Debt and Deficits

advertisement

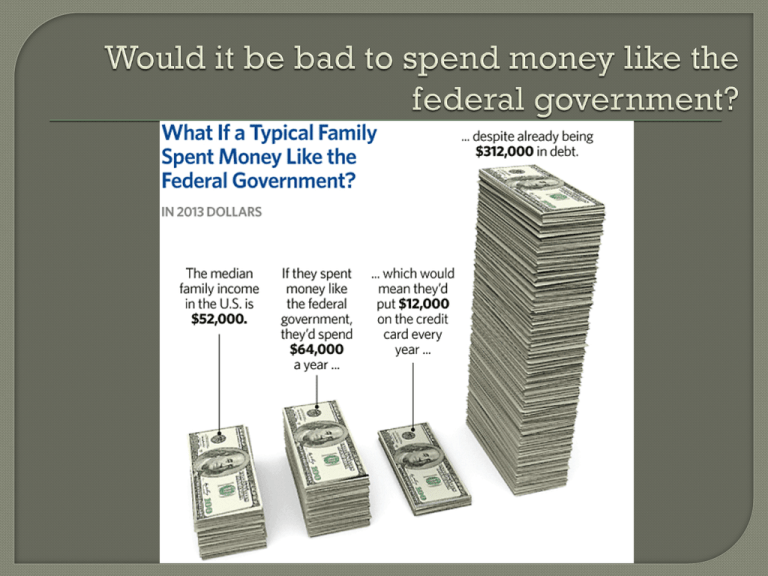

Macroeconomics Unit Chapter 14 BUDGET EOC study guide Macroeconomics #14 DEFICIT: when expenditures exceed revenue • Expenditure: an amount of money spent • Revenue: income BUDGET SURPLUS: when revenue exceeds expenditures Fiscal year Deficit 2009 2010 2011 2012 2013 2014 1,412,688,000,000 1,294,373,000,000 1,299,593,000,000 1,086,963,000,000 679,502,000,000 483,000,000,000 Deficit as share of GDP 9.8 percent 8.8 percent 8.4 percent 6.8 percent 4.1 percent 2.8 percent Source: http://www.politifact.com/wisconsin/statements/2014/sep/05/barackobama/obama-says-he-has-cut-national-deficit-half/ Gross domestic product (GDP) is a measure of the income and expenditures of an economy GDP is the total market value of all final goods and services produced within a country in a given period of time Source: http://taxfoundation.org Congress and the President!!! If the economy slows down, there is less tax revenue • It takes time to adjust Federal spending If war breaks out, spending increases What if There are Unforeseen Costs? Lobbyists can impact spending— spending in 2012 Source Open Secrets.org National Debt: the sum of all past deficits and surpluses • Currently: Over $18,611,073,500,000! approx. $57,768 per citizen or $155,926 per taxpayer Source: www.cbo.gov/sites /.../budgetinfogra phic.pd.. John Green on the Debt 2012