Baldwin Residential Real Estate Center for Real Estate Studies Baldwin

advertisement

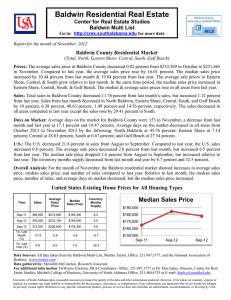

Baldwin Residential Real Estate Center for Real Estate Studies Baldwin Multi List Go to: http://cres.southalabama.edu http://cres.southalabama.edufor more data Report for the month of February, 2012 Baldwin County Residential Market (Total, Total, North North, Eastern Shore, Central, South, Gulf Beach) Prices: From January to February, the average sales price in all areas of Baldwin County increased. The total county average sales increased by 28.05 percent, or from $177,290 in January to $227,018 in February. The following increases occurred in North, Eastern Shore, Central, South, and Gulf Beach, respectively: 17.83, 48.67, 9.04, 20.39, and 8.29 percent. Compared to February, 2011, North, Eastern Shore, and Central all saw increases of 8.32, 5.16, and 11.20 percent, respectively. South and Gulf Beach both dec decreased reased by 5.48 and 1.07 percent, respectively, from the same month last year. All areas also increased in median sales price in North, Eastern Shore, Central, South, and Gulf Beach by 8.09, 15.27, 28.92, 23.26, and 13.92 percent, respectively. respective Sales: The total number of sales in Baldwin County rose from 229 in January to 261 in February, or by 13.97 percent. However, this is a 9.06 percent decrease from February, 2011, with total sales of 287. Eastern E Shore, South, and Gulf Beach increased, while North Baldwin and Central decreased in total number of sales. Days on Market: Average days on th the market for all Baldwin County also increased by 12.92 percent in February, or from 178 to 201 days. North Baldwin was the only area with a decrease in February, Febr a decrease from 291 to 143 days, or by 63.64 percent. Days on the m market for all Baldwin County also increased from the same month last year by 8.06 percent. U.S.: The U.S. market in December saw an increase in sales from $335,000 in November, 2011, to $349,000 in December, or 4.2 percent. Sales also increased from the prior year by 1.2 percent. Average sales price, median sales price, and inventory months supply upply all decreased in De December, cember, 2011, by 0.4, 1.1, and 9.9 percent, respectively. These three price trends also decreased from December, 2010, as well. Overall Analysis: For the month of February February, the Baldwin residential market showed an increase for all areas in prices, sales, and days on the market. arket. Overall, average sales price and median sales price increased by 28.05 percent and 17.24 percent,, respectively, since January. Average sales price rice also increased from February, 2011, while median sales price rice saw a decrease of 2.86 percent. Number of sales and average verage days on the market also increased in February by 13.97 and nd 12.92 percent, respectively. United States Existing Home Prices for All Housing Types Time Sales Average Sales Price Median n Sales Price Inventory Months Supply Dec-10 345,000 $217,900 $168,800 8.1 $170,000 Nov-11 335,000 $210,400 $164,000 7.1 $165,000 Dec-11 349,000 $209,500 $162,200 6.4 Vs. Last Month (%) 4.2 -0.4 -1.1 -9.9 Vs. Last Year (%) 1.2 -3.9 -3.9 -21.0 Median Sales Price $160,000 $155,000 Dec-10 Nov-11 Nov Dec-11 Data Sources: All data taken from the Baldwin win Multi Multi-List, Martha Taylor, Office: 251.947.3777,, and the National Association of Realtors: www.realtor.com. Data gathered by: Susan Grimsley, Grimsley Research Associate For additional information: DeWayne eWayne Cochran, MLS Coordinator, Office: 251.947.3777or Dr. Don Epley, Director, Director Center for Real Estate Studies, Mitchell College of Business, University of South AlabamaO AlabamaOffice: 251.460.6735 or E-mail: mail:depley@usouthal.edu. University of South Alabama takes reasonable measures to ensure the quality of the data and other information produced. Howev However, er, USA makes no warranty, express or implied, nor assumes any legal liability or responsibility forr th the accuracy, correctness, or completeness of any information, nor repres resents that its use would not infringe on privately owned rights. Reference to any specific commerc ercial product, process, or service does not constitute an endorsement, recommendation, rec or favoring by USA. Baldwin County Residential For the Month of February 2012 Baldwin County Areas Total County Jan-12 % vs prev mo % vs prev year North Baldwin Jan-12 % vs prev mo % vs prev year Eastern Shore Jan-12 % vs prev mo % vs prev year Central Jan-12 % vs prev mo % vs prev year South Jan-12 % vs prev mo % vs prev year Gulf Beach Jan-12 % vs prev mo % vs prev year Average Sale Price Median Sale Price Number of Sales Average Days on Market $227,018 $177,290 28.05 3.87 $170,000 $145,000 17.24 -2.86 261 229 13.97 -9.06 201 178 12.92 8.06 $134,875 $114,467 17.83 8.32 $124,300 $115,000 8.09 -5.11 4 11 -63.64 -63.64 143 291 -50.86 -22.70 $257,094 $172,925 48.67 5.16 $172,900 $150,000 15.27 -5.52 77 70 10.00 -10.47 188 165 13.94 -0.53 $107,963 $99,011 9.04 11.20 $107,000 $83,000 28.92 42.76 19 24 -20.83 -20.83 176 154 14.29 0.00 $130,492 $108,389 20.39 -5.48 $115,250 $93,500 23.26 15.83 55 48 14.58 -11.29 220 179 22.91 33.33 $280,072 $258,639 8.29 -1.07 $235,250 $206,500 13.92 0.11 106 76 39.47 1.92 206 180 14.44 3.00 Areas Defined as: North Eastern Shore Central South Gulf Beach Bay Minette, Stapleton, North Baldwin County Spanish Fort, Daphne, Fairhope Seminole, Loxley, Silverhill, Robertsdale, Summerdale Bon Secour, Gulf Shores N-ICW, Magnolia Springs, Foley, Lillian, Elberta Orange Beach, Gulf Shores S - ICW, Fort Morgan