EOCT Review

advertisement

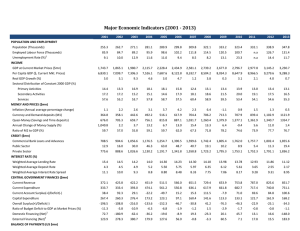

EOCT REVIEW The major concepts Fundamental Economics BRIGHT IDEAS MARKET ECONOMY 1. The U.S. has a market economy which features private ownership of businesses and very little government interference. Voluntary Exchange is also a BIG component of a market economy. This means that buyers and sellers come together to exchange goods/services. One other important feature of a market economy is the price system. This means if you’ve got the $, someone has the good/service! The price system is based on income. BRIGHT IDEAS TRANSFER PAYMENTS 2. Payments given by the government to an individual with no service required in return. A good example of transfer payments are: Welfare, WIC, Social Security, disability benefits, TANF, Medicare, Medicaid BRIGHT IDEAS CAPITAL Human Capital This involves investing in a PERSON. This could be training for an employee, college or school to make the employee more productive. Physical Capital This is an investment in technology, equipment, machinery to improve PRODUCTION. BIG IDEAS PPC A 5000 B C Illustrates Scarcity, Choice, and Trade-off’s D 4000 H E Points A-G = Maximum Output Point I = Lagging Production Point H = Impossible Military Goods 3000 I 2000 F 1000 G 0 1000 2000 3000 4000 5000 6000 Consumer Goods Microeconomics Supply and Demand, Decisions by Individuals or a Business Circular Flow Product Market Businesses Households Factor Market Supply and Demand Surplus 30 25 Price Floor Ex. Minimum wage Price 20 Equilibrium Price 15 10 5 Price Ceiling Ex. Apartment Rent Controls Shortage 0 5 10 15 20 25 30 35 40 45 50 55 60 Quantity Business Organizations What is it? One person SoleProprietorship 2 or more owners Partnership Corporation •Apply for legal charter, • gov’t views as separate entity •sell shares of company as stock Advantages Disadvantages Total profit, total control Responsible for all the debt – unlimited liability Share profit, responsible for all debt– unlimited liability Specialization, share responsibility Easy to raise money – stockholders earn profit on stocks Investors have limited liability – not responsible for company debt Complex organization, difficult decision making process Market Structures Characteristics Example Locally grown vegetables Perfect (Pure) Competition Large number of buyers and sellers nearly identical products Price takers – can’t control market Monopolistic Competition Many competing producers Product differentiation Advertising is essential Under Armour The North Face McDonalds a few large firms control the market Pricing decisions depend on behavior of other firms Soft Drinks – (Coke/Pepsi) Car Manufacturers one corporation has total control of the market ex. Technological (patent) or natural monopoly (utilities) Oligopoly Monopoly Macroeconomics Use of resources in the entire nation – GDP, Unemployment, Inflation, Monetary Policy, Fiscal Policy Economic Indicators Why are they important? Economic Indicators tell us how the economy is performing. Is the economy in a recession, expansion, sick or healthy? SICK = Stagflation means the economy is NOT growing (stagnant) and has high inflation. A.K.A. RECESSION or DEPRESSION HEALTHY = low unemployment, low inflation, high GDP. A.K.A. EXPANSION Economic Indicators 3 types Unemployment Structural (skills don’t match the job) Frictional ( looking for a better job) Cyclical (based on the business cycle) CPI (Consumer Price Index) measures the rate of inflation which compares the price of goods/services each year GDP measures economic growth Debt vs. Surplus DEBT Deficit means spending more money than you have National Debt is all the years of government deficit added together SURPLUS Surplus means taking in more than you spend Budget Surplus is based on the year-toyear (fiscal year) Congressional budget Monetary vs. Fiscal Policy MONETARY POLICY THE FED The Federal Reserve either increases or decreases the amount of money available to the public Reserve requirement Discount rate Open Market Operations (buy or sell) FISCAL POLICY CONGRESS TAXES SPENDING International Economics International Economics studies countries and their involvement with other countries with trade, imports and exports, and currencies. Comparative vs. Absolute Advantage Comparative Advantage ability to produce a good or service at a lower opportunity cost than another nation can Individuals and businesses are using comparative advantage when they SPECIALIZE in producing what they are best at and trading for the rest Absolute Advantage ability to produce more of a good or service than another nation can. Free Trade Arguments FOR Free Trade If all countries produced what they were best at – comparative advantage- and traded for the rest, everyone would benefit. Production and GDP would increase for all countries. This would deliver the greatest goods to the greatest number of people. Arguments AGAINST Free Trade Protection of national security Protection of infant industries Protection of jobs PROTECTIONISM Trading Blocs/Trade Barriers What do they do? Eliminates trade barriers with neighboring countries which leads to increases in GDP and productivity. EXAMPLES: NAFTA, EU, ASEAN Trade Barriers Advantages: protect domestic industries – reduces foreign competition – protects jobs, Increase government revenue – can reduce budget deficit Disadvantages: Fewer Choices and higher prices for consumers, encourages other nations to impose trade barriers against the U.S., hurting American exporters EXAMPLES: NAFTA, EU, ASEAN Exchange Rates Price of one nation’s currency in terms of another nation’s currency. Changes based on world demand for each country’s exports worldwide When the dollar is WEAK (DEPRECIATION): U.S. exports increase and the price of exports go up Travel abroad is more expensive for American tourists U.S. imports decline and the price of imports increases Foreign investment in U.S. businesses increases. When the dollar is STRONG (APPRECIATION): Imports increase and are cheaper for consumers to buy Travel abroad is cheaper for American tourists U.S. exports decline The U.S. trade deficit increases. Personal Finance Taxes 3 Types of Taxes Proportional – everyone pays the same portion or percentage – flat tax – ex. Social Security 6.2% Progressive – the more you make, the higher percentage you pay in taxes – ex. Income tax Regressive - people with lower incomes pay a higher tax percentage than those with higher incomes – ex. Sales Tax. Insurance People buy insurance to protect themselves financially for unexpected events that could be very expensive Examples – health, property, car, life, disability, life, accidental Pay a PREMIUM (amount per month, quarter) to guarantee coverage The insurance company takes the money people pay in premiums to pay claims. Budgeting Fixed expenses – those that do not change from month to month – house payment, car payment Variable expenses – exact dollar amount changes from month to month – power bill, water bill Disposable income – amount a person has leftover after all bills and necessities have been paid Credit and Interest Credit Worthiness – to borrow money you must have good credit (good credit score) Depends on your: Credit History – how well you have managed your bills and credit in the past (Credit Score) Collateral - property you have that the bank could take from you if you do not pay the loan Creditworthy – are you able to pay the money back given your income and current expenses Interest – money charged for borrowing money Interest paid – you can get paid interest for investments Interest charged – you will be charged interest if you borrow money APR – Annual Percentage Rate – interest rate on a credit card