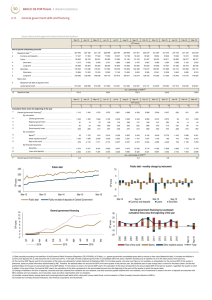

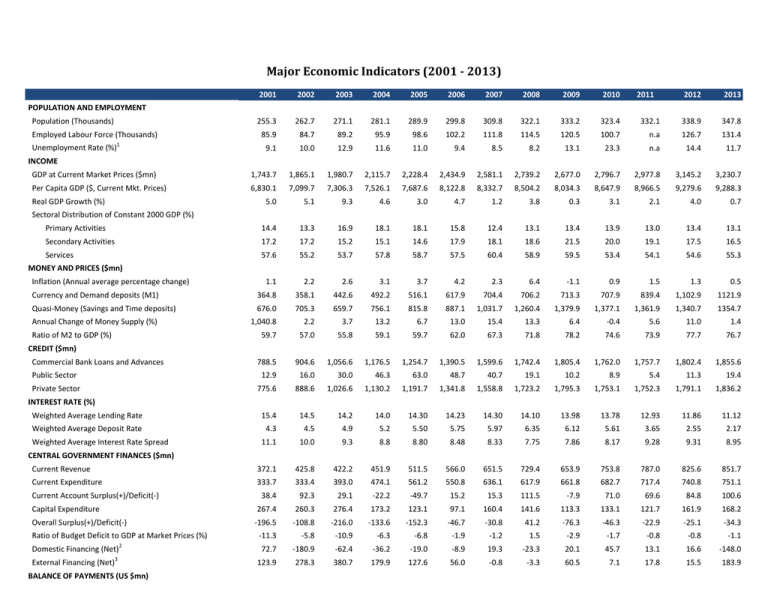

Major Economic Indicators (2001 2013)

