(c) crown copyright Catalogue Reference:CAB/24/195 Image Reference:0001

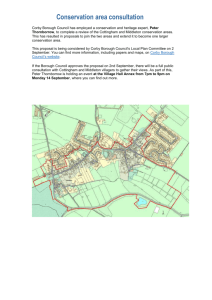

advertisement