Economics of the Firm Term paper 2005 Question I

Economics of the Firm

Term paper 2005

Question I

Part (i).

Private information about project value, rather than assets in place.

Assets in place: A

Project revenue: R ∈ { H , L }, H > L

Prob( R = H ) = p ∈ (0, 1)

ER = R = pH + (1 – p ) L

Project costs: I < L q = outsiders’ subjective probability that R = H , given a decision by the firm to invest. q ∈ [0, 1].

Outsiders’ assessment of the firm’s value given a decision to invest: q ( A + H ) + (1 – q )( A + L ) = A + qH + (1 – q ) L f f = fraction of the firm owned by new shareholders

Competition among risk-neutral investors ⇒

Expected income = expected costs f [ A + qH + (1 – q ) L ] = I

=

A + qH

I

+ (

1 − q

)

L

Economics of the Firm - Tore Nilssen – Term paper 2005 – 1

Current owners left with:

(1 – f )( A + R ), R ∈ { H , L }

The investment is profitable for current owners if:

(1 ) > A ⇔ f <

A

R

+ R

Consider first the L -type: If it is of type L , then the firm invests if:

A + qH

I

+ (

1 − q

)

L

<

A

L

+ L

Thus, the firm invests, even if q = 0, since H > L > I and 0 ≤ q ≤ 1.

Consider next the H -type: The firm, if of type H , invests if:

A + qH

I

+ (

1 − q

)

L

<

A

H

+ H

If also the H invests, the investors’ beliefs must be such that q = p , in order for beliefs to be consistent with strategies.

Inserting, we find that an equilibrium exists in which also H -type invests, if

A

I

+ R

<

A

H

+ H

⇔

H

I

>

A

A

+

+

H

R

.

This condition always holds, because

H

I

>

H

L

>

A H

+

>

+

+

.

Economics of the Firm - Tore Nilssen – Term paper 2005 – 2

The H type does not invest if

A + qH

I

+ (

1 − q

)

L

>

A

H

+ H

H type not investing is consistent with investors’ beliefs if q = 0. Thus, an equilibrium exists in which the firm invests only if it is of type L , if:

A

I

+ L

>

A

H

+ H

⇔

H

I

<

A

A

+

+

H

L

This condition can never hold here, as we just saw . Thus, this equilibrium does not exist in this case.

There is thus only one equilibrium, in which the firm always invests, whether its project has a high or a low value .

Extra question:

Would this equilibrium be possible also in a case where L < I ?

Yes. What is needed is:

L

I

>

A

A

+

+

L

R

, which may hold even when L < I .

When this condition holds and q = p , both types prefer investing to not investing.

→ Overinvestment in equilibrium

Economics of the Firm - Tore Nilssen – Term paper 2005 – 3

Part B.

Money burning

Let’s keep the above model.

We need to specify outside investors’ beliefs: If no money burning is observed, then q = 0.

Three conditions need to be satisfied:

(i) low-type firm must prefer no money-burning (revealing being low-type) to money-burning (believed to be high type).

1 −

I

(

A L

)

1

I

(

A + L C

) ⇔

C ≥ C * =

1

2

⎡

⎣

A H − ( ) 2 − 4

( ) ⎤

⎦

(ii) Money-burning must be better for the high type than not investing:

1 −

I

(

A H C

) > A ⇔ C < H – I

(iii) Money-burning must be better for the high type than investing without money-burning and being believed to be low type:

1 −

I

(

A H C

)

1

I

(

A H

)

Economics of the Firm - Tore Nilssen – Term paper 2005 – 4

Compare (ii) and (iii). (ii) is redundant, since (iii) is always stricter:

A

⎝

I

⎠

(

(iii) can be rewritten as:

C < I

H − L

A + L

A H

) ⇔

H

I

>

A H

A L

(i) and (iii) are compatible if:

C * < I

H − L

⇔ A + L > I , which always holds.

General issues:

• Term paper versus exam

• Answering without addressing the specific problem

• Formal analysis versus verbal discussion

• Formal analysis: Explain expressions – give intuition.

Specific issues:

• Distinguish ex-ante beliefs and revised beliefs ( p vs. q )

• Equilibrium analysis: beliefs and strategies mutually consistent. Start out with strategies and find beliefs that fit.

Economics of the Firm - Tore Nilssen – Term paper 2005 – 5

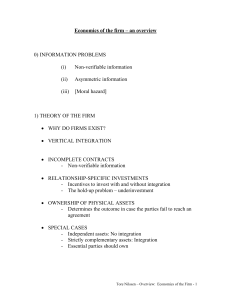

Question II.

• Again: Address the specific problem

• The whole model: not asked for

• The examples:

contract incompleteness

relationship-specific investments

outcome: hold-up

details: ex-post and ex-ante costs of renegotiation

outcome: ownership and control

Economics of the Firm - Tore Nilssen – Term paper 2005 – 6