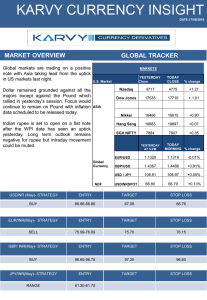

KARVY CURRENCY INSIGHT MARKET OVERVIEW GLOBAL TRACKER

advertisement

KARVY CURRENCY INSIGHT DATE:16/05/2016 MARKET OVERVIEW GLOBAL TRACKER Markets in Asia are trading on a weaker note tracking the US close on Friday. Better than expected retail sales data from the US activated dollar bulls and equity bears. Dollar index traded marginally higher as talks of June hike re-emerged. Limited economic data releases would help the dollar and majors float at current levels. MARKETS YESTERDAY Close TODAY CLOSE Nasdaq 4737 4717 -0.41 Dow Jones 17720 17535 -.1.05 Nikkei 16412 16535 +.1.04 Hang Seng 19719 19749 -2.47 SGX NIFTY 7829 7812 -0.22 U.S. Market % change ASIA Indian rupee is set to open on a weaker note; WPI data is unlikely to have a major affect. Rupees is trading near its 3 month high and how demand and supply act at this crucial levels would define the direction for this week. YESTERDAY AT 5.PM Global Currency NDF TODAY MORNING % change EUR/USD 1.1350 1.1312 -0.33% GBP/USD 1.4418 1.4368 -0.34% USD / JPY 108.86 108.84 -0.18% 66.76 66.85 `+0.13% USDINRSPOT USDINR (May)- STRATEGY ENTRY TARGET STOP LOSS BUY 66.89-66.92 67.15 66.79 EUR/INR(May)- STRATEGY ENTRY TARGET STOP LOSS SELL 76.03-76.15 75.70 76.20 GBP/ INR(May)- STRATEGY ENTRY TARGET STOP LOSS SELL 96.55-96.65 96.10 96.75 JPY/INR(May)--STRATEGY ENTRY TARGET STOP LOSS RANGE 61.25-61.70 USDINR OUTLOOK CURRENCY TECHNICAL OUTLOOK USDINR TECHNICAL OUTLOOK Above is the Daily Chart of USDINR, the pair opened at 66.91, and made a high of 66.99 and was trading in the narrow range throughout the day with doji pattern , the pair is expected to consolidate until close above 67.05 levels with strong volume ,where 50dma lies as RSI stand at 53.16 levels . STRATEGY(May)- ENTRY BUY TARGET 66.89-66.92 STOP LOSS 67.15 66.79 RES PIVOT SUP TREND 67.05/67.15/67.20 66.90 66.94/66.84/66.76 POSITIVE Fundamental Overview US dollar index is trading at 94.64, appreciating against most of the majors on Friday after a better than expected retail sales data was reported. Retail sales improved by 1.3% for the month of April against an expectation of 0.8% growth. Dollar rallied after the report but retracted some of the gains. Limited economic data is likely to keep the US dollar afloat, with a focus on housing data this week. Economic Data & News TIME 18:00:00 COUNTRY USD DATA NY Empire State Manufacturing Index (May) ACTUAL SURV 7.00 PREVIOUS 9.56 EUR/USD EURINR CURRENCY TECHNICAL OUTLOOK EUR/USD TECHNICAL OUTLOOK EUR/USD. Pair after opening at 1.1375 made a high of 1.1380 , and was trading in the narrow range for the day with some negative bias, the pair is making lower top and lower bottom on hourly chart with prices trading below its 200HMA that stand at 1.1400 until its trade above its recent swing high of 1.1457 any exhaustive opportunity in the pair STRATEGY SELL ENTRY 1.13401.1350 TARGET 1.12801.1250 STOP LOSS 1.1370 RES PIVOT SUP 1.1440/1.1490 1.1400 1.1280/1250 STRATEGY SELL ENTRY TARGET STOP LOSS 76.037615 75.70 76.20 RES PIVOT SUP 76.05/76.35 76.00 75.81/75.68 Fundamental Overview Euro is trading at 1.1306, depreciating against the US dollar after weak GDP report and the positive US economic data. Euro area GDP for the first quarter was reported at 0.5% against an expectation of 0.6%. There is no major economic data to be reported today and the pair is likely to breach the 1.13 mark. Economic Data & News TIME COUNTRY EVENT ACTUAL SURV PREVIOUS GBP/USD GBP/INR CURRENCY TECHNICAL OUTLOOK GBP/USD TECHNICAL OUTLOOK ABOVE is the Daily chart of GBPUSD pair after opening at 1.4447, made a high of 1.4452 and was trading volatile in the range of 1.4378-1460 with a support of 50DMA at 1.4375 and prices finding resistance at 1.45 so ,it has been trading near 50 DMA level so if sustains then the pair can correct to 1.4300,so any intraday exhaustive candle is a shorting opportunity STRATEGY SELL ENTRY 1.43901.4410 TARGET 1.4300 STOP LOSS 1.4430 RES PIVOT SUP 1.4460/1.4410 1.4400 1.4340/1/4300 STRATEGY ENTRY TARGET STOP LOSS SELL 96.5596.65 96.10 96.75 RES 97.10/96.85/96.60 PIVOT 96.55 SUP 96.30/95.95/95.70 Fundamental Overview Pound continued with its downward trajectory, trading at 1.4369 after making a low of 1.4337 on Friday after the US economic data. Weak economic data during the previous week and verbal warnings from the Bank of England governor about BREXIT supported the bears. Further downside can be expected in the currency pair with a focus on consumer prices and retail sales. Economic Data & News TIME COUNTRY DATA ACTUAL SURV PREVIOUS USD/JPY JPYINR CURRENCY TECHNICAL OUTLOOK USD/JPY TECHNICAL OUTLOOK USD/JPY pair after opening at 109.04 and made a low of 108.49 and bounce from the lower levels, the pair is trading in the narrow range for past three days and is expected to consolidate further as RSI stands at 48.79 and 20DMA at 108.79 with swing low of 105.51 and swing 111.89 STRATEGY ENTRY RANE 108.20109.50 TARGET STOP LOSS STRATEGY ENTRY TARGET RANGE 61.25-61.70 STOP LOSS RES PIVOT SUP RES PIVOT SUP 109.10/109.50 108.70 107.85/106.45 62.01/61.78/61.55 61.45 61.20/61.00/60.75 Fundamental Overview Japanese Yen is trading at 108.94, trading near the 109.00 and depreciating against the US dollar after last Friday data. Speculation about further easing from the Bank of Japan is driving the USDJPY price higher. Focus would be on the first quarter GDP data scheduled to be released this week. Economic Data & News TIME COUNTRY DATA ACTUAL SURV PREVIOUS Disclaimer The information and views presented in this report are prepared by Karvy CURRENCY TECHNICAL OUTLOOK Stock Broking Limited. The information contained herein is based on our analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. While acting upon any information or analysis mentioned in this report, investors may please note that neither Karvy nor any person connected with any associated companies of Karvy accepts any liability arising from the use of this information and views mentioned in this document. The author, directors and other employees of Karvy and its affiliates may hold long or short positions in the abovementioned companies from time to time. Every employee of Karvy and its associated companies are required to disclose their individual stock holdings and details of trades, if any, that they undertake. The team rendering corporate analysis and investment recommendations are restricted in purchasing/selling of shares or other securities till such a time this recommendation has either been displayed or has been forwarded to clients of Karvy. All employees are further restricted to place orders only through Karvy Stock Broking Ltd.