advertisement

Major Economic Indicators (2001 ­ 2013) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 255.3 262.7 271.1 281.1 289.9 299.8 309.8 322.1 333.2 323.4 332.1 338.9 347.8 85.9 84.7 89.2 95.9 98.6 102.2 111.8 114.5 120.5 100.7 n.a 126.7 131.4 9.1 10.0 12.9 11.6 11.0 9.4 8.5 8.2 13.1 23.3 n.a 14.4 11.7 GDP at Current Market Prices ($mn) 1,743.7 1,865.1 1,980.7 2,115.7 2,228.4 2,434.9 2,581.1 2,739.2 2,677.0 2,796.7 2,977.8 3,145.2 3,230.7 Per Capita GDP ($, Current Mkt. Prices) 6,830.1 7,099.7 7,306.3 7,526.1 7,687.6 8,122.8 8,332.7 8,504.2 8,034.3 8,647.9 8,966.5 9,279.6 9,288.3 5.0 5.1 9.3 4.6 3.0 4.7 1.2 3.8 0.3 3.1 2.1 4.0 0.7 Primary Activities 14.4 13.3 16.9 18.1 18.1 15.8 12.4 13.1 13.4 13.9 13.0 13.4 13.1 Secondary Activities 17.2 17.2 15.2 15.1 14.6 17.9 18.1 18.6 21.5 20.0 19.1 17.5 16.5 Services 57.6 55.2 53.7 57.8 58.7 57.5 60.4 58.9 59.5 53.4 54.1 54.6 55.3 POPULATION AND EMPLOYMENT Population (Thousands) Employed Labour Force (Thousands) Unemployment Rate (%)1 INCOME Real GDP Growth (%) Sectoral Distribution of Constant 2000 GDP (%) MONEY AND PRICES ($mn) Inflation (Annual average percentage change) Currency and Demand deposits (M1) Quasi‐Money (Savings and Time deposits) Annual Change of Money Supply (%) Ratio of M2 to GDP (%) 1.1 2.2 2.6 3.1 3.7 4.2 2.3 6.4 ‐1.1 0.9 1.5 1.3 0.5 364.8 358.1 442.6 492.2 516.1 617.9 704.4 706.2 713.3 707.9 839.4 1,102.9 1121.9 676.0 705.3 659.7 756.1 815.8 887.1 1,031.7 1,260.4 1,379.9 1,377.1 1,361.9 1,340.7 1354.7 1,040.8 2.2 3.7 13.2 6.7 13.0 15.4 13.3 6.4 ‐0.4 5.6 11.0 1.4 59.7 57.0 55.8 59.1 59.7 62.0 67.3 71.8 78.2 74.6 73.9 77.7 76.7 CREDIT ($mn) Commercial Bank Loans and Advances 788.5 904.6 1,056.6 1,176.5 1,254.7 1,390.5 1,599.6 1,742.4 1,805.4 1,762.0 1,757.7 1,802.4 1,855.6 Public Sector 12.9 16.0 30.0 46.3 63.0 48.7 40.7 19.1 10.2 8.9 5.4 11.3 19.4 Private Sector 775.6 888.6 1,026.6 1,130.2 1,191.7 1,341.8 1,558.8 1,723.2 1,795.3 1,753.1 1,752.3 1,791.1 1,836.2 15.4 14.5 14.2 14.0 14.30 14.23 14.30 14.10 13.98 13.78 12.93 11.86 11.12 INTEREST RATE (%) Weighted Average Lending Rate Weighted Average Deposit Rate 4.3 4.5 4.9 5.2 5.50 5.75 5.97 6.35 6.12 5.61 3.65 2.55 2.17 11.1 10.0 9.3 8.8 8.80 8.48 8.33 7.75 7.86 8.17 9.28 9.31 8.95 Current Revenue 372.1 425.8 422.2 451.9 511.5 566.0 651.5 729.4 653.9 753.8 787.0 825.6 851.7 Current Expenditure 333.7 333.4 393.0 474.1 561.2 550.8 636.1 617.9 661.8 682.7 717.4 740.8 751.1 38.4 92.3 29.1 ‐22.2 ‐49.7 15.2 15.3 111.5 ‐7.9 71.0 69.6 84.8 100.6 Weighted Average Interest Rate Spread CENTRAL GOVERNMENT FINANCES ($mn) Current Account Surplus(+)/Deficit(‐) Capital Expenditure Overall Surplus(+)/Deficit(‐) Ratio of Budget Deficit to GDP at Market Prices (%) Domestic Financing (Net) 2 External Financing (Net)3 BALANCE OF PAYMENTS (US $mn) 267.4 260.3 276.4 173.2 123.1 97.1 160.4 141.6 113.3 133.1 121.7 161.9 168.2 ‐196.5 ‐108.8 ‐216.0 ‐133.6 ‐152.3 ‐46.7 ‐30.8 41.2 ‐76.3 ‐46.3 ‐22.9 ‐25.1 ‐34.3 ‐11.3 ‐5.8 ‐10.9 ‐6.3 ‐6.8 ‐1.9 ‐1.2 1.5 ‐2.9 ‐1.7 ‐0.8 ‐0.8 ‐1.1 72.7 ‐180.9 ‐62.4 ‐36.2 ‐19.0 ‐8.9 19.3 ‐23.3 20.1 45.7 13.1 16.6 ‐148.0 123.9 278.3 380.7 179.9 127.6 56.0 ‐0.8 ‐3.3 60.5 7.1 17.8 15.5 183.9 2001 4 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Merchandise Exports (f.o.b.) 269.1 309.7 315.5 308.4 325.2 427.1 425.6 480.1 383.6 478.4 603.7 621.6 608.6 Merchandise Imports (f.o.b.) 478.1 496.9 522.3 480.7 556.2 611.9 642.0 788.2 620.5 647.2 774.6 818.1 875.9 Trade Balance ‐209.0 ‐187.2 ‐206.8 ‐172.3 ‐231.0 ‐184.8 ‐216.4 ‐308.2 ‐236.9 ‐168.9 ‐170.9 ‐196.6 ‐267.3 26.4 24.3 29.3 30.9 40.9 57.8 70.8 74.1 76.2 76.1 73.0 73.6 72.2 110.5 121.5 149.7 168.1 213.6 254.7 283.6 272.6 237.8 244.9 248.5 299.0 351.0 Remittances (Inflows) Tourism (Inflows) Services (Net) Current Account Balance 46.1 46.0 71.1 88.2 143.0 223.7 229.9 216.9 182.7 175.5 168.4 221.3 240.3 ‐190.4 ‐165.3 ‐184.3 ‐154.9 ‐151.2 ‐16.2 ‐52.1 ‐144.9 ‐60.2 ‐40.1 ‐16.9 ‐19.7 ‐72.1 179.2 168.0 188.5 127.3 ‐141.4 ‐60.0 ‐115.5 ‐196.4 ‐102.4 ‐21.6 4.8 ‐45.1 ‐96.7 ‐2.7 ‐5.4 ‐30.1 ‐31.2 12.2 49.8 22.9 57.9 47.2 4.3 18.1 52.8 113.8 Capital and Financial Flows Gross Change in Official International Reserves Gross Official International Reserves 5 120.1 114.7 84.6 48.0 35.8 85.6 108.5 166.4 213.7 218.0 236.1 288.9 402.7 Monthly Import Coverage n.a n.a n.a n.a 0.7 1.5 1.8 2.3 3.7 3.6 3.3 3.8 5.0 Monthly Import Coverage net of CFZ Imports 3.2 3.2 2.1 1.4 0.8 1.8 2.3 2.8 4.2 4.5 4.3 4.6 6.0 PUBLIC SECTOR DEBT Disbursed Outstanding External Debt (US $mn) 489.5 632.8 805.9 893.1 970.5 985.2 972.7 957.8 1,015.7 1,011.2 1,021.9 1,013.7 1,081.5 Ratio of Outstanding Debt to GDP at Market Prices (%) 56.1 67.9 81.4 84.4 87.1 80.9 75.4 69.9 75.9 72.3 68.6 64.5 66.9 External Debt Service Payments (US $mn) 76.9 77.3 82.8 96.8 88.9 134.3 133.4 96.9 81.2 76.6 81.4 79.0 62.0 External Debt Service Ratio (%) 6 Disbursed Outstanding Domestic Debt ($ mn) Domestic Debt Service Payments ($ mn) 17.3 15.7 15.7 17.8 14.2 17.0 16.2 11.2 11.3 9.3 8.6 7.7 5.9 208.7 171.9 256.5 278.5 279.4 299.9 321.9 332.8 320.2 367.8 381.2 389.9 385.2 17.7 19.2 13.7 18.8 23.1 27.5 30.4 47.7 39.1 40.1 20.5 20.3 20.0 Sources: CBB, MOF and SIB 1 Time series is at April except 2008, which is at May. Includes proceeds from the sale of BTL shares with domestic sources. 3 Includes privatization proceeds. 4 Includes CFZ gross sales. 2 5 6 Starting in 2005 these numbers have been revised to reflect only usable reserves as defined by BPM5. Excludes refinancing of US$99.2mn (2002), US$50.2mn (2003), US$95.4mn (2004), US$136.7mn (2005), the restructuring amount of US$541.0mn in 2007, US$0.8mn in 2008 and US$1.0mn in 2009. 2013 excludes 10% haircut on the restructuring of bond n.a. not available