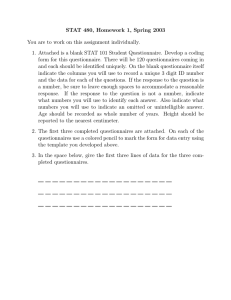

– Instructions Annual Questionnaire

advertisement

Annual Questionnaire – Instructions For the 2016 financial year QUESTIONNAIRES Please select and complete the relevant 2016 Annual Accounts Questionnaires which need to be completed before preparation of your financial statements. If you need any assistance, please contact your Crowe Horwath client advisor. Please complete a separate questionnaire for each entity or individual. We have questionnaires covering the following: Businesses (including computerised systems such as MYOB) Rental Properties Personal Taxation Returns Trusts Primary Industry Please sign and return the Acceptance and Authority to Disclose and Review Information sheet. Where you use a computerised system, it is important that you firstly work through the “End of Year Procedures – Computerised Systems” checklist. We also ask you to please complete the “Your Contact Details” form so that we can make certain our contact details for you are correct. Finally, please complete the “Needs Analysis” questionnaire. This enables us to ensure that all financial aspects of your business have been considered and ris ks minimised. When your records are complete and the questionnaires are signed off, either: Forward them to us, or Arrange a time for us to collect the records and discuss any issues. Our aim is to provide you with a continuing annual high quality acc ounting service at an appropriate fee. HOW CAN YOU HELP US GET YOUR TAX RETURN RIGHT? Advise us of any unusual transactions during the year. Supply us with all relevant documentation relating to e.g. entertainment, repairs and maintenance and overseas travel. Let us know of any other relevant information to avoid potential misinterpretation. This can be expensive under the new penalties regime. Supply a list of investments in companies domiciled outside New Zealand and Australia so that we can determine whether you will be affected by the new tax rules on portfolio investments. PROFESSIONAL STANDARDS Our role is to provide high quality financial information and advice appropriate to your personal needs and objectives. We act professionally in your best interests within the code of ethics and professional guidelines of the New Zealand Institute of Chartered Accountants. This involves adherence to standards of: Confidentiality Avoiding any conflict of interest which may prevent us acting on your behalf FEES We believe it is important for our clients to understand how our fees are calculated and our expectations for payment. Unless otherwise agreed in writing, our fees are calculated after taking account of a number of factors, including time spent on the assignment by our principals and employees, the levels of skill, specialised knowledge and responsibility involved, the urgency and circumstances in which your work is carried out and the complexity of your affairs. Disbursements paid on your behalf are reimbursable and will be invoiced. Invoices will be rendered on a monthly basis for work conducted in that month. In instances where your assignment has not been completed by month end, a progress invoice will be rendered. For clients and ourselves, we find that regular billing gives better control and helps budgeting and cash flow planning. Payment is due by the 20th day of the month following the issue date of the invoice. You are a valued client of Crowe Horwath (NZ) Limited. We are here to help you at a ny time and welcome your queries. We look forward to our relationship continuing to grow in the coming months.