Mar) ACTUAL SURV 3.60% PREVIOUS 3.60% Disclaimer The information and views presented in this report are prepared by Karvy CURRENCY TECHNICAL OUTLOOK Stock Broking Limited. The information contained herein is based on our analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. While acting upon any information or analysis mentioned in this report, investors may please note that neither Karvy nor any person connected with any associated companies of Karvy accepts any liability arising from the use of this information and views mentioned in this document. The author, directors and other employees of Karvy and its affiliates may hold long or short positions in the abovementioned companies from time to time. Every employee of Karvy and its associated companies are required to disclose their individual stock holdings and details of trades, if any, that they undertake. The team rendering corporate analysis and investment recommendations are restricted in purchasing/selling of shares or other securities till such a time this recommendation has either been displayed or has been forwarded to clients of Karvy. All employees are further restricted to place orders only through Karvy Stock Broking Ltd.