InternaƟonal Business Digest Center for InternaƟonal Business EducaƟon Inside This Issue

advertisement

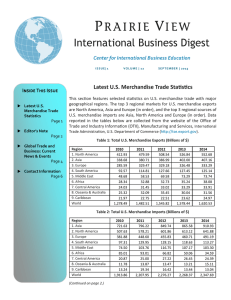

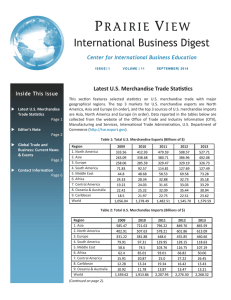

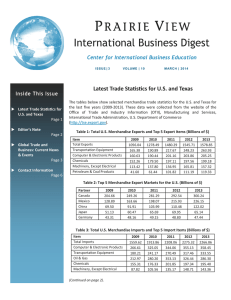

Volume 9 InternaƟonal Business Digest Issue 3 March Center for InternaƟonal Business EducaƟon 2013 Latest U.S. Trade StaƟsƟcs Inside This Issue Latest U.S. Trade StaƟsƟcs Page 1 The tables below show selected merchandise trade sta s cs for the U.S. and Texas for the last five years (2008‐2012). These data were collected from the website of the Office of Trade and Industry Informa on (OTII), Manufacturing and Services, Interna onal Trade Administra on, U.S. Department of Commerce (h p://tse.export.gov). Table 1: U.S. Merchandise Exports and Top 5 Export Items to the World (Billions of $) Editor’s Note Item Total Exports Transporta on Equipment Computer & Electronic Products Chemicals Machinery, Except Electrical Petroleum & Coal Products Page 2 South Africa: Business Culture Page 3 Global Trade and Business: Current Events Page 5 2008 1,287.44 206.15 190.28 171.64 145.43 59.03 2009 1,056.04 165.38 160.63 152.26 113.42 41.60 2010 1,278.26 190.92 190.40 179.57 137.81 61.42 2011 1,480.43 217.93 201.17 197.14 156.98 101.85 2012 1,546.46 247.88 203.69 197.60 165.72 111.55 Contact InformaƟon Table 2: Top 5 Export Markets for the U.S. (Billions of $) Page 7 Partner Canada Mexico China Japan United Kingdom 2008 261.15 151.22 69.73 65.14 53.60 2009 204.66 128.89 69.50 51.13 45.70 2010 249.10 163.47 91.88 60.49 48.41 2011 280.89 198.38 103.94 65.71 55.88 2012 291.76 216.33 110.59 70.05 54.82 Table 3: U.S. Merchandise Imports and Top 5 Import Items from the World (Billions of $) Item Total Imports Computer & Electronic Products Oil & Gas Transporta on Equipment Chemicals Machinery, Except Electrical 2008 2,103.64 300.11 392.96 255.50 180.53 124.90 2009 1,559.62 266.61 212.97 180.21 155.31 87.82 2010 1,913.16 325.04 280.20 241.11 176.39 105.52 2011 2,207.82 344.05 353.13 270.44 201.81 135.15 2012 2,275.39 355.20 327.01 317.21 197.32 148.45 (ConƟnued on page 2.) Editor’s Note Gree ngs. It gives us great pleasure to bring to you the 35th issue of the Prairie View InternaƟonal Business Digest, an electronic quarterly newsle er produced by the Center for Interna onal Business Educa on. This issue features three sec ons. The first sec on (Latest U.S. Trade StaƟsƟcs) presents up‐to‐date merchandise trade sta s cs for the U.S. and Texas for the last five years. The second sec on (South Africa: Business Culture) provides a brief narra ve of the business culture in South Africa, one of the most promising emerging economies in the world. The final sec on highlights current global business/trade news and events. Please note that all URL links are ac ve and you can go directly to an ar cle from the table of contents sec on Dr. Rahim Quazi on the first page. Editor We hope you con nue to find this e‐newsle er a valuable channel for important informa on rela ng to interna onal business. We do hope our efforts will inspire greater number of local firms to seek out new global business opportuni es. Should you have any ques ons or sugges ons, please feel free to contact us. Thank you for your support. Rahim Quazi, Ph.D. Editor, Prairie View InternaƟonal Business Digest Prairie View A&M University ‐ College of Business E‐mail: rmquazi@pvamu.edu Phone: (936) 261‐9225 Fax: (936) 261‐9226 Latest U.S. Trade Sta s cs (ConƟnued from page 2.) Table 4: Top 5 U.S. Expor ng States (Billions of $) U.S. Total Texas California New York Washington Illinois 2008 1,287.44 192.22 144.81 81.39 54.50 53.68 2009 1,056.04 162.99 120.08 58.74 51.85 41.63 2010 1,278.26 206.96 143.19 69.70 53.35 50.06 2011 1,480.43 251.01 