International Business Digest Cameroon – “Africa in Miniature”

advertisement

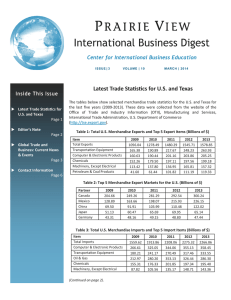

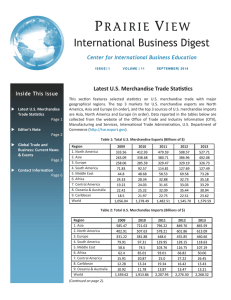

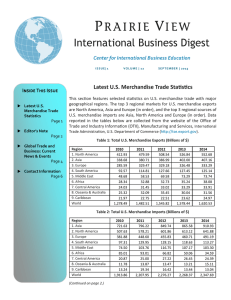

International Business Digest Center for International Business Education ISS UE | 3 VOLUM E | 11 M AR C H | 2 01 5 Cameroon – “Africa in Miniature” - contributed by Dr. Louis Ngamassi, Assistant Professor, PVAMU College of Business Cameroon ‐ Africa in Miniature Page 1 Editor’s Note Page 2 Latest Trade Sta s cs for U.S. and Texas Page 4 O en referred to as “Africa in Miniature”, Cameroon is a country located in Central Africa. It is situated at the mee ng point of Equatorial Africa to the south and Tropical Africa to the north. Cameroon shares common boundaries with Nigeria to the west, Chad to the northeast, the Central African Republic to the east, Congo, Gabon and Equatorial Guinea to the south. It has a coastline of 402 km bordering the Gulf of Guinea, an area of 475,650 km2, of which 466,464 km2 is land and 8,546 km2 is water. Es mated at 22 million, the popula on of Cameroon currently is made up of Chris ans (40%), Muslims (20%) and animists (40%). Global Trade and Business: Current News & Events Page 6 Contact Informa on Page 7 Cameroon is a former German colony. A er the First World War in 1919, Cameroon was mandated to the Bri sh and French rule by the League of Na ons. In 1946, it became a trust territory of the United Na ons Organiza on s ll under Bri sh and French rule. As a result of this colonial heritage, both French and English are currently the official languages in Cameroon. In addi on, a large number of local languages are spoken among the more than 200 ethnic groups in the country. Cameroon belongs both to the tropical humid zone and the Sahel zone and is blessed with a wide variety of climates, contours and vegeta on. The outcome is a geographical diversity which offers it a remarkable richness in areas as varied as agriculture, livestock, fishery, forestry, water energy and mines. The produc on of agricultural food crops (corn, cassava, plantain, rice, millet, sorghum, etc.) and cash crops (cocoa, coffee, co on, rubber, banana, pineapple etc.) make the Cameroonian agriculture one of the richest in Central Africa. Cameroon also possesses large reserves of oil and forestry resources. The presence of all these resources argue in favor of an industrial base on which the country could stake its accelerated development. (Con nued on page 3). Editor’s Note Gree ngs. It gives us great pleasure to bring to you the 43rd issue of the Prairie View Interna onal Business Digest, an electronic quarterly newsle er produced by the Center for Interna onal Business Educa on. This issue features three sec ons. In the first ar cle (Cameroon ‐ “Africa in Miniature”), Dr. Louis Ngamassi, a professor of Management Informa on Systems at PVAMU, presents a short narra ve of the geography, history and economy of his na ve country. The second sec on (Latest Trade Sta s cs for U.S. and Texas) presents up‐to‐date merchandise trade sta s cs for the U.S. and Texas for the last five years (2010‐2014). The final sec on highlights current global business/trade news and events. Please note that all URL links are ac ve and you can go directly to a sec on from the table of contents on the first page. We hope you con nue to find this e‐newsle er a valuable channel for important informa on rela ng to interna onal business. We also hope our efforts will inspire greater number of local firms to seek out new global business opportuni es. Should you have any ques ons or sugges ons, please feel free to contact us. Dr. Rahim Quazi Editor Thank you for your support, Rahim Quazi, Ph.D. Editor, Prairie View Interna onal Business Digest Center for Interna onal Business Educa on Prairie View A&M University E‐mail | rmquazi@pvamu.edu A Preview of Things to Come The College of Business will be moving to a brand new loca on on campus in summer 2015 along with the Center for Interna onal Business Educa on. Prairie View Interna onal Business Digest Page 2 Volume 11| Issue 3 Cameroon – “Africa in Miniature” - contributed by Dr. Louis Ngamassi, Assistant Professor, PVAMU College of Business (Con nued from page 1). Foreign Direct Investment in Cameroon Cameroon has always been ac vely seeking to a ract foreign direct investment (FDI) in order to create economic growth and employment. The GDP per capita is currently es mated at USD $2,400. Since the independence of the country in 1960, there has been con nuous effort by the Cameroon