Document 11731308

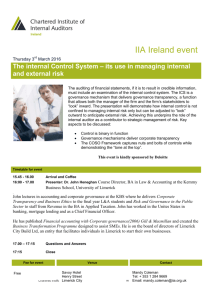

advertisement