28 JUNE 2010 TO: Academic Money Purchase Pension Plan Participants

advertisement

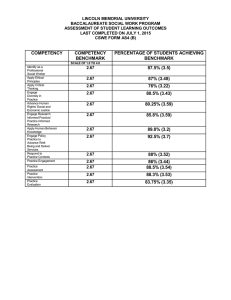

28 JUNE 2010 TO: Academic Money Purchase Pension Plan Participants FROM: Academic Money Purchase Pension Committee (AMPPC) ANNUAL REPORT TO PLAN PARTICIPANTS Since June of 2009, the Committee has met 9 times for a total of approximately 17 hours. Apart from the normal oversight duties associated with the operation of the Plan, a principal focus this year was relative to the committee’s responsibility to review the Governance Document every three years. To aid in this, the committee completed a self-assessment using the Joint Forum of Financial Market Regulators Capital Accumulation Plan (CAP) Guidelines Self Assessment Tool to benchmark the plan to ensure compliance with CAP Guidelines. The outcome of this along with the committee’s review of the plan’s Governance Document were a number of small changes, which have been forwarded to the Board of Governors and the Executive of the USFA for approval. Other initiatives of the Committee were to conduct an annual review and recommend changes to the Statement of Investment Policies and Procedures to the Board and the Executive of the USFA for approval and, in conjunction with Sun Life, develop a communication and education plan for the Plan. In response to a proposal from the University, the Committee agreed to the establishment of education sessions for members of the AMPPC to help ensure that these members exercise their oversight duties in an informed manner. These sessions were held in November 2009. Finally, the Committee has discussed a possible review of the current investment structure of the Plan, but no decision has been taken to date. As part of the ongoing education and communication strategy, the AMPPC drafted three newsletters to the membership and partnered with Sun Life Financial to circulate six newsletters dealing with financial planning and investment strategies. These newsletters can be viewed at the link noted at the end of the newsletter. The AMPPC together with Sun Life organized three different investment workshops which were held on October 21st and 22nd, 2009 to familiarize members with the principles of building an investment portfolio. In addition, the Committee arranged for a general meeting on February 1, 2010 that provided members with the opportunity to discuss the annual performance of the Plan with our Investment Consultant representative. Finally, the Committee partnered with Sun Life to hold retirement planning workshops on February 23rd and 24th, 2010. Investment Performance of the Plan As Plan members have differing risk preferences, the Plan makes several investment options available to members. These options allow members to select segregated funds with a mix of underlying assets that meets their investment needs. Members are reminded of their responsibility to review periodically the portfolio structure of their participation in the Plan and to revise it as appropriate given their needs. Stock markets around the world began to rebound off of their lows of early 2009. Investment declines of 2008 and early 2009 were somewhat mitigated in the rebound that occurred during the balance of the year. While in 2008, the Life Cycle Funds did provide some protection relative to their benchmarks they also participated in the rebounds in 2009. The benchmark portfolios for each of the funds have been determined using the actual returns of the market indexes such as the S&P/TSX Capped Composite Index, Standard and Poor’s 500 U. S. Stock Index, Morgan Stanley Europe, Australia and Far East Index, DEX Universe Bond Index and 91Day Canadian Treasury Bills. The following is a summary of the Plan’s investment performance as at December 31, 2009 exclusive of investment expenses: The total fund investment performance is summarized below: Fund Performance (gross) Money Market Benchmark Total fund Bond Fund Benchmark Total fund Conservative Life Cycle Fund Benchmark Total fund Balanced Life Cycle Fund Benchmark Total fund Aggressive Life Cycle Fund Benchmark Total fund Canadian Equity Fund Benchmark Total fund U.S. Equity Fund Benchmark Total fund Non-North American Equity Fund Benchmark Total fund One Year Four Years 0.6% 0.7% 3.1% 3.2% 5.4% 5.4% 4.9% 4.8% 8.0% 8.4% 4.0% 4.1% 13.1% 15.0% 2.1% 2.7% 15.5% 18.1% 1.1% 1.8% 35.1% 30.6% 3.9% 4.4% 7.4% 7.4% -3.3% -3.3% 11.9% 26.7% -1.5% 0.9% The Sun Life website at https://www.sunnet.sunlife.com/member/signin/index.aspx contains additional information about the Plan’s performance. Additionally, you can access the Plan’s Financial Statements at http://www.usask.ca/fsd Respectively submitted by Howie Wall, Chair Robert Lucas, Vice-Chair Academic Money Purchase Pension Committee