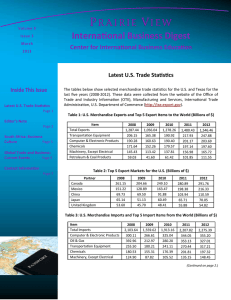

International Business Digest Latest U.S. Merchandise Trade Sta s cs

advertisement

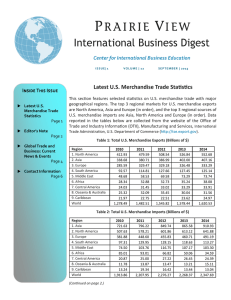

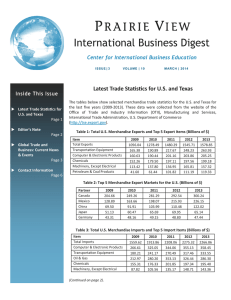

International Business Digest Center for International Business Education ISS UE | 1 VOLUM E | 11 S E P T E M B E R | 2 01 4 Latest U.S. Merchandise Trade Sta s cs Latest U.S. Merchandise Trade Sta s cs Page 1 Editor’s Note Page 2 This sec on features selected sta s cs on U.S. merchandise trade with major geographical regions. The top 3 markets for U.S. merchandise exports are North America, Asia and Europe (in order), and the top 3 sources of U.S. merchandise imports are Asia, North America and Europe (in order). Data reported in the tables below are collected from the website of the Office of Trade and Industry Informa on (OTII), Manufacturing and Services, Interna onal Trade Administra on, U.S. Department of Commerce (h p://tse.export.gov). Table 1: Total U.S. Merchandise Exports (Billions of $) Global Trade and Business: Current News & Events Page 3 Contact Informa on Page 6 Region 1. North America 2. Asia 3. Europe 4. South America 5. Middle East 6. Africa 7. Central America 8. Oceania & Australia 9. Caribbean World 2009 333.56 263.09 258.06 71.83 44.8 24.33 19.22 22.42 18.5 1,056.04 2010 412.93 338.68 285.59 92.57 48.68 28.34 24.03 25.32 21.97 1,278.49 2011 479.59 380.71 329.47 114.81 58.53 32.88 31.45 32.09 22.75 1,482.51 2012 508.57 386.96 329.19 127.69 69.58 32.73 33.03 35.44 22.51 1,545.70 2013 527.71 402.08 326.73 127.49 73.28 35.18 33.29 30.04 23.62 1,579.59 Table 2: Total U.S. Merchandise Imports (Billions of $) Region 1. Asia 2. North America 3. Europe 4. South America 5. Middle East 6. Africa 7. Central America 8. Caribbean 9. Oceania & Australia World (Con nued on page 2). 2009 585.47 402.91 331.22 79.91 58.6 62.4 15.91 12.28 10.92 1,559.62 2010 721.63 507.63 381.88 97.31 74.5 85.01 20.87 13.24 11.78 1,913.86 2011 796.22 578.21 448.6 129.95 103.76 93.01 25.0 19.34 13.87 2,207.95 2012 849.76 601.86 455.85 128.15 116.75 66.82 27.22 16.42 13.47 2,276.30 2013 865.59 613.09 460.66 118.63 107.19 50.06 26.45 13.43 13.21 2,268.32 Editor’s Note Gree ngs. It gives us great pleasure to bring to you the 41st issue of the Prairie View Interna onal Business Digest, an electronic quarterly newsle er produced by the Center for Interna onal Business Educa on. This issue features two sec ons. The first sec on (Latest U.S. Merchandise Trade Sta s cs) presents up‐to‐date sta s cs on U.S. merchandise trade with major geographical regions. The second sec on highlights current global business/trade news and events. Please note that all URL links are ac ve and you can go directly to a sec on from the Table of Contents on the first page. We hope you con nue to find this e‐newsle er a valuable channel for important informa on rela ng to interna onal business. We believe our efforts will inspire greater number of local firms to seek out new global business opportuni es. Should you have any ques ons or sugges ons, please feel free to contact us. Dr. Rahim Quazi Editor Thank you for your support, Rahim Quazi, Ph.D. Editor, Prairie View Interna onal Business Digest Center for Interna onal Business Educa on Prairie View A&M University E‐mail | rmquazi@pvamu.edu Phone | (936) 261‐9225 Fax| (936) 261‐9226 Latest U.S. Merchandise Trade Sta s cs (Con nued from page 1). Table 3: Top 5 Merchandise Export Markets for the U.S. (Billions of $) Country 1. Canada 2. Mexico 3. China 4. Japan 5. Germany (Con nued on page 5). 