Energy Intensity in China's Iron and ...

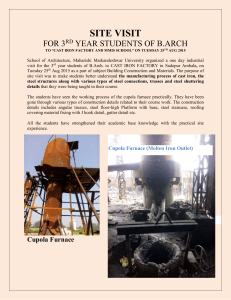

advertisement