government to encourage more foreign direct investment into the country. Over the years, Cameroon enacted a series of laws and regula ons to encourage and boost FDI inflow in the country. Such laws and regula ons include the Investment Code of 1990, amended in 1994; the Patent Rights Act, the Paris Conven on for the Protec on of and promo on of Industrial Property of 1883; and bilateral investment trea es for the protec on and promo on of investments signed in 1966. The enactment of these laws has not yet yielded the expected results. The laws helped Cameroon to a ract more FDI inflow. However, the increased FDI inflow did not generate enough economic growth. Some of the challenges preven ng Cameroon to fully benefit from the FDI inflow include: Transparency of Regulatory System ‐ Bureaucracy and a lack of transparency make business forma on costly and burdensome. Although Cameroonian business laws exist, implementa on of these laws can be challenging. Under the current judicial system, local and foreign investors have found it complicated, me‐consuming, and costly to enforce contractual rights, protect property rights, obtain a fair and expedi ous hearing before the courts, or defend themselves against frivolous lawsuits. Cameroon’s financial, legal and regulatory systems are solid, but enforcement is inconsistent and o en arbitrary. Efficient Capital Markets and Por olio Investments ‐ The cost of capital in Cameroon is high and repayment terms are short. Some large lenders to major companies have been able to extend the term beyond five years. Corrup on ‐ Corrup on is endemic in Cameroon, which consistently ranks as one of the most corrupt countries according to Transparency Interna onal’s Corrup on Percep ons Index (h p://www.transparency.org/country). _______________________________________ Sources: Akwaowo, E. (2013) “Exploring Foreign Direct Investments in Developing African Countries: Their Effects on the Economic Growth in Cameroon (2006‐2011)”. iBusiness, 2013, Vol. 5(1), 18‐35. Cameroon, The World Factbook, CIA (h ps://www.cia.gov/library/publica ons/the‐world‐factbook/geos/cm.html). Kum, E. B. (2009) “A Study on Foreign Direct Investment in Cameroon.” MBA Thesis submi ed to KDI School of Public Policy and Management. Prairie View Interna onal Business Digest Page 3 Volume 11| Issue 3 Latest Trade Sta s cs for U.S. and Texas The tables below show selected merchandise trade sta s cs for the U.S. and Texas for the last five years (2010‐2014). These data were collected from the website of the Office of Trade and Industry Informa on (OTII), Manufacturing and Services, Interna onal Trade Administra on, U.S. Department of Commerce (h p://tse.export.gov). Table 1: Total U.S. Merchandise Exports and Top 5 Export Items (Billions of $) Item Total Exports 1. Transporta on Equipment 2. Computer & Electronic Products 3. Chemicals 4. Machinery, Except Electrical 5. Petroleum & Coal Products 2010 1,278.49 190.89 190.44 179.50 137.80 61.44 2011 1,482.51 210.28 198.04 197.47 150.92 101.93 2012 1,545.70 241.38 203.15 197.54 159.59 111.15 2013 1,579.59 258.25 204.68 199.43 150.17 119.61 2014 1,623.44 273.02 208.97 200.11 152.15 118.54 Table 2: Top 5 Merchandise Export Markets for the U.S. (Billions of $) Partner 1. Canada 2. Mexico 3. China 4. Japan 5. U.K. 2010 249.26 163.66 91.91 60.47 48.41 2011 281.29 198.29 104.12 65.80 56.03 2012 292.65 215.91 110.52 69.96 54.86 2013 301.61 226.08 121.74 65.21 47.35 2014 312.13 240.33 124.02 66.96 53.87 Table 3: Total U.S. Merchandise Imports and Top 5 Import Items (Billions of $) Item Total Imports 1. Computer & Electronic Products 2. Transporta on Equipment 3. Oil & Gas 4. Chemicals 5. Machinery, Except Electrical 2010 1,913.86 325.05 241.17 280.20 176.33 105.56 2011 2,207.95 335.50 271.31 353.11 201.85 138.36 2012 2,276.30 347.79 318.04 326.73 197.91 151.26 2013 2,268.32 351.37 334.10 286.29 195.44 146.85 2014 2,345.19 366.10 355.76 261.57 205.84 160.67 Table 4: Top 5 Merchandise Import Partners for the U.S. (Billions of $) Partner 1. China 2. Canada 3. Mexico 4. Japan 5. Germany 2010 364.95 277.64 229.99 120.55 82.45 2011 399.37 315.32 262.87 128.93 98.68 2012 425.63 324.26 277.59 146.44 109.23 2013 440.45 332.55 280.53 138.57 114.34 2014 466.66 346.06 294.16 133.94 123.18 (Con nued on page 5). Prairie View Interna onal Business Digest Page 4 Volume 11| Issue 3 Latest Trade Sta s cs for U.S. and Texas (Con nued from page 4). Table 5: Total U.S. Merchandise Trade Balance (Billions of $) Partner World Total 2010 2011 2012 2013 ‐635.36 ‐725.45 ‐730.60 ‐688.73 