2009 204.66 128.89 69.50 51.13 43.31 Prairie View InternaƟonal Business Digest 2010 249.26 163.66 91.91 60.47 48.16 Page 2 2011 281.29 198.29 104.12 65.80 49.29 2012 292.65 215.91 110.52 69.96 48.80 2013 301.61 226.08 121.74 65.21 47.36 Volume 11| Issue 1 Global Trade & Business: Current News and Events Houston Tops the List of U.S. Export Hubs Last year, merchandise exports from 387 U.S. metropolitan areas totaled $1.4 trillion. The top five export hubs are: Houston‐The Woodlands‐Sugar Land ‐ $115.0 billion New York‐Newark‐Jersey City ‐ $106.9 billion Los Angeles‐Long Beach‐Anaheim ‐ $76.3 billion Sea le‐Tacoma‐Bellevue ‐ $56.7 billion Detroit‐Warren‐Dearborn ‐ $53.9 billion Export News from Tradeology (Interna onal Trade Administra on Blog) Plugging Into the Global Marketplace Join SelectUSA in Germany Making the Most of Interna onal Trade Shows Suppor ng the Best Environment for U.S. Exporters Finding “Harmony” in Expor ng U.S. Businesses Succeeding in Africa 4th Houston Shipping and Offshore Conference, October 10 This conference will bring together business execu ves and industry experts to discuss cri cal issues in shipping and offshore industries. Central target groups include representa ves from the interna onal shipping and mari me offshore industries as well as port authori es. The conference will host representa ves from several countries, including Norway, S. Korea, and Brazil. Conference fee: $300. For more informa on, see: h p://www.houstonsoc.com 6th Annual Harris County Interna onal Trade &Transporta on Conference, October 23 Harris County, a robust center of interna onal trade and home to one of the world’s busiest ports, provides a vital and essen al gateway for trade linking North America with interna onal markets. This conference will take a look into the future of trade and transporta on in this region. Registra on fee: $95. For more details, see: h p:// harriscountyevents.net/ Texas Governor’s Small Business Forums in October For more details, see: h p://www.texaswideopenforbusiness.com/small‐business/events.php October 9, 2014 ‐ Waco October 15, 2014 ‐ Dallas October 16, 2014 ‐ Laredo October 17, 2014 ‐ Houston October 21, 2014 ‐ San Antonio October 23, 2014 ‐ San Antonio October 29, 2014 ‐ Arlington (Con nued on page 4). Prairie View InternaƟonal Business Digest Page 3 Volume 11| Issue 1 Global Trade & Business: Current News and Events (Con nued from page 3). 2014 Interna onal Trade Educa on Series (in Aus n) This series of classes is designed to provide the knowledge needed to successfully grow U.S. businesses through interna onal trade. Cost: $35 each class. October 15, 2014 ‐ Understanding Foreign Cultures for Business November 19, 2014 ‐ Introduc on to Imports December 02, 2014 ‐ Essen als of U.S. Export Controls December 03, 2014 ‐ Technology and Encryp on Controls Colombia Texas Chamber of Commerce Trade Mission, November 3‐7 The Colombia Texas Chamber of Commerce is organizing a trade mission to Expo Oil and Gas Colombia 2014. This mission includes full admission to conference sessions; matchmaking mee ngs with key industry players (up to 6); discounted hotel rates; transporta on between hotel and the show, and support prior to and during the show. Par cipa on fee is $2,200 for CTCC members and $2,640 for non‐CTCC members. More details can be found at: h p://www.chamberorganizer.com/Calendar/moreinfo.php?even d=145664 China Energy Efficiency Trade Mission, December 7‐13 China’s 12th Five Year Plan (2011‐2015) calls for a 16% reduc on in the energy intensity of the economy. Consequently, opportuni es abound for U.S. companies to leverage their exper se to generate “megawa s” in China. The focus of this mission is to help U.S. companies (that provide technology and/or services related to energy efficiency) enter/expand into the Chinese market. Total cost is $7,500 (not including airfare, visa or interpreta on service). More details can be found at: h p://chinauseealliance.org/2014mission/ Trade Mission to Kenya, South Africa and Mozambique, February 23‐27, 2015 Kenya, South Africa and Mozambique are inves ng in key sectors. This trade mission will include mee ngs with local businesses, experts and poten al buyers. Cost: South Africa and Mozambique ‐ $3,450 for SMEs and $4,850 for large firms; $1,950 for Kenya. More details can be found at: h p://www.export.gov/trademissions/Africa2015/ Trade Mission to Morocco, Algeria and Egypt, March 4‐12, 2015 The U.S. Department of Commerce is organizing this execu ve‐led business development mission to help U.S. firms in the safety and security industry. The targeted sector for par cipa on is safety and security, including U.S.