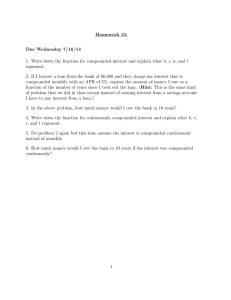

Chapter 5 Handouts and Study Guides RMbrtiL oh,c

advertisement

-i•o

1

oh,c

-

RMbrtiL

Chapter 5

Handouts and Study Guides

4

2:

6S pLc

3:60

.

b

j:

,•

S

Mathematics of Finance

_-

rctp

7

Part 1: “Leave it Alone” Finances: Compound and Simple Interest — C#ki- -Firs -I- CjVOkp 6V\€

‘Description: 73-z. for,

.-JaS

3

ti:

S L4A

d( df LA/Lt+ j tLLk

4

SLAJ1I) c U”4v

s-I

-

Three Scenarios:

(1) Simple Interest:

f

÷

5cer7ttflC A ivp

(a)

Is

ivv’e-fr ctf

cuE

iti

f2eAf

oi

swi

(b)

-H’iQ +1 -yi,

-

(c) Equation.

S—P+t(Fi )_P(l+it)

-

(d) Variables:

-‘-2

•

-I-

•

•

•

S=1 CCC2LV vaJ C4A tirvL

p=rt:k Prnc42cI1 aP-OUM7f_

-e--t

t —t%iL flU

a4’ t4’ie I

r= 4-”-Q. Y’vvw’& 1luLe4 iZ(zIf..

(e) Types of Questions:

I

,c

-(

L-W4- I

(2) Compound Interest:

/

tOU

k-he

a

4

J

L

)

*

-frj

t

1

€

4

Vt

a4- -I- j-iQ / flci/tL(

bQd

#I Ut

a. ty5u,vt.

w4 vaJ-L- t’t

• s=

—t-Le, a a

.

P=

ti-’e priv-iu,pLL-

•

ttj4J 1’W/VtM4’ D

•

rU’

4

4VWUj

t41€4’f

tiyv,

7Lh /w,vip sW’h Is Iiivec(

7jP

-

(e) Types of Questions:

tu’

t’i’-

:i

n=1?

)

uitkc

‘

-tk,

12

((d) Variables:

ç

/psrk1

S=P(l+L)

(c) Equation:

)

V&A..&C-

ttY

IS

L1.e.&iX)

?

/1 £IW4

JJ4L

(b)

,

k’/€

1

(a) SCCUV

7

-eRQc--f

1L”-e- IJ’14-ittf

i

-‘

(vtfeP4

L1fr-

£

1 aC

—

7

C’

(3) Continuously Compounded Interest:

&L.4h1

I

-

L

,okcl

%ia

‘-iafp1c

from

(c) Where does “e” come

AJ44f

vhgti1

(a)SCfl1r0d’

4- V

I, o k Ctf

-

4 bcf.-*Q-

,

1

cdJa4-

S=Penr

(d) Equation:

(e) Variables:

-U’v

•

s

•

p=t’&Q

•

t

=

•

r

=

QM

(Yl1L(

c&VL#-iVU4vL45/fj

(-44(1- F fk’e

Co’fO1*44 1-LVI(.€.

4

/

4

(b)1

P

tf1

15

cowL-po

-I-o

r,4w4 4

-t, j

Ut

r

-1-i YV€

t

VtL&

1Ct DCtA/t

u-e

-

fcf-L-wl4c 2

’E Ol y.,wO-vFJ

1

Lvn-f OL..-kj4

f-t’L4L.

b€-h(-V4

f-V?ncLpLL

-bte -w’-I-’

qa-i-s

-‘lA

ve-

in

tiôI

flLA

—7%q

-6

(f Types of Questions:

LAha

-t i—a

c- ei

i

i4

acc-a c)

APY: What if we want to compare the total interest earned across multiple investment methods?

