Costs Theory - Bannerman High School

advertisement

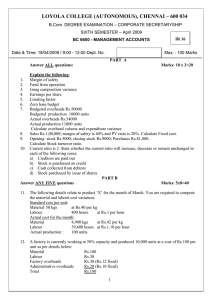

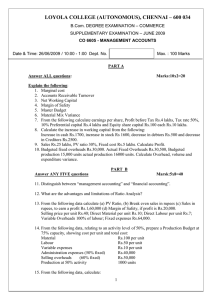

INTRODUCTION TO COST/MANAGEMENT ACCOUNTING Financial Accounting is mainly concerned with the “stewardship” function of a business – that is, accounting for what has happened over the past financial year and reporting that information to shareholders and other users of accounting information. The main job of the financial accountant is to record all the financial transactions which affect the business and these duties include: • setting up book-keeping/record keeping systems to record the income and expenditure of a business. •keeping a record of the business’s assets and liabilities. •preparing the final accounts of a business – Trading and Profit and Loss Account and a Balance Sheet. •preparing tax figures. DISADVANTAGES OF FINANCIAL ACCOUNTING? The main limitations of Financial Accounting from management’s point of view is that the information provided by Financial Accounting is: • out of date for management purposes • not detailed enough for management • not suitable for – • Planning • decision making • controlling costs The Cost and Management Accountant, on the other hand, is mainly concerned with providing information to assist management make better informed decisions and to help them plan ahead and to control the costs of the business. In general, the Cost and Management Accountant is mainly concerned with providing management with internal information to enable them to: •plan for the future •make decisions •control costs The main duties of the Cost Accountant are: •classifying costs – that is, deciding whether costs relate to materials, labour or overheads. •working out the final cost a job/product/service in order to determine the price to be charged to the customer. •providing detailed analysis of costs to help management make better informed decisions. •preparing budgets of future requirements for materials, labour and overheads in order to meet planned sales and production targets. ADVANTAGES OF COST ACCOUNTING The main advantage of Cost Accounting is that it provides detailed, up-to-date information to help management make decisions and control costs. PLANNING OR BUDGETING Cost Accounting helps management plan for the future in terms of estimating: • • • • • • future sales future production targets future material requirements future labour requirements future cash flows future profits DECISION MAKING Cost Accounting helps management to make better informed decisions as to whether to: • make or buy in component parts • continue or discontinue producing a loss-making product • accept or reject a special order at below the normal selling price • invest in expensive new plant and machinery CONTROLLING COSTS Cost Accounting helps management to control costs by allowing them to: • compare actual cost with budgeted costs • assign responsibility for the control of costs to individuals and departments PRICING Cost Accounting helps management to ascertain the costs of a job/product/service in order to: • determine the final selling price to be charged to the customer • submit tenders for contracts CLASSIFICATION OF COSTS There are three elements of cost: materials, labour and overheads. Materials, Labour and Overheads Materials are the natural resources that go into the making of any product, for example wood for a table, wool for a coat, flour for bread. Labour is the human resource that is essential for the production of any article and is rewarded with wages and salaries. As well as materials and labour, other expenses are incurred in production and these are generally known as overheads, for example electricity, rates and cleaning. Fixed Costs and Variable Costs Fixed costs are not affected by changes in the level of production. If output rises, the cost does not go up; if output falls the cost does not go down, for example rent Variable costs are those which change along with a change in the level of production, for example the cost of the wood for a table. When production increases, the cost rises and when production falls, the cost decreases. Semi-Variable Costs Several costs cannot be placed in either category and are classified as semivariable costs. These costs, for example electricity, gas and telephone charges, usually have a standing charge which is fixed and to this is added a variable charge which varies with usage. Direct Costs Direct costs are those which can be traced to the product being made, for example the wood for a table or the cloth for a jacket. Direct materials + Direct wages + =Prime Costs Direct expenses Indirect Costs Indirect costs are the other costs, also known as overheads, that arise but cannot be readily identified with a particular product, for example heating, cleaning and supervision. Prime Cost + Factory Overheads = Cost of Production Cost of Production + Selling and Administration Overheads = Total Costs