outh E X C h A N G E Holiday loans are Here

advertisement

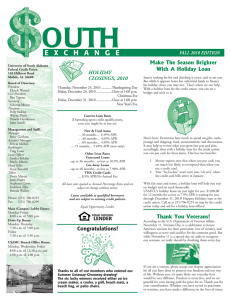

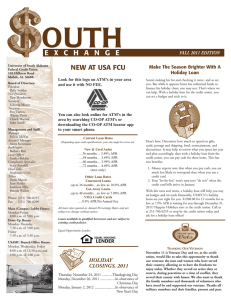

outh E X C H A N G E Holiday Loans Are Here University of South Alabama Federal Credit Union 103 Hillcrest Rd. Mobile, AL 36608 Board of Directors: President, Polly Stokley Vice President, Pam Henderson Secretary, Scherita Mixon Treasurer, Ben Tipton Board Members Wayne Davis Chuck Warnol John Smith Management and Staff: Manager Felicia McKee Assistant Manager Anita Stevenson Bookkeeper Barbara Roy Loan Officers Sandra Bolden Kristin Blackerby Compliance Specialist Stacy Barnhill Teller Supervisor Stephanie Lowe Tellers Doris Martin Brenda Walker Angela Garrick Phone: (251) 706-0255 Fax: (251) 706-0299 Main (Campus) Lobby Hours: Monday – Friday 8:00 a.m. till 5:00 p.m. Drive-Up Hours: Monday - Thursday 7:30 a.m. till 5:00 p.m. Friday 7:30 a.m. till 5:30 p.m. USAMC Branch Office Hours: Monday, Wednesday, Friday 8:00 a.m. till 12:30 p.m. and 1:00 p.m. till 4:00 p.m. Children’s & Women’s Hospital Branch Hours: Thursday 8:30 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. FALL 2013 EDITION Credit Unions Unite For Good: A Better Way It’s time to celebrate! October 17th is International Credit Union Day, a day set aside to recognize our history and philosophy as well as show you, our valued member/owner, our appreciation for your participation in the credit union. This year marks the 65th anniversary of the celebration of International Credit Union Day and this year’s theme, “Credit Unions Unite For Good: A Better Way,” reflects the power of cooperation that makes credit unions all over the world a force for good. As a not-for-profit financial cooperative, your credit union puts the best interests of its members first, not those of stockholders. From Alabama to Zimbabwe, credit unions everywhere improve the quality of life for their members and the communities in which they live. By belonging to the credit union and using the services, you not only help yourself to competitive rates and friendly service, you help others. So join us in celebrating “A Better Way” to manage your money today and to prepare for a secure financial future. Current Loan Rates (Depending upon credit qualifications, your rate might be as low as): New & Used Autos …36 months… 1.49% APR ….48 months… 1.69% APR ….60 months.... 1.99% APR ….72 months… 2.59% APR (new only) Other Loan Rates Unsecured Loans ..up to 36 months…as low as 10.9% APR Get-Away Loans ..up to 48 months…as low as 7.90% APR VISA Credit Cards ….8.9% APR/No Annual Fee All loan rates quoted as Annual Percentage Rates and are subject to change without notice. Loans available to qualified borrowers and are subject to existing credit policies. Equal Opportunity Lender. Equal Housing LENDER Santa has his helpers: Folks with pointy ears and long noses who wear funny hats. But what about you? How will you make the holidays all shiny and bright? A holiday loan from the credit union to the rescue! And a holiday loan can actually save you money. Rather than overextending yourself on credit cards (some of which may have interest rates of 25% or higher) determine how much you need for your holiday expenses: toys and gifts, gift wrap, cards, postage, entertainment, travel and so on. If it seems as though you may be spending too much, think about ways you can economize. For example, host a holiday brunch instead of dinner or invite guests to bring their specialty dish rather than footing the entire food bill yourself. Once you’ve arrived at a figure, see the credit union for your holiday loan. Use these funds (and no more) for your holiday spending. Having a pre-determined amount and a plan for spending puts you in control. With fair rates and terms, a holiday loan will help you stay on budget and on track financially. USAFCU‘s holiday loans are here. $1,200.00 for 12 months for as low as 7.9% APR is waiting for you through December 31, 2013! Happier Holidays start at the credit union. Call us at 251-706-0255 or stop by the credit union today and