To: Members of the Research Pension Plan From:

advertisement

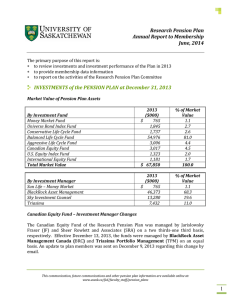

September 21, 2009 To: Members of the Research Pension Plan From: Research Pension Plan Committee REPORT TO PLAN PARTICIPANTS Since June of 2008, the Committee has met 10 times. Along with the normal oversight duties of the operation of the Plan, a major undertaking of the Committee was development of the Plan’s Governance Document. This document was approved by the Board of Governors and became effective July 1, 2009. The Committee also recommended rate changes to coincide with other employee groups at the University of Saskatchewan. The rate changes (amendment #13) were communicated to plan members in April, 2009 and became effective May 1, 2009. The Committee also conducted an annual review of the Statement of Investment Policies and Procedures. All of the above documents for the Research Pension Plan may be accessed at www.usask.ca/fsd/pensions/ under Pension Plans. The Research Committee, together with Sun Life Financial organized interactive investment workshops on October 15th and 16th, 2008 to familiarize members with the principles of building an investment portfolio. Retirement planning workshops were held on February 23rd and 24th, 2009. As part of the ongoing information and communication strategy, the Committee partnered with Sun Life to circulate seven newsletters dealing with financial planning and investment strategies. These newsletters can be viewed at the above mentioned link under Pension News. Investment Performance of the Plan As Plan members have differing risk preferences, the Plan makes several investment options available to members. These options allow members to select funds with a mix of underlying assets that meets their investment needs. Stock markets around the world declined precipitously in 2008 and this environment made for a very difficult year for investment returns. Nevertheless, the Life Cycle Funds did provide some protection relative to their benchmarks. The benchmark portfolios for each of the funds have been determined using the actual returns of the market indexes such as the S&P/TSX Capped Composite Index, Standard and Poor’s 500 U. S. Stock Index, Morgan Stanley Europe, Australia and Far East Index, DEX Universe Bond Index and 91-Day Canadian Treasury Bills. The following is a summary of the Plan’s investment performance as at December 31, 2008 exclusive of investment expenses: Fund Money Market Return Benchmark Bond Fund Return Benchmark 1 year 4 year 3.8% 3.3% 3.7% 3.6% 6.1% 6.4% 5.0% 5.1% -------------------------------------------------------------------------------------------------------------------------------------------This document and future communications are available online at: www.usask.ca/fsd/pensions Conservative Life Cycle Fund Return Benchmark Balanced Life Cycle Fund Return Benchmark Aggressive Life Cycle Fund Return Benchmark Canadian Equity Fund Return Benchmark U.S Equity Fund Return Benchmark International Equity Fund Return Benchmark -0.7% -1.2% 3.9% 3.9% -13.6% -15.2% 1.4% 1.4% -19.7% -21.6% 0.0% 0.1% -25.5% -33.0% 3.3% 1.7% -21.2% -21.2% -4.6% -4.5% -30.1% -29.2% -3.4% -1.8% The Sun Life member website at www.sunlife.ca/member contains additional information about the Plan’s performance. Additionally, you can access the Plan’s Financial Statements at http://www.usask.ca/fsd/pensions. Please contact the Pensions Office at 966-6633 or any member of the Research Pension Plan Committee if you have any questions about the items covered. The Research Pension Committee members are: • • • Doug Hassard (Plant Sciences) Neil Johnson (CLS) Carol Martel (VIDO) Bob Elliott (Financial Services) Laura Kennedy (Financial Services) Heather Fortosky (Pensions Office) -------------------------------------------------------------------------------------------------------------------------------------------This document and future communications are available online at: www.usask.ca/fsd/pensions