(1) Simple Interest:

APY=r

(2) Periodic Compounding Interest:

APY =( l+L)_l

II

(3) Continuously Compounding Interest:

APY =

—

1

APY is the percent increase in your account over 1 year.

i.e. the simple interest rate necessary to earn the amount of interest

‘uppbc

V

R-71odcaIc9

j-C,/j

opaJLe

(A)O-’Vt

& -j pe

(O&WLQC

/

-

I2t

4€

ifre,

D

vLa

—rj

c

/ pL

iri&j

v&zt

I (e1aesi

(S ‘p

t

i&’1J

Example 1: Given that we hwest $10,000 for four years at a annual interest rate of 7.5%

+1

r1

(a) If i4i interest, how much interest will we receive at the end of the four year period?

What will the account value be?

iyw-I t-t)

41 c4A21L

(+-rh

2

S

C4)YIt)iTVD(1

‘

÷1

r€E.SfDSC4)_P

-I.’

I :3

,

—/0,000

(b) If the interest is/compounded twice

what will the account be worth? How much

interest will we rëëie at thof th four year period

O5\

s+)fff*)

41JD7

VcLnd,&

I

L3 44HI-E’

LCnv

z /0, 89-’D

2

t

DO5

—

P

4I— (0) DoO

474f

23

Example 2: Man’ borrowed $3,000 at an interest rate of 18%. How much interest is due in 65 weeks if

(a) IfitiE1interest()

4ICL1lQki’

5

sC1crooC1+

l2

-a-- I,2S

t-c1/5)-P

.

•

b)if interest is compounded

•••

••

For--14’ cbI-) ftJi

,r

,AAILIloVrl ri 4

cr1:

—

-

:Z

Ca1(-UAt±tOv

GI

-3

1.25

c(I)2)—P

(c) If the interest is compounded continuously

-4

1

Ernv(t

st)

.5

_r4

-it VdL

CiIcthQ/V

V: O 1

r

-/ -zL25

+

I

sL’ 2T)

eDe-t-

o.rft26)

Ovo€

SLI.25)

=

cfl

—&o--Q

+

I

M

1L I_jW

J

E

Example 3: Assume that we invest $6,000 at 5% annual interest

I0

(a) If it’4simpl interest, howJoig will it take to double the value ofthe investment?

a: s&f) P(i+y-)

Le; c2(L,Doo) /2

rz

0

-

()4

::Il.t.

ry.uiih, how long will it take to double in value?

t’/#) P(i÷.y

i(

iaJ

:;•

(i4+Iki

L

0

r’

(Z

L,MkVW-LA4’1

(1-i jj

0.05

(1 +

c

)L2.zL

-zv

Th-o

r-/2

&oa2

-t)

o

5

1

I

1

I

4(12

VLtf1VW’1

(b) If the interest isJuie

•+ I For

OEt?

12-

\‘z-

.)

I a-é ,t (i

#

.o\

take

to de in e?

(c) If the interest is compounded continuously, how long will it

+I11(’

4-

•(4)

!2

‘I(I

Vu’A,b’

s

&z-vl2)

P l2&°

-

-:

.05-L

btO

41

ScIZe-

1

&1-3Pe’

j2OerO

c)

4 (z)

e

(e

(z)- ,O-

-

lMAkr&Wfr9

£&1

-

)

I

O5

e do you need to invest now in order to retire with 2 000,000 in 4 years if

Ec”mple 4..Hrnv nm

0/ 7

What if we have 45 years?

moneypounds_monthjjat 8/0.

‘

[5

-r

ForI4ç

_c

r

+1

Wv,fr—k€’

-

D-- 0) UV V

IA4/t

ti

+]

:

cv

1

O

O2Q

P()

j2-J

OrI-D

I—

(i+

4J

-L 4

Cp’-

£45

Ep1d9

C4/ct1tth kt — tV

‘

1

_p

cFD0,

O

—

4

L1

• r’

\i21

7)

.a!))21

.1-I

[Iv pf(J

Example 5:

(a) Find the value of an accouiit after 3 years if it’sompounded continuous and we originally

invested 00 at an interest rate of 10%. ‘q

iv (3)

rvi Ia

CV €-

-11 VoWLe t(

yr

.

