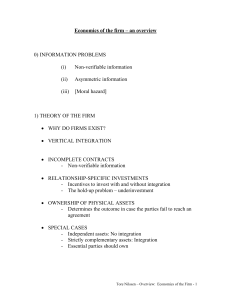

Corporate governance

Corporate governance

[Becht, Bolton, & Röell]

• Conflict of interest between outside investor and manager

• On top of that: dispersed ownership

conflicts of interest among various claimholders in the firm

problem of collective action among investors

How to resolve the collective-action among investors?

1. Concentration of ownership

2. Hostile takeovers

3. Delegation and concentration of control in the hands of the board of directors

4. Executive compensation contracts, aligning manager’s interest with that of investors

5. Clearly defined fiduciary duties for managers

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 1

The policy in most countries: Concentration of ownership in the hands of large shareholders.

Problems with this policy:

collusion among large shareholders and management against small shareholders

reduced liquidity of stock market

Policy in other countries: limiting the power of large shareholders

relying on boards of directors

minority shareholders better protected but at the cost of managerial discretion

Thus, the fundamental trade-off in corporate governance:

Managerial discretion vs. protection of small shareholders .

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 2

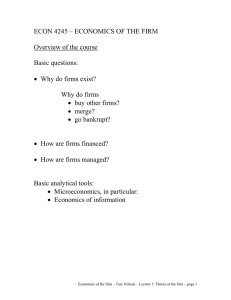

Background

• The privatization wave

• Pension funds and active investors

• Recent merger waves

• Capital market integration

• The 1998 Russia/Asia/Brazil crisis

• Scandals at big US firms

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 3

Framework for discussion

• Common agency

Manager as agent vs. multiple principals

Shareholders, creditors, suppliers, clients, employees, etc.

• Ex-post efficiency and ex-ante efficiency

Compare: static and dynamic efficiency

• What should a firm maximize? Shareholder value?

Not always. Example: conflict of interest owners vs. creditors – it would be better for efficiency if firm did not maximize shareholder value.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 4

• Shareholders vs. other constituencies: Three views

The shareholders are in most need of protection (Williamson)

No, investors need protection – and they are best protected by debt contracts (Jensen) o the “free cash flow” hypothesis o but: costs of financial distress

A firm’s cost of capital depends on its reputation for treating both shareholders and creditors well, so not much regulation is needed

• The tendency towards dispersed ownership

Small investor wealth

Risk diversification

A larger position may be more difficult to sell on the stock market

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 5

Takeovers

• Ex-ante efficiency vs. ex-post efficiency

• Ex-post efficiency: the market for corporate control

(Hirshleifer)

The free-rider problem: target owners get all the gain from takeover

If there are costs to taking over, there will be too few takeovers

Argument in favour of regulation diluting minority rights

One share – one vote

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 6

• Ex-ante efficiency: does the threat of takeovers affect behaviour among current management?

Short-termism in fear of firm being taken over while underpriced (Stein)

Takeover threats may discipline managers

But current owners don’t want the disciplining effect to be so strong that takeovers never happen. They benefit from takeovers at a good price.

Argument in favour of regulation that puts limits on anti-takeover defences.

• Empirical evidence on takeovers

Takeover threats disciplining? If so, then takeovers should mainly target poorly performing firms. – Not so.

Takeovers enhance value? – No, not on average.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 7

Blockholding

• One large shareholder who has incentives to monitor management.

• US and UK: restrictions on blockholders

• Blockholding facilitates takeovers (Hirshleifer)

• Trade-off risk sharing vs. incentives in a new fashion

Blockholding means investor is not optimally diversified, but improves on management’s incentives to perform

• Arguments in favour of giving blockholders incentives to hold larger blocks and to monitor more closely.

• But when the stock market is liquid, it is easy for the blockholder to get out, and so it makes less sense to subsidize blockholding.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 8

• On the other hand, also the stock market does monitoring – e.g., through speculators – and so large shareholders can focus on making use of the information available through the share price, such as share-price based executive compensation.

• Thus, speculators on the stock market and large shareholders complement each other.

• Conflicts of interest between blockholders and small shareholders.

Argument in favour of US-style regulation restricting blockholders.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 9

Bank monitoring

• Delegated monitoring by banks on behalf of investors/savers

• Avoiding duplication of monitoring

• Regulation of banks necessary to ensure proper incentives for bank managers to monitor firms

• Relationship banking

Banks’ ability to collect information

Banks’ role in renegotiations of loans

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 10

The board of directors

• Shareholder democracy

manager is executive branch of government

board is legislative branch

• Board “captured” by management?

Manager’s influence over the choice of board members (directors).

Manager has better information.

Advisory role vs monitoring role.

Board members’ financial stakes are small.

• Regulation: board independence

Independent board members have less knowledge?

Independent – of whom? (management – blockholder)

What about reappointments?

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 11

• Empirical findings on boards

Independent board more likely to fire manager following poor performance

Positive stock price reactions to news of appointment of independent board member

No correlation between firm performance and board composition

• Theory on boards

Board independence an endogenous variable

A manager who is known to have high ability has more say in board appointments

The longer a manager has been in the job, the more known he is for having high ability

– and therefore the less independent is the board, and the less effective is the monitoring of the manager.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 12

Executive compensation

• Executive compensation in the US: not even the sky is the limit?

• More emphasis needs to be put on how executive compensation is determined.

‘market standards’ etc.

the ‘self-serving manager’ hypothesis

• Agency theory predicts executive compensation should be related to the firm’s performance relative to other similar firms (e.g., in same industry), not its absolute performance.

Empirical work: This is not what happens in practice.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 13

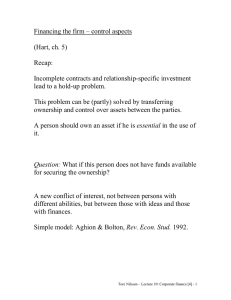

Sharing control with creditors

• Transfer of control in bad outcomes (Aghion &

Bolton)

• Disciplining effects of bankruptcy risk

Sharing control with employees

• The hold-up problem (Hart)

• Sharing control with employees is efficient when employees make valuable, firm-specific investments in their human capital.

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 14

Comparative financial systems

• Market-based systems

US, UK

• Bank-based systems

Japan, Germany

• Long-termism vs short-termism

In favour of the bank-based systems

• Protection of minority shareholders

in favour of market-based systems

• World-wide convergence to the US system?

International corporate-law competition

Differences in “legal origin”

Economics of the firm – Tore Nilssen – Lecture 12 – Corporate governance - 15