Document 11949928

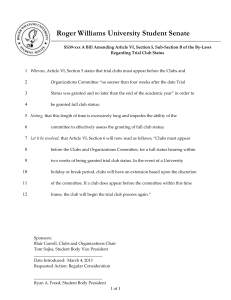

advertisement