5k’

i

23)

5

:: 5)O

(b) What interest rate must we find if we want to invest the same $5,000 in ontinuo

coeacifor3 years and have a future value of at least $7,000.

C(i)O

4111’1tAfj

s—

r-

ç)

Van4A2Le4

-

::

5ca7v

e

r(3)

OLDO

50U V

?r) j(-3r

tkA4J47i(4”1

—s

rD

Example 6: Which is a befter investment deal?

r

i

i.

2 ¶7j

(a) An account earning l0°,leinteresk.

y

(APY.

+112.

‘i

—

(b) An account earning 9% interest(cpoundedily

I F44’

-:

Vltk)LI.4

AP1 (

)-t-’-

I

=

-

(c) An account earning 8.75% interest compounded quart]

-L:

i+vr

VitbL

41

+PI(I

•0

g . 4-1

rc°5

—-__)

(d) An account earning 8.6%

41

-i-I

,APje

.

1

a.

Vk

L9cO

C (&tLS

‘tAo.°E

I

-V

1.

-

V.’

-I

‘V

V

V

1

Vl

-St

-SV

c

VVt

VVVV

V

—

V

—

—

—.

.,

VV_V

-S.

‘-S

SW

LV

V

i-S

‘IS

t

V

V

S-S.

(V

/

.5-

VI

V

V

S

S.tV

VS.V)S

V—S

.V4

VI

ii

I,

VII

IV

i

I!

i

V

V

—

.:

-

SI

‘VVV

VC

-S-S

V

r

V

V

-

VVI

-S

V

V

VVIS

-:

•_

ISV-S

V3

J

jirrr

--

r

•—--

2h5

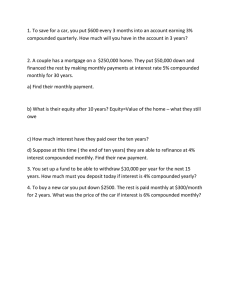

Mathematics of Finance

Pat 2: “Looking for a Lump Sum in the Future”:

Investing

Description:.

77-ze-

I

/ie,

6vJ

penod

s=

•

2

Ae

LA)tfl1

-“

ai,i a&ouw(

1h 30’1(

d

tteD

-

4ninw’- f

fl1C

‘t,tC

)

=

ra,J-c

hyig,vuf

&t(

ç (d) Types of Questions:

+ I( How

Iitmp

1

,d [sH)7

P’j ‘--i’A / Lp d

N=

=

6

a

/a-&4L

vto tvc1

L

“

r

SCOLA4

•

•

ic9

Lvi.

( (c) Variables:

\

iAALQJ

Ac

(1) Future Value of an Ordinai’ Annuity ,( C2YdA Vbi4i

ç (a)&Vt’ PeIO4LC dJaCLc

(b) Equation: S= R(

pt]

via Multiple Deposits

,

L.LWL

j 10

(Q1Af

i-his cfvd qra9UP a”-Q

1orrrv,1ac

o

9tüLtc

4

—

‘

k’LOV

v 1-L tC( Wt

1

tIA

(2) Sinking Fund Payment Formula

i ç (a)S(-Wjj

‘

-i

iav t L&a’v-e.

b/

t.

Li1I

1aky feY) ot&

3

l

eup St4,t’s

ir nw4vtf

’Ni)

1

(b) Equation: RzS((

(c) Variables:

• S = ttAJ2 ACQL44t1 L&U,

•

R=

•

N=

o wv-’1

2,t

i

p jtevt1

C-

r

•

=

(d) Types of Questions:

tb w

c 1- yVLO

JS

€a Ch CAzp o S

/ -jr c

0

.v

÷

+

+

-:-

+

tu

I

I

--

ci

I)

L.

Lb1

z

•1

‘V

1

H

-

_.z.

Ij

-

-;

p1]

[5

Example 1: Suppose Jessica wants to create a college fund for her daughter, Olivia, who was just born.

