International Business Digest Latest U.S. Merchandise Trade Sta s cs

advertisement

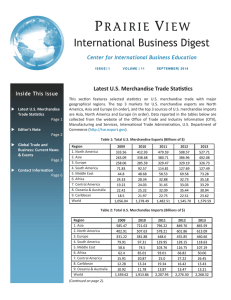

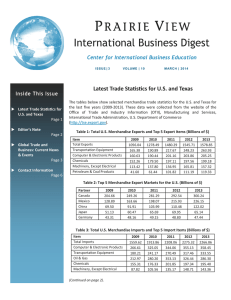

International Business Digest Center for International Business Education I S S U E | 1 VOLUME | 12 SEPTEMBER | 2015 Latest U.S. Merchandise Trade Sta s cs Latest U.S. Merchandise Trade Statistics Page 1 Editor’s Note Page 2 Global Trade and Business: Current News & Events Page 4 Contact Information Page 6 This sec on features selected sta s cs on U.S. merchandise trade with major geographical regions. The top 3 regional markets for U.S. merchandise exports are North America, Asia and Europe (in order), and the top 3 regional sources of U.S. merchandise imports are Asia, North America and Europe (in order). Data reported in the tables below are collected from the website of the Office of Trade and Industry Informa on (OTII), Manufacturing and Services, Interna onal Trade Administra on, U.S. Department of Commerce (h p://tse.export.gov). Table 1: Total U.S. Merchandise Exports (Billions of $) Region 1. North America 2. Asia 3. Europe 4. South America 5. Middle East 6. Africa 7. Central America 8. Oceania & Australia 9. Caribbean World 2010 412.93 338.68 285.59 92.57 48.68 28.34 24.03 25.32 21.97 1,278.49 2011 479.59 380.71 329.47 114.81 58.53 32.88 31.45 32.09 22.75 1,482.51 2012 508.54 386.99 329.18 127.66 69.58 32.73 33.02 35.45 22.51 1,545.82 2013 526.84 402.00 326.48 127.45 73.29 35.24 33.29 30.04 23.62 1,578.44 2014 552.68 407.16 333.29 125.14 73.74 38.08 33.91 31.56 24.97 1,620.53 Table 2: Total U.S. Merchandise Imports (Billions of $) Region 1. Asia 2. North America 3. Europe 4. South America 5. Middle East 6. Africa 7. Central America 8. Oceania & Australia 9. Caribbean World (Con nued on page 2.) 2010 721.63 507.63 381.88 97.31 74.50 85.01 20.87 11.78 13.24 1,913.86 2011 796.22 578.21 448.60 129.95 103.76 93.01 25.00 13.87 19.34 2,207.95 2012 849.74 601.86 455.83 128.15 116.75 66.82 27.22 13.47 16.42 2,276.27 2013 865.58 613.12 460.71 118.63 107.17 50.06 26.45 13.21 13.44 2,268.37 2014 910.93 641.88 491.19 113.27 103.30 34.59 24.39 15.11 13.04 2,347.69 Editor’s Note Gree ngs. It gives us great pleasure to bring to you the 45th issue of the Prairie View Interna onal Business Digest, an electronic quarterly newsle er produced by the Center for Interna onal Business Educa on. This issue features two sec ons. The first sec on (Latest U.S. Merchandise Trade Sta s cs) presents up‐to‐date sta s cs on U.S. merchandise trade with major geographical regions. The second sec on highlights current global business/trade news and events. Please note that all URL links are ac ve and you can go directly to a sec on from the Table of Contents on the first page. We hope you con nue to find this e‐newsle er a valuable channel for important informa on rela ng to interna onal business. We believe our efforts will inspire greater number of local firms to seek out new global business opportuni es. Should you have any ques ons or sugges ons, please feel free to contact us. Dr. Rahim Quazi Editor Thank you for your support, Rahim Quazi, Ph.D. Editor, Prairie View Interna onal Business Digest Center for Interna onal Business Educa on Prairie View A&M University E‐mail | rmquazi@pvamu.edu Phone | (936) 261‐9225 Fax| (936) 261‐9226 Latest U.S. Merchandise Trade Sta s cs (Con nued from page 1.) Table 3: Top 5 U.S. Merchandise Export Markets (Billions of $) Country 1. Canada 2. Mexico 3. China 4. Japan 5. U.K. 2010 249.26 163.66 91.91 60.47 48.41 2011 281.29 198.29 104.12 65.80 56.03 2012 292.65 215.88 110.52 69.98 54.86 2013 300.75 226.07 121.72 65.22 47.35 2014 312.42 240.25 123.68 66.83 53.82 EMBA (Con nued on page 3.) Trip to China (Con nued from page 1). Prairie View InternaƟonal Business Digest Page 2 Volume 12| Issue 1 