outh E X C h A N G E Time To CelebraTe

advertisement

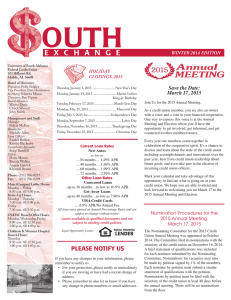

outh E X C H A N G E FALL 2012 EDITION University of South Alabama Federal Credit Union 103 Hillcrest Rd. Mobile, AL 36608 Board of Directors: President Polly Stokley Vice President Pam Henderson Secretary Scherita Mixon Treasurer Ben Tipton Board Members Wayne Davis Chuck Warnol John Smith Management and Staff: Manager Felicia McKee Assistant Manager Anita Stevenson Bookkeeper Barbara Roy Loan Officers Sandra Bolden Kristin Blackerby Compliance Specialist Stacy Barnhill Head Teller Stephanie Lowe Tellers Doris Martin Kathleen Ellis Brenda Walker Angela Garrick Phone: (251) 706-0255 Fax: (251) 706-0299 Main (Campus) Lobby Hours: Monday – Friday 8:00 a.m. till 5:00 p.m. Drive-Up Hours: Monday - Thursday 7:30 a.m. till 5:00 p.m. Friday 7:30 a.m. till 5:30 p.m. USAMC Branch Office Hours: Monday, Wednesday, Friday 8:00 a.m. till 12:30 p.m. and 1:00 p.m. till 4:00 p.m. Available at the Credit Union Time to Celebrate Make the Season Brighter With A Holiday Loan International Credit Union Day It’s a simple, but profound message: Members Matter Most. It’s the key concept behind credit unions and the theme for this year’s International Credit Union Day, October 18. Observed the third Thursday of October each year, ICU Day is a day set aside to reflect on credit union values and principles: Why we do what we do, and how we do it. This is also the United Nations’ International Year of Cooperatives, a yearlong celebration promoting the many ways credit unions and other cooperatives worldwide are helping people help themselves. As a not-for-profit financial cooperative, your credit union is in business for only one reason: to provide you, our member-owner, with financial services to help you improve the quality of your life. Members Matter Most - three words that speak to the heart of credit union philosophy. So join us in celebrating ICU Day. You are our number one priority. Stop by the credit union to learn more about how you can get the most out of your membership. Cu rrent Loa n R ates Santa’s making his list and checking it twice, and so are you. But while it appears Santa has unlimited funds to finance his holiday cheer, you may not. That’s where we can help. With a holiday loan from the credit union, you can set a budget and stick to it. Here’s how: Determine how much to spend on gifts, cards, postage and shipping, food, entertainment, and decorations. It may help to review what you spent last year and plan accordingly, and then with a holiday loan from the credit union, you can pay cash for these items. This has two benefits: • • Money experts note that when you pay cash, you are much less likely to overspend than when you use a credit card. Your “ho-ho-hos” won’t turn into “oh no’s” when the credit card bills arrive in January. With fair rates and terms, a holiday loan will help you stay on budget and on track financially. USAFCU‘s holiday loans are just right for you. $1200.00 for 12 months for as low as 7.9% APR is waiting for you through December 31, 2012! Happier Holidays start at the credit union. Call us at 251-706-0255 or stop by the credit union today and ask for a holiday loan officer! (Depending upon credit qualifications, your rate might be as low as): New & Used Autos …36 months… 2.49% APR ….48 months… 2.69% APR ….60 months.... 2.99% APR ….72 months… 3.59% APR (new only) Other Loan Rates Unsecured Loans ..up to 36 months…as low as 10.9% APR Get-Away Loans ..up to 48 months…as low as 7.90% APR VISA Credit Cards ….8.9% APR/No Annual Fee All loan rates quoted as Annual Percentage Rates and are subject to change without notice. Holiday Closings, 2012 Thursday, November 22, 2012................ Thanksgiving Day Monday, December 24, 2012......................... Close at 1:00 Tuesday, December 25, 2012...................... Christmas Day Monday, December 31, 2012......................... Close at 1:00 Tuesday, January 1, 2013............................ New Year’s Day Loans available to qualified borrowers and are subject to existing credit policies. Equal Opportunity Lender. Equal Housing LENDER STATEMENT OF FINANCIAL CONDITION As of August 31, 2012 ASSETS: Total Net Loans & VISAs Net Investments Fixed Assets Land and Building Other Assets TOTAL ASSETS Liabilities & equity: Liabilities (Payables) Member Deposits: Certificates of deposit Share Drafts (Checking) IRAs Christmas & Youth Clubs Regular Shares Equity Regular Reserves Undivided Earnings TOTAL LIABILITIES & EQUITY 8,216,602.81 24,599,689.35 83,180.73 734,240.16 278,990.47 $33,912,703.52 156,784.48 3,596,557.22 4,943,876.82 1,367,375.65 583,802.88 18,941,519.92 336,491.99 3,090,248.24 $33,912,703.52 Important Message About Christmas Clubs Christmas Club balances will be automatically deposited into either your credit union share account or into your credit union checking account on the night of November 1. VISA Gift Cards Are Here! VISA gift cards are perfect for any occasion--smart, thoughtful and always well received. Stop by the main branch and check out the variety of gift cards we have. We offer Christmas, “For You”, and All Occasion cards. Our low fee of $3.50 per card makes them affordable and convenient. Laughing stirs up the blood, expands the chest, electrifies the nerves, clears away the cobwebs from the brain, and gives the whole system a cleansing rehabilitation. 8.9% Annual Percentage Rate No Annual Fees Pick up a USAFCU VISA credit card application at your nearest branch and start enjoying your lower rate today! Credit cards available to qualified borrowers; all loans subject to existing credit policies. Credit card rate quoted as Annual Percentage Rate. We would like to take a moment to express our deepest gratitude to those brave men and women, our veterans, who have sacrificed and given so much in the name of freedom. Veterans Day, November 11 of each year, is the day we officially honor all American veterans, living and dead, of wartime and peacetime. It is a day dedicated to thanking living veterans for their commitment and service to our country. Originally observed as Armistice Day, a day to honor all veterans of WWI, Veterans Day was deemed an official legal holiday on June 1, 1954. The day is traditionally commemorated with a wreathlaying ceremony at the Arlington National Cemetery and events throughout the U.S. As of 2001, the week of November 11-17 was named National Veterans Awareness Week. It is so important during this designated time (and every day) to stop, think about, appreciate, and thank those dedicated individuals who have given so much for America, its people, and our way of life. We salute you! Even though more and more of the documents in life can be dealt with electronically, there is still a large amount of legal and financial paperwork requiring paper as well as a signature. Sometimes, you even need a notarized signature. Signing your name in the presence of a notary signifies that you are doing so without undue influence; no one is forcing you to sign. You are also declaring you are signing the document for the intentions outlined in it and that you swear or affirm the document contains the truth. If you need notary services, call on the credit union. We have a notary on staff who is available to help you. It’s just one more benefit of belonging to the credit union.