Jessica will deposit each of her annual $2,000 bonus checks in this college account on Olivi&s birthday

each year (i.e. at the end of each year of her life) for the next 18 years. The account earns 8% interest,

compounded yearly. How much money will Olivia have toward college when she turns 18 years old?

V

Ci rotp

s It. L ‘ al ii ok) f-

4

()

l)pas d

€1

futwt?

trSinaP-, Arir’w±

Fv Vde

L+)

I-low frflW-h

—

U&

I

-—

a u-b’ o

I

I

.

dq_

I

—

w.-z —Lzt.i-z1

.

r(÷—

&oL—

{j

Example 2: Suppose that you can afford to put $500 per month into an investment aOcount to save

toward your retirement. You regularly invest this amount for 20 years in an account that you predict

will earn 7.5% interest compounded monthly, without taking to much risk. ‘What will the account be

worth upon your retirement?

5L4W’

3

OVj

frWtt

(DseVc

+1

p,

I

Ztt11

Ho,v kvl,aal

r

(a(cI+ic

CGLUItL&y

(i_)

-j

I

IZO

,O

rZ.OS

-o

22D

zGO[

ts

Example 3: Mark has a debt of $28,000 to pay in 5 years. How much must he invest at the end of each

quarter in an account earning 12% interest compounded quarterly to be able to pay off the debt?

M-t I#IpEL kpotc n

ou-j

Obcvo1i2

/up sw

o

)/ow 1MkC

If O17i4Lft c

1

+2J%

-evid

n.t(z(o)4O

fri

+4

1 0’I:eJlY?nIv1

Ivv

L

2

-I

4O14JII1

i

oh-I-

!(D’-)

L41’

]4t

&tC

tK

—)

ord

g

c

2&:

4

rn

)

IY’V4

c?

JI_

1s j

r

1

Example 4: Find the future value of an account, earning 6% compounded monthly, with $150

deposited at the beginning of everj month for 8 years.

tl,iu,1 lip 1. ck

Il 0

5U M

>

•e4lnr)tA,&

ForuJa’

I

var42l,-a

fuwip

-

P

,

r=,o

Dt-.j.

V4/t-W

)5’O)

fr..j iéf2(

)

,i::Ilj-(Z

1

O)

i° (14

c ft)

12.

rr

I

(i+)

j_isi

12-

} p4J

Example 5: George and Mary have a friendly contest between them to see who can earn the most

money in the next 5 years. They each can only invest a total of $10,000 in an account earning io°,L

interest compounded monthly, but neither of them has that much money up front. George decides to

invest $5,000 at the beginning of the 5 years, and then add $85 at the end of each month to his account.

Mary invests $170.00 at the end of every month for 5 years. Who has more money at the end of 5

4-

&

j{

1

sw so OW

vMtIHp(t ocfS io’J

ft&&-t’t

tn

eatin

pCS

YvwVt*

{

How

(fQ’

ip

iv w..

C)

OrCW’ft4

zLv4-j-

:)

41

&

f’

S(5)

vablri: S

I

•VjhLc

7.eA2-e

6

-

+1 c

()

?p

f

5

OrCtvv

çpor,-(4’. (4)

=

L

L

I

lb

O-rvaf’t Oi&

‘-°

r’-j.—I

g

E

S c+)

ç-wvi

-

-

‘

n-fl

1

.

8

(Q)l2L

Ia-,

g;=::3

k’i044q

eoc((#—

ft 4:

—ti

r

P(I4E)

I

Jb6J7t1

2)&M

,iu

pLL.

e”A

)

t’.

r

_1] +

1-low

.1

6 58 JL5 jS_14

3

iI.c hOv., /Lf)

f.

rvJ

çv(A’L ith LQ

Vk4

“t”

rz I

D

Ji.fI2(Z6Q

Example 6: YOU graduate from college at the age of 25 and because you’re tired of living with little

money, you decide not to invest toward your retirement for the first five years of your career. This

allows you to enjoy more of your money for that time interval. After that five-year period, you invest

$400 at the end of every month in an account earning 9% interest compounded monthly for the next 35

years.