Latest U.S. Merchandise Trade Sta s cs (Con nued from page 2.) Table 4: Top 5 U.S. Merchandise Export Items to Canada (Billions of $) Export Item 1. Transporta on Equipment 2. Machinery, Except Electrical 3. Chemicals 4. Computer and Electronic Products 5. Oil & Gas Total Merchandise Exports to Canada 2010 53.77 26.99 26.74 25.63 5.58 249.26 2011 57.45 30.13 29.97 27.75 6.57 281.29 2012 61.54 32.93 29.75 28.71 6.13 292.65 2013 64.32 31.11 30.24 27.99 9.64 300.75 2014 65.10 32.53 30.82 27.76 16.92 312.42 Table 5: Top 5 U.S. Merchandise Export Items to Mexico (Billions of $) Export Item 1. Computer and Electronic Products 2. Transporta on Equipment 3. Chemicals 4. Machinery, Except Electrical 5. Petroleum & Coal Products Total Merchandise Exports to Mexico 2010 32.96 19.61 18.23 12.98 11.99 163.66 2011 35.23 23.87 21.54 14.73 20.32 198.29 2012 36.61 27.75 23.59 17.72 20.67 215.88 2013 38.62 30.08 24.09 18.84 19.32 226.07 2014 40.50 30.73 24.92 21.20 19.05 240.25 Table 6: Top 5 U.S. Merchandise Export Items to China (Billions of $) Export Item 1. Transporta on Equipment 2. Agricultural Products 3. Computer and Electronic Products 4. Chemicals 5. Machinery, Except Electrical Total Merchandise Exports to China 2010 10.62 13.82 15.24 11.80 9.30 91.91 2011 12.30 14.69 13.63 13.59 10.37 104.12 2012 15.09 20.72 13.92 12.94 9.43 110.52 2013 22.56 18.90 16.02 13.90 9.50 121.72 2014 26.47 18.29 16.34 13.80 9.69 123.68 Table 7: Total U.S. Merchandise Trade Balance (Billions of $) Region 1. Oceania & Australia 2. Caribbean 3. South America 4. Central America 5. Africa 6. Middle East 7. North America 8. Europe 9. Asia World Prairie View InternaƟonal Business Digest 2010 13.54 8.73 ‐4.74 3.16 ‐56.67 ‐25.82 ‐94.70 ‐96.29 ‐382.95 ‐635.36 2011 18.22 3.41 ‐15.14 6.46 ‐60.13 ‐45.24 ‐98.62 ‐119.13 ‐415.50 ‐725.45 Page 3 2012 21.98 6.09 ‐0.49 5.80 ‐34.09 ‐47.18 ‐93.32 ‐126.65 ‐462.75 ‐730.45 2013 16.82 10.18 8.82 6.84 ‐14.82 ‐33.88 ‐86.28 ‐134.23 ‐463.58 ‐689.93 2014 16.45 11.94 11.87 9.52 3.49 ‐29.55 ‐89.20 ‐157.90 ‐503.78 ‐727.15 Volume 12| Issue 1 Global Trade & Business: Current News and Events The Trans‐Pacific Partnership (TPP) The Trans‐Pacific Partnership (TPP) is a soon‐to‐be formed trade bloc between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, U.S. and Vietnam. These countries together account for nearly 40% of the global GDP and one‐third of world trade. The TPP deals with many areas ranging from financial services and telecommunica ons to sanitary standards for food, etc. Many TPP provisions are similar to those of previous trade agreements such as the 1994 Uruguay Round of the GATT and the 1994 North American Free Trade Agreement (NAFTA). According to U.S. proponents of the agreement, the TPP will support domes cally produced exports, enforce fundamental labor rights, and promote protec on of the environment. Interna onal Visitors’ Favorite U.S. Des na ons According to the 2014 Survey of Interna onal Air Travelers (SIAT), the top three most‐visited US states by overseas visitors were New York, Florida and California. New York was the most visited state by overseas travelers for a 14th consecu ve year. Hawaii, Nevada, Texas, Massachuse s, Illinois, New Jersey and Pennsylvania rounded out the top 10 most‐visited states. The top 10 most popular ci es among overseas travelers were New York City, Miami, Los Angeles, Orlando, San Francisco, Las Vegas, Honolulu, Washington, D.C., Boston and Chicago. Historic Trade Agreement on Informa on and Communica on Technology Forty seven countries have reached a historic agreement to eliminate tariffs on Informa on and Communica on Technology (ICT). In this first tariff‐cu ng agreement at the WTO in 18 years, the par cipa ng countries agreed to expand the scope of products that receive duty‐free treatment under the WTO Informa on Technology