How to create better cashflow when your I

advertisement

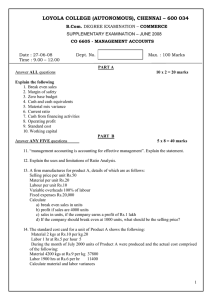

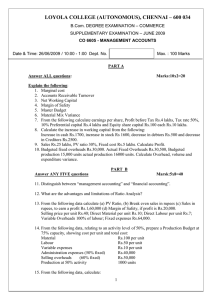

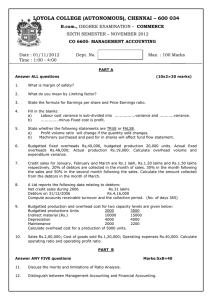

How to create better cashflow when your business is growing. I f you’re in the happy position of seeing own realistic personal budget so that you Consider using a financing mechanism to your business in a growth phase, it pays can draw a set budgeted amount from the fund your debtors. Consider leasing fixed assets instead of purchasing them. Monitor to consider how you can most effectively business. Plan for income tax payments and manage your in-comings and out-goings. at the very least have annual accounts and and reduce overheads as much as possible. In a time of growth, cash is required to tax positions completed as soon as possible Consider subcontracting rather than pay suppliers but it may not be replaced after balance date. employing where appropriate. Carefully decide how to bring cash into the business Align your bank accounts Introduce an appropriate level of cash account where PAYE, GST and Income tax into the business by way of capital or (expressed as a percentage of sales) are for some months until a sale is converted into cash. The level of Stock and Debtors will increase until these reach the optimal level for the business size and that requires an increase in the level of cash to support this growth. Funding is also needed to pay overheads, tax obligations and capital investment. Inadequate planning and management during this phase is one reason such a high percentage of new businesses Owner advances. Meet further funding requirements with an optimal mix of short For more information, please contact: Monitor sales and stock To avoid this cash trap, here are some key Monitor Gross margins on your sales. Have as tips to consider. many Cash Sales as possible. Ensure careful stock management so as not to overstock. It should limit liability but allow for the appropriate level of capital input from shareholders or partners and it should accommodate borrowing from both owners and external financial organisations. regularly transferred. This will ensure funds are available on due dates. and long term debt. fail in their first year. Choose the right business structure Consider maintaining a separate bank Brent Cheyne tel (03) 548 2139 email Brent.Cheyne@crowehorwath.co.nz Use Consignment stock where possible. Have good systems so that all stock and sales are accounted for. Keep control of debt and overheads Negotiate better discounts and more favourable payment terms with your Plan and budget Create an up to date business plan that includes a Cash flow budget. Compare actuals to budget and regularly update the budget to meet reality. Prepare your suppliers, where possible, including the possibility of instalment arrangements. Have a strict Customer Credit policy in place and administer this efficiently. Charge interest on overdue accounts. Stop Credit where necessary. Need helping managing growth? Call us for trusted, practical advice Tel 03 548 2139 www.commerce.org.nz 13