[IofI

(a) How much will your retirement account be worth at age 65?

+

(b) How much more would your account have been worth if you had only invested the $400 per

month for the first eight years and then let the money sit there earning compound interest for the

entire 40 years?

(c) How much would the account be worth if you had invested the $40ly r the entire

40 years?

fri h0L/

i’twWp dtpOfc n-v w iJ Q(&

I(o)

vve

.

2

((#rL)’_/

r

#)L

Ca’tuYt

L

t

1

(b)

r .r— —

12

-

‘x::Il

r-.c3’

I

(It

-1

&

cpd

tLcLc2It4-’d

s ()

.0

Cc-) -b 4cv.)

+

31

Jwfr4Ccstj

I23

=

2

q

( —u7r

4 I 5

I

Example 7: A $50,000 machine will have a market value of $6,000 in 15 years, which is the usable

lifespan of this machine. Anew machine is expected to sell for $68,000 at that time. The company sets

up a sinking fund to pay for the new machine in the future. Payments are made to the fund twice each

year. If the fund earns 7% interest compounded twice yearly, how much should each payment be?

H.L

I S

UtfL(oto

-k

Crp’4- Ca’vi &€-U

o

o z

-t t:W

VYt-vt

r(’

C€i1Itd-teyc!

+

ch

ea A’i p

—

‘e-v’o

V1/Vt-/

1

&v

1

fr1’

Lkc L*

or

R=bo0o[

r’Q1

f,r

.z

P

‘

L e-n- Q’, ( fr4 h a 14;

k’Ø CQWhV.(,Vt (Q/1-h

L n V’k,

c2

41

t

-)

tJ-

fr1w

OrW.AL1

-) S

(Z

tAv.-voM

iE2_

=

—1

(J3-[J_

—

4$i,3.25J

4

4,

“-.

#4;

U

‘•-

1*

Th

.

-

4.

4

4

Al:

1..

l.

r

i.

.•c.

4

-

A

;

-‘

C.,

•

Ji,i

-

—

—

4#.

44..

.1

-I.

4$

ii-

(b pftJ

Mathematics of Finance

/

(O U.f

‘Part 3: “Loildng for Periodic ‘Payments’ in

Investing a Lump Sum Now so You can make Multiple Withdrawals in the Future

’cv j,’-fro n W h O ryuj jo jvf 1

orcLc -o I u (tt. S

voj&t

.,k)tU”

W

Description:

Three Scenarios:

(1) Present Value of an Ordinary Annuity:

h Qi

4k

(b)

(c) Equation:

a

1

‘-4

(a) S C€flCU—(Ac’

o6

e &c1’

S 1t-W-

y-l&%J

Q

‘-e2L tv

ft IYLL M 04

R(1—(l+r)’)

—

(d) Variables:

:

=

•

•

)

7I(pA’j1rIJ412S

csmou1*

r/n.

•

N=fl.°t

r= cWWWJL

•

=

4t

• =ç &- Ie4’z-cAd per f_’f

-o1-i-.L -l-iv-e

;,

(e) Types of Questions:

u,h4*

fl’U4AA7

a

/

-

çkh42f K

u€

p-vf

e. a

-

H V yy( (,

q,i- 1-Q

rcL&- C H4L

p t tteiv4-

eath

ri-h cL

FYkd

•aJ ?

/VS1yr,f

eio d

kO

&

ha

7

0

J;7

-e

n

ci

I

I4

II

•

II

L

I)

z

•

L

•

—S

C

0’

C

LI)

CO

CD

•

:-

0

%_

4-4

.-i-

II

•

‘

-

II

•

•—

-

•

&. ‘I

-

•

•

—

4

C

II

•

‘

•

(c

L

II

•

CD

I

4

0

0

IT

•

n

+

n

C

CD

+

n

C

‘cD’

lip

CD

LI)

CD

-t

ll need to withdraw $10,000

t

f)xample 1: Frank is calculating when he can retire. He estimates that he

(5 1

expenses

living

for 25 years. The account

for

account

retirement

from

his

quarter

of

every

at the end

earns 6.5% interest compounded quarterly. What amount of money needs to be in the investment

account upon his retirement to achieve his financial goal?

rJ4faj

&tiItipe J

) V3Uf)

Lii

J

Forr-.

i

I

C

1

I

1%

Vc4J.

