docx - The European Timber Trade Federation

advertisement

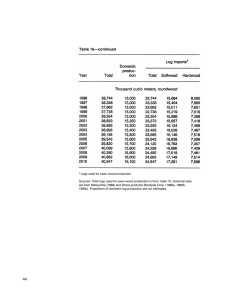

Press release ISC 2015 Amsterdam Softwood battles through headwinds back to growth The consensus at the International Softwood Conference was that the industry is still dealing with the consequences of global recession in many areas. The international speaker line-up at the recent Amsterdam event highlighted different countries emerging from downturn at different rates. The industry was also coping with market shifts triggered, or accentuated by the crisis, most significantly Asia, and notably China’s rising influence. However opportunities were also identified in evolving trading patterns, the global move towards sustainable, low-carbon ‘bio economics’ and particularly the drive to green building. Another positive highlighted was increased desire for forest products sector cooperation, especially in communication. The ISC itself was also judged a success. Held in the historic Koepelkerk and co-organised by the European Timber Trade Federation (ETTF) and European Organisation of Sawmill Industries (EOS), with the Netherlands Timber Trade Association as national hosts, it attracted 140 delegates, with nearly 200 at a spectacular gala dinner in the Rijksmuseum. The opening global market presentation from analyst Rupert Oliver of Forest Industries Intelligence clearly showed an industry in overall recovery. “Total softwood trade increased from 275 million m3 in 2010 to 315 million m3 in 2014, with consumption up from 272 million m3 to 313 million m3,” he said. “That’s a significant rebound.” Within these figures the key development was China’s growth. Europe remained the world’s top softwood producer, with 2014 output of 101 million m3, followed by the US and Russia, on 95.7 million m3 and 36 million m3. But Chinese production expanded fastest, from 15.2 million m3 in 2010 to 28.8 million m3 in 2014. Its consumption also nearly doubled to 47.3 million m3. EOS President Sampsa Auvinen acknowledged the worst of the recession was over, but described recovery, notably in Europe, as a ‘roller coaster of market ups and downs’. There were also now concerns about European softwood output outstripping consumption, despite talk of an EOS country reduction to 79.6 million m3 this year. European mills also faced the challenge of becoming more responsive to demand fluctuation in order to service more volatile, developing markets worldwide. With European end-user industry confidence levels still varying widely, ETTF President Andreas von Möller agreed producers must treat markets individually and be sensitive to over-production risk. Marc Brinkmeyer, Chief Executive of Idaho Forest Group, said the US and Canadian softwood sectors also faced ‘headwinds’. But underlying trends were positive, with US annual housing starts back over 1 million and lumber demand forecast to hit 53 billion board feet in 2017, against 42 billion last year. According to Ilim Timber’s Sviatoslav Bychkov, the Russian softwood sector was on an upward track too, having adapted to log export curbs, sanctions and the ruble’s volatility. Sawn exports rose 5.4% to 21 million m3 in 2014, with 22 million m3 forecast this year. Naohiro “Bob” Iwami, of Interfor Japan, also said prospects for the 28-million m3 Japanese softwood lumber market were healthy. He acknowledged government aims to increase timber self-sufficiency. “But efforts to increase overall consumption create opportunities for imports too,” he said. Reviewing prospects in Morocco, Algeria, Libya and Tunisia and the wider Middle East and North African (MENA) region, Guillaume Hotelin of Comarbois and Jan Gustaf Roempke of ARA Timber accepted the softwood sector faced major obstacles, from conflict, to lack of credit. But they also highlighted opportunities in MENA markets, which have a combined population over 400 million currently import 10 million m3 of softwood a year, mostly Nordic/European and Russian, and typically have growth rates over 3%. They also flagged up opportunities in post-sanction Iran. The ISC featured presenters from ‘sister’ forest products industries too, Marco Mensink, Director General of the Confederation of European Paper Industries, and Marc Michielsen, CEI-Bois President and Executive Director of European pallet sector federation FEFPEB. They saw market challenges and opportunities ahead, and potential for wider forest products sector marketing and lobbying alliances. Otto Bosch, consultant to the European Wood Network, also told delegates about developments in the Wood Toolbox, the ETTF- and EOS-backed online timber marketing material resource. The possibilities for using latest wood construction case studies to excite market interest were underlined by Ole Herbrand Kleppe, Chief Project Manager of Bob Real Estate Development, in his presentation on Norway’s Treet building. This 14-storey Bergen block is the world’s new tallest timber building and, said Mr Kleppe, its engineered wood and timber module design could pose serious commercial competition for steel and concrete construction – and stores 2000 tonnes of CO2. The next ISC takes place in Paris in 2016. Note for editors: I case of any questions please contact Paul van den Heuvel (Royal NTTA) tel: +31(0)-36-5321020 / +31-(0)-6-20133945 or André de Boer (ETTF) tel: +31-(0)-36-5321020 or Silvia Melegari (EOS) tel: +32 2 5562585. *****