159.12 84.89 64.77 64.82 2012 1,546.46 265.35 161.70 79.19 75.52 68.03 (ConƟnued on page 6.) Prairie View Interna onal Business Digest Page 2 Volume 9 Issue 3 South Africa: Business Culture Local Time: The standard me in South Africa is two hours ahead of Greenwich Mean Time and seven hours ahead of Eastern Standard Time/six hours ahead of Eastern Daylight Time throughout the year. Clocks are not advanced in summer. Normal Business Hours: Generally, business hours are weekdays 8:00 am‐1:00 pm and 2:00‐4:30 pm. Most offices observe a five‐day week, but most shops are also open on Saturdays from 8:30 am to 1:00 pm. Malls are generally open from 9:00 am to 9:00 pm. The banking hours are weekdays 9:00 am‐3:30 pm, and Saturdays 8:30 am‐11:00 am. Business Dress Code: The business dress code is mainly western. For a business mee ng, it is safer to wear more conserva ve clothes. Men can’t go wrong with a collar and e. Ladies should not wear short skirts and open blouses. A well pressed suit with a collar blouse and high heels should suffice. In the South African Muslim culture, men may wear fez or a white skull cap. Muslim women’s dress is modern, but their heads are usually covered in public. Handshakes: In the urban business environment, the western handshake is more common. The handshake is firm and eye contact is maintained. The tradi onal African handshake is a so , finger p handshake for friendliness. Both men and women may touch their elbow with the other hand, and women may bend their knees to show respect. The Muslim culture usually has a so western style handshake. Tradi onally a man should not extend his hands out to a Muslim woman, but a woman can do so with a man. The Hindu culture has also adopted the western style handshake. The tradi onal Hindu women may greet guests by pu ng the palms of their hands together with a slight bow (Namaste), instead of a handshake. Gree ng and Mee ng: At business mee ngs or network func ons, it is wise to have business cards readily available. Informa on on company deals, finances, etc. should be treated as confiden al. South Africans are generally very casual in their business dealings, and as such deals should not be rushed. In the tradi onal South African culture, it is customary to greet everyone at a mee ng and respect those in authority. People may at mes speak loudly as a gesture that there are no secrets between them. African men tradi onally remain seated when being introduced. In the white South African culture, comple ng a task on me is o en considered more important than social nice es. Gree ngs between strangers are polite, but reserved. There is not much small talk in business mee ngs. In the Muslim South African culture, conversa ons are generally quieter. It is customary not to schedule business mee ngs during prayer mes (par cularly on Fridays) or to interrupt prayers. (ConƟnued on page 4.) Prairie View Interna onal Business Digest Page 3 Volume 9 Issue 3 South Africa: Business Culture (ConƟnued from page 3.) Level of Formality: When dealing with a company, ensure that they know your status in terms of the hierarchy in your company, and in return ensure that you understand the status of the people you are dealing with as well. You can hand over a business card when mee ng for the first me. Understanding the hierarchy of a company will help you make the most of the communica on and decision‐making processes. To bypass a level of seniority in order to get a decision passed is generally unacceptable. Gi Giving: A er developing a good business rela onship, it is a good idea to present small gi s to business associates or their families. Personalized gi s like desk accessories or a high quality pen are a good idea for a gi . You should