R2

‘I..

Va-vic140 :

t2..

/i9,ü-oD

cP

C5)

IO

Du

Fi_(t

L

r

4(5)

M

Example 2: Find the present value of a college ftrnd that pays $2,000 at the end of each month from

account that earns 9% interest compounded monthly for 6 years

yfrJ/&t) f@2’

J1

LA) tr

L1;

°

=

t

41

I

pc1i

&

Vct{i

fiZ€4e/

(1

—

)

4.

C-irp3

rvcL

‘I

-

q

9

c

CA1O

-

•

o

+‘I

-LL

/2t(,)

anL

-Far

/

41

)

3

Example 3: Tracy received an inheritance of $200,000 from his grandmother. How much can he

withdraw from his account at the end of each quarter for the next 30 years, if his money compounds

cjr]y with 6% interest?

Crp3

h)pL

crcLLaJzj

u/

tc/PJl-iA41

Cal

eQ

eo

I-

4I

‘‘1

r--°

C

‘

-

ID— Dct,

-cr’

&oo

/_

V-12D

I —( I

-ti5]

J

5

e’

y4’. 60

0

Mathematics of Finance

Description:

a’—- Iofl) us pVir[q

1- 4td CA) (1 L.i re.jt (A/i-)

gi’-

cI’tA’

1,V-fr4’V’

ç W-

4

Ci VVVt4

Part 4: “Lets Borrow Some Money”:

to

v’O

p 47

4

a)

Amortization Formulas:

(1) Periodic Payment of an Amortized Loan:

Equation:

1

R=S(

—(1÷r)

(2) Total Interest Paid:

Equation:

Ni? S

—

(3) Loan Payoff Amount:

Equation:

Payoff =SN_k=R(

1 —(1 +r

Variables:

•

R=

pJrYL/t.v(

• s=

bat-i

•

=

•

E

N=fl#

avioLvv’t

()re4Qe

ro ppvf)

jir)

(1-o1a 4/-

•

•

r

•

n

•

f k

P

tu(e12

=

=

p

O1Sk\i

1V

&-6

/E

4

Pt7

j4/

I

-/i.’l

Ca—r--r

j

i

L/’€

La-v-.

12

ftr

t

rQ ‘i)

-1 i7#

p&/7rvc

V

--4-,

—I

—

I

1

•

•

•.•

—

c

1-4

-4-

*

Example 4: Karen receives a lottery prize of $1,200,000 with payments of $5,000 at the beginning of

every month for 20 years. If the money is in an account earning 5% interest compounded monthly,

what is the real value of the lottery prize today?

t-’- fuw-.& tiLl p L, p aimt

4

,rvtIv : Q ivi.p

n w rvI

+

/I

4.

n

c

yuite,

aed-i

Ca((u(4lO’.

..‘.j

GLA.&L.

(

l’rO4..9

c

.05

o(1

-

&c

—201

/2-

vU)

L’5

pic7

t

birthday. However,

Example 5: Suppose Bienda receives an inheritance of $20,000, on her 20

according to the will of the donor, she is not to receive the money until she is 30 years old. She plans

to leave the money in the interest bearing account, earning 8% interest compounded quarterly, and only

make quarterly withdrawals, starting at the end of the first quarter after her birthday, for 15 years total.

Howmuchwilleachwithdrawalbe? i’° P°(D APS cO—O

aOtrvO

C

I

.O%)(io)

I

()

-=

j.i.

