Newsletter March 2012 Bi-monthly Newsletter of Horwath Choongjung LLC

advertisement

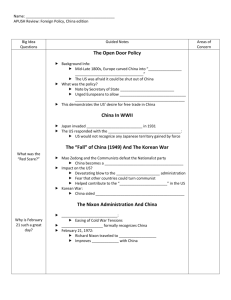

Providing Excellence In Client Services March 2012 Newsletter Bi-monthly Newsletter of Horwath Choongjung LLC Contents This newsletter is prepared and issued by Horwath Choongjung LLC (Choongjung Accounting Corp.) on a bi-monthly basis and intended to provide foreign investors with an update on tax law changes in Korea NTS Taxation Trend and other related subjects of special interests to foreign investors. The information provided herein should not form a basis of any Scrutinization of fee for payment guarantee provided to a foreign (nonKorean) subsidiary decision as to a particular course of action, nor should it be relied upon as a substitute for a detailed advice in individual cases. --------------------------------------------------------------------------------------------------- 2012 Tax Law Changes Extension of 50% income tax exemption period for the qualified foreign engineers Please contact any of the following individuals with any inquiries or comments. Contacts: G.S. Sim or H.S. Kim at Tax&BPO Services of Horwath Choongjung [Tel: (82)(2) 316-6600, Fax: (82)(2) 775-5885, E-mail: post@crowehorwath.co.kr] (You may find this newsletter and other items of interest at http://www.crowehorwath.co.kr) New Tax Ruling Application of “denial of unfair transactions” to an in-kind contribution transaction by a Korean branch Tax Filing Information Global individual income tax return filing by May 31, 2012 Audit l Tax l Advisory www.crowehorwath.co.kr -1- March 2012 NTS Taxation Trend Scrutinization of fee for payment guarantee provided to a foreign (nonKorean) susidiary 1. Scrutinization of fee for payment guarantee provided to a foreign (nonKorean) subsidiary When a foreign subsidiary of a Korean company uses a loan from the financial institutions in the foreign country, the Korean company usually provides the foreign subsidiary with payment guarantee and the foreign subsidiary pays a fee for the payment guarantee. Based on the announcement of National Tax Service (“NTS”), the amount of payment guarantees for the foreign subsidiaries provided by the Korean parent companies steeply increased to USD 12 billion, 23 billion and 42 billion in 2007, 2008 and 2009, respectively. Under the Korean tax law, the fee for payment guarantee received from the foreign subsidiary is treated as taxable income and subject to the Korean transfer pricing rules. However, as it is not clear how to determine the arm’s length price of the fee for payment guarantee, certain Korean parent companies were deemed to have received the fees for payment guarantee at a lower level and as a result, there have been disputes on the appropriateness of the fees for payment guarantee between NTS and the taxpayers over the years. NTS has collected the information on the payment guarantees from the Korean parent companies and the relevant financial institutions, and recently developed a calculation model of arm’s length price of the fee for payment guarantee. It is known that NTS plans to, based on the calculation model, recommend certain taxpayers to file amended corporate tax returns or impose underpaid corporate taxes on the Korean companies which have received the lower fees for payment guarantees than the arm’s length prices. Considering the size of payment guarantees, the number of relevant Korean companies and the number of years concerned, NTS is likely to levy a significant amount of taxes in relation to the payment guarantee. In this connection, it is likely that tax appeals or litigations by the relevant Korean companies against the tax assessments by NTS will increase. Audit l Tax l Advisory www.crowehorwath.co.kr -2- March 2012 2012 Tax Law Changes 2. Extension of 50% income tax exemption period for the qualified foreign engineers Foreign engineers prescribed in Article 16 of Presidential Decree of Tax Incentive Limitation Law are eligible for the tax exemption of the amount equivalent to 50% of the income tax on the earned income for two years from the initial service date which should be before December 31, 2011. However, the initial service date has been extended to December 31, 2014 and as a result, the qualified foreign engineers starting their initial services in Korea on or after January 1, 2012 and before December 31, 2014 will be able to enjoy the above income tax exemption. New Tax Ruling 3. Application of “denial of unfair transactions” to an in-kind contribution transaction by a Korean branch (Gukjesewon-582, 2011.12.23) When a Korean branch of a foreign company invests assets and liabilities in a newly established Korean company (“New Company”) in the form of in-kind contribution, if the Korean branch does not receive the fair market price for the transferred net assets including goodwill from the New Company, Article 52 (Denial of Unfair Transactions) of Corporate Tax Law will apply and additional taxes may be assessed as a result of tax adjustments made by the Korean tax authorities. Tax Filing Information 4. Global individual income tax return filing by May 31, 2012 Korean citizens and foreigners who are considered to be residents for tax purposes are subject to taxation on worldwide income derived from sources both inside and outside of Korea. The income includes global income [employment (earned) income, business profits, pension, dividend, interest and other income], severance pay, and capital gains. Regarding the scope of income subject to the tax return filing, an exception exists for the foreigners who lived in Korea less than 5 years. A foreigner deemed to be a non-resident is taxed only on income derived from sources within Korea, including wages and salaries earned in Korea, unless a tax treaty to which the individual is subject indicates otherwise. The foreign expatriate officers and employees are eligible to apply a flat income tax rate of Audit l Tax l Advisory www.crowehorwath.co.kr -3- March 2012 15% (plus local income tax) instead of the progressive income tax rates ranging from 6% to 38% plus local income tax (an application must be filed separately). However, when choosing the flat income tax rate, the expatriate officer or employee concerned must give up all the existing available benefits including nontaxable income treatment, tax reduction and tax exemption relating to income taxes. Taxpayers making monthly tax payments and having only one source of worldwide income (i.e., either Class A or Class B) are generally not required to file a global income tax return since the employer (for Class A income earners) or the Class B taxpayers' association (for Class B income earners) finalizes the individual's tax liability at the end of the year. Taxpayers having more than one source of income, however, are required to file a global income tax return for the year and pay taxes due on such income on or before May 31 of the following year, or prior to permanently leaving Korea. In case an employee has both Class A and Class B income declared to the Class B taxpayers’ association, the employer who pays Class A income may finalize the employee’s tax liability by including Class B income in the exact payroll withholding tax settlement at the end of the year instead of the employee filing a global income tax return. * * * * * Horwath Choongjung LLC Member Crowe Horwath International PMAA Jaram Building, 16th Floor, 566 Dohwa-dong, Mapo-gu, Seoul 121-815, Korea TEL: (82)(2) 316-6600 FAX: (82)(2) 775-5885 E-mail: post@crowehorwath.co.kr Website: http://www.crowehorwath.co.kr Horwath Choongjung LLC is a member of Crowe Horwath International, a Swiss association. Each member firm of Crowe Horwath International is a separate and independent legal entity. Horwath Choongjung LLC and its affiliates are not responsible or liable for any acts or omissions of Crowe Horwath International or any other member of Crowe Horwath International and specifically disclaim any and all responsibility or liability for acts or omissions of Crowe Horwath International or any other Crowe Horwath International member. Audit l Tax l Advisory www.crowehorwath.co.kr -4-