always arrive at a dinner party with a gi , such as flowers, chocolates or a bo le of wine. Larger organiza ons will offer to send a driver to your hotel to pick you up or take you back a erwards. You are not required to p the driver, but a small gi , such as a company pen, will be appreciated. Conferences, Bosberade and Workshops: Conferences are o en held at the end of the financial year. The objec ve is to discuss new products/services, as well as the performance for the year and upcoming company goals. “Bosberade” is Afrikaans for “a counsel in the bush,” and literally involves a specific group of people spending me together in a rural se ng, such as a wildlife retreat. This is very popular among senior business managers/execu ves who break away from office to discuss strategies and other important issues. Workshops have a short dura on and are usually held onsite, rather than away from the company. Tipping: Giving a 10‐15% gratuity is customary, although it also depends on the quality of service. The hotel recep onist/concierge should be asked about the going rate. It is customary to p people who provide any type of service, such as Bellhops, delivery people, tour guides, gas sta on a endants, people who look a er parked cars in public places/malls, and shu le bus drivers at airports if they help with bags. Vaca on Times: The most popular vaca on mes are over Christmas and Easter. South Africa’s school vaca on calendar o en influences business ac vi es, as families go away at these mes for their annual holiday. Schools in the coastal and inland provinces close on slightly different dates. The majority of retail businesses are usually open on public holidays, except on Christmas Day and Day of Goodwill (December 26th). Most other businesses shut down between mid‐December to mid‐January. Since Johannesburg has a sizeable Jewish community, business travelers should carefully plan their ac vi es there during the week before Easter and major Jewish holidays. Sources: South Africa: Culture, h p://globaledge.msu.edu South Africa, h p://www.execu veplanet.com/ Prairie View Interna onal Business Digest Page 4 Volume 9 Issue 3 Global Trade & Business: Current News and Events 2012 Texas Merchandise Exports Up Merchandise exports from Texas increased 6% in 2012 to a record high of $265.4 billion (up from $251 billion in 2011). Total merchandise and service exports from the U.S. also reached an all‐ me high at $2.2 trillion in 2012 suppor ng nearly 10 million American jobs. More details can be found at: h p://www.trade.gov/mas/ian/statereports/. China 2013 Business Handbook The U.S. Commercial Service in China has recently published this resource guide for U.S. firms. See: h p://www.export.gov/china. Petroleum Exhibi on and Conference of Mexico 2013: April 9‐11, Villahermosa, Mexico The annual interna onal gathering for Mexico’s oil industry is cer fied by the U.S. Commercial Service and expected to draw more than 3,000 par cipants. See: h p://www.PECOMexpo.com. Business Trade Mission to Turkey: April 13‐20, Turkey The City of Houston, Greater Houston Partnership, and Texas‐Turkish American Chamber of Commerce are jointly organizing a trade mission to Turkey. City officials will join business leaders on the trip to explore poten al trade and investment opportuni es. Delegates will meet with high‐level representa ves of Turkish Ministries, government officials, and top Turkish businesses. Texas’s merchandise export earnings from Turkey were $2.6 billion in 2012. ACCESS 2013 ‐ Interna onal Trade Forum: May 1‐2, San Diego, CA Senior commercial officers and trade specialists from the U.S. Department of Commerce will help iden fy new export markets and develop market entry strategies in Africa, Middle East, and