44

4

itlpLL

CL1

N

in

D

R

4IC9

+-)o

a

1

—

C I * r]

j

4

(‘+

)

4/ti4tt

Example 6: Upon graduation from college, Luce’s parents decide to give her a large cash gift, since

their business is doing well. They’re forward-thinking parents and want to invest in their daughters

retirement. They give her exactly enough to create monthly retirement payments of $4,000, paid at theL

I

each month, starting in 40 years. The payments will last for 20 years total. After shopping

round, they found an extremely safe investment that pays 5.4% terest, compounded monthly. How

fl1of

much will they put in this account for Luce upon graduation?

-t-o

a pev’ o ci o

&rvotic

r (]

4

(4

-

t

I

f

Vcu4 tt1 Ii’

A4

1

tjcwt

u

p

(°

[i-( *

j_(/rc)j/r(ltrc)

I+tp

C 0054

\Jd-11

p

i=

r

H1

-

‘

,

)*.•

t.

,

.

‘a,’

4

I,

“

:

[‘i

•—

-

C

-

r

:•

-M

:-

--

-

-

-.

-

•

)

-;:

‘

,

r

-

2’

,

>:

:

:

‘-I

s_

—

‘

:2-

(

4

Example 1: Katie works hard and saves her work and gift money during junior high and high school.

She wants to buy a car for herself when she graduates from high school. Suppose she can save $4,000

by the time she graduates from high school and she wants to purchase a car valued at $15,000. If she

can get a loan with special interest rate of 3.6%, compounded monthly, for 6 years, how much will her

monthly payments be?

rv

‘iQ’1-I

f

.fo a/4 7 r i-’. / o a k7

v ij’.- c

v.

1A

:

thQ

S hj, t,o a,vt

+

r

OC(’t

.

(2

S

r

It g’vt

-fr

N)

-

/2

o

p

-

j

1L

v oos

7

o(

/I

)

S-1s-4

cl

OO3 2)

Example 2: Scott found a lot of land to build his home on. It will cost $40,000, and lie will amortize

his loan over 8 years with yearly payments. Create an amortization schedule for his loan, and answer

the following questions if the interest rate on his loan is 7.8% compounded annually.

[io

(a) What is his yearly payment?

(b) What is the interest for the first payment?

(c) How much principle is paid in the first payment?

(

4O)vV

(oQ-)

b 9o:?.53 1,vv

‘3 I2-c2VD

•* fc3’o

670’5

3I,2I21c

4DoOI’

.)12.S’

3

W

2

26Ob.0

f25

44:p;, i/

29iit

1b

t

2

!

*o5

IIS.2t

5

a

1Th’-

4

a

1

I2)3cO

$

4q

,4D62

s

C c) /jjs

+2.

]

d

1

1,1v.pa

cJt1\&A’t+

P.ex2cI

3

pt

#2.

O•

41 t.02.

r

Example 3: Mike is buying a home for his family and has the choice of a 15-year, a 20 year or a 30year amortized loan with monthly payments. The amount of his loan originally is $210,000, with an

interest rate of 5.7% compounded monthly.

(j0

(a) Compute the fmance charge for each loan type.

(b) How nmch savings is there if he goes with the 15-year loan?

, /2

r- -zo,oç

oo4

It

rqf (N-cJ

(f-(ir

I?5 i4

4 IQ23

a4-°

—

38—

(7-

-

I-0

J

U

3

_°4-L

_s/

N

LV CI L

j

-e&4r

1

I

“h(

wi i—

tAZeC(

ai

$1

3’90

/ü

10

-

tA).

,

4

f

—

sa J

Iü

-

Example 4: A ski resort purchases a large piece of equipment for a chairlift for $300,000. Suppose the

ski resort takes out a loan for this equipment, making quarterly payments with interest rate of 4.8%

compounded quarterly for 10 years.

