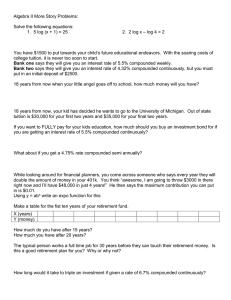

1. To save for a car, you put $600 every... compounded quarterly. How much will you have in the account...

advertisement

1. To save for a car, you put $600 every 3 months into an account earning 3% compounded quarterly. How much will you have in the account in 3 years? 2. A couple has a mortgage on a $250,000 home. They put $50,000 down and financed the rest by making monthly payments at interest rate 5% compounded monthly for 30 years. a) Find their monthly payment. b) What is their equity after 10 years? Equity=Value of the home – what they still owe c) How much interest have they paid over the ten years? d) Suppose at this time ( the end of ten years) they are able to refinance at 4% interest compounded monthly. Find their new payment. 3. You set up a fund to be able to withdraw $10,000 per year for the next 15 years. How much must you deposit today if interest is 4% compounded yearly? 4. To buy a new car you put down $2500. The rest is paid monthly at $300/month for 2 years. What was the price of the car if interest is 6% compounded monthly?