U.S. Merchandise Trade Surplus: Top 5 Partners 2014 ‐721.74 1. Hong Kong 2. Netherlands 3. U.A.E Emirates 4. Australia 5. Singapore 22.27 31.99 32.01 36.66 15.68 18.77 18.36 23.34 10.52 13.48 20.31 22.15 13.22 17.38 21.59 16.86 11.58 12.17 10.29 12.83 U.S. Merchandise Trade Deficit: Top 5 Partners ‐273.04 ‐295.25 ‐315.11 ‐318.71 ‐34.30 ‐49.39 ‐60.43 ‐66.98 ‐60.08 ‐63.13 ‐76.47 ‐73.37 ‐66.32 ‐64.58 ‐61.69 ‐54.45 ‐28.38 ‐34.03 ‐31.61 ‐30.94 35.08 22.86 19.31 16.00 14.07 1. China 2. Germany 3. Japan 4. Mexico 5. Canada ‐342.63 ‐73.74 ‐66.97 ‐53.83 ‐33.94 Table 6: Top 5 U.S. Merchandise Expor ng States (Billions of $) 2010 1,278.49 206.99 143.21 53.35 69.68 50.06 U.S. Total 1. Texas 2. California 3. Washington 4. New York 5. Illinois 2011 1,482.51 251.10 159.42 64.80 85.00 64.90 2012 1,545.70 264.67 161.75 75.66 81.34 68.16 2013 1,579.59 279.49 168.04 81.64 86.52 66.09 2014 1,623.44 289.02 174.13 90.65 86.01 68.18 Table 7: Total Merchandise Exports and Top 5 Export Items from Texas (Billions of $) World Total 1. Petroleum & Coal Products 2. Computer & Elec. Products 3. Chemicals 4. Machinery, Except Electrical 5. Transporta on Equipment 2010 206.99 33.06 39.25 38.86 26.38 18.72 2011 251.10 51.84 42.17 46.65 27.54 21.91 2012 264.67 56.88 45.13 46.96 29.44 25.10 2013 279.49 60.61 48.17 47.87 29.96 24.40 2014 289.02 59.09 46.61 46.11 29.86 23.25 Table 8: Top 5 Merchandise Export Markets for Texas (Billions of $) Partner 1. Mexico 2. Canada 3. Brazil 4. China 5. Netherlands Prairie View Interna onal Business Digest 2010 72.69 18.76 7.15 10.27 5.92 2011 87.19 22.12 10.06 10.95 8.82 Page 5 2012 94.44 23.86 10.04 10.30 9.60 2013 100.92 26.08 10.86 10.85 9.55 2014 102.63 31.12 11.76 10.99 8.91 Volume 11| Issue 3 Global Trade & Business: Current News and Events Export Earnings Hit New Record: Total U.S. export earnings reached $2.35 trillion in 2014, se ng a new record. Merchandise exports from Texas also hit a record high at $289 billion. Doing Business 2015, Going Beyond Efficiency The World Bank has recently released this annual report on business regula ons in 189 economies across the world. Explore Africa Business Opportuni es Webinar Series: Cost ‐ $40 each session April 1, Angola and Mozambique: Record Growth From Port to Port April 15, Ethiopia: Looking Ahead to Growth and Transforma on April 29, Nigeria: Export Opportuni es in the “Giant of Africa” Asia/Pacific Business Outlook Conference, April 13‐14, Los Angeles, CA This is a premier conference for exporters and investors targe ng Asian markets. Texas EU Business Summit, April 22‐23, Aus n, TX This is a premier event for Texas businesses, entrepreneurs and economic development professionals seeking to expand their footprints in Europe. Discover Global Markets: The Americas, May 12‐14, Miami, FL Senior U.S. diplomats and business leaders will discuss new market opportuni es and effec ve business strategies in the region. Export News from Tradeology (Interna onal Trade Administra on Blog) A Record Year for American Exports, Further Proof of American Greatness African Ambassadors Make the Case for U.S. Companies to Do Business in Africa U.S. Manufacturing A racts Foreign Investment How Trade Stats Can Help US Businesses Expand Abroad U.S.‐China Rela ons: Great for TV, but Greater for the U.S. Economy Sources: Export News, U.S. Export Assistance Center, Houston Export News, U.S. Export Assistance Center, Aus n Tradeology, Interna onal Trade Administra on Blog Prairie View Interna onal Business Digest Page 6 Volume 11| Issue 3 Next Issue Available: June 2015 If you would like to receive an electronic version of this newsle er, contact Dr. Rahim Quazi at 936‐261‐9225 or rmquazi@pvamu.edu Visit our website! PVAMU College of Business | www.pvamu.edu/business or CIBE |h p://www.pvamu.edu/business/alumni‐friends/center‐for‐interna onal‐ business‐educa on/ PVAMU College of Business Vision and Mission Statements Vision Statement Our vision is to empower students from diverse backgrounds to become produc ve and ethical business professionals who are among the best in the world. Mission Statement We provide a diverse student body with an educa on that creates highly produc ve professionals who are ethical, entrepreneurial, and prepared to succeed in the global economy. The College achieves this through excellence in teaching, research and service, and engagement with the business community and other stakeholders. The student experience is dis nguished by personal a en on, teamwork, leadership training, and apprecia on of the social responsibility of business.