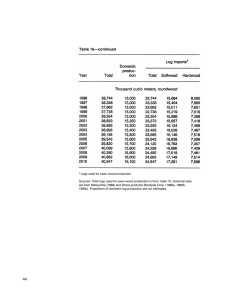

CHAPTER PROJECTED TIMBER DEMANDISUPPLY RELATIONSHIPS 7.

advertisement