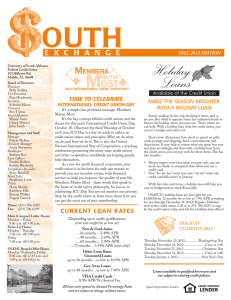

outh E X C h A N G E

advertisement

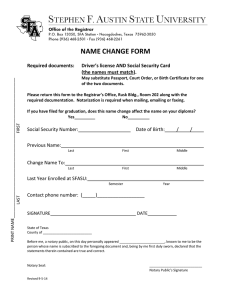

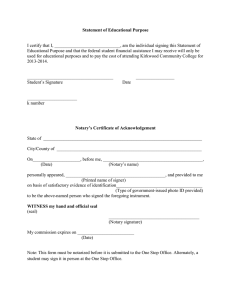

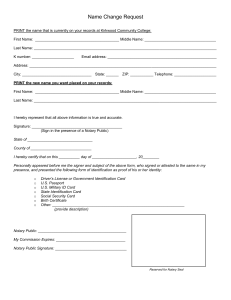

outh E X C H A N G E Thank You University of South Alabama Federal Credit Union 103 Hillcrest Rd. Mobile, AL 36608 Board of Directors: President, Polly Stokley Vice President, Pam Henderson Secretary, Scherita Mixon Treasurer, Ben Tipton Board Members Wayne Davis Chuck Warnol John Smith Management and Staff: Manager Felicia McKee Assistant Manager Jessica Dickson Bookkeeper Michele Allen Loan Officers Sandra Bolden Kristin Blackerby Compliance Specialist Stacy Barnhill Tellers Brenda Walker Angela Garrick Khyrstal Brown Phone: (251) 706-0255 Fax: (251) 706-0299 Main (Campus) Lobby Hours: Monday – Friday 8:00 a.m. till 5:00 p.m. Drive-Up Hours: Monday - Thursday 7:30 a.m. till 5:00 p.m. Friday 7:30 a.m. till 5:30 p.m. USAMC Branch Office Hours: Monday, Wednesday, Friday 8:00 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. Children’s & Women’s Hospital Branch Hours: Thursday 8:30 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. FALL 2015 EDITION Holiday Help from Your Credit Union Is your Grinch-like budget barely covering the cost of Santa’s cookies and milk this holiday season? We can help. With a Holiday Loan from the credit union, you can enjoy this most wonderful time of the year. And our low-interest rates mean you won’t end up with a holiday hangover from bringing on credit cards. Start by calculating your expenses: gifts, wrapping paper, shipping and postage, decorations, cards, holiday meals and parties and so on. Last year’s bills can help remind you of what you spent. Too much? Think about ways of trimming back. For example, draw names instead of buying everyone on your list a gift or ask family members to help with meal preparation by bringing a dish to pass. Plan to ship gifts in ample time instead of paying for expedited deliveries. With your spending plan complete, see us about a Holiday Loan. Then shop with cash. Research shows that many consumers spend less when they use cash instead of plastic. Happy holidays from all of us at the credit union. Current Loan Rates (Depending upon credit qualifications, your rate might be as low as): New & Used Autos .…36 months… 1.74% APR ….48 months… 1.94% APR ….60 months.... 2.24% APR ….72 months… 2.84% APR (new only) Other Loan Rates Unsecured Loans ..up to 36 months…as low as 10.40 % APR Get-Away Loans ..up to 48 months…as low as 7.40% APR VISA Credit Cards ….8.9% APR/No Annual Fee All loan rates quoted as Annual Percentage Rates and are subject to change without notice. Loans available to qualified borrowers and are subject to existing credit policies. Equal Opportunity Lender. Equal Housing LENDER VETS Thank You Vets! Wednesday, November 11, 2015 marks the 96th observance of Veterans Day. President Woodrow Wilson declared the day a federal holiday in 1919. Originally known as Armistice Day, the name was changed to Veterans Day in 1954. The date was chosen in reference to the ending of World War I: Germany signed an armistice with the Allies at 11 a.m. on November 11, 1918. Today, Veterans Day is dedicated to honoring all who have served our country. It is an important reminder of the sacrifices all of our military men and women have made on our behalf and an opportunity to acknowledge and thank them for their service and contributions. As we mark the day, all of us at the credit union want to say, “Thank you vets!” This summer the credit union participated in the Mobile County Summer Internship Program. Some of you had the opportunity to meet Tanner Lee on our teller line. Tanner resides in Baldwin County and is currently attending Harvard University. We wish Tanner the best of luck at school and thank him for his hard work and dedication at the credit union. STATEMENT OF FINANCIAL CONDITION As of July 31, 2015 ASSETS: Total Net Loans & VISAs Net Investments Fixed Assets Land and Building Other Assets TOTAL ASSETS Liabilities & Equity: Liabilities (Payables) Member Deposits: Certificates of Deposit Share Drafts (Checking) IRAs Christmas & Youth Clubs Regular Shares Equity Regular Reserves Undivided Earnings TOTAL LIABILITIES & EQUITY 10,893,111.89 28,366,092.48 60,459.80 659,642.56 119,806.18 $40,099,112.91 653,089.39 2,572,182.90 4,955,593.04 1,316,716.63 557,472.69 26,097,619.97 336,491.99 3,609,946.30 $40,099.112.91 The Alternative Way to Save Do you have extra money on hand; why not lock it up by opening a Share Certificate? Your credit union offers Share Certificates that allow you to choose a term that matches the path you are on. It’s a safe and easy way for you to reach short and long term financial goals, such as setting up funds for education, fun getaways, a rainy day fund, etc. Give yourself the opportunity to save with a “hands off” approach and a chance for that hard-earned cash to grow. To find out more about this alternative way to save, call, visit us online, or stop by the credit union. Important Message About Christmas Clubs Christmas Club balances will be automatically deposited into either your credit union share account or into your credit union checking account on the night of November 2nd. VISA Gift Cards Are Here! VISA gift cards are perfect for any occasion--smart, thoughtful and always well received. Stop by the main branch and check out the variety of gift cards we have. We offer Christmas, “For You”, and All Occasion cards. Our low fee of $3.50 per card makes them affordable and convenient. Holiday Closings, 2015 Thursday, November 26, 2015..................Thanksgiving Day Thursday, December 24, 2015.......................Close at 1 p.m. Friday, December 25, 2015.......................... Christmas Day Thursday, December 31, 2015.......................Close at 1 p.m. Friday, January 1, 2016................................ New Year’s Day Credit Union Notary Services for Your Convenience If you require professional notary services, look no further than your credit union. From contracts and financial documents, to birth records to deeds and other real estate transactions, to agreements and powers of attorney, we can help with all of your notary needs. With a Notary Public on-site, you have easy access to an impartial, state-licensed, and legal witness for the signing of your document. Having your documents signed, sealed, and legally authenticated is easy and affordable at the credit union. Rather than searching for and making a special trip to a separate notary, you can have your document(s) notarized in your local branch while conducting your regular financial transactions. Keep in mind, members and non-members must present a valid photo ID and sign the document in the presence of the notary. It’s advisable to contact the credit union for exact notary locations and hours - often the notary is available at certain branches during specific hours. Give us a call ahead of time to ensure a successful and hasslefree visit. For a full list of branch locations and phone numbers, visit our website. The Last Word Worrying is like sitting in a rocking chair. It gives you something to do, but it doesn’t get you anywhere.