Agreement. As a result, tariffs will be eliminated on roughly 200 ICT products that have a value of more $1 trillion in global trade. Top Markets Series The Interna onal Trade Administra on's Top Markets Series is a collec on of 19 sector‐specific reports that are designed to help U.S. exporters compare markets across borders. The reports provide a detailed assessment of the compe veness landscape within a sector, as well as the opportuni es and challenges facing U.S. exporters in key markets. Readers can download or view individual case studies within larger reports. DISCOVER GLOBAL MARKETS The U.S. Commercial Service is offering this na onal series of conferences to help U.S. businesses expand sales, penetrate new markets, and boost their bo om line through exports. Discover Global Markets: E‐Commerce Strategies: October 8‐9, Dallas/Ft. Worth, TX. The content will resonate with any company relying on e‐commerce and social media to drive business development, build brand awareness, and maintain contact with customers and partners around the world. Cost: $395. Discover Global Markets: Pacific Rim Consumers: October 29‐30, Orange County, CA. Hosted by the U.S. Commercial Service and the District Export Council of Southern California, this conference will focus on what consumers are buying throughout Asia and the Pacific region and how to sell to them. Cost: $395. (Con nued on page 4.) Prairie View InternaƟonal Business Digest Page 4 Volume 12| Issue 1 Global Trade & Business: Current News and Events (Con nued from page 4.) Export News from Tradeology (Interna onal Trade Administra on Blog) Cloud Compu ng Exports Drive Growth at Home and Abroad Six Reasons to Look South to Mexico and Central America’s Infrastructure Build‐Out Update to Important Commerce Data Tool Helps Businesses Improve their Export Services and Stay Compliant U.S. Innovators, Entrepreneurs and Businesses Capitalize on Emerging Markets in Africa Women Impac ng Public Policy Partners with ITA to Help Women Entrepreneurs Explore Business Growth Opportuni es Five Drivers of Export Opportunity: U.S. Building Products and Green Building Understanding Renewable Energy Export Markets and the Opportunity for U.S. Companies American Compe veness and the Global Race for Export Success U.S. Goods Exported to Trade Agreement Partners Supported 3.2 Million Jobs in 2014 Beyond the Border: U.S.‐Canada and U.S.‐Mexico Trade in Perspec ve Export Success Series: Export Sales to Mexico Opening Doors to La n America Sources: Export News, U.S. Export Assistance Center, Houston Export News, U.S. Export Assistance Center, Aus n Tradeology, Interna onal Trade Administra on Blog globalEDGE Newsle er, Michigan State University Interna onal Business Center Prairie View InternaƟonal Business Digest Page 5 Volume 12| Issue 1 Next Issue Available: December 2015 If you would like to receive an electronic version of this newsle er, contact Dr. Rahim Quazi at 936‐261‐9225 or rmquazi@pvamu.edu Visit our website! PVAMU College of Business | www.pvamu.edu/business or CIBE |h p://www.pvamu.edu/business/alumni‐friends/center‐for‐interna onal‐business‐educa on/ PVAMU College of Business Vision and Mission Statements Vision Statement The Prairie View A&M University College of Business strives to be among the best regional business schools in the na on by empowering students from diverse backgrounds to reach their full poten al. Mission Statement The Prairie View A&M University College of Business provides students from diverse academic and socioeconomic backgrounds with educa on that helps them become business professionals and leaders who are ethical, entrepreneurial, produc ve, and prepared to succeed in the global economy. The College achieves excellence through quality teaching, research, service, and engagement with the business community.