September 2012

advertisement

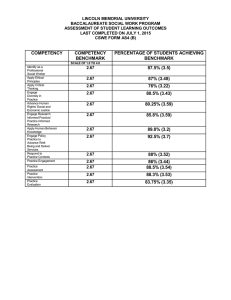

September 2012 TO: FROM: Academic Money Purchase Pension Plan Participants Academic Money Purchase Pension Committee (AMPPC) ANNUAL REPORT TO PLAN PARTICIPANTS Since June of 2011, the Committee has met 10 times for a total of approximately 18 hours. Apart from the normal oversight duties associated with the operation of the Plan, a principal focus this year was to continue a review of the investment structure of the Plan. As stated in the previous newsletter, the current investment structure has been in place since the transfer of assets in June of 2002. The Committee believed it was appropriate to review whether the current platform was still meeting the investment needs of Plan participants. In October of 2011, Aon Hewitt was engaged to conduct a formal asset mix optimization study for each of the three Life Cycle Funds. After review of this study, the Committee concluded that the current investment structure of the Plan should remain unchanged. A communication was sent to the membership in June of 2012 with a comprehensive overview of the investment structure review process. This newsletter and other communications for the Plan can be viewed at the following link: http://www.usask.ca/fsd/faculty_staff/pension_plans/whats_new/pension_news_ampp.php As part of the ongoing education and communication strategy, the AMPPC together with Sun Life organized two enrollment and investment information sessions and three interactive investment workshops on November 1st and 2nd to familiarize members with the structure of the Plan and the principles of building an investment portfolio, respectively. In addition, the Committee arranged for a general meeting on February 7, 2012 that provided members with the opportunity to discuss the annual performance of the Plan with our Investment Consultant representative. Sun Life also provided a presentation on the member website, including how to use the asset allocation and retirement tools. The Committee partnered with Sun Life to hold retirement planning workshops on March 12th and 13th, 2012. Another initiative of the Committee was to conduct an annual review and recommend changes to the Statement of Investment Policies and Procedures to the Board and the Executive of the USFA for approval. Investment Performance of the Plan As Plan members have differing risk preferences, the Plan makes several investment options available to members. These options allow members to select segregated funds with a mix of underlying assets that meets their investment needs. Members are reminded of their responsibility to review periodically the portfolio structure of their participation in the Plan and to revise it as appropriate given their needs. In 2011 global uncertainty continued due to lingering European debt concerns. Adding to investor’s concerns was the downgrade in Spain’s credit rating. The U.S. equity market soared in 2 October; BlackRock U.S. Equity Fund was the strongest performing investment option in the final quarter of 2011. The International Equity Fund trailed the MSCI EAFE Index, pushing all three Life Cycle Funds below their respective benchmarks. The benchmark portfolios for each of the funds have been determined using the actual returns of the market indexes such as 91-Day Canadian Treasury Bills, the DEX Universe Bond Index, the S&P/TSX Capped Composite Index, Standard and Poor’s 500 U. S. Stock Index and Morgan Stanley’s Europe, Australia and Far East Index. The following is a summary of the Plan’s annual investment performance as at December 31, 2011 exclusive of Plan expenses: Fund Money Market Fund Return Benchmark Bond Fund Return Benchmark Conservative Life Cycle Fund Return Benchmark Balanced Life Cycle Fund Return Benchmark Aggressive Life Cycle Fund Return Benchmark Canadian Equity Fund Return Benchmark U.S. Equity Fund Return Benchmark International Equity Fund Return Benchmark 1 year 4 year 1.2% 1.0% 1.6% 1.4% 9.7% 9.7% 7.0% 7.0% 6.3% 6.7% 5.3% 5.2% (0.7%) 1.0% 1.7% 1.3% (4.3%) (1.9%) (0.3%) (0.8%) (7.7%) (8.7%) 0.2% (0.7%) 4.6% 4.6% (0.9%) (0.9%) (19.2%) (10.0%) (6.9%) (7.6%) The Sun Life website at https://www.mysunlife.ca contains additional information about the Plan’s performance. You can access the Plan’s Financial Statements and Statement of Investment Policies & Procedures (SIPP) at www.usask.ca/fsd/faculty_staff/pension_plans/index.php Academic Money Purchase Pension Committee Members: Faculty Association Appointees: Don Gilchrist, Economics Bob Lucas, Economics George Tannous, Edwards School of Business ASPA Observer: Board of Governor Appointees: Laura Kennedy, Financial Services Division Mike Sander, Financial Services Division Jim Traves, University Advancement Anand Elango, Edwards School of Business