‐based manufacturers of safety and security equipment, U.S. based providers of safety and security services, and U.S. trade associa ons promo ng U.S. safety and security products and services. Applica on Deadline: January 15, 2015. More details can be found at: h p://www.export.gov/trademissions/safetysecurity2015/ Sources: Export News, U.S. Export Assistance Center, Houston Export News, U.S. Export Assistance Center, Aus n Tradeology, Interna onal Trade Administra on Blog Prairie View InternaƟonal Business Digest Page 4 Volume 11| Issue 1 Latest U.S. Merchandise Trade Sta s cs (Con nued from page 2). Table 4: Top 5 U.S. Merchandise Export Items to Canada (Billions of $) Export Item 1. Transporta on Equipment 2. Machinery, Except Electrical 3. Chemicals 4. Computer and Electronic Products 5. Primary Metal Manufacturing Total Merchandise Exports to Canada 2009 41.01 21.92 23.02 21.21 8.46 204.66 2010 53.77 26.99 26.74 25.63 12.83 249.26 2011 57.45 30.13 29.97 27.75 14.70 281.29 2012 61.54 32.93 29.75 28.71 14.80 292.65 2013 64.32 31.11 30.23 27.99 15.05 301.61 Table 5: Top 5 U.S. Merchandise Export Items to Mexico (Billions of $) Export Item 1. Computer and Electronic Products 2. Transporta on Equipment 3. Chemicals 4. Petroleum & Coal Products 5. Machinery, Except Electrical Total Merchandise Exports to Mexico 2009 24.96 14.35 15.59 6.58 11.87 128.89 2010 32.96 19.61 18.23 11.99 12.98 163.66 2011 35.23 23.87 21.54 20.32 14.73 198.29 2012 36.61 27.76 23.59 20.67 17.72 215.91 2013 38.61 30.07 24.09 19.32 18.85 226.08 Table 6: Top 5 U.S. Merchandise Export Items to China (Billions of $) Export Item 1. Transporta on Equipment 2. Agricultural Products 3. Computer and Electronic Products 4. Chemicals 5. Machinery, Except Electrical Total Merchandise Exports to China 2009 7.49 10.58 12.53 9.71 6.46 69.50 2010 10.62 13.82 15.24 11.80 9.30 91.91 2011 12.30 14.69 13.63 13.59 10.37 104.12 2012 15.09 20.72 13.92 12.94 9.43 110.52 2013 22.55 18.91 16.03 13.90 9.51 121.74 Table 7: Total U.S. Merchandise Trade Balance (Billions of $) Region 1. Oceania & Australia 2. Caribbean 3. South America 4. Central America 5. Africa 6. Middle East 7. North America 8. Europe World 2009 11.49 6.23 ‐8.08 3.31 ‐38.07 ‐13.8 ‐69.35 ‐73.15 ‐503.58 Prairie View InternaƟonal Business Digest 2010 13.54 8.73 ‐4.74 3.16 ‐56.67 ‐25.82 ‐94.7 ‐96.29 ‐635.36 2011 18.22 3.41 ‐15.14 6.46 ‐60.13 ‐45.24 ‐98.62 ‐119.13 ‐725.45 Page 5 2012 21.98 6.09 ‐0.46 5.80 ‐34.08 ‐47.18 ‐93.29 ‐126.66 ‐730.60 2013 16.83 10.19 8.85 6.84 ‐14.89 ‐33.91 ‐85.38 ‐133.94 ‐688.73 Volume 11| Issue 1 Next Issue Available: December 2014 If you would like to receive an electronic version of this newsle er, contact Dr. Rahim Quazi at 936‐261‐9225 or rmquazi@pvamu.edu Visit our website! PVAMU College of Business | www.pvamu.edu/business or CIBE |h p://www.pvamu.edu/business/alumni‐friends/center‐for‐ interna onal‐business‐educa on/ PVAMU College of Business Vision and Mission Statements Vision Statement Our vision is to empower students from diverse backgrounds to become produc ve and ethical business professionals who are among the best in the world. Mission Statement We provide a diverse student body with an educa on that creates highly produc ve professionals who are ethical, entrepreneurial, and prepared to succeed in the global economy. The College achieves this through excellence in teaching, research and service, and engagement with the business community and other stakeholders. The student experience is dis nguished by personal a en on, teamwork, leadership training, and apprecia on of the social responsibility of business.