Document 12022354

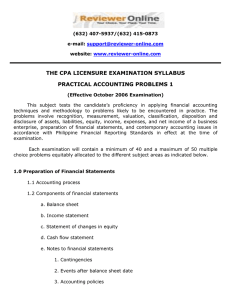

advertisement