South Asia. Registra on details available at: h p://export.gov/california/sandiego/index.asp. Trade Winds Asia 2013 Conference and Trade Mission: May 9‐17, East Asia This trade mission will provide opportuni es to conduct business‐to‐business mee ngs with firms in S. Korea, Japan, Taiwan, Hong Kong and the Philippines. More details are available at: h p://export.gov/pennsylvania/tradewinds/. Informa on about a $700 subsidy is available at: h p://www.export.gov/fedex. Gas & Oil Expo North America 2013: June 11‐13, Calgary, Canada This is Canada’s largest energy event with expected a endance by 20,000+ registered professionals and 500 exhibi ng companies. Register at: h p://gasandoilexpo.com/registra on/. Sources: Houston Export News, U.S. Export Assistance Center, Houston InternaƟonal NewsleƩer, Mayor's Office of Interna onal Trade and Development, City of Houston Prairie View Interna onal Business Digest Page 5 Volume 9 Issue 3 Latest U.S. Trade Sta s cs (ConƟnued from page 2.) Table 5: Top 5 Import Partners for the U.S. (Billions of $) Partner China Canada Mexico Japan Germany 2008 337.77 339.49 215.94 139.26 97.50 2009 296.37 226.25 176.65 95.80 71.50 2010 364.94 277.65 229.91 120.55 82.43 2011 399.36 315.35 262.86 128.92 98.66 2012 425.64 324.25 277.65 146.39 108.52 Table 6: U.S. Merchandise Trade Balance (Billions of $) Partner 2008 World Total ‐816.20 U.S. Trade Surplus: Top 5 Partners Hong Kong 15.02 Australia 11.63 United Arab Emirates 13.13 Netherlands 18.60 Belgium 11.60 U.S. Trade Deficit: Top 5 Partners China ‐268.04 Japan ‐74.12 Mexico ‐64.72 Germany ‐42.99 Saudi Arabia ‐42.26 2009 ‐503.58 2010 ‐634.90 2011 ‐727.39 2012 ‐728.94 17.48 11.59 10.71 16.14 7.78 22.27 13.21 10.53 15.88 9.90 32.05 17.30 13.46 18.90 12.47 32.04 21.67 20.33 18.39 12.07 ‐226.88 ‐44.67 ‐47.76 ‐28.19 ‐11.26 ‐273.06 ‐60.06 ‐66.43 ‐34.27 ‐19.86 ‐295.42 ‐63.22 ‐64.49 ‐49.51 ‐33.65 ‐315.05 ‐76.34 ‐61.32 ‐59.74 ‐37.55 Table 7: Merchandise Exports and Top 5 Export Items from Texas (Billions of $) World Total Petroleum & Coal Products Chemicals Computer and Electronic Products Machinery, Except Electrical Transporta on Equipment 2008 192.22 25.32 38.38 35.21 27.27 16.92 2009 162.99 21.33 31.02 32.05 23.77 14.40 2010 206.96 33.07 38.86 39.23 26.38 18.71 2011 251.01 51.72 46.62 42.08 27.55 22.10 2012 265.35 57.25 46.99 45.25 29.43 25.21 Table 8: Top 5 Export Markets for Texas (Billions of $) Partner Mexico Canada China Brazil Netherlands 2008 62.09 19.38 8.42 5.96 7.06 Prairie View Interna onal Business Digest 2009 56.04 13.80 8.91 5.04 6.06 Page 6 2010 72.63 18.76 10.28 7.16 5.92 2011 87.39 22.12 10.93 10.06 8.80 2012 94.80 23.72 10.33 10.01 9.48 Volume 9 Issue 3 PVAMU College of Business Vision and Mission Statements Vision Statement: Our vision is to empower students from diverse backgrounds to become produc ve and ethical business professionals who are among the best in the world. Mission Statement: We provide a diverse student body with an educa on that creates highly produc ve professionals who are ethical, entrepreneurial, and prepared to succeed in the global economy. The College achieves this through excellence in teaching, research and service, and engagement with the business community and other stakeholders. The student experience is dis nguished by personal a en on, teamwork, leadership training, and apprecia on of the social responsibility of business. Prairie View A&M University College of Business P.O. Box 519; MS 2300 Prairie View, TX 77446 Next Issue ‐ June 2013 If you would like to receive an electronic version of this newsle er, please contact Dr. Rahim Quazi in the College of Business at 936‐261‐9225 or rmquazi@pvamu.edu Visit our website! www.pvamu.edu/business or www.pvamu.edu/pages/4478.asp