Market Shows Strong Signs of Recovery Month of April, 2010

advertisement

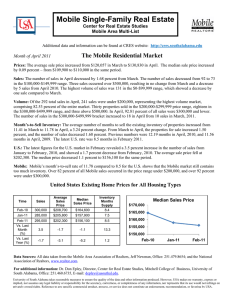

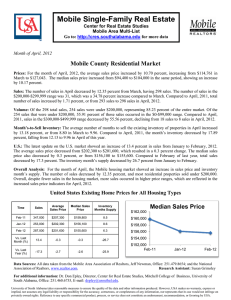

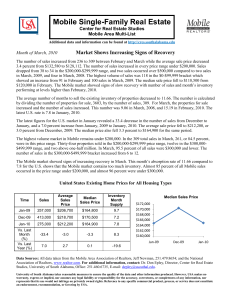

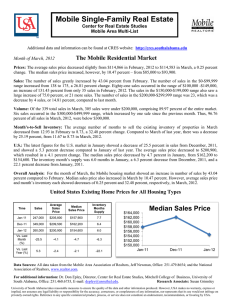

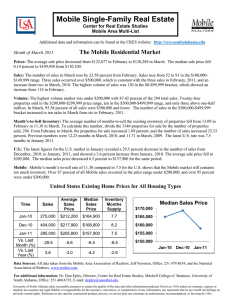

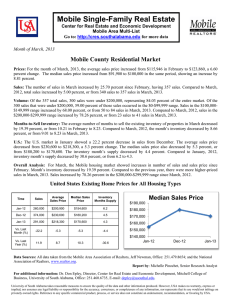

Mobile Single-Family Real Estate Center for Real Estate Studies Mobile Area Multi-List Additional data and information can be found at http://cres.southalabama.edu Market Shows Strong Signs of Recovery Month of April, 2010 The number of sales increased from 318 to 326 between March and April while the average sale price increased dramatically by 20.35 percent from $128,396 to $154,530. The number of sales increased in every price range over $100,000. Sales dropped from 119 to 93 in the $0-$99,999 range, and eight sales occurred over $500,000 compared to four sales in April, 2009, and seven in April, 2008. The highest volume of sales was 97 in the $100,000-$149,999 bracket which showed an increase from 96 in March and 83 sales in April, 2009. The median sale price rose to $130,000 from $118,500 in March. The Mobile market showed strong signs of recovery. The average number of months to sell the existing inventory of properties decreased to 11.50. The number is calculated by dividing the number of properties for sale, 3750, by the number of sales, 326. For April, the properties for sale increased and the number of sales increased. This number was 11.38 in April, 2009, and 11.51 in March, 2010. The latest U.S. rate is 8.5 in February, 2010. The latest figures for the U.S. market in February revealed a 9.1 percent increase in the number of sales from January to February, and a 7.1 percent increase from February, 2009, to February, 2010. The average sale price fell to $208,700, or -1.6 percent from January, 2010. The median price also fell 0.2 percent to $164,600 for the same period. The highest volume market was under $200,000. Of the 326 total sales in April, 254, or 77.9 percent, were in this price range. Forty-seven properties sold in the $200,000-$299,999 price range, seventeen in the $300,000-$499,999 range, and eight above one-half million. In April, 92.3 percent of all sales were $300,000 and lower. The number of sales in the $300,000-$499,999 bracket increased from 12 to 17. The Mobile market showed signs of increasing recovery in April. This month’s absorption rate of 11.50 compared to 8.5 for the U.S. shows that the Mobile market still contains too much inventory. Almost 78 percent of all Mobile sales occurred in the price range under $200,000, and 92 percent were under $300,000. United States Existing Home Prices for All Housing Types Time Sales Feb-09 280,000 Ave. Sales Price $210,300 Jan-10 275,000 Feb-10 Vs. Last Month (%) Vs. Last Year (%) Med. Sales Price Inventory Mo. Supply $168,200 9.7 $212,200 $164,900 7.8 300,000 $208,700 $164,600 8.5 9.1 -1.6 -0.2 9.0 Median Sales Price $172,000 $170,000 $168,000 $166,000 $164,000 $162,000 $160,000 Jan-09 7.1 -0.8 -2.1 Dec-09 Jan-10 -12.4 Data Sources: All data taken from the Mobile Area Association of Realtors, Jeff Newman, 251.479.8654; and the National Association of Realtors, www.realtor.com. For additional information, contact: Dr. Don Epley, Director, Center for Real Estate Studies, University of South Alabama, Office: 251.460.6735, E-mail: depley@usouthal.edu. University of South Alabama takes reasonable measures to ensure the quality of the data and other information produced. However, USA makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, correctness, or completeness of any information, nor represents that its use would not infringe on privately owned rights. Reference to any specific commercial product, process, or service does not constitute an endorsement, recommendation, or favoring by USA. April 2010 Mobile County Single-Family Residential Report Average Sales Price $200,000 Median Sales Price $140,000 $135,000 $150,000 $130,000 $125,000 $100,000 $120,000 $115,000 $50,000 $110,000 $0 $105,000 Apr-07 Apr-08 Apr-09 Month Ave. Sales $ Apr-07 $156,645 Apr-08 $161,277 2.96 Apr-09 $144,193 -10.59 Mar-10 $128,396 Apr-10 $154,530 Annual 08 $153,089 Annual 09 $143,064 Mar-10 vs. Last Year (%) Apr-10 Apr-07 vs. Last Month (%) Number of Sales 500 Apr-09 Mar-10 vs. Last Year (%) Month Med. Sales $ Apr-07 $135,900 Apr-08 $137,000 0.81 Apr-09 $124,500 -9.12 Mar-10 $118,500 Apr-10 $130,000 Annual 08 $133,850 Annual 09 $127,000 20.35 -6.55 Apr-08 Apr-10 vs. Last Month (%) 9.70 -5.12 Month's Inventory 14 12 400 10 300 8 200 6 4 100 2 0 0 Apr-07 Apr-08 Apr-09 Mar-10 Month # Sales vs. Last Year (%) Apr-07 Apr-10 Apr-07 vs. Last Month (%) Apr-08 Apr-09 Month Month's Inventory 5.41 Mar-10 vs. Last Year (%) 469 Apr-07 Apr-08 390 -16.84 Apr-08 9.06 67.47 Apr-09 299 -23.33 Apr-09 11.38 25.61 Mar-10 318 Mar-10 11.51 Apr-10 326 Apr-10 11.15 Annual 08 4106 Annual 08 10.33 Annual 09 3472 Annual 09 12.42 2.52 -15.44 Apr-10 vs. Last Month (%) -3.13 20.23 0-$99,999 $100,000$149,999 $150,000$199,999 $200,000$299,999 $300,000$499,999 Apr-07 115 167 94 63 23 7 Apr-08 101 124 76 55 27 7 4 Apr-09 113 83 51 33 15 Mar-10 119 96 50 35 12 2 Apr-10 93 97 64 47 17 8 Ann. 08 1248 1234 764 588 204 71 Ann. 09 1142 1090 612 450 143 34 Number Month Over $500K Price Range of Sales 180 160 140 120 100 80 60 40 20 0 Apr-07 Apr-08 Apr-09 Mar-10 Apr-10