(a) What are the quarterly payments?4

(b) How much interest does the resort pay

Find the unpaid balance (loan payoff amount) after three years.

d) If the ski resort pays off the loan at the end of three years, how

j)aking the rest of the payments?

t

M;Iz

Fsz ci

I

I

bynot

4

[A .f2L4-

/

q)4;:/5j

‘14,11247

1 frC-Q

3d20

9I1z,4

3)S

s

4

94.ci

3)4,5

3

)l24.

oç+]

3)3cQ

)10I0/

3. We learned fornrnlas describing the following financial ideas:

o

Simple interest

o

Periodically compounded interest

o

Continuously compounded interest

o

APY of an account

o

Future value of an annuity due

o

Future value of an ordinary annuity

o

Sinking fund

o

Present value of n ordinary annuity

o

Present value of an annuity due

o

Present value of a deferred annuity

o

Periodic payment of an amortized loan

[1 5

p1 c]

• Total interest paid

o

Loan payoff amount

Decide which fornmla should be used to solve each problem below. (You don’t need to

solve the problem. Just decide which formula applies.)

(a) A bank robber has stolen $20,000 which he places in an account (at a different

bank) paying 7.5% interest compounded quarterly. He intends to make equal

withdrawals at the beginning of each quarter for 15 years. How much will each

withdrawal be?

-c,SVt VO&A€

o

(b) Which of the following accounts pays best?

i. 7.5% compounded annually

ii. 7.25% compounded quarterly

iii. 7% compounded monthly

iv. 7.75% compounded continuously

A9

4t

7WV\4

i-

(c) Martha Stewart wants to redo her kitchen. Her standards are high, so this will

cost her $1,200,000. She doesn’t want to take out a loan, so instead she decides to

save up, making monthly deposits in an account paying 11% interest compounded

monthly. If she intends to save for three years, how much does each payment need

tobe?

IvvA1

Page 3

N

(ci) Paula Dean also wants to redo her kitchen. Her wants are more modest, so

she intends to spend only $800,000. She will take out a loan at 12.7% interest

compounded quarterly and pay it back in cjuarterly payments over 5 years. How

much will each pa ment be?

c ayv’vL’

th

o1--e

+1

Ioa

(e) Robert has very little financial experience, so he deposits his $8000 in savings in

an account paying 7.5% simple interest. How much money will Robert have 15

years from no

tvwpL

-

iv-eS1

(f) Kelly is saving for retirement. She pays $400 at the end of each month into an

account paying 8.2% interest compounded monthly. If she retires in 35 years, how

much money will she have?

a LI flJi

V

awi

(g) How much money should be invested at 6% interest compounded continuously to

have a total of $12,000 after 10 years?

(Ov’

‘vitd

4

ti’

-

H

-+

I

(h) George took out a loan of $60,000 to pay for school. The interest is 3.8% com

pounded monthly. George intended to pay off the loan in twenty years, but after

eight years of payments he received an inheritance allowing him to pay off the

rest in a lump. How much money was required to make this payment?

LOtbv.

(i)

ptj

+

Allen wins the lottery. He expects a lump Payment of $2,000,000, but lie discovers

that his prize will be paid out in installments of $25,000 at the end of each

quarter for the next 20 ears. If the money is in an account paying 6% interest

compounded quarterly, what is the current value of the account?

a

pcv vhAi

(j)

ordiiuiy

vivv- -I-

Carrie takes out a mortgage for $250,000 at an interest rate of 6.3% compounded

monthly for twenty years. If Carrie makes equal monthly payments on the loan,

what is the total finance charge?

tø{td

i€-c

poid

(k) Horatio wants to buy a yacht. If he puts $500 at the beginning of each month

into an account paying 7.2% interest compounded monthly for the next ten years,

how much can he spend on his yacht?

cw

fu-e, voL o-

1

(1) Joan invests $15,000 in an account paying 7% interest. How much money will she

have in 15 years?

4

1

(m) Hugo sets up a collegefnd for his newborn baby, Genevieve. Hugo will put a

lump sum into an account paying 8.8% interest. When Genevieve turns 18, she

t4QM

V

a

Page 4

I

b

p

will make regular withdrawals of $3,000 at the beginning of each month for four

yeam. How much does Hugo need to invest now?

• ...

.

Page5

,1

(3

‘j%