ask for a holiday loan officer! Simplify With Direct Deposit Don’t miss out on one of life’s greatest conveniences! Have your paycheck or regularly recurring payments such as a Social Security or pension check deposited to your credit union account. Once there, it can be allocated as you wish. For example, to make a loan payment, to set aside money in a special savings account, for that vacation of a lifetime, or for a down payment on your dream car. Having your funds deposited directly to the credit union makes managing your money easier than ever because direct deposit and automatic payments work handin-hand to simplify your finances. So what are you waiting for? Call or stop by the credit union. We’ll help you make the appropriate arrangements with your payroll office, Social Security or other provider. STATEMENT OF FINANCIAL CONDITION As of August 31, 2013 ASSETS: Total Net Loans & VISAs Net Investments Fixed Assets Land and Building Other Assets TOTAL ASSETS Liabilities & equity: Liabilities (Payables) Member Deposits: Certificates of deposit Share Drafts (Checking) IRAs Christmas & Youth Clubs Regular Shares Equity Regular Reserves Undivided Earnings TOTAL LIABILITIES & EQUITY 9,602,552.88 24,945,300.84 61,193.42 708,663.84 394,429.06 $35,712,140.04 735,414.53 3,090,727.13 4,678,651.07 1,488,134.07 571,619.17 21,628,498.76 336,491.99 3,182,603.32 $35,712,140.04 We Salute You! We would like to take a moment to express our deepest gratitude to those brave men and women, our veterans, who have sacrificed and given so much in the name of freedom. Veterans Day, November 11 of each year, is the day we officially honor all American veterans, living and dead, of wartime and peacetime. It is a day dedicated to thanking living veterans for their commitment and service to our country. Originally observed as Armistice Day, a day to honor all veterans of WWI, Veterans Day was deemed an official legal holiday on June 1, 1954. The day is traditionally commemorated with a wreath-laying ceremony at the Arlington National Cemetery and events throughout the US. As of 2001, the week of November 11-17 was named National Veterans Awareness Week. It is so important during this designated time (and every day) to stop, think about, appreciate, and thank those dedicated individuals who have given so much for America, its people, and our way of life. We salute you! Important Message About Christmas Clubs BECOME A MASTER AT BALANCING DEBT Christmas Club balances will be automatically deposited into either your credit union share account or into your credit union checking account on the night of November 1. VISA Gift Cards Are Here! VISA gift cards are perfect for any occasion--smart, thoughtful and always well received. Stop by the main branch and check out the variety of gift cards we have. We offer Christmas, “For You”, and All Occasion cards. Our low fee of $3.50 per card makes them affordable and convenient. Holiday Closings, 2013 MOVE YOUR BALANCE TO OUR LOWER INTEREST RATE CREDIT CARD. Paying less interest and fees is the straight path to financial steadiness. IT’S DEBT DEFYING! Lower interest and fees with the greatest of ease. STOP CLOWNING AROUND Pay off debt with a smile so you can start investing in your future. THE ELEPHANT IN THE ROOM You can’t ignore it any longer. It’s time to take control of your bills by putting your foot down on monthly interest payments. EXPERT JUGGLING One monthly card payment is all you need to handle due dates, billing statements and money management without dropping the ball. Applying for our credit union VISA credit card is easy, with an 8.9% rate on purchases and balance transfers, stop by or call our credit union today. Thursday, November 28, 2013.............Thanksgiving Day Tuesday, December 24, 2013......................Close at 1:00 Wednesday, December 25, 2013............. Christmas Day Tuesday, December 31, 2013......................Close at 1:00 Wednesday, January 1, 2014...................New Year’s Day Beware of little expenses. A small leak will sink a great ship. - Benjamin Franklin